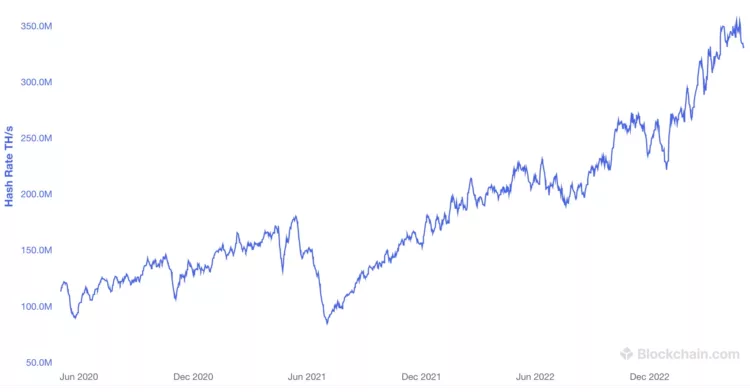

Bitcoin’s Hashrate Crosses 350 Exahashes

source link: https://www.trustnodes.com/2023/05/02/bitcoins-hashrate-crosses-350-exahashes

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Bitcoin’s Hashrate Crosses 350 Exahashes

Bitcoin’s hashrate has reached a new all time high, racing from 89 exahashes a second (Ex/s) in July 2021 when China banned bitcoin mining to above 350 Ex/s.

The combined power to secure the network has now almost doubled since bitcoin’s price peaked in November with the asics mining scene clearly knowing of no bear market.

Innovation continues with the Jack Dorsey owned payment software Block announcing they’ve finished the prototype of a 5 nanometer bitcoin mining asics and are moving to 3 nanometers.

“In support of our three nanometer ASIC development, this month we moved forward with manufacturing a prototype of our completed five nanometer design.

This is an exciting milestone which will allow us to experiment with design variants, validate our design work, and calibrate our testing on real silicon.

We expect to receive the prototypes back this fall,” said Naoise Irwin, Senior Product Lead of Mining Hardware at Block.

This would be the first time a western company manufactures bitcoin asics since western startups invented them in circa 2013.

We speculated in 2020-21 that something like this would happen because the mining scene has significantly increased in the United States.

Many of these miners are stock traded too and one of them secured a deal with a whole nuclear power station for mining.

Some miners are rolling out solar panels and quite a few are utilizing hydro power, but the manufacturing of asics themself has been concentrated in China.

This was a potential risk as the Chinese Communist Party in power has been hostile to crypto since 2014.

The need to manufacture these asics at home therefore has been apparent for some time, and there were whispers and rumors now and then back in 2020-21 that some startups were gearing up to do just that.

Whether the huge rise in hashrate reflects those developments is not too clear, but the trillion dollar crypto network is now more secure than ever.

That’s from market participants but also some state participants. We suspect Iran in particular, while the little country of Bhutan has been confirmed to have been mining.

Russia may start moving that way as it starts feeling the pinch of sanctions, but for now it appears more that it is stock traded miners dominating the scene, though a successful entry by Block in the asics manufacturing business can change the game significantly.

They announced they had secured a deal with Intel which “accelerates our mining system development, enabling us to get to market more quickly.”

The particular needs of the bitcoin mining business and its competitive nature may develop the semiconductors market more widely, so a successful entry by Block may be followed by others, and we should be able to see much of it in the chart.

Not necessarily the details, but this huge rise in hashrate is in our view due to two main aspects. First, cheap sources of energy are being used, and they’re cheap because they are too remote to be used for other purposes like flared gas.

The other reason is probably advances in asics development, as well as growth in demand shown by the fact new miners keep entering the market.

That might sooner or later reflect on the price as the bitcoin network now becomes far more secure.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK