PacWest stock rises on new optimism about regional banks

source link: https://finance.yahoo.com/news/pacwest-stock-rises-on-new-optimism-about-troubled-regional-banks-200050055.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

PacWest stock rises on new optimism about troubled regional banks

The California lender announced another asset sale as it recovers from the industry chaos in the spring.

of regional lenders

PacWest (PACW) announced a $3.5 billion sale of loans to alternative investment manager Ares Management, providing another lift to a regional bank hammered during the industry chaos earlier this year.

The deal, the latest of several moves by the Beverly Hills, Calif.-based lender to shrink its balance sheet, helped push PacWest's stock up 4% Monday. Several other regional banks also rose.

PacWest is one of several regional lenders that struggled to keep depositors following the March 10 failure of Silicon Valley Bank. Regional bank stocks hit a year-to-date low on May 4, the week regulators seized San Francisco-based bank First Republic and sold the bulk of its operations to JPMorgan Chase (JPM).

Read more: What are bank fees, and how do I avoid them?

But since then, those stocks rallied for four of the last six weeks on optimism that the worst was over for regional banks. For the period, the KBW Regional Bank Index (^BKX) has gained 9%, outpacing the S&P 500. The index closed 5% lower last Friday and slightly lower the previous week.

Another positive note for banks is that their deposit withdrawals have stabilized. Commercial banks have regained approximately $99 billion in deposits since the second week of May, according to data released Friday by the Federal Reserve. Their deposits have fallen 6% since a peak in April 2022.

Many banks also still face pressures from high interest rates and the possibility of stronger capital requirements for banks with more than $100 billion in assets, which will make it more difficult to earn robust profits.

Earlier this month, a number of US bank executives revised down their estimates of net interest income, the crucial margin between what banks make on their loans and pay for their deposits.

“The acute phase of bank stress is over, but a long and winding road remains,” Wedbush analyst David Chiaverini said in a Monday research note.

Wedbush reiterated a "cautious outlook" for second quarter results, with the expectation there will be more downward revisions in net interest income once banks begin reporting in the second half of July.

SmartAsset

SmartAssetWhich Americans Pay the Most Taxes?

Most income taxes in the United States are paid by the people with the most income. That is in keeping with the generally progressive nature of the individual federal income tax, the primary source of government revenues, which applies higher … Continue reading → The post Who Pays the Most Taxes in the U.S.? appeared first on SmartAsset Blog.

15h ago Yahoo Finance

Yahoo FinanceAston Martin, Lucid reach EV tech deal, stocks soar

EV maker Lucid announced a deal with Aston Martin to white label its EV tech as the luxury automaker looks to build out its electric offerings later this decade.

10h ago Investopedia

InvestopediaMichael Jordan Is Selling His Majority Stake in the Hornets—Here’s Jordan’s Net Worth

NBA legend Michael Jordan is selling his majority stake in the Charlotte Hornets for an estimated $3 billion. One of the best basketball players in NBA history, Jordan has a net worth of $2 billion as of 2023, thanks to lucrative endorsements such as Nike and the Jordan Brand, and other business ventures.

2d ago Yahoo Finance

Yahoo FinanceTesla stock drops after Goldman Sachs downgrade

Goldman Sachs became the latest Wall Street firm to downgrade Tesla stock as analysts react to a more than 100% rally in the stock so far this year.

11h ago Fortune

FortuneBanks face their worst losses since the 2008 crisis if inflation cannot be tamed, says the world’s brain trust of central bankers

The Bank for International Settlements, the central bank to the world, warned unsustainable debt levels mean the global economy is not out of the woods.

14h ago Bloomberg

BloombergChina’s Top Oil Traders Go Head-to-Head in Middle East Play

(Bloomberg) -- Two giants in China’s oil and refining sector have taken the biggest opposing positions in Middle East crude trading in years, transforming global cargo flows and puzzling oil traders the world over.Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotThe 10 Worst US Airports for Flight Disruptions This SummerStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Putin Faces Historic Threat to Absolute Grip on Power in RussiaRussia Latest

3h ago Yahoo Finance

Yahoo FinanceCarnival 'victim of own success' as shares plummet despite earnings beat

Carnival Corporation shares fell more than 10% on Monday. One analyst says the cruise liner is a victim of its own success.

10h ago Yahoo Finance

Yahoo FinanceMeta's Mark Zuckerberg-led reorganization is getting company back to its 'secret sauce': top exec

Change has been the norm for Meta the past 12 months. One top exec at the company says the change has worked creative wonders.

16h ago TipRanks

TipRanksWarren Buffett and Ken Griffin Have One Thing in Common: They Both Like These 2 “Strong Buy” Stocks

Following in the footsteps of one of Wall Street’s investing giants is a well-known strategy for those looking for alpha in the markets. But is there a better blueprint out there? There is! Tracking the moves of not one, but two investing legends. And when two stock pickers with almost unrivaled success are seen leaning into the same names, surely investors are keen to find out why they are piquing the interest of the leaders in the field. In this case, we’re talking about Warren Buffett and Ken

13h ago Barrons.com

Barrons.comPacWest Bancorp Stock Jumps as Ares Buys $3.5 Billion of Loans

Shares of the bank were hammered earlier in the year amid the turmoil among regional banks triggered by the collapse of Silicon Valley Bank.

16h ago Yahoo Finance

Yahoo FinanceFederal Reserve's message to the bullish stock market: We will break you

Fight the Fed at your own risk.

15h ago Reuters

ReutersPacWest sells $3.5 billion loan portfolio to asset manager Ares

The deal, which helped drive up PacWest shares by more than 6%, came after it said in May it was evaluating asset sales. "This transaction will improve our liquidity and capital as we continue to implement our announced strategy to return our focus to relationship-based community banking," PacWest Chief Executive Officer Paul Taylor said in a statement. PacWest and other regional lenders have turned to the Federal Reserve's Bank Term Funding Program to buoy their liquidity in the wake of the crisis that unfolded in March.

17h ago Reuters

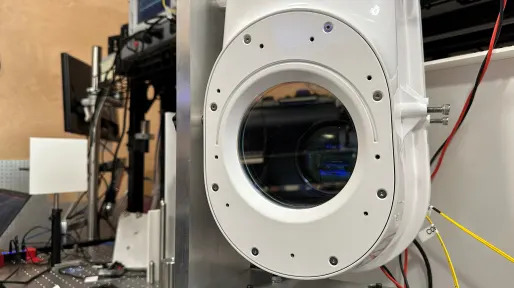

ReutersAlphabet bets on lasers to deliver internet in remote areas

Google parent Alphabet is delivering internet service to remote areas by using beams of light in a project known as "Taara".

18h ago Bloomberg

BloombergChina Gains Prop Up Asia Stocks; Dollar Edges Down: Markets Wrap

(Bloomberg) -- Strength in Hong Kong-listed technology stocks helped prop up Asian shares on Tuesday, buoying sentiment after US stocks slid amid concern that the Federal Reserve will push the US into recession.Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotThe 10 Worst US Airports for Flight Disruptions This SummerStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Putin Faces Historic Threat to Absolute Grip on Power in RussiaRussia Latest: Z

1h ago Bloomberg

BloombergSurging Summer Travel Won’t Save US Gasoline Demand

After three pandemic summers, a record number of Americans will hit the highway this July 4th weekend, but even that won’t return the country’s struggling gasoline sector to its pre-Covid peak.

1d ago Benzinga

BenzingaFrugal Billionaire Warren Buffett Drives A 2014 Car And Looks For Hail-Damaged Deals

Warren Buffett's choice of vehicle has become a topic of interest among many people. Renowned for his frugal and simple lifestyle, the billionaire investor drives a 2014 Cadillac XTS. While some billionaires indulge in extravagant cars as a visible symbol of wealth and success, Buffett's preference for older models reflects his unique approach to life and finances. Buffett's frugality and minimalist mindset have been key factors in his tremendous success as an investor. His ability to seek value

7h ago Business Insider

Business InsiderNancy Pelosi's husband just snapped up $2.6 million of Apple and Microsoft stock, closing out an options bet that the shares would soar

Paul Pelosi bought 5,000 shares of both Apple and Microsoft stocks on June 15, exercising 50 call options purchased on May 24, 2022.

4h ago Benzinga

BenzingaIt'll 'Upset A Lot Of Donors': Elon Musk Mocks Joe Biden's Tweet Calling On The Super Rich To Pay 'Their Fair Share.' Here's How Some Billionaires Pay Less Income Tax Than You

The fairness of the U.S. tax system has long been debated. Earlier this month, President Joe Biden tweeted, “It’s about time the super-wealthy start paying their fair share.” The message caught the attention of Tesla Inc. CEO and Twitter Inc. owner Elon Musk. “Please give him the password, so he can do his own tweets,” Musk replied, implying that the tweet wasn’t written by the commander in chief himself. But the billionaire business tycoon actually agrees with Biden’s view. “In all seriousness,

11h ago Oilprice.com

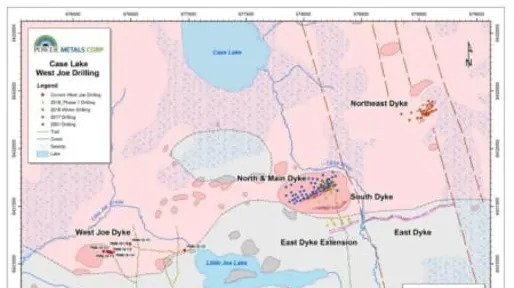

Oilprice.comThe Rare Metal Keeping Xi and Biden Up At Night

Canada’s Case Lake is the center of one of the most exciting rare metal discoveries of the last decade, with a small explorer unearthing what could be the only new cesium play in existence

4h ago TipRanks

TipRanks‘When Overbought Is Bullish’: Oppenheimer Sees S&P Uptrend Reaching 4,600 — Here Are 2 ‘Strong Buy’ Stocks to Bet on It

Investors will never stop looking for the best time to enter or exit the markets, but it is a very difficult move to get right. As fabled investor Peter Lynch has put it, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” With this in mind, Ari Wald, the Head of Technical Analysis at Oppenheimer says a better way to assess where the market is at is to follow the trend. More specifically, from a

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK