5 Truths About Stablecoins Every Crypto Investor Should Know

source link: https://sfoerster-5338.medium.com/5-truths-about-stablecoins-every-crypto-investor-should-know-cfd95c873d6c

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

5 Truths About Stablecoins Every Crypto Investor Should Know

They aren’t stable and may be prone to “bank runs”

JUSTIN TALLIS/AFP via Getty Images

The cryptocurrency industry is still in its infancy, and the sub-category of stablecoins even more so. However, with an estimated size of around $160 billion — compared with only $11 billion in June 2020 — the stablecoin sector has grown considerably. Trading data for some of the oldest stablecoins are now available for almost five years, and so we can start to draw some conclusions, not based on conjecture, but based on facts. I’ve collected data on the largest stablecoins that claim to be pegged to the U.S. dollar, and I’ve come up with five truths that every crypto investor should know.

Stablecoins 101

Stablecoins are cryptocurrencies that are generally considered to have a relatively stable price, with a peg to a fiat currency like the U.S. dollar, pegged to the value of other cryptocurrencies, or some other assets like gold. While traditional cryptocurrencies like bitcoin tend to be quite volatile as I explain here, stablecoins are designed to not be volatile. Stablecoins are preferred by some traders as a means to buy or sell traditional cryptocurrencies because then only the value of the crypto investment varies. Stablecoins also facilitate quick trading compared with the alternatives, because it can take several days to settle trades using government-issued currencies.

There are a variety of stablecoin types, as described by CoinDesk. One type, including the three largest, are “backed” and have cash or cash-equivalents (like Treasury bills) in their reserves. Another type, including Neutrino, Terra, and Frax, are algorithmic (algo), backed by an algorithm that facilitates a change in supply between the stablecoin (such as Terra) and another cryptocurrency (Luna) that props them up.

A Brief History of Stablecoins

According to CoolWallet, the first stablecoins, BitUSD and NuBits, were issued in 2014 and were collateralized through other cryptocurrencies. The breakthrough stablecoin was Tether (USDT), created in November 2014 (initially called RealCoin) and issued on the Bitfinex exchange in 2015. In November 2017, Tether was in the news because it reported that about $30 million worth of tokens were stolen by hackers. As I previously reported, Tether has a checkered past to say the least and academic research suggested a connection in 2017 between bitcoin and tether, with data to support a “pushed” hypothesis whereby an increase in the supply of tether may have resulted in an increase in the price of bitcoin.

CoinMarketCap lists 84 actively traded stablecoins. The top three by market capitalization are Tether, USD Coin (USDC), and Binance USD (BUSD). Five stablecoins each have market capitalizations greater than $1 billion.

The Top 15 USD Pegged Stablecoins

My initial screen is based on the top 20 stablecoins by market capitalization according to CoinMarketCap.com (as of June 10, 2022). The final sample of 15 includes only stablecoins based on pegs to the U.S. dollar. Data are from Yahoo!Finance, daily prices (once per day), starting on November 9, 2017 (the initial date of available data for Tether).

#1 Stablecoins linked to the U.S. dollar trade close to a dollar, on average

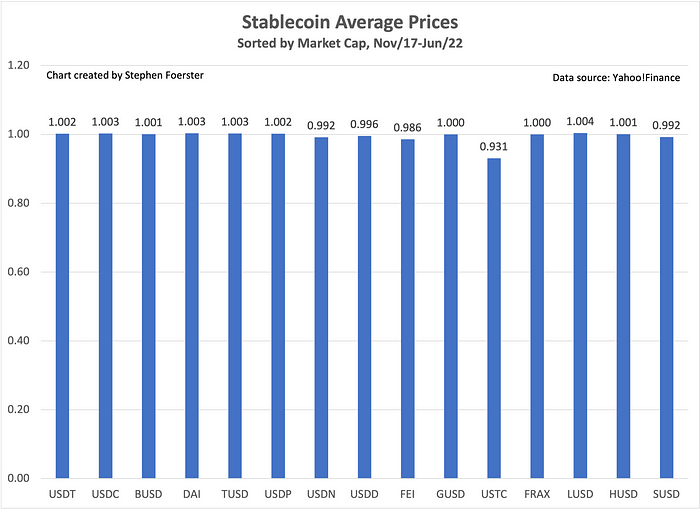

The chart below shows the average price for each of the stablecoins over the sample period, listed from left to right from largest to smallest market capitalizations.

The overall average price is $0.994, only 0.57 percent below the dollar peg. The average that excludes Terra (described in more detail in #5 below, which also explains its relatively low average price) is even more impressive, at $0.999, only 0.11 percent below a dollar. At first blush, the evidence supports the stability of stablecoins.

Of course, we need to be cautious when only looking at averages, which can be deceptive. There’s that old joke: Did you hear what happened to the 6-foot statistician who was wading across a river with an average depth of 3 feet? He drowned! Which brings us to our next important observation.

#2 Stablecoins aren’t stable

Imagine in a perfect world if stablecoins pegged to the U.S. dollar were always truly stable. Here’s what a graph of their prices over time would look like.

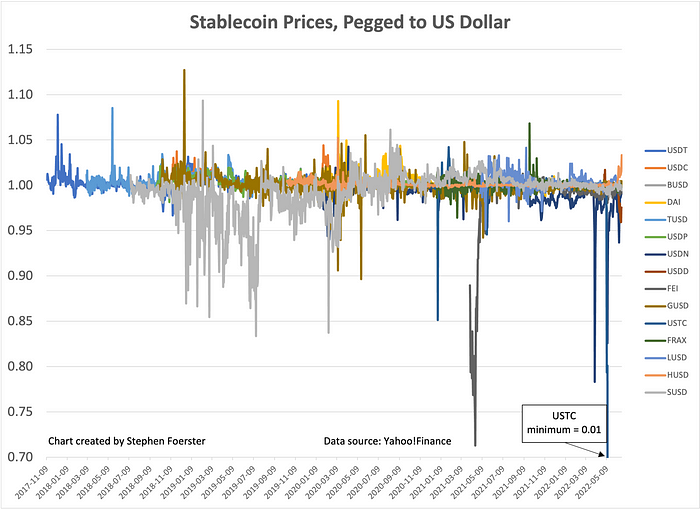

Now let’s contrast that with what the actual graph looks like.

The contrast is quite stark. Prices are as high as $1.127 and (not shown on the chart) as low as less than $0.01. Throughout the sample period, various coins have deviated substantially from the expected dollar price.

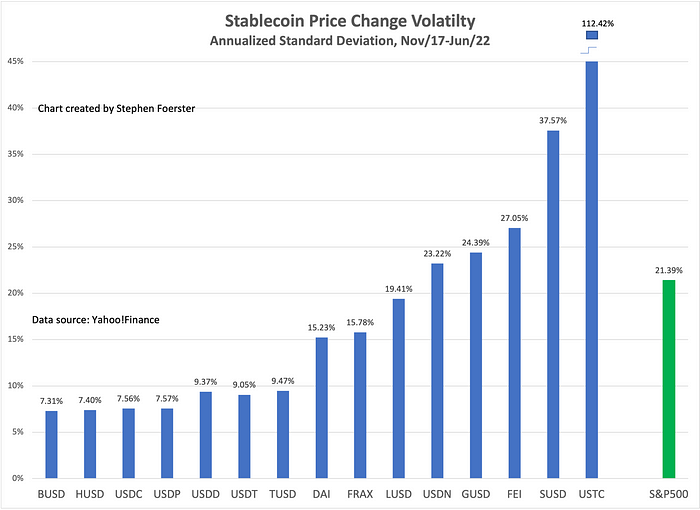

#3 One-third of the largest stablecoins are more volatile than the overall U.S. stock market

This next chart examines the average annualized standard deviation of each stablecoin’s daily price change compared with the standard deviation of the S&P 500 over the entire sample period. Standard deviation is a statistical measure that captures volatility (deviation from the mean or average) in a standardized manner. Think of IQ scores, that have an average of 100, and a standard deviation of 15. IQ scores tend to have a bell shape (or Normal) distribution which implies that about two-thirds of the population are within plus or minus one standard deviation of the average — between 85 and 115.

The standard deviations range from a low of 7.3 percent for Binance to a high of 112.4 percent for Terra. Even for the most stable of stablecoins, Binance, daily prices changes ranged from -5.6 percent to 5.5 percent.

Backed versus algo stablecoins have similar volatility (excluding Terra) on average: 15.7 percent for those backed and 16.0 percent for the algos.

While not an apples-to-apples comparison, the chart also shows the annualized standard deviation of daily changes in the S&P 500 index, a broad measure of U.S. large stock prices. What is somewhat surprising is that for this sample of the 15 largest stablecoins, one-third are more volatile than the overall stock market.

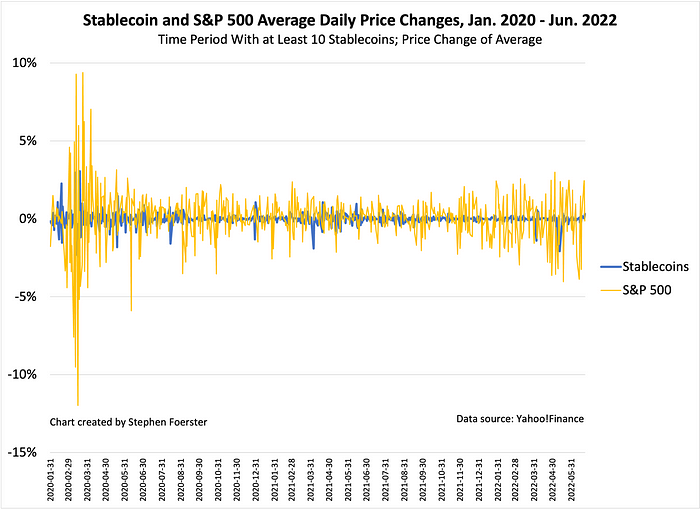

#4 Stablecoin volatility isn’t correlated with overall stock market volatility

This next chart explores whether stablecoin volatility is related to overall stock market volatility. This analysis is based on a shorter time period starting in January 2020 to ensure that there are at least 10 stablecoins in the sample. The period includes very volatile markets early in the pandemic, and more recent stock market volatility.

A visual inspection of the chart shows that there is no discernable relationship. A statistical analysis confirms this as the correlation between the average stablecoin price changes and S&P 500 price changes is a relatively low -0.10 (correlations range from -1.00 to +1.00). We can infer that stablecoin volatility isn’t driven by stock market volatility.

#5 Stablecoin “bank-runs” can occur

Let’s consider banks first. The bank lending model is one that requires banks to set aside capital worth only a fraction of deposits, while the bank makes money by lending at a higher rate than it pays on deposits. A bank run occurs when a large number of depositors all rush to withdraw their funds at the same time, perhaps precipitated by concerns about the stability of the bank. While many real bank runs have occurred, you may be familiar with the famous bank run that takes place in the Christmas classic, It’s a Wonderful Life. (Check it out here when Jimmy Stewart’s character George Bailey deals with a bank run and gives one of the best descriptions of what a bank does. Then check out this short clip from the Simpsons, when Bart starts a bank run, and you’ll appreciate parody at its finest!)

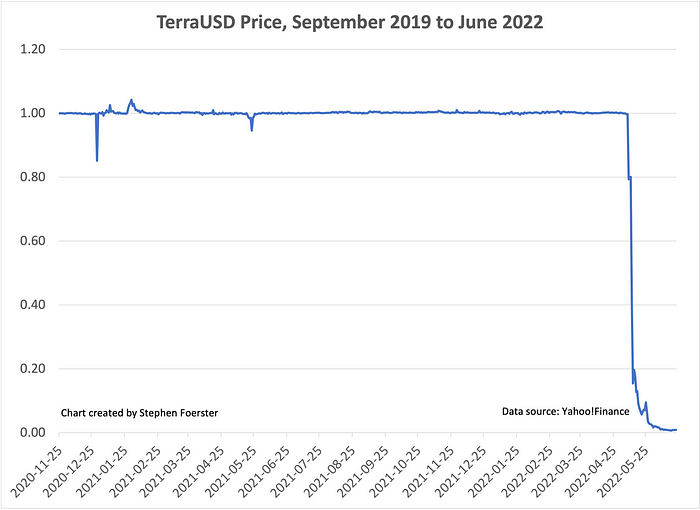

The banking industry is built around trust, and the same is true with stablecoins. If all investors trust that a stablecoin that is tied to the U.S. dollar is actually worth a dollar, then that’s what it should trade for. But if some kind of catalyst causes holders to sell, which might drive the price below a dollar, then that could precipitate others to sell as well. If stabilizing mechanisms don’t work, then a viscous cycle can drive the price down. That’s what happened recently with TerraUSD.

Billionaire Mike Novogratz, former hedge fund manager, reinvented himself as one of the biggest proponents of cryptocurrencies and became a cult figure. His latest venture, Galaxy Digital Holdings, Ltd., made a prominent bet in late 2020 on a newcomer cryptocurrency called Luna that was trading for well under $1 — recall that Luna is the algo stabilizing coin associated with Terra. On March 26th, 2021, he tweeted that he would get as tattoo if Luna rose beyond $100, which it did by late-December, 2021. On January 4th, 2022 he tweeted an image (below) of a large tattoo on his left biceps of a howling wolf and moon, and a Luna banner, and the message, “I’m officially a Lunatic!!”

Image of Mike Novogratz’s tattoo from Twitter, January 4, 2022

Perhaps he shouldn’t have gotten a permanent tattoo. Luna started imploding around May 7, 2022 when Terra’s price dropped below a dollar which prompted a run that in turn prompted a selloff of Luna. Within days $40 billion of value of the two currencies was wiped out. The following chart shows Terra’s price decline.

TerraUSD wasn’t the first stable coin to experience a “death spiral.” In June 2021 a stablecoin called Iron went in such a spiral, costing investors (including billionaire Mark Cuban) $2 billion. The firm itself referred to it as “the world’s first large-scale crypto bank run.”

Conclusion

In a low interest rate environment like today, many investors chase yields, looking for decent returns, but often not aware of the risks associated with potentially higher returns. Some investors turned away from traditional financial institutions that didn’t provide attractive yields on savings and instead put their savings into cryptocurrencies through a sort of “crypto bank” like Anchor Protocol that was offering yields of 20 percent on Terra deposits. However, unlike real banks, deposits in Anchor Protocol weren’t insured. Stablecoins aren’t stable. Stablecoin “bank runs” have occurred and may occur again. Stablecoins are ripe for regulation — the sooner the better.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK