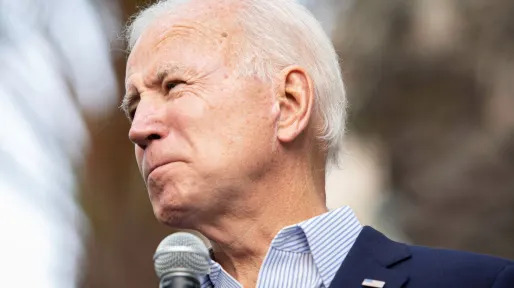

This week in Bidenomics: The debt ceiling “X Date” begins to menace

source link: https://finance.yahoo.com/news/this-week-in-bidenomics-the-debt-ceiling-x-date-begins-to-menace-174915848.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

This week in Bidenomics: The debt ceiling 'X Date' begins to menace

Everybody wants to ignore the federal debt-ceiling drama, the flagellation ritual Congressional Republicans periodically inflict on the nation. And it’s usually safe to do that.

But the moment of reckoning is drawing into view, which means investors may need to buckle up and grab the Jesus handle until Congress does its job and gets back to business as usual.

The government officially hit the federal borrowing limit in January, which means the Treasury can’t issue any more debt until Congress passes a new law raising the limit. Treasury can move money around to keep paying the bills for a while. But eventually, Treasury will hit the “X date,” when there’s simply not enough cash to cover all the bills and the government will default on some of its obligations if Congress doesn’t allow it to borrow more.

When is the X date? For a while, it seemed likely to arrive in mid to late summer. But recent reports suggest the X date could come sooner, perhaps as soon as June. That’s because federal tax receipts during the tax filing season appear to be weaker than expected. That leaves the government with less incoming revenue to pay its bills, which means the point at which it will come up short will come sooner.

The Biden administration is due to provide data on recent tax receipts, with an X date update, the week of April 24. “This is a huge catalyst to watch,” Evercore ISI policy strategist Tobin Marcus wrote in a recent analysis. “If we get a June ‘X date,’ hold onto your hats.”

Republicans and Democrats in Congress have made little progress on a deal to raise the borrowing limit, given the assumption they’d have until August or September to work something out. An earlier X date could turbocharge negotiations, but also spook markets that have been tuning out this needless drama.

For all the brinkmanship, Congress has always raised the debt ceiling, often at the last minute, and prevented the nation from defaulting on its obligations. But the process has inflicted some real damage. The case study is 2011, when ascendent Tea Party Republicans insisted it was worth risking a default to demand spending cuts and reduce federal borrowing.

Reuters

ReutersBrazil's Embraer to build NATO-approved aircraft in Portugal

Brazil's Defence Minister Jose Mucio said on Friday his country's planemaker Embraer SA would manufacture aircraft that meet NATO's requirements in a partnership with Portuguese aerospace company OGMA. Embraer, which holds 65% of OGMA's capital, makes several types of planes, including a light attack aircraft called "Super Tucano". The company launched last week the A-29 Super Tucano with a NATO configuration, initially focussing on meeting the needs of European nations.

2h ago AP Finance

AP FinanceLyft gears up to make 'significant' layoffs under new CEO

Lyft is preparing to lay off hundreds of employees just days after new CEO David Risher began steering the ride-hailing service with a eye of driving down costs to help bring its fares more in line with its biggest rival, Uber. Risher, a former Amazon executive, informed Lyft's workforce of more than 4,000 employees in an email posted online Friday that a “significant” number of them will lose their jobs. It came at end of his first week as Lyft's CEO.

7h ago Bloomberg

BloombergSCOTUS to Rule on Abortion Pill Access

Bloomberg's Sara Forden and Jack Fitzpatrick give their insights on the upcoming ruling the Supreme Court will give on the abortion pill, Mifepristone. They also discuss Speaker Kevin McCarthy's Debt Ceiling bill and whether or not he has the votes to bring the bill to the floor. Both Sara Forden and Jack Fitzpatrick speak with Annmarie Hordern and Joe Mathieu on Bloomberg's "Balance of Power."

5h ago Engadget

EngadgetGoogle gives Bard the ability to generate and debug code

Google's Bard chatbot now has the capability to help you with programming tasks.

15h ago SmartAsset

SmartAssetMost Americans Don't Pass This Social Security Quiz. Can You?

If you're approaching retirement age, chances are you need to brush up on your Social Security knowledge. A recent MassMutual poll found that most people nearing retirement age don't know the ins and outs of this vital safety net program. … Continue reading → The post 65% of People Struggled With These Social Security Questions: Can You Get Them Right? appeared first on SmartAsset Blog.

15h ago Yahoo Finance

Yahoo FinanceHere's why debt ceiling watchers have June 15 circled on their calendars

Experts in Washington and on Wall Street are making their best guesses for how close the government will come to defaulting.

13h ago Benzinga

BenzingaBiden Administration Paying Americans Thousands of Dollars to Upgrade Their Homes

On Aug. 16, President Joe Biden signed the Inflation Reduction Act into law, directing billions of dollars to Americans looking to upgrade their homes, businesses and cars. Don’t Miss: The House-Printing Robot Shaking Up a $7.28 Trillion Industry One provision of the law allows Americans making less than $150,000 a year to claim a $7,500 tax credit for buying an electric car. The law also provides $9 billion in rebates to help people electrify their home appliances and make their houses more ene

8h ago Reuters

ReutersFord defeats class action appeal over F-150, Ranger trucks' fuel economy

Ford Motor Co on Friday defeated an appeal by consumers who said the automaker cheated on fuel economy tests for its F-150 and Ranger trucks, allowing it to inflate mileage estimates on window stickers. In a 3-0 decision, the 6th U.S. Circuit Court of Appeals in Cincinnati said federal law gave the Environmental Protection Agency authority to estimate vehicle fuel economy, preempting the plaintiffs' state law-based claims. Ford's F-series has been the best-selling American truck for 46 straight years.

10h ago Barrons.com

Barrons.comHow a Disappointing Tax Season Has Increased the Risk of a U.S. Default

What happens when an unflappable stock market meets an intractable Congress? With the debt ceiling’s X-date fast approaching and a disappointing tax season in the books, we may get the answer sooner than expected. At first glance, it looks like progress is being made on the debt ceiling.

8h ago Bloomberg

BloombergArgentina Central Bank Lifts Rate to 81% as Inflation Jumps

(Bloomberg) -- Argentina’s central bank increased its benchmark interest rate by 300 basis points Thursday after annual inflation soared in March and foreign currency reserves slumped.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $300SpaceX Says It Blew Up Starship Rocket After Engine MishapMeet the Guy Who Scored $250,000 of Tickets for $17,000 After Airline ErrorUS, Ukraine Allies Co

1d ago The Telegraph

The TelegraphPutin has one last chance to blackmail Europe into submission

As a way of using social media channels, it was at least on-brand.

2d ago Reuters

ReutersBed Bath & Beyond considers asset sales, Sixth Street bankruptcy loan - Bloomberg News

The home goods retailer is also looking to secure funding from U.S.-based investment firm Sixth Street Partners to support its operations through Chapter 11 proceedings but the plans could still change, Bloomberg News reported on Friday. Bed Bath and Beyond did not respond to a request for comment, while Sixth Street Partners declined to comment. In January, Reuters reported that the embattled retailer was negotiating a loan to help it navigate bankruptcy proceedings, with Sixth Street in talks to provide some funding.

1h ago Yahoo Finance

Yahoo FinanceUS economy has 'regained growth momentum' in April as recession fears swirl

Persistent worries about the US economy falling into recession continued to be challenged by data showing better-than-expected growth across industries.

12h ago Fortune

FortuneBitcoin, the debt ceiling, and the ‘revolt’ against the U.S. dollar

The U.S. dollar is losing ground to other currencies, including Bitcoin. A debt ceiling crack-up can only accelerate this trend.

15h ago Yahoo Finance

Yahoo FinanceHits and misses in the Republican debt-ceiling plan

There are some non-starters, but also several elements that could be part of a final compromise with Democrats to raise the federal borrowing limit and get back to business as usual.

1d ago Fortune

FortuneDisney heiress calls for a tax code revamp and calls out the ultra-wealthy who ‘amass fortunes so large that they threaten our democracy’

Abigail Disney and other progressive-minded millionaires want the government to take more of their money.

1d ago Bloomberg

BloombergEuro Zone Turns Page on War Shock With Growth Seen Returning

(Bloomberg) -- The euro zone probably resumed growth in the first quarter as all four of its biggest economies proved resilient enough to shake off the fallout from war on the region’s frontier.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAlphabet CEO’s Pay Soars to $226 Million on Huge Stock AwardCities Keep Building Luxury Apartments Almost No One Can AffordEuropeans Are Rethinking Summer Vacations Because of OvercrowdingUS Supreme Court Keeps Ab

13h ago Benzinga

BenzingaWill US Medicare Fully Cover Alzheimer's Drugs? Eli Lilly Thinks Yes!

Eli Lilly And Co (NYSE: LLY) expects the U.S. Medicare health plan to loosen its grip on the coverage limits on new Alzheimer's drugs, as more data emerging in coming weeks show that clearing amyloid brain plaques can help patients. Lilly plans to release results from a trial of its experimental amyloid-targeting drug donanemab before the end of June. More study data on Leqembi from Eisai Co Ltd (OTC: ESALY)/Biogen Inc (NASDAQ: BIIB) is also expected in the coming months. FDA granted accelerated

10h ago Business Insider

Business InsiderInvestors see a US recession ahead, sticky inflation, and more rate hikes from the Fed, JPMorgan says

"We do not see inflation providing the Fed an option for easing before a recession takes hold, and we maintain a risk bias toward a recession."

1d ago CoinDesk

CoinDeskEU Parliament Approves Crypto Licensing, Funds Transfer Rules

The vote clears the way for landmark MiCA regulation to take effect in 2024.

2d ago Barrons.com

Barrons.comStocks and Bonds Are Sending Very Different Signals. Which Is Right?

The confidence in one market and the concern in the other create a confounding environment for investors in equities and bonds.

9h ago Investopedia

InvestopediaCryptocurrencies Get First Europe-Wide Regulation

The European Parliament approved sweeping laws aimed at regulating the crypto industry in the European Union, including tracing transactions over 1,000 euros.

1d ago Bloomberg

BloombergBiden Aims to Unveil China Investment Curbs With G-7 Backing

(Bloomberg) -- President Joe Biden aims to sign an executive order in the coming weeks that will limit investment in key parts of China’s economy by American businesses, people familiar with the internal deliberations said.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireSpaceX Says It Blew Up Starship Rocket After Engine MishapTesla Increases Price of Model S, X in US After Shares SlumpAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $

20h ago Barrons.com

Barrons.comYellen Delivers a Rare Dose of China Optimism. Is Xi Listening?

In a speech on U.S.-China relations, Treasury Secretary Janet Yellen spoke about room for nuanced diplomacy. It's on Beijing now to meet her halfway, writes Brian P. Klein.

1d ago Reuters

ReutersFed tilts toward rate hike, with a possible pause in view as lending slows

U.S. Federal Reserve officials remain set to raise interest rates at their May 2-3 meeting but key data between now and then, particularly a survey of bank lending officers, may shape how they weight the risks facing the U.S. economy and whether they decide to pause further increases. Since the March 21-22 meeting Fed officials say they have kept in close touch with bank executives and contacts in other industries to gauge how the dramatic collapse of Silicon Valley Bank on March 10 affected the willingness of financial firms to provide credit to businesses and households, and try to gauge if bigger problems threatened. The increased monitoring has included daily checks on liquidity, Fed officials said, and a drive to be sure all banks had the paperwork ready to borrow quickly from different Fed facilities should it be necessary - signs of how seriously top central bankers viewed the collapse of SVB and the smaller Signature Bank.

18h ago Business Insider

Business InsiderThe US may be headed for a credit crunch that could deepen a looming recession, Citi global chief economist says

A lending squeeze is a "very significant wild card [with] a downside risk that we are very, very focused on," top economist Nathan Sheets said.

8h ago Bloomberg

BloombergFed’s Cook Says Assessing Tighter Credit, Strong Data for Rate Decisions

(Bloomberg) -- Federal Reserve Governor Lisa Cook said that US inflation remains elevated and “broad based,” but she’s assessing the impact of tighter credit conditions to determine how high interest rates need to be to bridle price pressures.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAlphabet CEO’s Pay Soars to $226 Million on Huge Stock AwardCities Keep Building Luxury Apartments Almost No One Can AffordEuropeans Are Rethinking Summer Vacations

8h ago Reuters

ReutersFactbox-Chile lithium move latest in global resource nationalism trend

Chile's President Gabriel Boric announced on Thursday he would nationalise the country's vast lithium industry to boost the economy and protect the environment. The shock announcement is the latest in a trend as countries look to assert greater control over key resources amid intensifying competition for materials that are crucial to the energy transition. * Home to the world's largest lithium reserves, Chile said it will over time transfer control of its vast lithium operations from industry giants SQM and Albemarle to a separate state-owned company.

20h ago AP Finance

AP FinanceTribes seek invitation to Rio Grande water commission

A commission that oversees how the Rio Grande is managed and shared among three Western states has adopted a recommendation that could set the stage for more involvement by Native American tribes that depend on the river. The Rio Grande Compact Commission voted unanimously Friday during its annual meeting in Santa Fe to direct its legal and engineering advisers to look into developing protocols for formal discussions with six pueblos that border the river in central New Mexico. Pueblo leaders have been seeking a seat at the table for years, saying their water rights have never been quantified despite an agreement made nearly a century ago between the U.S. Interior Department and an irrigation district to provide for irrigation and flood control for pueblo lands.

4h ago Business Insider

Business InsiderElon Musk predicts a year of 'stormy weather' for the US economy - and warns Tesla faces a raft of headwinds

Higher interest rates, rising fears of layoffs, and banks pulling back on lending are bad news for Tesla and other automakers, Elon Musk said.

1d ago Reuters

ReutersFed's Cook sees a less certain outlook for future of monetary policy

Federal Reserve Governor Lisa Cook said Friday that the outlook for the next stage of central bank monetary policy has grown less clear after the institution has taken appropriately aggressive steps over the last year to lower price pressures. As the Fed moves toward its next decision on where to set interest rate policy, “I am weighing the implications of stronger momentum in the economy apparent in economic indicators over the past few months against potential headwinds from recent banking developments,” Cook said in the text of a speech to be delivered before the Georgetown University McDonough School of Business. “If tighter financing conditions are a significant headwind on the economy, the appropriate path of the federal funds rate may be lower than it would be in their absence,” Cook said, while adding “if data show continued strength in the economy and slower disinflation, we may have more work to do.”

8h ago Reuters

ReutersDebt ceiling jitters lift US credit default swaps to highest since 2011

LONDON/NEW YORK (Reuters) -Market jitters over the U.S. debt ceiling lifted the cost of insuring exposure to its debt to the highest level in over a decade on Thursday, while JPMorgan warned of a "non-trivial risk" of a technical default on U.S. Treasuries. A showdown over U.S. government efforts to raise the $31.4 trillion debt ceiling for the world's largest economy has sent jitters through global financial markets. Spreads on U.S. five-year credit default swaps - market-based gauges of the risk of a default - widened to 50 basis points, data from S&P Global Market Intelligence showed, more than double the level in January.

2d ago Barrons.com

Barrons.comFears of a Default Spur Buying Frenzy of 1-Month Treasuries

Investors are increasingly worried that the federal government could default by mid-June unless Congress acts to lift the debt ceiling. The one-month T bill matures before then.

16h ago Reuters

ReutersYellen raps China for serving as 'roadblock' in debt restructuring process

As the world's largest official bilateral creditor, China should participate in meaningful debt relief for countries facing problems, but it has served for too long as a "roadblock" to necessary action, Treasury Secretary Janet Yellen said in a major speech on U.S.-China relations on Thursday. Yellen said the United States expected China to make good its pledge to work constructively on issues such as debt relief and climate change, noting that delays in restructuring raised costs for both borrowers and creditors. Speaking at Johns Hopkins University's School of Advanced International Studies, Yellen welcomed China's recent provision of credible financing assurances for Sri Lanka, but said Washington continued to urge China's "full participation" in providing debt treatments for Zambia, Ghana and other countries.

1d ago

Russia Mistakenly Bombs Own City, Leaves Huge Crater

A Russian Su-34 jet fighter mistakenly bombed the city of Belgorod near the Ukraine border on Thursday, according to the Defense Ministry. The region’s governor said the explosion left a 66-foot crater and injured three people. Photo: Pavel Kolyadin/Zuma Press

19h ago Yahoo Finance

Yahoo FinanceTime is dwindling for 1.5 million taxpayers to get unclaimed 2019 tax refunds

The Internal Revenue Service said it is holding about $1.5 billion in unclaimed tax refunds for the 2019 tax year.

1d ago CBS MoneyWatch

CBS MoneyWatchYour tax refund landed on time this year? Thank the IRS.

After years of unsatisfactory performance, the tax agency is finally making significant strides — no, really.

7h ago The Wall Street Journal

The Wall Street JournalBiden Administration Considers Tougher Regulation of Money-Market, Hedge Funds

A group of top federal regulators proposed changing the way it designates nonbanks as systemically important.

8h ago Bloomberg

BloombergCalifornia to Supply Most Water Since 2006 After Winter Deluge

(Bloomberg) -- California will send water to cities and towns in amounts not seen in nearly two decades after an exceptionally wet winter created a record mountain snow pack and filled parched rivers and streams.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $300SpaceX Says It Blew Up Starship Rocket After Engine MishapUS, Ukraine Allies Consider Near-Total Ban on Exports to RussiaMeet

1d ago The Wall Street Journal

The Wall Street JournalGOP Presidential Hopefuls Aim to Gain on Trump by Wooing Evangelicals

Spiritual references, conservative policy from Sen. Tim Scott and others show the importance of the group.

2d ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK