Starbucks earnings: 3 things we’re watching ahead of the Earnings Call

source link: https://finance.yahoo.com/video/starbucks-earnings-3-things-watching-000019569.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Starbucks earnings: 3 things we’re watching ahead of the Earnings Call

Starbucks earnings: 3 things we’re watching ahead of the Earnings Call

Starbucks (SBUX) earnings are expected at 4:05pm ET Tuesday, May 2, 2023. Starbucks CEO Laxman Narasimhan will address investors and key stakeholders in his first earnings call, at 5:00pm ET. Wall Street expects Starbucks (SBUX) to report strong sales momentum in the U.S. as consumers continue to spend despite higher prices. Overseas, analysts expect an increase in international sales and narrowing declines in China as the COVID-19 related impact may now be a tailwind for the coffee chain. Yahoo Finance's Brad Smith, Seana Smith and Brooke DiPalma will break down their key takeaways after the call. Make sure you tune into Yahoo Finance live coverage ahead of Tuesday’s earnings call. Yahoo Finance Live Programming on Thursday: - 9:00 am ET: Julie Hyman, Brad Smith will outline what they want to hear from Starbucks CEO Laxman Narasimhan in his inaugural earnings call - 11:00 am ET: Why the earnings call matters with Rachelle Akuffo - 4:00 pm ET: Seana Smith and Akiko Fujita bring Starbucks’s earnings to you live - 6:00 pm ET (or when the earnings call ends): Brad Smith and Seana Smith will have a vibe check with market reaction and a look ahead at what Starbucks’s results mean for both consumers and investors.

-

Starbucks earnings: 3 things we’re watching ahead of the Earnings Call

-

Why the human genome could be healthcare’s holy grail10:14

-

CEOs weigh in on banking crisis

-

Hawaiian Airlines is going to see 'better results over the next couple of quarters,' CEO says

Hawaiian Airlines is going to see 'better results over the next couple of quarters,' CEO says -

What you need to know about negotiating a severance package

-

First Republic’s collapse: ‘There will be more bank failures,’ analyst

-

Barbie is a 'power brand': Mattel CEO

-

Barbie movie is 'a showcase for the quality of the movies we're looking to make,' Mattel CEO says

-

JPMorgan acquires First Republic, DeSantis-Disney feud escalates, Lordstown Motors' warning

-

We are probably heading for recession: Citi CEO

-

Writers’ Strike looms in Hollywood: What to expect

-

U.S. could hit debt ceiling by June 1 if no deal is reached, Treasury Secretary Yellen warns in new letter

-

JPMorgan 'got the best part of the deal' buying First Republic Bank, analyst says

Starbucks (SBUX) earnings are expected at 4:05pm ET Tuesday, May 2, 2023. Starbucks CEO Laxman Narasimhan will address investors and key stakeholders in his first earnings call, at 5:00pm ET.

Wall Street expects Starbucks (SBUX) to report strong sales momentum in the U.S. as consumers continue to spend despite higher prices. Overseas, analysts expect an increase in international sales and narrowing declines in China as the COVID-19 related impact may now be a tailwind for the coffee chain.

Yahoo Finance's Brad Smith, Seana Smith and Brooke DiPalma will break down their key takeaways after the call.

Make sure you tune into Yahoo Finance live coverage ahead of Tuesday’s earnings call.

Yahoo Finance Live Programming on Thursday:

- 9:00 am ET: Julie Hyman, Brad Smith will outline what they want to hear from Starbucks CEO Laxman Narasimhan in his inaugural earnings call

- 11:00 am ET: Why the earnings call matters with Rachelle Akuffo

- 4:00 pm ET: Seana Smith and Akiko Fujita bring Starbucks’s earnings to you live

- 6:00 pm ET (or when the earnings call ends): Brad Smith and Seana Smith will have a vibe check with market reaction and a look ahead at what Starbucks’s results mean for both consumers and investors.

Video Transcript

BRAD SMITH: But after the call on Starbucks, they got a new CEO that's in there at the helm. We'll hear the voice of Laxman Narasimhan. Additionally there, we're going to be watching for any weakness that they're talking about in China. Also, are they still passing prices on to consumers and if so, where. Keep a close eye on those tickets and what they have to say about it.

And lastly, is digital performing well. We already heard this a [? la ?] Chipotle early on in the earnings season here. We'll see if that's holding true on the digital transformation side for Starbucks, and where the app purchases have held up for those rewards members out there.

[MUSIC PLAYING]

Yahoo Finance

Yahoo FinanceStarbucks earnings preview: US sales growth, China recovery in focus

Starbucks (SBUX) is set to report second quarter fiscal year 2023 earnings results on Tuesday, May 2. Expected: good news for investors.

17h ago Investor's Business Daily

Investor's Business DailyFirst Republic Bank Is The Second-Largest U.S. Bank Failure. What Comes Next?

First Republic Bank marked the 2nd largest bank failure in U.S. history. Are there more to come? What comes next from regulators?

14h ago Reuters

ReutersUS judge declares mistrial in Apple-Masimo smartwatch trade secrets fight

(Reuters) -A U.S. judge in California on Monday declared a mistrial in Masimo Corp's smartwatch trade secret lawsuit against Apple Inc after jurors failed to reach a unanimous verdict in the potential billion-dollar case. A Masimo spokesperson said in a statement that the company was "disappointed that the jury was unable to reach a verdict" but intends to retry the case. The jury in federal court in Santa Ana had been asked to determine whether Cupertino, California-based Apple misused confidential information from Masimo related to the use of light to measure biomarkers including heart rates and blood-oxygen levels.

12h ago The Telegraph

The TelegraphTechnology and slow growth ‘will destroy 14 million jobs by 2027’

Technology and slow economic growth will destroy 14 million jobs around the world by 2027 with secretaries and bank workers facing the biggest losses, economists have warned.

1d ago Bloomberg

BloombergIndonesia Has a Lot of Opportunity for Telecom: Sinha

"Indonesia has a lot of opportunity for the telecom sector." Vikram Sinha, president director and chief executive officer at Indosat Ooredoo Hutchinson, one of Indonesia's largest telecom companies, discusses first-quarter earnings, growth and his outlook for 5G. He speaks exclusively on Bloomberg Television.

5h ago AP Finance

AP FinanceBP posts $5B quarterly profit on strong oil and gas trading

British energy giant BP posted a strong quarterly profit on Tuesday even as oil and natural prices that soared after Russia's war in Ukraine last year have eased off. The company said the earnings report "reflects an exceptional gas marketing and trading result” and a “very strong oil trading result.” Oil companies around the world have been reporting bumper earnings in the wake of Russia's invasion of Ukraine in February 2022, which sent energy prices soaring and curtailed some of Moscow's supplies to the world.

50m ago

First Republic Seized and Sold: Why It Happened and What Comes Next

The FDIC seized First Republic Bank early Monday and struck a deal to sell the bulk of its operations to JPMorgan Chase. WSJ’s Ben Eisen explains what led to the bank’s failure and what it means for customers, investors and the industry. Illustration: Preston Jessee

8h ago Yahoo Finance

Yahoo FinanceFed decision, Apple earnings, April jobs report: What to know this week

The next major test for markets awaits Wednesday when the Federal Reserve makes its next decision on rate hikes.

22h ago Bloomberg

BloombergAlibaba’s Faded Rally Signals Grim Outlook Ahead

(Bloomberg) -- It took only four weeks for optimism around Alibaba Group Holding Ltd.’s breakup plan to fizzle. Restoring it will likely be an uphill battle.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoMorgan Stanley Plans 3,000 More Job Cuts as Dealmaking SlumpsNigeria Targeted a UK Mansion; Its Next Leader’s Son Now Owns ItAlibaba’s American Depositary Rece

50m ago Yahoo Finance

Yahoo FinanceNew lower I bond rate comes with 'a pleasant surprise'

The annualized yield for the Treasury Department’s inflation-protected assets is 4.3% for new purchases made until October 31.

19h ago Yahoo Finance

Yahoo FinanceInside JPMorgan's late-night scramble to buy First Republic

Takeout Mexican, lots of coffee and more than 800 people fueled a weekend-long effort by JPMorgan to win a government-led auction.

14h ago Bloomberg

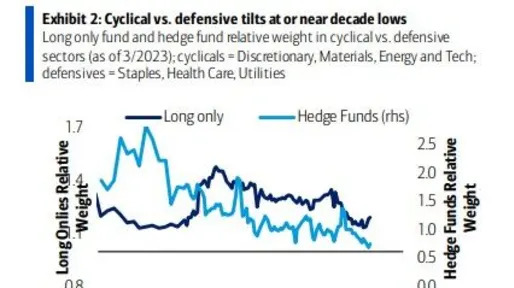

BloombergStock Pickers on Wall Street Are Going All-In on Recession Bets

(Bloomberg) -- As Wall Street economists and central bankers debate if and when the US economy will slip into a recession, big money managers aren’t waiting to find out. Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoMorgan Stanley Plans 3,000 More Job Cuts as Dealmaking SlumpsBuffett Will Beat the Market as Recession Looms, Investors SayIncreasingly, professio

15h ago TipRanks

TipRanks‘Investment opportunity of a lifetime’: Cathie Wood says the robotaxi market could be worth trillions — here are 3 stocks to invest in it (besides Tesla)

Advances in technology often come loaded with financial opportunities and scanning the one presented by the nascent autonomous driving sector, Cathie Wood thinks there is a huge one at play. The Ark Invest CEO has not been shy about making some bold predictions in the past and thinks investors should not underestimate what’s in store for this up-and-coming industry. “We think that the robotaxi opportunity globally will deliver $8 to $10 trillion in revenue by 2030 and is one of the most importan

21h ago Investor's Business Daily

Investor's Business DailyFour Stocks Turn $10,000 Into $50,000 In Four Months

April turned out to be great month for most S&P 500 investors. But it was stupendous for those who picked the best stocks.

23h ago Bloomberg

BloombergFirst Republic’s Jumbo Mortgages Brought On Bank’s Failure

(Bloomberg) -- The seeds of First Republic Bank’s downfall were sown in the jumbo mortgages of Silicon Valley, where a unique strategy to loan wealthy individuals extraordinary sums of money blew up in spectacular fashion.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoBuffett Will Beat the Market as Recession Looms, Investors SayMorgan Stanley Plans 3,000 More

17h ago Bloomberg

BloombergRivian’s Troubles Don’t End at a 93% Wipeout

(Bloomberg) -- The relentless erosion in Rivian Automotive Inc.’s share price is revealing an ugly truth: Investors have little faith left in the ability of the Amazon.com Inc.-backed company to compete in a crowded electric-vehicle market.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureRivian’s Troubles Don’t End at a 93% WipeoutBuffett Will Beat the Market as Recession Looms, Investors SayPeak Oil Spells

21h ago TipRanks

TipRanksInsiders Pour Millions Into These 2 Beaten-Down Stocks — Here’s Why You Might Want to Ride Their Coattails

Whether you’re a seasoned trader or a novice, the oldest piece of advice in economics still holds true: buy low and sell high. The challenge lies in determining the right time to purchase stocks that are undervalued or to sell those that are overpriced. There are plenty of signs to crack that code, but one of the clearest is the insiders’ trading patterns. The insiders are corporate officers, companies’ higher-ups, whose positions put them ‘in the know.’ Therefore, monitoring their trades, espec

1d ago Zacks

ZacksNikola (NKLA) to Report Q1 Earnings: What's in the Offing?

The Zacks Consensus Estimate for Nikola's (NKLA) loss per share and revenues is pegged at 28 cents and $16.25 million, respectively, for the first quarter of 2023.

19h ago Bloomberg

BloombergCoinbase Insiders Sued for Dumping Stock, Saving $1 Billion

(Bloomberg) -- Coinbase Inc. Chairman and Chief Executive Officer Brian Armstrong, board member Marc Andreessen and other officers avoided more than $1 billion in losses by using inside information to sell stock within days of the cryptocurrency platform’s public listing two years ago, before bad news sent the share price tumbling, according to a lawsuit filed by an investor.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought

7h ago Fortune

FortuneWarren Buffett’s right-hand man Charlie Munger says most money managers are little more than ‘fortune tellers or astrologers’

The 99-year-old Berkshire Hathaway vice chairman told the Financial Times Sunday there’s now a “glut of investment managers that’s bad for the country.”

17h ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK