Gen Z Investors Love Crypto, Gold and Banking Stocks, According to New Apex Q1 2...

source link: https://www.businesswire.com/news/home/20230531005239/en/Gen-Z-Investors-Love-Crypto-Gold-and-Banking-Stocks-According-to-New-Apex-Q1-2023-Investor-Study/?feedref=Zd8jjkgYuzBwDixoAdXmJgT1albrG1Eq4mAeVP392108z0rKxVVxdvxSyALYUz1HevRMp3sIgu8q3wq1OF24lT93qbEzrwa15HGbLqMObxaYD4oVpTqXBG-F7OLxNV1juLAuCkn8FS6sh-I3dfDZEg%3D%3D

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Gen Z Investors Love Crypto, Gold and Banking Stocks, According to New Apex Q1 2023 Investor Study

- Apex Next Investor Outlook report reveals generational investing trends

- Data shows surprising response to SVB fallout

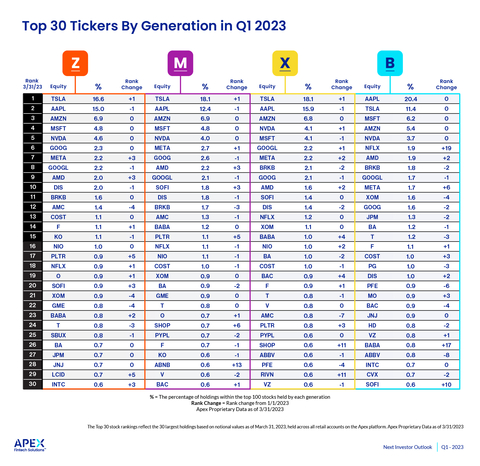

The top 30 tickers by generation in Q1 2023. The top 30 stock rankings reflect the 30 largest holdings based on notional values as of March 31, 2023, held across all retail accounts on the Apex platform. ApexProprietary Data as of 3/31/2023, Rank Change = Rank change from 1/1/2023 (Graphic: Business Wire)

DALLAS--(BUSINESS WIRE)--The Q1 2023 Apex Next Investor Outlook (ANIO) report revealed surprising investing trends across generations in response to major market-moving triggers, including the fallout from the Silicon Valley Bank crisis and ongoing stock volatility. The study utilizes data from Apex Fintech Solutions (“Apex”), the fintech for fintechs powering innovation and the future of digital wealth management. The study revealed trend-bucking data, including increased Gen Z demand for both gold and crypto as well as strong millennial interest in buying bank stocks amidst uncertainty in the banking industry.

“Gen Z investors were in elementary school when Lehman Brothers crashed in 2008 - so in many respects, the Q1 bank crisis was really that generation’s first true financial crisis”

Tweet this

The ANIO report analyzes investor data who trade through introducing brokers on the Apex Clearing Platform - across more than 1.3m Gen Z accounts and 5.6m accounts held by Millennials, Gen Z and Boomers, calculated from January 1 - March 31, 2023.

The following data refers to the rankings of the most commonly held securities at Apex by generation in Q1 2023. The data shows a given ticker’s movement within this ranking system among a particular generation. These observations are for informational purposes about generational trends and are not investment advice. Key report findings include:

SVB ripple effect across generations: Gen Z investors were measurably more fazed by bank uncertainty than other generations who have first-hand experience with prior financial crises. On March 29 - the peak selloff day for bank stocks - Gen Z sold securities at an even higher rate than all other groups of older investors.

Millennials are rocking the bank stocks: While older generations were selling off bank stocks, many millennials bought instead - shares of Charles Schwab (SCHW) shot up 21 places in the ranking amongst millennials, even while its overall market value plummeted by nearly 33%. Millennials also invested in First Republic Bank (FCRB), moving it up 25 positions in the rankings compared to Q4 2022.

All generations agree on their favorite seven stocks: Across generations, the top seven largest holdings held in retail accounts on the Apex platform were: 1. TSLA 2. AAPL 3. AMZN 4. MSFT 5. NVDA 6. GOOG/GOOGL 7. META.

Investors get zealous about gold: While global retail demand for gold dropped 13% YoY from Q1 2022, investors on the Apex platform were more zealous; in one week, from March 6 through March 13, the notional value of these investments increased 560%.

Gen Z still likes crypto and digital: Gen Z’s three hottest, climbing-the-ranks stocks in Q1 include a crypto-economy company (COIN); a Bitcoin ecosystem provider (MARA), and a cybersecurity business (CRWD).

“Gen Z investors were in elementary school when Lehman Brothers crashed in 2008 - so in many respects, the Q1 bank crisis was really that generation’s first true financial crisis,” comments Connor Coughlin, Chief Commercial Officer, Fintech at Apex Fintech Solutions. “This is a generation that invests in disruptors and against expected trends - and over $70 trillion in assets will be passed down to this generation in the coming decades. Fintechs and advisors need to understand the attitudes, interests and values of this digital and disruptive generation.”

About Apex Fintech Solutions

Apex Fintech Solutions is a fintech powerhouse enabling seamless access, frictionless investing, and investor education for all. Apex’s omni-suite of scalable solutions fuel innovation and evolution for hundreds of today’s market leaders, challengers, change-makers, and visionaries. The Company’s digital ecosystem creates an environment where clients with the biggest ideas are empowered to change the world. Apex works to ensure their partners succeed on the frontlines of the industry via bespoke custody & clearing, advisory, institutional, digital assets, and SaaS solutions through its Apex Clearing™, Apex Advisor Solutions™, Apex Silver™, and Apex CODA Markets™ brands.

For more information, visit the Apex Fintech Solutions website: https://www.apexfintechsolutions.com.

Contacts

MEDIA:

Vested

[email protected]

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK