Fed pauses rate hikes, UnitedHealth stock slides, Shell raises dividend: Top sto...

source link: https://finance.yahoo.com/video/fed-pauses-rate-hikes-unitedhealth-211520977.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Fed pauses rate hikes, UnitedHealth stock slides, Shell raises dividend: Top stories

Fed pauses rate hikes, UnitedHealth stock slides, Shell raises dividend: Top stories

The Fed pauses after 15 months of interest rate hikes. UnitedHealth shares slide as Americans reschedule surgeries that they delayed due to the pandemic. Shell raises its dividend and share buybacks. Yahoo Finance Live breaks down some of the top stories of the day.

-

Fed pauses rate hikes, UnitedHealth stock slides, Shell raises dividend: Top stories

-

Barbara Corcoran: Right now is the best time to buy a home

-

Fed decides to pause: Impact on investors, markets

-

Bud Light loses top sales spot to Modelo after boycott

-

Secretary Blinken set to travel to China this week

-

Why Americans should care about natural gas prices falling

-

Mortgage rates are 'going to stay elevated beyond what people are used to': Expert

-

Google should break up its ad business, EU regulators say

-

Tesla stock extends win streak to 14-straight session

-

Health insurers fall, Affirm's stock tumbles, AMD shares higher: Trending tickers

-

AMD closes higher, AWS reportedly considers using its AI chips

-

Stocks close mixed after Fed pause

-

New ETF uses AI to help investors buy the dip

The Fed pauses after 15 months of interest rate hikes. UnitedHealth shares slide as Americans reschedule surgeries that they delayed due to the pandemic. Shell raises its dividend and share buybacks. Yahoo Finance Live breaks down some of the top stories of the day.

Video Transcript

JULIE HYMAN: Now, it's closing time here at Yahoo Finance. Here's a look at some of the top stories of the day. The Fed officially pressing pause. The central bank holding rates steady after 15 months of interest rate hikes. But leaving the possibility of more tightening this year on. The table stocks initially sold off on the news. But as Fed Chair Jay Powell held his news conference, markets climbed from their lows. Powell reiterating that the Fed will be data-dependent and he said July's meeting as well.

AKIKO FUJITA: One of the top trending tickers today UnitedHealth, the stock sliding after the company said costs were rising amid more surgeries. Previously, insurers had benefited from people delaying non-urgent surgeries because of COVID. The company losing more than $40 billion in market cap or market value as a result of today's decline. But the warning from United was good news for medical device makers. Those stocks got a big bounce today.

JULIE HYMAN: And oil giant Shell raising its dividend and share buybacks. The company also saying it's going to grow its gas and LNG business at its investor conference today. And it's also going to maintain its oil output. Shell's CEO trying to increase investor confidence by focusing on financial performance.

Barrons.com

Barrons.comDon’t Blame the Fed for the Dow’s Drop—Blame UnitedHealth

Did the Fed ding the Dow? It certainly did initially, with the index tumbling 400 points or so after the central bank paused its rate hikes but suggested that it isn’t finished raising them. The closing level suggests otherwise.

6h ago Investor's Business Daily

Investor's Business DailyUnitedHealth's Bad News Hits Insurers, But Sparks Surgery Partners Breakout

UNH stock slumped after management said more seniors are getting hip and surgery procedures. That sent Surgery Partners stock racing past a buy point.

6h ago The Wall Street Journal

The Wall Street JournalShell to Lift Dividend, Launch $5 Billion Buyback

Shell outlined plans to boost its dividend, buy back $5 billion in shares and reduce capital spending. The energy major said it would lift its shareholder distribution to 30%-40% of cash flow from operations through the cycle, with a 15% increase in dividend a share effective from the second quarter.

20h ago Barrons.com

Barrons.comShell Stock Rises on Plans to Give More Cash to Shareholders

The biggest European oil company is boosting distributions to 30% to 40% of cash flow, compared with current rates of 20% to 30%.

17h ago The Wall Street Journal

The Wall Street JournalShell’s New Strategy Avoids the Toughest Questions

The European energy major promises stable oil and gas production this decade, but higher hurdles for investments in lower-carbon alternatives.

13h ago Barrons.com

Barrons.comUnitedHealth and Humana Stocks Fall as Seniors Catch Up on Surgeries, Leading to Higher Costs

'More seniors are just more comfortable accessing services for things that they might have pushed off a bit like knees and hips,' the health insurer says.

10h ago AP Finance

AP FinanceShell ditches lower oil production target but insists it's committed to cutting emissions

Shell has effectively abandoned a plan to cut oil production by 1-2% per year until the end of the decade, instead maintaining output at current levels in a move that risks angering climate activists. Ahead of an investor update in New York on Wednesday, Europe's largest energy company argued that it had already met the target it had set for itself in 2021 through asset sales. London-based Shell said it had seen its production drop from 1.9 million barrels of oil equivalent per day in 2019 to 1.5 million in 2022.

15h ago Reuters

ReutersHomebuilder Lennar raises full-year forecast for home deliveries

Existing homes inventory remains 44% below pre-pandemic levels, according to data from the National Association of Realtors, resulting in price rises in some parts of the country, multiple offers and homes being sold above list price. The perennial shortage of homes on the market is frustrating would-be buyers eager to take advantage of dips in mortgage rates. "As consumers have come to accept a "new normal" range for interest rates, demand has accelerated, leaving the market to reconcile the chronic supply shortage derived from over a decade of production deficits," said Stuart Miller, executive chairman at Lennar.

7h ago Bankrate

BankrateBiggest winners and losers from the Fed’s rate-hike pause

As the Fed holds steady on rates, here are the biggest winners and losers from its latest decision.

9h ago TipRanks

TipRanks‘Too Cheap to Ignore’: Wells Fargo Sees Compelling Opportunity in These 2 Stocks

Everyone is always on the lookout for the best possible deal – that applies to all walks of life, be it at the supermarket, the top echelons of sport, or the investing world. That said, finding the best deal in the stock market could be a complex endeavor because, while it is probably easy to find equities priced in a low range, there might be a good reason why said names are going for cheap. Therefore, a little help in discerning which stocks are just not worth the time of day and which ones ar

13h ago Benzinga

BenzingaJack Dorsey's '$300 Million Bar Tab' To Rub Shoulders With Jay-Z Results In Lawsuit

Many people assume that Twitter was the reason for Jack Dorsey’s impressive fortune, but that actually isn’t the case. When Elon Musk acquired Twitter in October 2022 for $44 billion, Dorsey held a modest 2% ownership of the company’s outstanding equity, equivalent to approximately 18 million shares. Dorsey's pre-tax earnings from the Twitter sale amounted to $978 million. Don't Miss: Why Silicon Valley Elites Are Betting On This Startup’s Vision For Reuniting American Families The true source o

12h ago Business Insider

Business InsiderThe stock rally will end soon, recession will hit, and the Fed won't hike interest rates again, markets guru Jeremy Siegel predicts

The stock-market boom won't last, the economy will suffer a mild recession, and the Fed won't raise interest rates any higher, Jeremy Siegel says.

3h ago Investopedia

InvestopediaThe Fed Paused Rates, Here's What It Means for CDs

The Federal Reserve neither raised nor lowered its benchmark interest rate Wednesday meeting—put neither upward nor downward pressure on the rates banks offer on certificates of deposit.

9h ago Investor's Business Daily

Investor's Business Daily5 Of The Fastest Growing Companies, With Bullish Charts To Top

These 5 stocks are among the fastest growing companies with strong earnings history and projections. All are in bases nearing buy points.

8h ago Investor's Business Daily

Investor's Business DailyMarket Rally Resilient After Fed Surprise; Tesla Ends Record Run, Big Warning Fuels This Group

The market rally held up despite a Fed forecast of two more rate hikes. Tesla ended a big win streak. Medical product firms flashed buy signals after UnitedHealth's warning.

52m ago SmartAsset

SmartAssetAsk an Advisor: We're in Our Mid-50s and Have $2 Million in Our 401(k)s. Should We Pivot to Roth Contributions?

We are a dual-income couple in our mid-50s with over $2 million in our 401(k)s. Should we "sacrifice" the pre-tax benefit and switch to Roth contributions at work? -Wendy Like most tax-related questions, the answer is "it depends." Based on … Continue reading → The post Ask an Advisor: We're in Our Mid-50s and Have $2 Million in Our 401(k)s. Should We Pivot to Roth Contributions? appeared first on SmartAsset Blog.

10h ago Fortune

FortuneBill Gates falls another notch on the world’s billionaire list, as AI takes Larry Ellison higher

Oracle shares soar on AI buzz, lifting Ellison’s net worth.

1d ago Bloomberg

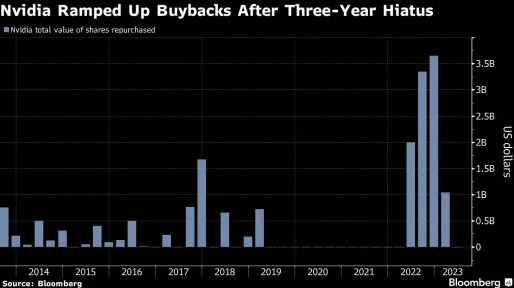

BloombergNvidia Buyback Freeze Follows Perfectly Timed Binge

(Bloomberg) -- Nvidia Corp. made some astute stock buybacks last year ahead of a monster rally fueled by the artificial intelligence frenzy. Now the chipmaker is drawing attention because it stopped buying.Most Read from BloombergElizabeth Holmes Objects to $250-a-Month Victim Payments After PrisonTrump Urges Prosecutors to Drop Case, Offers Defense PreviewBiggest Losers of AI Boom Are Knowledge Workers, McKinsey SaysKen Griffin Ramps Up Credit Bets, Anticipating US RecessionNYC’s Rent Surge Def

13h ago Fortune

FortuneVivek Ramaswamy is threatening GOP heavyweights in the polls–but his business record doesn’t live up to the hype

Yale's Sonnenfeld and Tian retrace presidential hopeful Vivek Ramaswamy's business record.

13h ago Barrons.com

Barrons.comBitcoin Slips After Fed Decision. Where Prices Could Go Next.

and other cryptocurrencies were declining after the Federal Reserve’s decision to pause interest rates Wednesday. Digital assets may be particularly vulnerable to the central bank’s projection of a higher terminal rate later this year. The price of has retreated 0.3% over the past 24 hours to about $25,842.14, slipping below the $26,000 and $27,000 range that has dominated for much of the period since the largest digital asset hit a 10-month high above $30,000 in April.

9h ago

Recommend

-

12

12

Display panel shortages could lead to price hikes, low stock Just what we need right now By

-

4

4

MarketsTesla wants to split its stock so it can pay a stock dividend; shares gainPublished Mon, Mar 28 20226:28 AM EDTUpdated Mon, Mar 28 20227:46 PM E...

-

7

7

Premium ...

-

3

3

Tesla (TSLA) announces 3-for-1 stock split with stock dividend coming August 24 August 6, 2022...

-

8

8

August 22, 2022 ...

-

7

7

UnitedHealth Group Incorporated stock performance and analyst projectionsS&P 5003,583.07

-

8

8

US Markets Loading... In the news ...

-

11

11

Fed Pauses Rate Hikes But Signals More Tightening To Come Catch...

-

6

6

TechUnitedHealth working to restore Change Healthcare systems by mid-March, company...

-

2

2

TechUnitedHealth Group has paid more than $3 billion to providers follow...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK