Poloniex's Guide for the Bear Market - 5 Best Investment Strategies to fight Inf...

source link: https://blockmanity.com/press-release-2/poloniexs-guide-for-the-bear-market-5-best-investment-strategies-to-fight-inflation/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

5 Best Investment Strategies to fight Inflation

In their latest article, Poloniex has shared a detailed guide to deal with the bear market along with 5 best investment strategies to fight inflation. Following are the 5 routes that Poloniex suggests are the ones to take in the bear market. These investment strategies can help you stay ahead of the inflation and ensure better yields.

Investing in gold is the traditional way to beat inflation. According to Forbes Advisor, gold has seen an average annual gain of 9.48% over the two decades between September 2001 and September 2021. Therefore, gold has long been regarded as a tool of good retaining value. As gold is valued in U.S. dollars, which gives it an advantage when the U.S. dollar falls in value. Although you can purchase gold bullion in the form of coins or bars from jewelry shops and banks, the storing and insuring processes will cost you additional costs so it is more advisable to choose an alternative for gold investment. For example, opening a precious metals passbook account, also known as “Paper Gold”, to invest in gold and other precious metals. Or else you can also invest in gold-focused mutual funds and exchange-traded funds (ETFs).

Stocks

Investing in a diversified stock portfolio is another inflation-hedging approach. But, pouring money into the stock market, of course, doesn’t guarantee risk-free, but if you need to be patient enough and try to pick some blue chips with a strong reputation and reliability so that you can just hold it for a while before selling it off to make some gains. For such, you may consider choosing an ESG (Environmental, Social, and Governance) fund since many conglomerates care about the environment nowadays, so you can tell ESG is a trend. In addition, technology, other growth stocks, consumer goods companies, and others in the defensive sector are also worth noting since these industries are thriving and you can expect some good results over time.

Real Estate

If possible, buying property is always the best investment option. Once you own a property, you can rent it as the housing price continues to rise, so that you can make a fortune. However, if you have limited capital, you may consider investing in Real Estate Investment Trust (REIT) since it is a collective investment scheme that aims to deliver a source of recurrent income to investors through focused investment in a portfolio of income-generating properties such as shopping malls, offices, hotels and serviced apartments in the local or oversea markets. Basically, you don’t physically own the real estate, but you will receive regular income distribution from REITs should the property values increase over time. A majority of REIT’s net income after tax is paid in a form of dividends.

Alternative investments

You may also consider investing in luxury items like Rolex, Gucci, Tiffany & Co., or you can purchase others with intrinsic values including fine arts, vintage cars, and collectibles. Although it’s hard to predict their prices in the future, the value of these items is expected to appreciate over time. Besides, you may also consider buying cryptocurrencies, like Bitcoin (BTC) and Ether (ETH), and NFTs, since these new digital assets are used to hedge inflation in recent years.

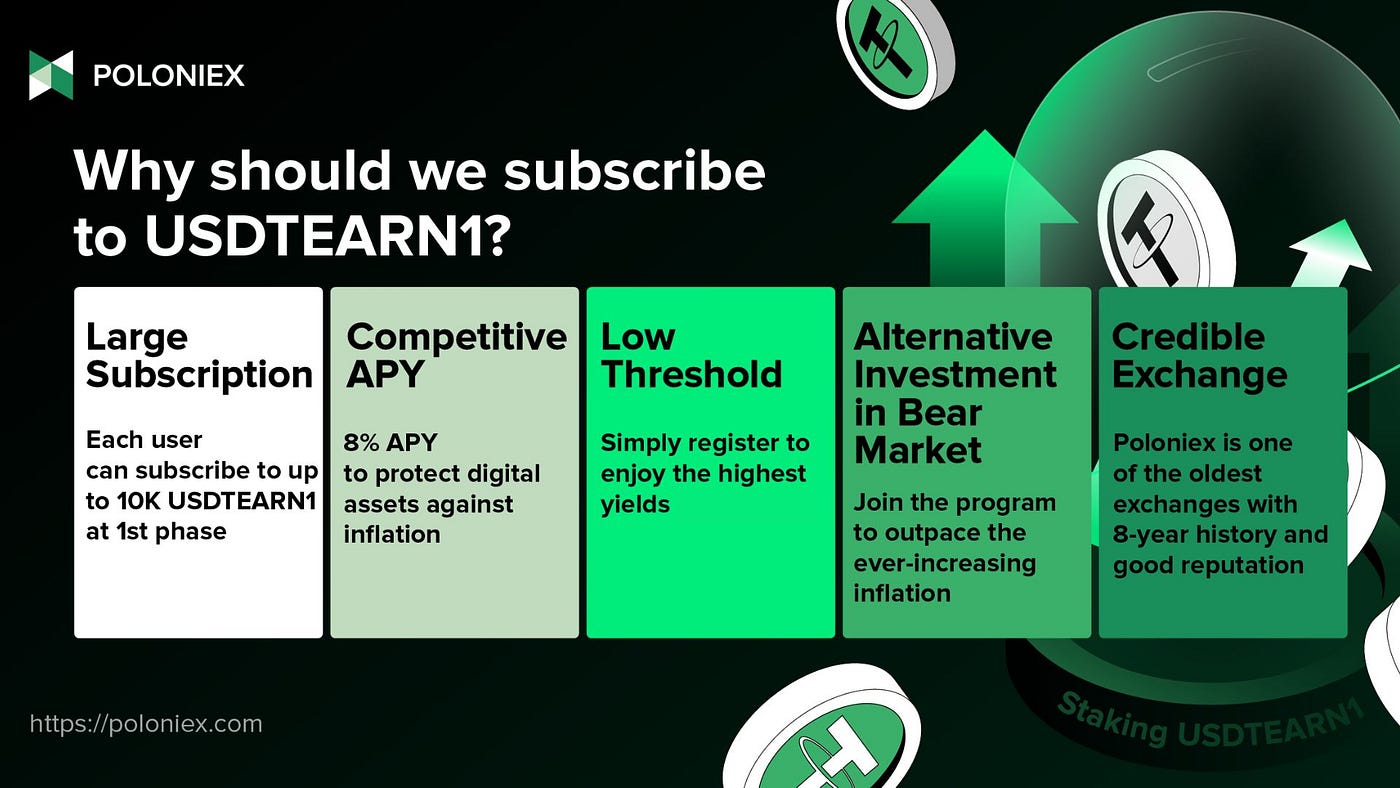

As these digital assets are maturing that the crypto market can be very volatile, so if you are curious about this area, yet you are also a conservative investor, you may consider joining Poloniex’s newly launched program, dubbed Poloniex EARN, to grow your crypto holdings in a fixed term to protect your digital assets from being eroded in the high inflation.

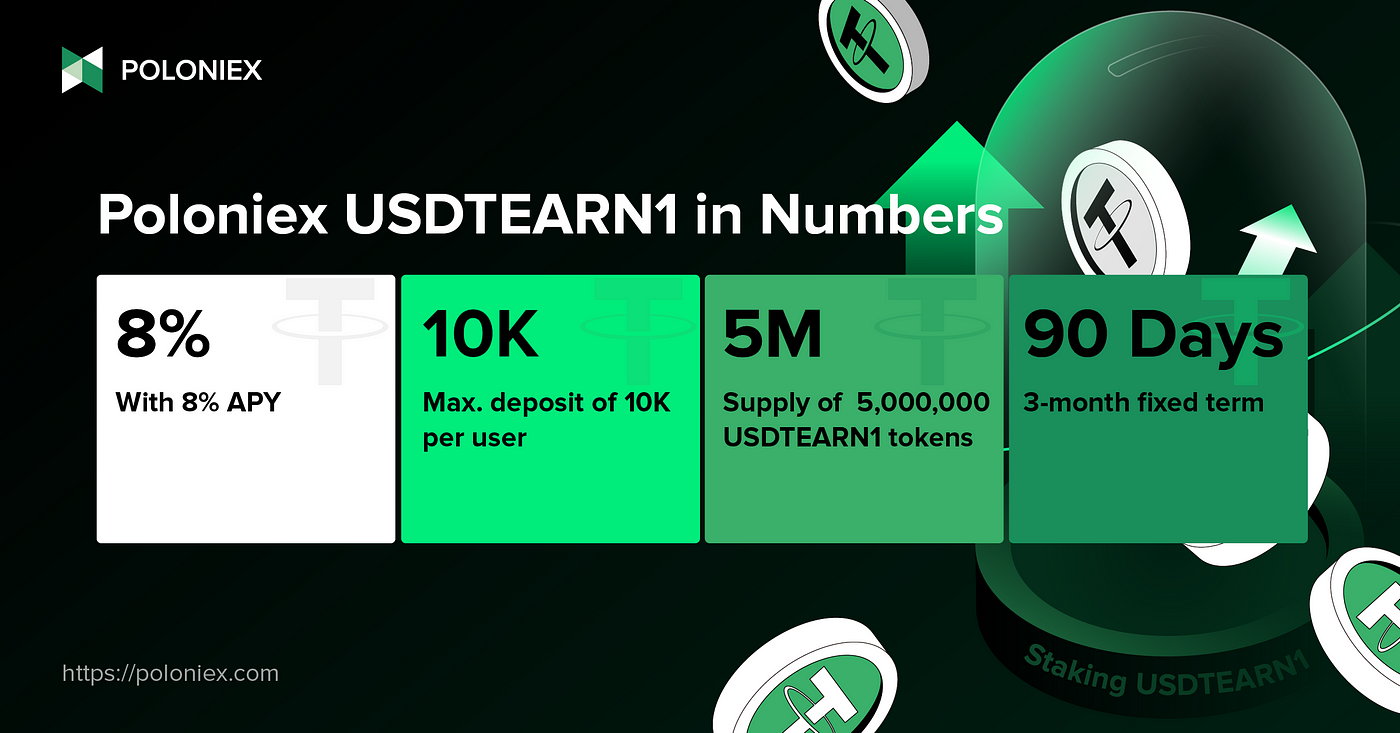

The first leg of the programe, named USDTEARN1, commenced on September 26, 2022 with a total supply of 5,000,000 USDTEARN1. Each user is allowed to subscribe to up to 10,000 USDTEARN1 and to lock the holdings in a 90-day fixed term with an APY of 8%. For more information, please visit Poloniex Support Centre.

In conclusion, all investments are subject to risk, investors are advised to consider the risk of assumption beforehand and the rule of thumb is always DYOR.

About Poloniex

Poloniex is one of the oldest cryptocurrency exchanges that allows you to buy or sell digital assets, such as Bitcoin (BTC), Ethereum (ETH), TRON (TRX), and other altcoins. Founded in 2014, security, new features, and user interface are some of their top priorities. The exchange guarantees that users will experience safety and security while conducting transactions.

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.

Get the latest news on Blockchain only on Blockmanity.com. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Recommend

-

3

3

Overcome The Investment Fear During Bear Market With Gnox (GNOX), Binance Coin (BNB), and Solana (SOL)

-

43

43

“美国版支付宝”Circle欲收购数字货币交易所Poloniex 但双方均不愿回应此事

-

38

38

一站式金融服务机构Circle宣布收购加密资产交易所 Poloniex

-

3

3

IRS Summons Of Circle And Poloniex User Data Authorized – HodlalertIRS Summons Of Circle And Poloniex User Data Authorized An IRS summon...

-

5

5

DeFi 101: Tokens, Tools, and Trading From smart contracts and oracles to yield farming and liquidity pools, DeFi co...

-

3

3

Poloniex LaunchBase Relaunches With APENFT’s Native Token NFT • CryptoMode Search

-

5

5

Circle拨款1040万美元,寻求与美国SEC就Poloniex案件达成和解 • 6 小时前 碳链...

-

7

7

扫码领取奖励更多详情链小象(CFOR)未来可兑换比特币、以太坊、瑞波、EOS等区块链资产;链向财经合作区块链项目资产;链向财经应用内的增值产品和服务、链向财...

-

6

6

美国SEC:加密货币交易平台Poloniex同意支付超1000万美元罚款解决运营未注册交易平台的指控 - 律动BlockBeats 律动 BlockBeats 消息,8 月 9 日,SEC 宣布,Poloniex LLC 同意支付超 1000 万美元的罚款,以解决对其运营未注册数字资产交易平台的指控,而...

-

5

5

SEC Settles Poloniex Charges – TrustnodesThe Securities and Exchange Commission (SEC) today announced one of the oldest crypto exchange, Poloniex LLC, has agreed to pay more than $10 million to settle charges for operating an unregistered onl...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK