$30 billion rescue of First Republic Bank

source link: https://finance.yahoo.com/news/inside-the-30-billion-rescue-of-first-republic-bank-003752506.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Inside the $30 billion rescue of First Republic Bank

An 11-bank plan to save First Republic began with a brainstorming session between JPM CEO Jamie Dimon, Fed chair Jerome Powell and Treasury secretary Janet Yellen

invest a total of $30 billion

The $30 billion rescue of First Republic Bank began with a series of phone calls Tuesday between JPMorgan Chase CEO Jamie Dimon, Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen.

Dimon was in Washington, according to a person familiar with the events, and he wanted to discuss some issues that concerned bank capital. The subject soon turned to the fate of the nation's 14th-largest bank.

Shares in the San Francisco lender had been sliding since last week's failure of Santa Clara-based Silicon Valley Bank, and $70 billion in financing from JPMorgan Chase and the Federal Reserve announced Sunday night failed to alleviate the pressure as this week began. The stock dropped 62% on Monday.

The CEO of the nation's biggest bank, the Fed chair and the Treasury secretary started brainstorming, according to people familiar with the discussions, with input from another powerful regulator: Federal Deposit Insurance Corporation Chair Martin Gruenberg. Their idea? JPMorgan could give First Republic some deposits.

Such an infusion could help solve a major concern. Deposit withdrawals are what put pressure on Silicon Valley Bank and made it impossible to continue standing on its own. Last Thursday, customers withdrew $42 billion in just one day, leaving the bank with a negative cash balance, and regulators seized the bank Friday. The concern was the same could happen to First Republic.

The next day, Dimon took this idea to some of his peers. At a Bank Policy Institute event, he approached other executives, including Citigroup CEO Jane Fraser, and commitments for $5 billion in uninsured deposits from Citigroup (C), Bank of America (BAC) and Wells Fargo (WFC) soon followed. JPMorgan also agreed to put in $5 billion.

An infusion of $20 billion was considered enough, but these four banks decided to seek more from smaller rivals on Wednesday and Thursday. U.S. Bancorp (USB), Truist (TFC), PNC (PNC), State Street (STT) and Bank of New York Mellon (BK) each agreed to deposits of $1 billion. The last to join, according to the people familiar with the events, were Goldman Sachs (GS) and Morgan Stanley (MS). They each agreed to deposit $2.5 billion.

The Wall Street Journal

The Wall Street JournalEleven Banks Deposit $30 Billion in First Republic Bank

Eleven banks have deposited $30 billion in First Republic Bank, according to a joint statement from the heads of the Treasury, Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency.

40m ago Zacks

ZacksWall Street Bulls Look Optimistic About Micron (MU): Should You Buy?

Based on the average brokerage recommendation (ABR), Micron (MU) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

1d ago Bloomberg

BloombergMexico Banks Safe From Global Problems, Finance Chief Says

(Bloomberg) -- Mexico’s financial system is safe from the problems with liquidity facing banks in other countries after the collapse of Silicon Valley Bank because its lenders have weathered crises before and have behaved in a cautious manner, the country’s finance minister said.Most Read from BloombergFirst Republic Set to Get $30 Billion of Deposits in RescueIn New York City, a $100,000 Salary Feels Like $36,000First Republic Bank Is Exploring Options Including a SaleThe 10 Top US Cities Where

2h ago Quartz

QuartzFirst Republic Bank: What's next?

A slide in shares of First Republic Bank came to halt on March 16, on reports that banks including JPMorgan Chase, Citigroup, and Wells Fargo were ready to pump a combined $30 billion into the suddenly troubled lender.

6h ago MarketWatch

MarketWatchFirst Republic gets $30 billion in deposits from 11 major U.S. banks, but stock resumes slide as it suspends dividend

Big banks pledge $30 billion to First Republic as a backstop after the company's stock hit an all-time low following the failure of Silicon Valley Bank.

4h ago Benzinga

BenzingaElectric Vehicles Might Not Be The Cheaper Alternative Consumers Thought: 2022 Study Reveals Surprising Results

https://cdn.benzinga.com/files/images/story/2023/03/15/michael-fousert-yhxlyjylr3c-unsplash.jpg?optimize=medium&dpr=2&auto=webp&crop=1200%2C800 For many drivers, cost savings is the No. 1 reason to ditch their gas-powered vehicle in exchange for an electric model. Even though electric vehicles (EVs) are generally priced higher than their gas counterparts, they provide the opportunity to save money in the long run. That’s why the market continues to grow at a rapid pace. But there’s something you

1d ago Bloomberg

BloombergSwedish Pension Fund Alecta Starts Internal Probe After $2 Billion Banks Bet

(Bloomberg) -- The board of Sweden’s biggest pension fund, Alecta, has instructed its chief executive officer to immediately initiate an investigation into its $2.1 billion bet on three niche banks tied to the collapse of Silicon Valley Bank.Most Read from BloombergFirst Republic Set to Get $30 Billion of Deposits in RescueIn New York City, a $100,000 Salary Feels Like $36,000First Republic Bank Is Exploring Options Including a SaleThe 10 Top US Cities Where a $100,000 Salary Goes the FurthestNe

11h ago MarketWatch

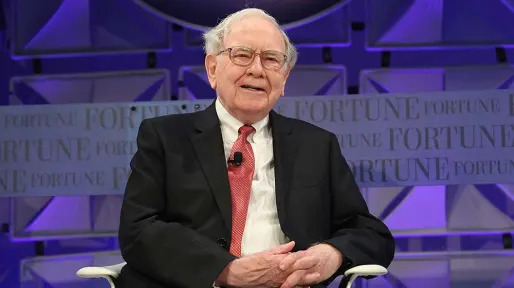

MarketWatchBend the market like Buffett: Stop checking your stock portfolio — especially on your phone — and you’ll make more money.

How many times today have you checked to see how your investment portfolio is performing? Checking your portfolio balance is not a benign activity; the more you check the more likely you are to invest in lottery-type stocks. The occasion to discuss this tendency is the recent publication of Berkshire Hathaway’s (BRK) (BRK) annual report, which includes the much-anticipated thoughts on investing from CEO Warren Buffett.

4h ago Bloomberg

BloombergSchwab Clients Pull $8.8 Billion From Prime Funds This Week

(Bloomberg) -- Charles Schwab Corp. saw $8.8 billion in net outflows from its prime money market funds this week as investors scrutinized the brokerage’s resilience amid questions about the health of the wider financial industry.Most Read from BloombergFirst Republic Set to Get $30 Billion of Deposits in RescueIn New York City, a $100,000 Salary Feels Like $36,000First Republic Bank Is Exploring Options Including a SaleThe 10 Top US Cities Where a $100,000 Salary Goes the FurthestNew Fed Bank Ba

2h ago Investor's Business Daily

Investor's Business DailyStock Market Surges To Weekly Highs; Warren Buffett Makes Big Move While Bank Stocks Rally

Warren Buffett's Berkshire Hathaway added over $467 million worth of Occidental Petroleum shares.

9h ago MarketWatch

MarketWatchU.S. stocks set for wild swings as trillions in options contracts set to expire Friday

U.S. stocks could see increasingly wild swings in the coming days as option contracts tied to trillions of dollars in securities are set to expire on Friday, removing a buffer that some say has helped to keep the S&P 500 index from breaking out of a tight trading range.

5h ago TipRanks

TipRanksCharles Schwab CEO says he took advantage of the recent dip. Here are 3 other bank stocks insiders are buying now

‘Buy the dip’ has not become the ubiquitous phrase it is for no reason. With bank stocks recently falling in unison whether they are in danger of meeting the same fate as SVB and Signature bank or not, there are plenty of ‘buy the dip’ opportunities investors can take advantage of right now. And that’s what one CEO has been doing. Having watched shares of his firm Charles Schwab drop by more than 30% since the crisis began, CEO Walter Bettinger said on Tuesday that he purchased 50,000 shares for

1d ago Bloomberg

BloombergBanks Borrow $164.8 Billion From Fed in Rush to Backstop Liquidity

(Bloomberg) -- Banks borrowed a combined $164.8 billion from two Federal Reserve backstop facilities in the most recent week, a sign of escalated funding strains in the aftermath of Silicon Valley Bank’s failure.Most Read from BloombergFirst Republic Set to Get $30 Billion of Deposits in RescueIn New York City, a $100,000 Salary Feels Like $36,000First Republic Bank Is Exploring Options Including a SaleThe 10 Top US Cities Where a $100,000 Salary Goes the FurthestNew Fed Bank Backstop Has Scope

1h ago Benzinga

BenzingaElon Musk Frets As Microsoft Axes AI Ethics Team, Richard Branson's Virgin Orbit Stops Ops, Credit Suisse To Borrow Up To $54B: Today's Top Stories

https://cdn.benzinga.com/files/images/story/2023/03/16/elon_musk_at_a_press_conference.jpg?optimize=medium&dpr=2&auto=webp&crop=1200%2C800 Benzinga Amid Thin Twitter Safety Staff, Elon Musk Frets Over Microsoft Reportedly Axing AI Ethics Team Elon Musk fusses over Microsoft Corporation (NASDAQ: MSFT), reportedly firing its AI Ethics and Society team amid concerns about the reduced Twitter workforce. Musk reacted to a news report about Microsoft slashing its Ethics and Society team within the art

9h ago TheStreet.com

TheStreet.comIs Nvidia One of the Best Stocks to Own Right Now?

Nvidia stock has been on fire, attempting to post its 10th weekly gain in the past 11 weeks. Here's how to trade it now.

7h ago MarketWatch

MarketWatchI’m 70 and weighing whether to ‘sell everything’ and put it all in Treasuries, or hire a financial adviser even though it would cost $20K a year. What should I do?

THE ADVICER MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. Links in this content may result in us earning a commission, but our recommendations are independent of any compensation that we may receive.

2d ago Investor's Business Daily

Investor's Business DailyStock Market Rallies As 11 Bank Giants Aid First Republic, But FRC Dives Late; Apple, Microsoft Flash Buy Signals

The stock market rallied strongly Thursday as JPMorgan and other big banks said they'll deposit $30 billion into First Republic. Apple and Microsoft are buys.

21m ago Barrons.com

Barrons.comCharles Schwab Insiders Loaded Up on Shares

With bank stocks fluctuating wildly this week after Silicon Valley Bank’s collapse, Charles Schwab CEO Walt Bettinger and other insiders bought the dip, according to Securities and Exchange Commission filings. Charles Schwab stock (ticker: SCHW) is down about 28% over the past month. Amid the stock’s turmoil on Monday, Bettinger and founder Charles Schwab published a statement to reassure investors.

5h ago Reuters

ReutersU.S. bank deposits have started moving to money market funds - Goldman Sachs

(Reuters) -Goldman Sachs said deposits have started to move out of U.S. banks and towards money markets funds, as investors seek the safety in Treasury securities amid worries about stresses in the banking sector. Retail money market funds have seen large and accelerating inflows over the last week, Goldman said in a note on Thursday, likely suggesting some migration away from deposits. Following the collapse of SVB Financial Group and Signature Bank, U.S. regional bank stocks have had a bruising last few days, as investors worried about possible deposit outflows causing capital issues at other regional banks.

10h ago Bloomberg

BloombergBove Says ‘Crisis Is Over’ as Banks Eye First Republic Rescue

(Bloomberg) -- The “banking crisis is over,” Odeon Capital analyst Dick Bove said after reports that the nation’s largest private banks will provide $30 billion in liquidity to stabilize First Republic Bank.Most Read from BloombergFirst Republic Set to Get $30 Billion of Deposits in RescueIn New York City, a $100,000 Salary Feels Like $36,000First Republic Bank Is Exploring Options Including a SaleThe 10 Top US Cities Where a $100,000 Salary Goes the FurthestNew Fed Bank Backstop Has Scope to In

6h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK