Synopsys Could Sell More to China Without Export Rules, CEO Says

source link: https://finance.yahoo.com/news/synopsys-could-sell-more-china-174630876.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Synopsys Could Sell More to China Without Export Rules, CEO Says

(Bloomberg) -- Brisk growth in China for chip-design company Synopsys Inc. could be even greater without export restrictions, outgoing Chief Executive Officer Aart de Geus said after the company raised its outlook for revenue and profit this year.

Most Read from Bloomberg

On Wednesday, Synopsys announced quarterly sales and earnings that also beat analysts’ estimates. Sales to China increased around 60% from the previous year, to 20% of the total, according to a Bloomberg Intelligence analysis of data released by the company.

“If there were no restrictions, we could probably sell more to China. But we live up to those restrictions,” de Geus said in a Bloomberg TV interview Thursday.

De Geus said artificial intelligence is sparking demand for complex semiconductor chips that Synopsys helps foundries manufacture.

“It’s one of those wonderful situations where the demand continually exceeds what our customers can deliver,” de Geus said. “I.e. the race is on, and in that race we are key ingredients.”

Synopsys offers software used by chip manufacturers. Demand could grow as chips become more complex in part because the company’s designs incorporate artificial intelligence that learns from prior designs and leads to quicker results, according to Bloomberg Intelligence.

The electronic design automation software provider on Wednesday said its president and chief operating officer, Sassine Ghazi, will take on the CEO roll on Jan. 1. De Geus will transition into the role of executive chair.

Sunnyvale, California-based Synopsis has about 20,000 employees and revenue over the last twelve months of approximately $5.5 billion, the company said in a statement announcing the executive transition.

Bloomberg

BloombergChina Targets Yuan Bears With Most Forceful Fixing Guidance

(Bloomberg) -- China delivered its strongest ever pushback against a weaker yuan via its daily reference rate for the managed currency, as it sought to restore confidence to a market spooked by disappointing data and heightened credit risks.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New York‘Poor Man’s Cocaine’ Costing $3 a Pill Threatens to ProliferateUS Equities Remain in Retreat as Bonds Rebound: Markets WrapChina’s Hidden Financial Dangers Erupt With Shadow

19h ago Fortune

FortuneA private equity firm that received B Corp status says ESG and DEI are helping its performance: ‘This is not fluff and happy talk. This works’

"This is the formula for success," says Graham Weaver, founder and CEO of private equity firm Alpine Investors.

19h ago The Telegraph

The TelegraphBritain’s largest pension scheme to invest billions in private companies in boost for savers

Britain’s largest pension scheme will start investing billions of pounds in private companies in a boost to Jeremy Hunt’s plans to deliver higher returns for savers.

11h ago Bloomberg

BloombergMounting Union Wage Demands Risk Impeding Canada’s Inflation Fight

(Bloomberg) -- Wages negotiated by union workers in Canada are creeping higher, complicating the central bank’s bid to restore price stability.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New York‘Poor Man’s Cocaine’ Costing $3 a Pill Threatens to ProliferateUS Equities Remain in Retreat as Bonds Rebound: Markets WrapChina’s Hidden Financial Dangers Erupt With Shadow Bank CrisisBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsUnionized workers have stag

18h ago Bloomberg

BloombergInstacart Plans for September IPO in Boost for US Listings

(Bloomberg) -- Instacart Inc. is planning an initial public offering as soon as September, according to people familiar with the matter, adding to a potential rebound for US listings.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is Kidding Itself on Avoiding a Recession‘Poor Man’s Cocaine’ Costing $3 a Pill Threat

12h ago Reuters

ReutersAllianz bolsters private credit bet with new $1.6 billion fund

Allianz Global Investors, the insurance company's money management division, is pushing ahead with plans to raise at least 1.5 billion euros ($1.63 billion) for a new global private credit fund, a spokesperson said, as investors boost exposure to the asset class. The company established the Allianz Global Diversified Private Debt Fund (AGDPDF) II in Luxembourg in mid-June, company filings show. The fund plans to hold its first close before the end of the year, the spokesperson said, meaning it will have secured enough capital to start making investments.

18h ago Bloomberg

BloombergBalbec Raises Over $460 Million for Its Latest Flagship Credit Fund

(Bloomberg) -- Alternative asset manager Balbec Capital LP has secured roughly $465 million in commitments for its sixth flagship fund, which will invest in consumer, residential and commercial loan portfolios. Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is Kidding Itself on Avoiding a Recession‘Poor Man’s Cocai

14h ago Bloomberg

BloombergStanChart Joins Banks Eyeing Swaps Credit Suisse Once Dominated

(Bloomberg) -- Standard Chartered Plc is joining a growing list of banks keen to explore opportunities in a debt-swap market that was once dominated by Credit Suisse.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is Kidding Itself on Avoiding a Recession‘Poor Man’s Cocaine’ Costing $3 a Pill Threatens to Proliferat

13h ago Reuters

ReutersMarketmind: Adjusting to a new, higher yield world

With the nominal 10-year U.S. Treasury yield a whisker from printing its highest level since 2007 and the inflation-adjusted 'real' yield already the highest since 2009, there is a growing sense that the post-2008 world of ultra-low interest rates and borrowing costs might be gone for good. A poor auction of 20-year Japanese Government Bonds on Thursday - one of the worst in decades, according to some analysts - only deepened the sense of anxiety. Figures on Friday are expected to show that core consumer price inflation in Japan eased to a 3.1% annual rate in July from 3.3% in June.

1d ago Zacks

ZacksNorthrop (NOC) Wins Contract to Aid SEWIP Block 3 Systems

Northrop (NOC) is set to provide design agent engineering of SEWIP Block 3 systems.

16h ago Reuters

ReutersChina unveils measures to revive stock market

SHANGHAI (Reuters) -China's securities regulator unveiled a package of measures on Friday aimed at reviving a sinking stock market, but investors said they would do little to boost confidence if the economy remains sluggish. The China Securities Regulatory Commission (CSRC) proposed steps including cutting trading costs, supporting share buybacks and encouraging long-term investment to support a stock market that has slid to nine-month lows. The regulator said it did not know if there would be a cut in stamp duty, a measure which has been discussed recently but which the CSRC said is beyond its power, falling within the remit of the Ministry of Finance.

20h ago The Telegraph

The TelegraphChinese property giant Evergrande files for US bankruptcy protection

China’s Evergrande, the world’s most indebted property developer, has filed for bankruptcy protection in the US as Beijing’s real estate crisis deepens.

22h ago Bloomberg

BloombergBonds Gain as Investors Spot Value After Sector’s Pummelling

(Bloomberg) -- Global bonds won some respite Friday from the selloff that lifted yields to multiyear highs as stock market declines stoked demand for lower-risk assets.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is Kidding Itself on Avoiding a Recession‘Poor Man’s Cocaine’ Costing $3 a Pill Threatens to Prolifer

14h ago TechCrunch

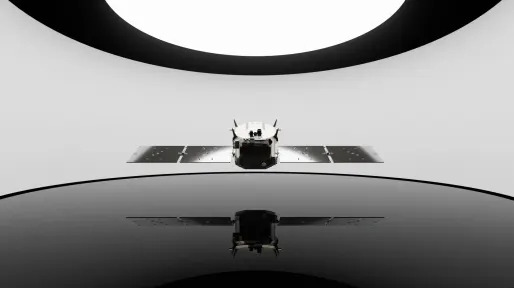

TechCrunchTrue Anomaly gets regulatory greenlight for first spacecraft reconnaissance mission

Defense-focused space technology startup True Anomaly has received key permits from regulators that will allow it to demonstrate imaging and rendezvous capabilities on-orbit for the first time. The two authorizations -- from the National Oceanic and Atmospheric Administration (NOAA) and the Federal Communications Commission (FCC) -- give the company the greenlight to perform non-Earth imaging and to demonstrate in-space rendezvous proximity operations, respectively. True Anomaly is planning on executing these capabilities using two of its “autonomous orbital vehicle” spacecraft, which the company calls Jackals, during a mission early next year.

1d ago Bloomberg

BloombergChinese Officials Meet Foreign Firms to Ease Data Law Fears

(Bloomberg) -- China’s internet regulator is reaching out to foreign firms, including Walmart Inc. and PayPal Inc., to discuss ways to navigate Beijing’s new data-security rules, an effort to reassure multinationals worried about their ability to operate in the world’s No. 2 economy under the latest regulations. Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBitcoin Calm Shatters With Sudden Tumbl

2d ago Investor's Business Daily

Investor's Business DailyIBD 50 Stock Nears All-Time High; Beats S&P 500 With 45% Growth

Growth stock Kinsale is near an all-time high after a 45% gain for the year. Wall Street estimates 45% growth for the insurance stock in fiscal 2023.

2d ago Reuters

ReutersJapan's core inflation eases, bolstering view BOJ will stand pat

TOKYO (Reuters) -Japan's core consumer prices slowed in July, supporting expectations the Bank of Japan (BOJ) will be in no rush to phase out monetary easing, even as inflation remains stubbornly above the central bank's target. The 3.1% rise in the core consumer price index (CPI), which includes oil products but excludes volatile fresh food prices, matched a median market forecast, following a 3.3% increase the previous month. It held above the BOJ's 2% inflation target for the 16th straight month.

1d ago Bloomberg

BloombergApplied Materials Gives Strong Forecast as Chip Slump Eases

(Bloomberg) -- Applied Materials Inc., the largest US maker of chipmaking machinery, gave a bullish forecast for the current quarter, indicating that an industry slump may be fading.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is Kidding Itself on Avoiding a Recession‘Poor Man’s Cocaine’ Costing $3 a Pill Threate

1d ago Bloomberg

BloombergOak Hill, Blue Owl Lead Record Private Credit Deal for Vista’s Finastra

(Bloomberg) -- Private credit behemoths Oak Hill Advisors and Blue Owl Capital are leading a group of lenders on the record-setting $5.3 billion loan package to help Vista Equity Partners refinance Finastra Group Holdings Ltd.’s debt, according to people with knowledge of the matter.Most Read from BloombergChina Evergrande Group Files Chapter 15 Bankruptcy in New York‘Poor Man’s Cocaine’ Costing $3 a Pill Threatens to ProliferateGoldman Plans Hiring Spree to Fix Lapses After Increased Fed Scruti

2d ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK