Warren Buffett sells stakes in two banks, raises Bank of America bet

source link: https://finance.yahoo.com/news/warren-buffett-sells-stakes-in-two-banks-raises-bank-of-america-bet-220257631.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Warren Buffett sells stakes in two banks, raises Bank of America bet

weighing in on everything

Warren Buffett cut his exposure to two more banks last quarter while raising his commitment to Bank of America (BAC) and buying new stock in Capital One (COF).

The billionaire's investment conglomerate Berkshire Hathaway (BRK-A) (BRK-B) sold $1.4 billion of its remaining holdings in custody bank Bank of New York Mellon (BK) and Minneapolis regional lender US Bancorp (USB), according to filings.

They are the latest of his longstanding bank bets to be pared. The Oracle of Omaha sold a large portion of Berkshire’s holdings in US banks between 2020 and 2022, some just months before the banking system upheaval that began in mid March.

The 92-year-old investor has over the decades played the role of rescuer to a number of institutions, including in the 2008 financial crisis. He has yet to emerge as a white knight for any banks in trouble during this current crisis, at least in any way that has thus far been made public.

Buffett made it clear at Berkshire's annual shareholders meeting earlier this month that he is still "cautious" about holding many bank stocks. One exception he cited was Bank of America, which remains one of Berkshire’s largest holdings.

In the first quarter, according to filings, Berkshire increased its Bank of America holdings by 2%, despite the value of its total position in the stock falling $4 billion through the quarter.

"I like Bank of America and I like the management," Buffett said at the shareholder gathering in Omaha, Nebraska.

Buffett has a long history with Bank of America. He injected $5 billion into the Charlotte, N.C.-based bank in 2011. At the time Brian Moynihan was still a relatively new chief executive and the lender's shares were under severe pressure due to losses from subprime loans.

Buffett did invest more deeply into several other financial stocks in the quarter. Berkshire added $954 million of Capital One (COF) and raised its holding in Ally Financial (ALLY) by $10.6 million. The conglomerate also sold $1.1 million of Jefferies Financial Group (JEF) and didn't touch its stake in Citigroup (C).

Yahoo Finance

Yahoo FinanceStocks moving in after-hours: Berkshire Hathaway, Capital One, Beam, Tesla

Stocks moving in after-hours: Berkshire Hathaway, Capital One, Beam, Tesla

5h ago Business Insider

Business InsiderTaylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Taylor Swift's father told Boaz Weinstein the singer invests in a particular type of mutual fund, the hedge fund manager tweeted after a concert.

8h ago Fortune

FortuneWarren Buffett’s top 5 dividend paying stocks that will help him make nearly $6 billion in cash this year

Follow Buffett’s lead to build a portfolio of dividend-paying stocks.

8h ago Yahoo Finance

Yahoo FinanceSilicon Valley Bank CEO Greg Becker: 'I am truly sorry'

The former CEO plans to tell lawmakers that no bank could have survived a bank run 'of that velocity and magnitude.'

2h ago TipRanks

TipRanksBillionaire George Soros Loads Up on These 2 ‘Strong Buy’ Stocks — Here’s Why You Might Want to Follow in His Footsteps

If you’re going to be forever known for one thing, being the ‘man who broke the Bank of England’ is a description many would sign up for. That is how George Soros is regularly introduced, and the story involves how he bet against the British Pound in 1992 and pocketed $1 billion from the trade in a single day. Of course, Soros’ legendary reputation does not rest solely on that headline-grabbing act, and the billionaire investor has had a decades-long career of almost unmatched investing success.

1d ago AP Finance

AP Finance3M fires company executive for inappropriate conduct weeks after promotion

WASHINGTON (AP) — 3M has fired prominent company executive Michael Vale due to “inappropriate personal conduct and violation of company policy,” the maker of Post-it notes, industrial coatings and ceramics announced on Monday. Vale was promoted to group president and chief business and country officer just last month. Vale worked at 3M for more than 30 years, according to an April 25 press release announcing his promotion, which said he would report to Chairman and CEO Mike Roman.

10h ago Bloomberg

BloombergAsian Stocks Gain; Topix Set for Three-Decade High: Markets Wrap

(Bloomberg) -- Asian equities advanced, led by Japanese shares and tech stocks, with traders looking for clues of any breakthrough in negotiations in Washington to avert a US default. Most Read from BloombergTurkey Latest: Erdogan Says Unclear If Vote Will Go to RunoffTurkey Set for Runoff as Erdogan Falls Just Short of VictoryS&P ETF Barely Budges on Yellen’s Late-Day Notice: Markets WrapChicago’s Empty Office Towers Threaten Its Future as a Major Financial HubMicrosoft’s $69 Billion Activision

31m ago TipRanks

TipRanksSeeking at Least 11% Dividend Yield? Here Are 2 Top ETFs to Consider

You’ve probably heard the old market adage to “Sell in May and go away.” Instead, how about using this time to start considering dividend-paying ETFs? There’s no time like the present to start building a dividend portfolio that can set you up with years of passive income. Here are two big dividend ETFs that both yield over 11% that you can consider using to jumpstart your dividend portfolio. Even better, while some high-yield ETFs lure investors in with eye-popping yields but then end up providi

7h ago Bloomberg

BloombergGoogle Billionaire Sergey Brin Gifts $600 Million in Surging Shares

(Bloomberg) -- Google co-founder Sergey Brin gifted Alphabet Inc. shares worth roughly $600 million on Thursday during a week that saw his wealth grow by the most in over two years.Most Read from BloombergTurkey Latest: Erdogan Says Unclear If Vote Will Go to RunoffTurkey Set for Runoff as Erdogan Falls Just Short of VictoryS&P ETF Barely Budges on Yellen’s Late-Day Notice: Markets WrapChicago’s Empty Office Towers Threaten Its Future as a Major Financial HubMicrosoft’s $69 Billion Activision De

4h ago The Wall Street Journal

The Wall Street JournalBerkshire Hathaway Opens New Position in Capital One, Exits Taiwan Semiconductor, BNY Mellon

Berkshire Hathaway's 13F is out. + Warren Buffett's company trimmed its stakes in Chevron, McKesson, Activision Blizzard, General Motors, AON, Ally Financial, Amazon.com and Celanese in the first quarter, the filing showed.

6h ago Yahoo Finance

Yahoo FinanceFanatics' $150 million deal for PointsBet reflects industry 'growing up'

The deal shows how the sports betting industry — which some believe could more than double to be worth $167 billion by the end of decade —has been a tough one for smaller players to survive in. It's either find more capital to keep up with the Joneses, or leave the neighborhood.

7h ago Yahoo Finance

Yahoo FinanceVice files for bankruptcy amid digital media turmoil

Vice Media's bankruptcy filing comes as digital media companies grapple with high costs, widespread layoffs and declining valuations.

13h ago Zacks

ZacksTop Analyst Reports for Visa, Pfizer & SAP

Today's Research Daily features new research reports on 16 major stocks, including Visa Inc. (V), Pfizer Inc. (PFE) and SAP SE (SAP).

6h ago Bloomberg

BloombergStan Druckenmiller, David Tepper Lead Family Offices Betting on AI

(Bloomberg) -- Billionaire investing titans Stanley Druckenmiller and David Tepper loaded up on stocks benefiting from the artificial intelligence boom during the first quarter. Most Read from BloombergTurkey Latest: Erdogan Says Unclear If Vote Will Go to RunoffTurkey Set for Runoff as Erdogan Falls Just Short of VictoryS&P ETF Barely Budges on Yellen’s Late-Day Notice: Markets WrapChicago’s Empty Office Towers Threaten Its Future as a Major Financial HubMicrosoft’s $69 Billion Activision Deal

4h ago Reuters

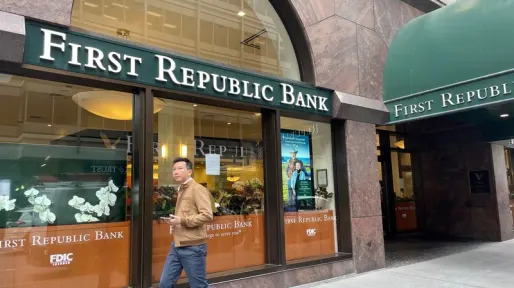

Reuters'Big Short' investor Burry bet on regional banks in first quarter

Hedge fund manager Michael Burry, who rose to fame with his bets against the U.S. housing market before the 2008 financial crisis, added new positions in several regional banks during a tumultuous first quarter for the sector, according to securities filings released on Monday. Burry's Scion Asset Management’s positions included 150,000 shares in First Republic Bank, 250,000 shares in PacWest Bancorp, 850,000 shares in New York Community Bancorp, and 125,000 shares of Western Alliance Bancorp , filings showed. First Republic collapsed May 1, making it the largest bank failure since the 2008 financial crisis.

8h ago Investor's Business Daily

Investor's Business DailyDow Jones Up As McCarthy Gives Debt Ceiling Warning; Activist Investor Targets This Growth Stock

The Dow Jones rose as Kevin McCarthy gave a debt ceiling warning. Microsoft stock rose after a regulator boosted a deal. Meta stock popped.

6h ago Benzinga

Benzinga'We Don't Want To Compete With Elon': Warren Buffett Praises Tesla CEO, But These EV Companies — Including One In His Portfolio — Are Still In The Game

Elon Musk and Warren Buffett are talented in their own right. One is a serial entrepreneur who co-founded Tesla Inc., revolutionized the electric car industry and is sending rockets into space. The other is an investing legend who has helped Berkshire Hathaway Inc. shareholders generate extraordinary returns for decades. At Berkshire’s latest annual shareholders meeting, Buffett spoke highly of the Tesla CEO. “Elon is a brilliant, brilliant guy,” Buffett said. “He dreams about things, and his dr

10h ago Investopedia

InvestopediaONEOK Buys Magellan for $18.8 Billion to Add Oil, Refined Products

Natural gas pipeline operator ONEOK agreed to buy Magellan Midstream Partners, L.P. for $18.8 billion.

6h ago Barrons.com

Barrons.comSoFi CEO Anthony Noto Discloses Stock Purchases by Wife Dating Back to 2021

The chief executive disclosed on Tuesday about $220,000 of SoFi stock purchases made by his wife Kristin Noto from August 2021 through this May.

8h ago Barrons.com

Barrons.comC3.ai Stock Rises on Earnings Update. Demand Is ‘Just Exploding’ for Enterprise AI, CEO Says

The artificial-intelligence software provider forecast higher revenue and a lower operating loss in its fourth quarter than it had told investors to expect.

9h ago

Recommend

-

9

9

Warren Buffett advised graduates to read, polish their communication skills, and find a job they love in a virtual address. Here are the 11 best quotes.

-

14

14

Warren Buffett kicked himself for not inventing Airbnb, which filed to go public this week: 'I wish I'd thought of it'

-

3

3

TechWarren Buffett-backed electric automaker BYD ships 100 cars to NorwayPublished Mon, Jun 7 20215:39 AM EDT

-

11

11

MarketsAs Warren Buffett turns 91, the legendary investor prepares Berkshire Hathaway for a new economyPublished Mon, Aug 30 202110:08 AM EDTUpdated Mo...

-

5

5

Warren Buffett gets gloomy: America's 'inc...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK