This week in Bidenomics: A glimpse of normal

source link: https://finance.yahoo.com/news/this-week-in-bidenomics-a-glimpse-of-normal-144817322.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

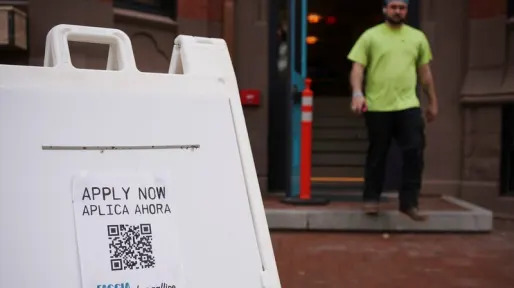

This week in Bidenomics: A glimpse of normal

really contributed

The Federal Reserve and everybody else following the economy have been desperately looking for signs the economy is cooling. Finally, it is.

Employers added 236,000 jobs in March, which is a solid monthly improvement—but it’s also the smallest gain in 27 months. There’s now a solid trend in place showing moderation in the job market after two years of COVID-related distortions and a seemingly unquenchable need for workers.

Earnings are up 4.2% from a year ago, which is also decent—yet that trend is declining, too. A year ago, earnings were growing at a 5.9% annual rate, which raised concerns about a wage-price spiral in which higher labor costs push prices up and lock in inflation. But that doesn’t seem to be happening, either.

This is exactly what the Fed wants to see, and President Biden probably likes it, too. The Fed has been aggressively hiking interest rates to bring inflation down, and one sign that is working is cooling demand for labor. That’s what we’re seeing. Inflation peaked at 9% last June, and it’s now down to 6%. The Fed wants inflation below 3%, and decelerating job growth suggests that’s where it is heading.

There are other signs of a slowdown that should further reassure the Fed. A separate report showed that job openings dropped to 9.9 million in February, which, again, is elevated, but 17% below the peak from last spring. A historically low level of applications for unemployment insurance has been ticking upward since January. A service-sector report shows a slowdown there, too. That’s important because goods inflation is back to normal, but services inflation is still too high. A slowdown in service activity should bring that inflation down.

Two important trends are emerging. First, the Fed is either done hiking interest rates or nearly done. It has raised short-term rates by 4.75 percentage points since last March, including a quarter-point hike on March 22 that some policymakers thought was excessive. If the consumer-price report on April 12 shows a further dip in the inflation rate, as expected, the Fed may have all the top cover it needs to shift into neutral. Even if it doesn’t, future rate hikes will be minimal.

Yahoo Finance

Yahoo FinanceGoldman Sachs: US homebuyers likely see 'modest' impacts from bank crisis

The real estate market is likely to feel a crunch from this year's bank crisis, but the U.S. residential market shouldn't feel the biggest impacts. But that still doesn't mean it's clear sailing for U.S. homebuyers.

10h ago Yahoo Finance

Yahoo FinanceThe IRS lays out where the first chunk of its new $80 billion in funding will go

The Internal Revenue Service announced new details Thursday of exactly how it plans to spend its coming $80 billion windfall.

9h ago Reuters

ReutersTop U.S. shipping gateway mostly closes due to port worker shortage - employer group

(Reuters) -A shortage of West Coast port workers has forced the busiest U.S. ocean trade gateway to largely shut on Friday, after months of strained labor negotiations between the union dock workers and their employers. A substantial number of ports of Los Angeles and Long Beach workers, including operators needed to load and unload cargo, failed to show up on the job starting Thursday evening, according to the Pacific Maritime Association (PMA), which represents employers. The PMA said the missing workers were a result of a coordinated action by the International Longshore and Warehouse Union (ILWU) to withhold labor as contract talks drag on.

6h ago Bloomberg

BloombergUS Bank Lending Slumps by Most on Record in Final Weeks of March

(Bloomberg) -- US bank lending contracted by the most on record in the last two weeks of March, indicating a tightening of credit conditions in the wake of several high-profile bank collapses that risks damaging the economy.Most Read from BloombergJob Market Softens Only a Bit, Keeping Fed on Track for May HikeSummers Says Recession Probabilities Rising, Fed Nearing the EndTesla Cuts Prices of All Models for the Second Time This YearGoogle and Amazon Struggle to Lay Off Workers in EuropeLA, Long

3h ago Fortune

FortuneElon Musk’s brother Kimbal dumps $17 million worth of Tesla shares on the market

The younger sibling, a director on Tesla’s board, lined up the transaction four months ago, thereby freeing up the corporate insider to sell stock during a blackout period.

1d ago Barrons.com

Barrons.comNew Car Prices Are Shocking. Used Ones Are Worse. What It Means for Dealer Stocks.

STREETWISE BARRONS My car seems to be beating the stock market. It’s nothing special—a midsize, mass-market sport-utility vehicle leased in September 2020. On the pandemic supply-chain timeline, that’s after the toilet paper panic and just before the everything-else shortage.

5h ago Barrons.com

Barrons.comGold Is Nearing an All-Time High. Here’s Why.

Recession, inflation, and bank concerns, plus some trepidation about the debt ceiling, have driven the price of the yellow metal. As gold rises, so too should gold-mining stocks.

2h ago The Wall Street Journal

The Wall Street JournalExxon Mobil, Johnson & Johnson, Alphabet: Stocks That Defined the Week

Exxon Mobil has held preliminary and informal discussions about acquiring U.S. fracking company Pioneer Natural Resources , The Wall Street Journal reported Friday, adding that the cash-rich oil-and-gas giant has been looking to expand and has had discussions with at least one other company. Exxon shares jumped 5.9% Monday.

2h ago SmartAsset

SmartAssetHow Much Is Selling My Home Really Going to Cost Me?

Selling your house is a major financial transaction. Whether you're downsizing, upgrading or moving for another reason, you need to know what to expect. After all, you want to get the most you can out of your investment, and part … Continue reading → The post How Much Does It Cost to Sell a House? appeared first on SmartAsset Blog.

1d ago Reuters

Reuters'Powell's curve' plunges to new lows, flashing US recession warning

The Federal Reserve's preferred bond market signal of an upcoming recession has plunged to fresh lows, bolstering the case for those who believe the central bank will soon need to cut rates in order to revive economic activity. Research from the Fed has argued that the "near-term forward spread" comparing the forward rate on Treasury bills 18 months from now with the current yield on a three-month Treasury bill was the most reliable bond market signal of an imminent economic contraction. That spread, which has been in negative territory since November, plunged to new lows this week, standing at nearly minus 170 basis points on Thursday.

1d ago Reuters

ReutersU.S. yields and dollar climb after jobs report

U.S. Treasury yields and the dollar climbed in an abbreviated session on Friday after employment data for March indicated the labor market remained tight last month, raising the odds that the Federal Reserve has at least one more rate hike in store. Nonfarm payrolls increased by 236,000 jobs last month, the Labor Department said, very close to the 239,000 expectated by economists surveyed by Reuters.

10h ago Investopedia

InvestopediaIRS Targets Wealthy Taxpayers with New Strategic Plan

The Internal Revenue Service is set to increase scrutiny for wealthy taxpayers in a new plan funded by $80 billion it will receive under the President’s Inflation Reduction Act.

1d ago Bloomberg

BloombergFed Traders Eye CPI After Jobs Data Boost Odds of a May Hike

(Bloomberg) -- Bond traders are betting that the Federal Reserve probably has one more interest-rate hike to go in this tightening cycle as the economy shows resilience — for now at least — despite recent banking turmoil.Most Read from BloombergJob Market Softens Only a Bit, Keeping Fed on Track for May HikeSummers Says Recession Probabilities Rising, Fed Nearing the EndTesla Cuts Prices of All Models for the Second Time This YearGoogle and Amazon Struggle to Lay Off Workers in EuropeLA, Long Be

5h ago Fortune

FortuneElon Musk says it will cost $14 trillion for the world to rely on fossil fuels but a lot less to convert to clean energy

Tesla's new Master Plan is also a vision for the future of a global sustainable economy.

1d ago The Wall Street Journal

The Wall Street JournalTreasury Yields Climb After Strong Jobs Report

U.S. government bond prices fell Friday, pushing yields higher, after the latest jobs numbers suggested that there remains substantial demand for workers despite some recent signs of a weakening economy.

8h ago Bloomberg

BloombergJob Market Softens Only a Bit, Keeping Fed on Track for May Hike

(Bloomberg) -- US payrolls rose at a firm pace last month with the unemployment rate dropping again near record lows, paving the way for the Federal Reserve to increase interest rates at its next meeting.Most Read from BloombergJob Market Softens Only a Bit, Keeping Fed on Track for May HikeSummers Says Recession Probabilities Rising, Fed Nearing the EndTesla Cuts Prices of All Models for the Second Time This YearGoogle and Amazon Struggle to Lay Off Workers in EuropeLA, Long Beach Port Terminal

9h ago Reuters

ReutersU.S. IRS to hire nearly 20,000 staff over two years with $80 billion in new funds

The U.S. Internal Revenue Service plans to hire nearly 20,000 new employees and deploy new technology over the next two years as it ramps up an $80 billion investment plan to improve tax enforcement and customer service, it said on Thursday . The tax agency, in its long-awaited Strategic Operating Plan, said it will obligate about $8.64 billion of the new funding during the 2023 and 2024 fiscal years, and that 7,239 of the new hires during those years will be enforcement staff. "The IRS is going to hire more data scientists than they ever have for enforcement purposes," U.S. Deputy Treasury Secretary Wally Adeyemo told reporters, adding that these would complement more traditional tax attorneys and revenue agents in using new data analytics technology to identify audit targets.

1d ago Yahoo Finance

Yahoo FinanceOne thing Biden and Trump have in common

Both presidents intervened in the economy to gain an edge over China. We may never go back to laissez-faire policies.

8h ago Reuters

ReutersInside the US jobs report: Record-low Black unemployment

The Black unemployment rate hit a record low in March, a milestone for a U.S. labor market that most policymakers and economists expect to begin cooling in the face of higher interest rates, jeopardizing those historic gains. The Black unemployment rate tumbled to 5% last month from 5.7% in February, the Bureau of Labor Statistics said on Friday, perhaps the most notable data point in a report that at once displayed the resilience of the American job market but also the early signs of its vulnerability to the higher borrowing costs engineered by the Federal Reserve over the last year. Only a month ago, Fed Chair Jerome Powell faced withering criticism from a band of progressive Democratic lawmakers who accused him of trying to orchestrate a slowdown in hiring that would put historically vulnerable populations - Blacks in particular - at the greatest risk of job losses.

7h ago FX Empire

FX EmpireEUR/USD Forecast – Euros Sits at Extreme Highs

The Euro has been very quiet during the day on Friday, which is not a huge surprise considering that liquidity would have been an issue as it was Good Friday.

12h ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK