Biggest banks to infuse First Republic with $30 billion

source link: https://finance.yahoo.com/news/biggest-banks-to-infuse-first-republic-with-30-billion-to-stabilize-troubled-lender-192748893.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Biggest banks to infuse First Republic with $30 billion to stabilize troubled lender

Eleven lending giants led by JPMorgan and Bank of America agree to provide deposits to the beleaguered San Francisco bank

some breaking news

The biggest U.S. banks are banding together to rescue beleaguered San Francisco lender First Republic (FRC) with $30 billion of uninsured deposits, an unusual joint effort to stabilize a rival and restore calm following a volatile week.

The infusion from 11 of the nation's biggest banks, including JPMorgan Chase (JPM) and Bank of America (BAC), follows a steep drop in the shares of First Republic, which was the nation's 14th-largest bank as of Dec. 31 with $212 billion in assets.

JPMorgan, Bank of America, Citigroup (C) and Wells Fargo (WFC)—the four largest lenders in the U.S. by assets—deposited $5 billion apiece. Goldman Sachs (GS), Morgan Stanley (MS) each deposited $2.5 billion while U.S. Bancorp (USB), Truist (TFC), PNC (PNC), State Street (STT) and Bank of New York Mellon (BK) each deposited $1 billion. The deposits have to stay at First Republic for 120 days and earn interest at the same rate of current depositors, according to a person familiar with the pact.

"The actions of America’s largest banks reflect their confidence in the country’s banking system," the banks said in a joint release. "Together, we are deploying our financial strength and liquidity into the larger system, where it is needed the most." Federal Reserve Chair Jerome Powell, Treasury Secretary Janet Yellen and two other regulators said in a joint statement that "this show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system."

The extraordinary infusion from First Republic's competitors is an attempt to stop a slide for the California lender that began during last week's failure of another lender in the same state: Santa Clara-based Silicon Valley Bank. An initial infusion of $70 billion in financing from JPMorgan and the Federal Reserve announced Sunday failed to alleviate the pressure.

First Republic's shares plummeted again this week after S&P Global and Fitch Ratings downgraded the bank's credit rating. Shares recovered Thursday after The Wall Street Journal and Bloomberg reported details of the industry pact, with the stock up 10% at the close. CNBC also earlier reported the 120-day term of the deposits provided by the 11 banks.

Bloomberg

BloombergSchwab Clients Pull $8.8 Billion From Prime Funds This Week

(Bloomberg) -- Charles Schwab Corp. saw $8.8 billion in net outflows from its prime money market funds this week as investors scrutinized the brokerage’s resilience amid questions about the health of the wider financial industry.Most Read from BloombergFirst Republic Set to Get $30 Billion of Deposits in RescueIn New York City, a $100,000 Salary Feels Like $36,000First Republic Bank Is Exploring Options Including a SaleThe 10 Top US Cities Where a $100,000 Salary Goes the FurthestNew Fed Bank Ba

2h ago Investopedia

InvestopediaHow Does the New French Retirement Age Stack Up Globally?

Amid fervent protests from citizens and lawmakers, French President Emmanuel Macron unilaterally changed the retirement age Thursday. See how it compares to other countries.

7h ago Engadget

EngadgetVirgin Orbit furloughs most employees and pauses operations for a week

Satellite launching company Virgin Orbit is starting an "operational pause" and furloughing most employees except for a skeleton crew.

18h ago USA TODAY

USA TODAYThese are the 10 housing markets across the US where home sellers are sitting pretty

Affordability is a key factor when it comes to areas where sellers still have advantages. There are the 10 hot locations in the housing market.

4h ago Reuters

ReutersUS attorneys general condemn credit-card firms for backtracking on gun sale code

A coalition of 14 attorneys general condemned payment networks majors including Visa Inc, American Express Co and Mastercard Inc for pausing work on a merchant code to help detect suspicious gun sales in the United States. The group, led by New Jersey AG Matthew Platkin, condemned the firms for buckling under political pressure, in a letter sent to the chief executives of the companies, and called their action "unjustifiable" on Thursday. Visa, Mastercard and American Express did not immediately respond to Reuters requests for comment.

10h ago Investor's Business Daily

Investor's Business DailyStock Market Surges To Weekly Highs; Warren Buffett Makes Big Move While Bank Stocks Rally

Warren Buffett's Berkshire Hathaway added over $467 million worth of Occidental Petroleum shares.

9h ago AP Finance

AP FinanceFloods fill some of California's summer strawberry fields

As river water gushed through a broken levee, thousands of people in a California farming town were forced to evacuate as their homes were flooded and businesses destroyed. Industry experts estimate about a fifth of strawberry farms in the Watsonville and Salinas areas have been flooded since the levee ruptured late Friday about 70 miles (110 kilometers) south of San Francisco and another river overflowed. It's too soon to know whether the berry plants can be recovered, but the longer they remain underwater the more challenging it can get, said Jeff Cardinale, a spokesperson for the California Strawberry Commission.

8h ago TheStreet.com

TheStreet.comCathie Wood Plows Millions Into Her Newest Investment

While Ark Invest owner Cathie Wood is beloved by some and reviled by others, one thing is for sure -- whatever she does in the world of finance gets plenty of attention. Another sector Wood has been bullish on is crypto -- despite major collapses in 2022 that sent many investors running for the hills in a panic. Nine investors put in a total of $7,281,630, raised by The ARK Crypto Revolutions U.S. Fund LLC. The additional eight million was raised by the ARK Crypto Revolutions Cayman Fund LLC. Both funds are private and open to a limited number of investors.

8h ago TipRanks

TipRanksBillionaire David Rubenstein Loaded Up on These 2 Beaten-Down Stocks — Here’s Why They Could Bounce Back

Will Silicon Valley Bank’s collapse influence the policy makers to take a more forgiving stance regarding its interest rate hiking endeavors? Word on the Street is that it is a possibility, but David Rubenstein is not so sure – the billionaire investor thinks the Fed will find the middle ground in its continued efforts to rein in inflation. “I suspect 25 basis points is the split-the-baby decision that’s most likely,” Rubenstein said ahead of the Federal Reserve’s meeting next week. Whether Rube

11h ago TipRanks

TipRanksCharles Schwab CEO says he took advantage of the recent dip. Here are 3 other bank stocks insiders are buying now

‘Buy the dip’ has not become the ubiquitous phrase it is for no reason. With bank stocks recently falling in unison whether they are in danger of meeting the same fate as SVB and Signature bank or not, there are plenty of ‘buy the dip’ opportunities investors can take advantage of right now. And that’s what one CEO has been doing. Having watched shares of his firm Charles Schwab drop by more than 30% since the crisis began, CEO Walter Bettinger said on Tuesday that he purchased 50,000 shares for

1d ago Investor's Business Daily

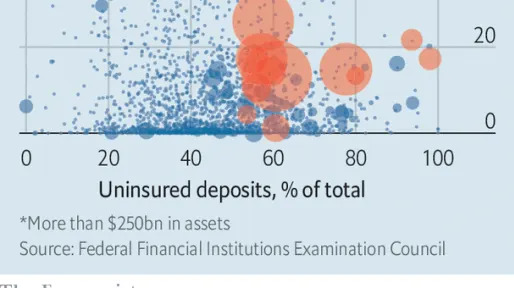

Investor's Business DailyReport: 10 Banks Are Most Exposed To Uninsured Deposits

High levels of uninsured deposits helped do in Silicon Valley Bank and Signature Bank. But it turns out they're not alone.

2d ago Investor's Business Daily

Investor's Business DailyIBD Screen Of The Day: AMD Surges Past Buy Point, Chipotle Boast Rising Profit Estimates

AMD stock surged past a new buy point in today's stock market action, while Chipotle boasts rising profit estimates.

3h ago MarketWatch

MarketWatchI’m 70 and weighing whether to ‘sell everything’ and put it all in Treasuries, or hire a financial adviser even though it would cost $20K a year. What should I do?

THE ADVICER MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. Links in this content may result in us earning a commission, but our recommendations are independent of any compensation that we may receive.

2d ago Barrons.com

Barrons.comCharles Schwab Insiders Loaded Up on Shares

With bank stocks fluctuating wildly this week after Silicon Valley Bank’s collapse, Charles Schwab CEO Walt Bettinger and other insiders bought the dip, according to Securities and Exchange Commission filings. Charles Schwab stock (ticker: SCHW) is down about 28% over the past month. Amid the stock’s turmoil on Monday, Bettinger and founder Charles Schwab published a statement to reassure investors.

5h ago Reuters

ReutersU.S. bank deposits have started moving to money market funds - Goldman Sachs

(Reuters) -Goldman Sachs said deposits have started to move out of U.S. banks and towards money markets funds, as investors seek the safety in Treasury securities amid worries about stresses in the banking sector. Retail money market funds have seen large and accelerating inflows over the last week, Goldman said in a note on Thursday, likely suggesting some migration away from deposits. Following the collapse of SVB Financial Group and Signature Bank, U.S. regional bank stocks have had a bruising last few days, as investors worried about possible deposit outflows causing capital issues at other regional banks.

10h ago The Economist

The EconomistHow deep is the rot in America’s banking industry?

Silicon Valley Bank may be the start of something grimmer

14h ago Reuters

ReutersU.S. banks' CDS prices surge as contagion concern widens

A jump in the cost for Wall Street banks to insure bonds against default on Wednesday was another worrisome indicator of credit stress for investors amid the crisis at Credit Suisse and at U.S. regional banks. According to S&P Global Market Intelligence, spreads on five-year credit default swaps on JPMorgan Chase & Co, Bank of America Corp, Morgan Stanley and Wells Fargo shot up to their highest since October, while those for Goldman Sachs and Citigroup Inc are highest since November. "Credit spreads are telling you there is systemic risk in the system," said Lance Roberts, chief investment strategist at RIA Advisors.

1d ago MarketWatch

MarketWatchBuffett loves cash dividends and here’s why you should too – plus 8 stocks with higher yield to get you started.

Dividend-paying stocks are consistent, defensive and tend to outperform over time, writes Michael Brush.

5h ago The Wall Street Journal

The Wall Street JournalEleven Banks Deposit $30 Billion in First Republic Bank

Eleven banks have deposited $30 billion in First Republic Bank, according to a joint statement from the heads of the Treasury, Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency.

43m ago Barrons.com

Barrons.comRivian Stock Is Really Just About Free. Investors Shouldn’t Forget Cash.

The electric vehicle maker's cash balance at the end of 2022 almost equals the company's market capitalization.

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK