Lots of sellers, fewer buyers, in markets for startup shares

source link: https://finance.yahoo.com/news/lots-sellers-fewer-buyers-markets-072516680.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Lots of sellers, fewer buyers, in markets for startup shares

There's a lot of confusion in the private market right now. On the one hand, venture firms are still announcing new funds on a daily basis. They're hosting catered sushi brunches. On the other, layoffs abound, and titans of industry sound worried. JPMorgan's Jamie Dimon sees an economic hurricane ahead. For his part, Elon Musk reportedly told Tesla executives this week he has a "super bad feeling" about the economy. He's also laying off 10% of Tesla's salaried employees, he told them in a brief email this morning.

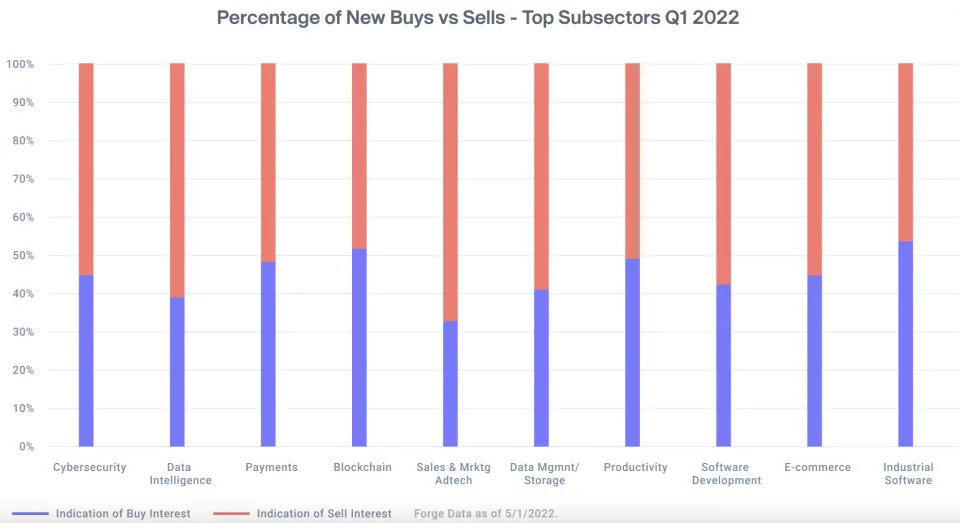

You could hardly blame people looking to sell their startup shares, or those looking to buy them, for feeling unsure about where to meet on price, and that's exactly what's happening right now, says secondary market experts like CEO Kelly Rodriques of Forge Global. In fact, Rodriques says, on Forge, a trading platform for private firms' shares that went public earlier this year via a SPAC, the "supply of private shares right now is higher than it's ever been in history -- by a lot."

Rodriques calls it "price disequilibrium. There's a ton of seller interest, but the range between seller and buyer expectations is too wide for a lot of trading to happen."

Image Credits: Forge Global

He's not alone in seeing this pattern. Justin Fishner-Wolfson separately says the most remarkable thing about the secondary market right now is how stagnant it is. Fishner-Wolfson cofounded and oversees 137 Ventures, a San Francisco-based firm that offers loans to founders, executives, early employees and other large shareholders of private, high-growth tech companies in exchange for the option to convert their debt into equity, and he notes that valuations in the private markets are "slow to change" because "people are waiting to see what things are actually worth."

You can hardly blame them, he suggests; the signals all around appear haywire. "If you look at the public markets, you've got even very large companies moving 5 to 10 percentage points a day, without specific news. Like, this isn't an earnings call that's driving the price." Given that "people don't really know what things are worth on any given day," he says, "in the private markets, things are mostly just slowing down while people wait to see whether or not pricing is something [they] could sort of approximate today, whether or not it gets worse from here, [or] whether or not it gets better from here."

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK