Mono aims to be ‘first bankingless bank’ for Latin America’s small businesses

source link: https://finance.yahoo.com/news/mono-aims-first-bankingless-bank-120511835.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Mono aims to be ‘first bankingless bank’ for Latin America’s small businesses

Opening a business bank account should be fairly easy, but after seeing firsthand just how hard it was, Salomon Zarruk and Sebastian Ortiz decided they didn’t want another Latin American business to run into the same kind of difficulty.

The pair, who worked together at Tpaga in Colombia, relocated to Mexico a few years ago to launch the mobile wallet company there, and let’s just say, Zarruk was less than impressed with the experience. In fact, he told TechCrunch that opening a bank account for the company “was a mess.”

What they came up with was Mono, which means “monkey” in Spanish, a fintech company that provides corporate or business accounts for startups in Colombia. Zarruk and Ortiz, along with Juan Camilo Poveda and José Tomás Lobo, started Mono in January while going through Y Combinator.

Like Zarruk and Ortiz, Poveda has banking experience, having previously developed lending and banking products for Nubank. Meanwhile, Lobo has a tech operations and execution background.

The company’s name is inspired from what happens after there is a fire in the forest, Lobo explained. Though the whole land is black and filled with ashes, it is still fertile, and when the monkeys start going from tree-to-tree eating seeds, they drop many of the seeds on the ground, which become new growth.

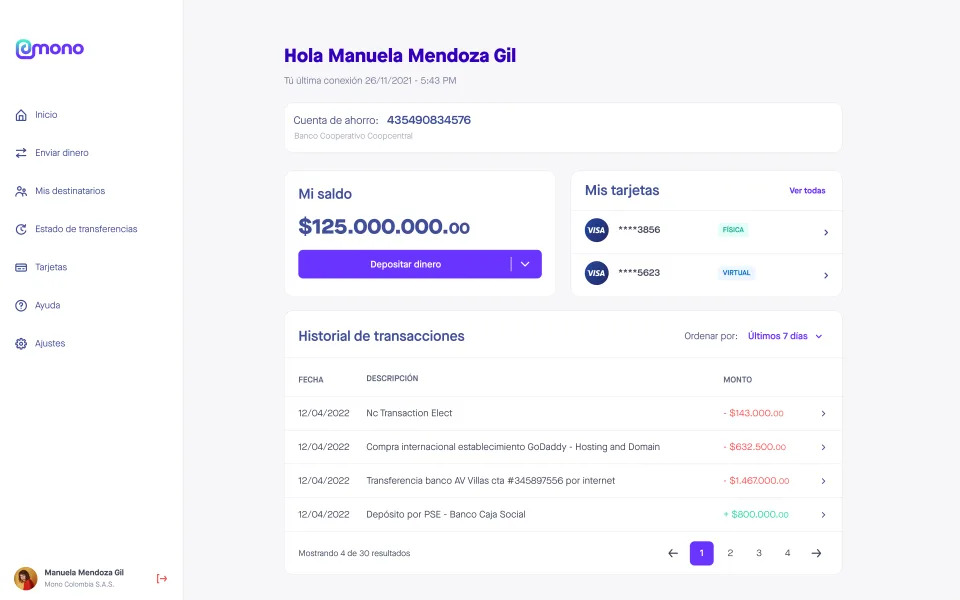

Example of Mono's banking dashboard. Image Credits: Mono

“Those seeds thrown make the rebirth of the forest, and we like that analogy because that’s what small businesses do for the economy — entrepreneurs come in and make changes to the economy,” he added.

Zarruk called Mono “the first bankingless bank” for startups and small businesses in Latin America, providing financial services and fully digital bank accounts that can be opened in around 15 minutes versus an average of two weeks at an incumbent bank.

He explained that the fintech can be labeled “the first” because he believes the company is the first to build a bank for entrepreneurs in Latin America, what he defined as an autopilot bank, that automates several accounting services that are highly manual today. In fact, when Mono tried to establish a bank account at one of the big banks in Colombia, after filling out the paperwork, it still didn’t have an account after two months, Zarruk added.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK