M&A deals in Permian basin exceeds $100 billion in 2023 - WoodMac

source link: https://finance.yahoo.com/news/m-deals-permian-basin-exceeds-030311196.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

M&A deals in Permian basin exceeds $100 billion in 2023 - WoodMac

(Reuters) - The value of U.S. oil and gas mergers and acquisitions in the Permian basin this year has reached a record of more than $100 billion after several multi-billion dollar deals, consultancy Wood Mackenzie said in a news release on Tuesday.

Those include the blockbuster deals such as Exxon Mobil's $60-billion proposed deal for Pioneer Natural Resources PXD.N and Chevron's $53-billion agreement for Hess.

Other deals include Permian Resources' $4.5 billion bid for Earthstone Energy and Ovintiv's $4.3 billion splurge on three Permian Basin acquisitions.

Civitas Resources spent a combined $4.7 billion for two private-equity owned properties in the Permian, Tap Rock Resources and Hibernia Energy III assets.

The Permian basin is a prime target for producers looking to increase their inventory. Lying between Texas and New Mexico, the basin's shale oil output is highly productive with large undeveloped reserves and robust infrastructure.

Occidental's purchase of CrownRock announced on Monday will create the sixth producer in the lower 48 U.S. states of 1 million barrels of oil equivalent per day, with others including Chevron, EOG, ExxonMobil, EQT and ConocoPhillips, Wood Mackenzie said.

In the Permian specifically, Occidental will become a top three producer behind the majors, pumping more oil and gas pro-forma than Pioneer did at the time of its sale announcement, WoodMac said.

"This transaction cements an absolute banner year in Permian acquisitions and divestments spend. Coupled with other mega 2023 deals like ExxonMobil and Pioneer, it solidifies Permian scale and multi-decade longevity as a 'must have' trait for US Majors and Super-Independents," Robert Clarke, vice president of upstream research at Wood Mackenzie said.

WoodMac said the total merger and acquisitions spend this year in the top U.S. shale field is the highest since $65 billion in 2019, led by Occidental Petroleum Corp's $38 billion acquisition of Permian rival Anadarko.

(Reporting by Rahul Paswan and Brijesh Patel in Bengaluru; Editing by Christian Schmollinger)

Bloomberg

BloombergGoldman Says ‘Buy the Dip’ If Stocks Drop After Repricing Fed Cuts

(Bloomberg) -- New data showing resilience in the US labor market put a lid on the US stock market’s five-week advance, with further declines representing a buying opportunity, according to Goldman Sachs Asset Management’s Alexandra Wilson-Elizondo.Most Read from BloombergAbu Dhabi Is the World’s Newest Wealth Haven for BillionairesJack Ma’s Biggest E-Commerce Rival Is Coming for AmazonWall Street Holds Back on Big Bets Before CPI Test: Markets WrapBitcoin’s Largest Decline in Four Months Frays

1d ago Zacks

ZacksPioneer Natural Resources Company (PXD) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Pioneer Natural Resources (PXD). This makes it worthwhile to examine what the stock has in store.

1d ago Barrons.com

Barrons.comOccidental’s CEO Is Rolling the Dice With CrownRock Deal

Exxon Mobil and Chevron are using all equity to finance big acquisitions, but Occidental is relying mainly on debt.

23h ago Bloomberg

BloombergOccidental’s $10.8 Billion Takeover Is a High-Stakes Debt Wager

(Bloomberg) -- The $10 billion of debt lined up for Occidental Petroleum Corp.’s takeover of Texas shale driller CrownRock LP is sizing up to be one of the largest bridge financing deals of the year — and a crucial test for the energy giant.Most Read from BloombergJPMorgan Is in a Fight Over Its Client’s Lost $50 Million FortuneAbu Dhabi Is the World’s Newest Wealth Haven for BillionairesRaimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip BreakthroughHarvard’s Deepening Disunity Pits Alum

20h ago Bloomberg

BloombergChina Chipmaker Seeks Funds at $19.5 Billion Value as IPOs Cool

(Bloomberg) -- Changxin Memory Technologies Inc. is delaying its initial public offering and will instead consider raising funds at about a 140 billion yuan ($19.5 billion) valuation, becoming the latest Chinese company to call off a debut because of volatile market conditions.Most Read from BloombergJPMorgan Is in a Fight Over Its Client’s Lost $50 Million FortuneGoldman Trader Who Was Paid $100 Million Since 2020 to Step DownRaimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip Breakthrou

12h ago Reuters

ReutersOil settles slightly higher, investors still wary

(Reuters) -Oil prices settled up slightly on Monday as OPEC+ production cuts failed to fully offset worries around crude oversupply and softer fuel demand growth next year. Brent crude futures settled up 19 cents, or 0.3%, to $76.03 a barrel while U.S. West Texas Intermediate crude futures settled up 9 cents, or 0.1%, at $71.32. Despite a pledge by the OPEC+ group, which comprises the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, to cut 2.2 million barrels per day (bpd) of crude oil production in the first quarter, investors remain sceptical about compliance.

2d ago Motley Fool

Motley FoolHere's What Rivian Needs to Do to Soar in 2024

Rivian has a clear path forward; it just comes down to execution.

1d ago TechCrunch

TechCrunchRelevance AI's low-code platform enables businesses to build AI teams

Many companies already use generative AI tools, like OpenAI's ChatGPT, which can help improve workers' performance by as much as 40% compared with workers who don't use it. An Australia-based startup, Relevance AI, wants to help companies of all sizes build custom AI agents for any use case or function to maximize productivity with its SaaS-based low-code platform. "Our mission is to enable teams only to be limited by their ideas, not their size -- from the seasoned industry player to the ambitious newcomer," co-founder of Relevance AI Daniel Vassilev said.

18h ago Bloomberg

BloombergSaudi Chemical Giant Sees Weak Global Demand Extending Into 2024

(Bloomberg) -- The head of Saudi Arabia’s largest chemicals producer warned of another difficult year for the industry in 2024, as the outlook for the global economy remains weak. Most Read from BloombergAbu Dhabi Is the World’s Newest Wealth Haven for BillionairesJack Ma’s Biggest E-Commerce Rival Is Coming for AmazonBitcoin’s 2023 Rally Frays During Brief 7.5% Drop Toward $40,000Wall Street Holds Back on Big Bets Before CPI Test: Markets WrapIndia Court Upholds Modi’s Move to Scrap Kashmir’s A

1d ago Motley Fool

Motley FoolIs Rivian Stock a Buy in December?

The electric vehicle maker's shares are down substantially from their IPO price. Is it time to buy?

1d ago Investor's Business Daily

Investor's Business DailyWarren Buffett-Backed Occidental Petroleum Seals $12 Billion Deal For Permian Producer

Warren Buffett-backed Occidental Petroleum announced Monday it agreed to purchase privately held Permian Basin oil producer, CrownRock. The deal, valued at around $12 billion, would be the company's first major acquisition since 2019. Occidental Petroleum's bid for CrownRock comes as energy companies look to increase their share of the consolidating Permian Basin pie.

19h ago Bloomberg

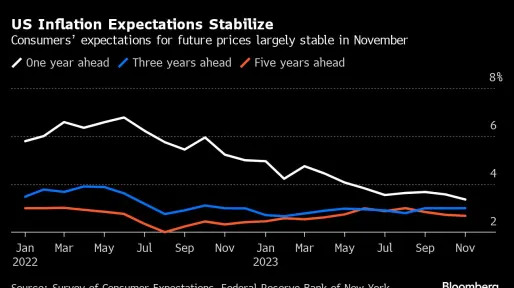

BloombergUS Year-Ahead Inflation Views Drop to Lowest Since April 2021

(Bloomberg) -- US consumers’ near-term inflation expectations dropped in November to the lowest level since April 2021, according to a Federal Reserve Bank of New York survey released Monday.Most Read from BloombergAbu Dhabi Is the World’s Newest Wealth Haven for BillionairesJack Ma’s Biggest E-Commerce Rival Is Coming for AmazonWall Street Holds Back on Big Bets Before CPI Test: Markets WrapBitcoin’s Largest Decline in Four Months Frays Startling RallyHarvard’s Deepening Disunity Pits Alumni Ag

1d ago Bloomberg

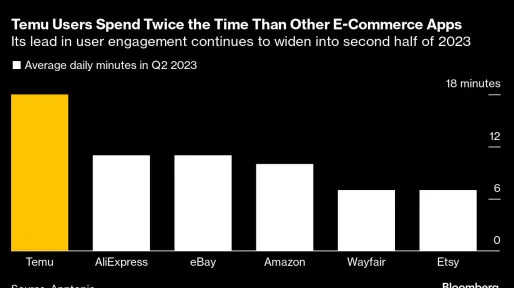

BloombergShoppers Spend Almost Twice as Long on Temu App Than Key Rivals

(Bloomberg) -- Shoppers are spending almost twice as long on Temu, the online shopping juggernaut backed by Chinese heavyweight PDD Holdings Inc., than they are on the apps of major rivals like Amazon.com Inc., according to research firm Apptopia. Most Read from BloombergJPMorgan Is in a Fight Over Its Client’s Lost $50 Million FortuneGoldman Trader Who Was Paid $100 Million Since 2020 to Step DownRaimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip BreakthroughAbu Dhabi Is the World’s New

14h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK