NBA star Giannis Antetokounmpo spread his money across half a dozen bank account...

source link: https://finance.yahoo.com/news/nba-star-giannis-antetokounmpo-kept-190704594.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

NBA star Giannis Antetokounmpo spread his money across half a dozen bank accounts as a rookie because of the FDIC's $250,000 limit. Billionaire team owner Marc Lasry told him to invest instead.

Silicon Valley Bank's implosion has spotlighted the federal deposit insurance limit of $250,000.

The cap led NBA star Giannis Antetokounmpo to open multiple bank accounts to protect his fortune.

Billionaire investor Marc Lasry told the player to invest in US Treasuries and other assets instead.

The sudden collapse of Silicon Valley Bank has shone a spotlight on federal deposit insurance, which only extends to $250,000 of a customer's money at a single bank. When Giannis Antetokounmpo first learned of the limit, he opened half a dozen bank accounts to protect his fortune.

The basketball star arrived in the US a decade ago at age 18, and went to the bank to open an account, he told Bloomberg on Friday. "I had no money growing up, so I asked them, 'Is my money safe?'" he recalled. After finding out about the $250,000 cap, Antetokounmpo promptly opened accounts at "five, six, seven" banks.

Marc Lasry, the billionaire co-owner of Antetokounmpo's team, the Milwaukee Bucks, shared his reaction to learning of Antetokounmpo's numerous bank accounts at the Bloomberg Wealth Summit last year.

"I'm like, 'Giannis, you can't be having accounts at 50 different banks," Lasry said. "Let me tell you something, if JPMorgan goes under, your little dinky banks are going to go under too. Let me explain what you should buy, you should buy US Treasuries, you should buy this...'"

Lasry, a distressed-debt investor, noted that Antetokounmpo's concerns about safeguarding his cash likely stemmed from his childhood in Greece. The Mediterranean country suffered a sovereign-debt crisis in the mid-2010s that stoked fears among citizens that their bank deposits could be seized or lost.

In recent years, Antetokounmpo has acted on the advice of Lasry and other trusted advisors. "There's way smarter ways to do it, keep your money safe," the power forward told Bloomberg, adding that he's strategically expanded his portfolio since the pandemic.

Antetokounmpo has plenty of money to protect and deploy. He netted an estimated $81 million in earnings on and off the court last year, according to Forbes. The magazine ranked him 10th on its list of the world's highest-paid athletes, after the likes of Lionel Messi ($130 million), LeBron James ($121 million), and Tom Brady ($84 million).

Fortune

FortuneBillionaire investor Charlie Munger says stock market ‘gambling’ is as addictive as ‘heroin’—but he sees no way to fix it

Berkshire Hathaway's Munger criticized investors who trade like they're "gambling" and said it causes harm like the Great Depression.

6h ago Fortune

FortuneElon Musk’s swelling inventories of unsold Tesla cars have Wall Street worried

Even by Tesla’s own official count, the number of cars in stock is reaching levels not seen since the third quarter of 2020—despite the generous use of rebates to entice consumers.

13h ago TipRanks

TipRanksBuy These Clean Energy Stocks, Morgan Stanley Says, Forecasting Over 100% Upside

Right now, we’re at the cusp of a world-changing shift in the green energy economy, as both social and political will have come together to promote a switch from traditional fossil fuels to sustainable and environmentally friendly energy sources. For investors, this shift can open up new vistas of opportunity. Morgan Stanley’s Andrew Percoco believes that the opportunity in clean energy is substantial. The analyst maintains a ‘constructive’ view of energy renewables, and picked out two stocks th

3h ago Bloomberg

BloombergJPMorgan’s Kolanovic Warns Stocks Are in ‘Calm Before the Storm’

(Bloomberg) -- A risk-on mood fueling this year’s equities rally is likely to falter, with headwinds from bank turbulence, an oil shock and slowing growth poised to send stocks back toward their 2022 lows, according to JPMorgan strategist Marko Kolanovic.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Video SeriesOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaSwiss Prosecutors Probe Credit Suisse Deal, Job

6h ago SmartAsset

SmartAssetThis Move Lets You Insure $1.5 Million or More at a Single Bank

Following the recent bank collapses there's good reason to be concerned about how much of your money is and isn't insured. The bad news: Just because an account is held by a bank doesn't automatically mean it's insured. The good … Continue reading → The post This Move Lets You Insure $1.5 Million or More at a Single Bank appeared first on SmartAsset Blog.

12h ago Zacks

ZacksFirst Republic Bank and JPMorgan are part of Zacks Earnings Preview

First Republic Bank and JPMorgan are part of Zacks Earnings Preview.

18h ago Investor's Business Daily

Investor's Business DailyAMC Stock Dives, APE Preferred Shares Soar On Stock Conversion Settlement

The settlement, which needs court approval, would let AMC Entertainment convert APE preferred shares into common AMC stock.

3h ago Barrons.com

Barrons.comApple Likely to Boost Its Dividend and Stock Buybacks Yet Again

The iPhone maker has been increasing its dividend for the last 10 years—and slashing share count for the last five. Expect both to continue when Apple reports March-quarter earnings.

10h ago SmartAsset

SmartAssetWho Should Use Vanguard, Fidelity and Schwab?

SmartAsset compares three of the largest investment companies based on usability, trade experience, offerings and cost. Learn more here.

2d ago Zacks

ZacksMicrosoft (MSFT) Stock Sinks As Market Gains: What You Should Know

In the latest trading session, Microsoft (MSFT) closed at $287.13, marking a -0.41% move from the previous day.

6h ago Zacks

ZacksNvidia (NVDA) Outpaces Stock Market Gains: What You Should Know

In the latest trading session, Nvidia (NVDA) closed at $279.66, marking a +0.68% move from the previous day.

6h ago Zacks

ZacksHere's Why General Electric (GE) Should Grace Your Portfolio

General Electric (GE) is poised for growth on the back of continued momentum in the Aerospace segment and a rebound in the Power segment. Handsome rewards to shareholders add to the stock's appeal.

12h ago Yahoo Finance

Yahoo FinanceRivian: Q1 deliveries top estimates, 'on track' to hit 2023 production forecast

EV-maker Rivian delivered some much needed positive news today to investors, announcing that Q1 deliveries that topped estimates for the quarter, and its production forecast is still on track.

13h ago Investopedia

InvestopediaTop CD Rates Today, April 3

See what today's top nationwide rate is for every CD term, and how it compares to the previous business day's top rate. We collect data from more than 200 financial institutions.

7h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures: Tesla Dives Below Latest Buy Point On Deliveries Miss; What To Do Now

Dow Jones futures were lower late Monday. Tesla stock dived below its latest buy point after a Q1 deliveries miss; what to do now.

2h ago Reuters

ReutersYellen says not willing to allow contagious bank runs to develop

U.S. Treasury Secretary Janet Yellen on Monday said deposit outflows from small and medium-sized banks were diminishing, but she was watching the situation closely and was "not willing to allow contagious runs to develop" in the U.S. banking system. Yellen told reporters after an event at Yale University that confidence in the banking system was strengthened by actions taken by the Treasury, Federal Reserve and Federal Deposit Insurance Corp after the failures of Silicon Valley Bank and Signature Bank.

6h ago Bloomberg

BloombergWall Street Banks Set to Lose More Than $1.3 Billion on Citrix Buyout Debt

(Bloomberg) -- Wall Street banks are poised to realize at least $1.3 billion in losses on the sale of ultra-risky debt tied to the leveraged buyout of Citrix Systems Inc.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Video SeriesOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenBillionaire Blocked From His New Palace Blasts ‘Socialist’ IndiaA group of b

11h ago Benzinga

BenzingaMark Cuban Is Signing The Payroll Check For His Startup

The Silicon Valley Bank’s (SVB) unforeseen fallout has created ripple effects across the U.S. banking and startup sectors. This is because the SVB was one of the most coveted banks among startup companies and venture capitalists. What was the 16th-largest bank in the U.S. serviced approximately half of all U.S. venture capitalist-backed startups. Don’t Miss: Elon Musk & Sam Altman Say Scary Good AI Is On The Way – Here's How Retail Is Investing Millions Consequently, the banking mammoth’s sudden

9h ago Barrons.com

Barrons.comTesla Set a Delivery Record. Why the Stock Is Dropping—and What Wall Street Thinks.

Tesla delivered 422,875 vehicles in the first quarter of 2023, up from 405,278 vehicles in the fourth quarter of 2022 and up from the 310,048 vehicles delivered in the year-ago period.

7h ago Investor's Business Daily

Investor's Business Daily10 Stocks Consistently Shower Investors With Big Gains In April

April is one of the best months of the year for S&P 500 investors. And some stocks keep handing investors big gains during the month.

15h ago SmartAsset

SmartAssetThese Trusts Can Help You Avoid Estate Taxes

Estate taxes are a form of transfer tax that affects the very wealthy. For multimillionaire households, avoiding the estate tax is a significant issue. One tool that households can use to try to minimize their estate tax liability is the … Continue reading → The post How to Avoid Estate Taxes With Trusts appeared first on SmartAsset Blog.

14h ago Bloomberg

BloombergWorst-Performing Funds of 2023 Are Drawing Huge Amounts of Cash

(Bloomberg) -- Add this to the long list of market surprises in the first quarter of 2023: The worst-performing exchange-traded funds still managed to attract massive amounts of cash. Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Video SeriesOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenBillionaire Blocked From His New Palace Blasts ‘Socialist’ Ind

9h ago Zacks

ZacksWall Street Analysts Think Enphase Energy (ENPH) Is a Good Investment: Is It?

According to the average brokerage recommendation (ABR), one should invest in Enphase Energy (ENPH). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

14h ago American City Business Journals

American City Business JournalsWells Fargo's departure leaves Chester without bank branch in central business district

Wells Fargo & Co.'s plan to close its branch at 501 Avenue of the States in Chester will leave TD Bank as the lone bank or credit union with a retail location in the city of roughly 33,000 residents. In a statement, Wells Fargo (NYSE: WFC) said it made the “difficult decision” to close the Chester branch, effective June 21. It will also keep an ATM at that location and continue to support organizations such as Drexel Neumann Academy, Chester Improvement Project and Foundation for Delaware County.

1d ago Investor's Business Daily

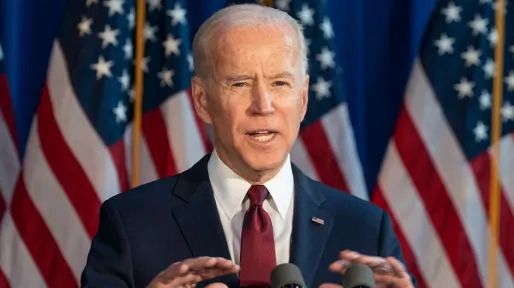

Investor's Business DailyBiden Approval Rating Shows Resilience As Financial Stress Rises

President Biden's approval rating is holding near its best level in more than a year, though cracks in the economic outlook are emerging, the IBD/TIPP Poll finds.

13h ago Benzinga

BenzingaREITs Are Back In Favor With Analysts

Analysts’ estimates of real estate investment trusts (REITs) have been on a roller coaster ride in 2023. After beginning the New Year with a slew of upgrades on REITs that had been badly battered throughout 2022, the analyst community was extremely quiet in February. Although there were dozens of Maintain and Reiterate ratings, not one analyst upgraded a REIT in February, and there were nine REITs that received downgrades. But as March comes to an end, REITs seem to be back in favor with analyst

12h ago The Telegraph

The TelegraphPutin pushes Russian oil exports to record high

Vladimir Putin has pushed seaborne deliveries of Russian crude to record highs to fill Moscow's war chest, even as the Kremlin vowed to tighten oil supplies.

8h ago Barrons.com

Barrons.comApple Stock Nears a Record. iPhone Demand Could Help It Soar, Analyst Says.

Strong demand for the phones in Asia and improving revenue from services revenue bode well for the shares, analysts at Wedbush say.

13h ago Zacks

ZacksAmazon (AMZN) Stock Sinks As Market Gains: What You Should Know

Amazon (AMZN) closed the most recent trading day at $102.41, moving -0.85% from the previous trading session.

6h ago Reuters

ReutersUS sales at top automakers rise on improving inventory, Toyota struggles

General Motors Co, which replaced Toyota as the top U.S. automaker in 2022, posted a 17.6% rise in first-quarter auto sales. "We gained significant market share in the first quarter, pricing was strong, inventories are in very good shape, and we sold more than 20,000 EVs (electric vehicles) in a quarter for the first time," GM Executive Vice President Steve Carlisle said in a statement.

17h ago Barrons.com

Barrons.comSmall-Cap Stocks Look Ready to Rally. Take a Look at These Two.

As of Friday's close, the Russell 2000 was at 44% of the S&P 500's level, a ratio seen in early 2020 when Covid-19's arrival left the economy in perilous waters.

9h ago Bankrate

BankrateBest brokerage account bonuses in April 2023

Have some extra cash you want to invest? Brokerages are rewarding new clients.

1d ago CoinDesk

CoinDeskBitcoin Drops to $27.5K While Dogecoin Spikes After Twitter Logo Change

BTC needs a catalyst to break the $30,000 threshold. DOGE spikes after Twitter CEO Elon Musk changes the logo on the social media platform to the Dogecoin symbol from a blue bird.

6h ago Barrons.com

Barrons.comIntel Stock Scores an Upgrade. Fundamentals May Have Bottomed, Analyst Says.

The chip maker should be able to make its earnings estimates and may hit its chip pipeline schedule, writes Bernstein.

11h ago Investopedia

InvestopediaTesla Slumps on EV Credit Change Despite Record Deliveries

Tesla shares slumped despite delivering record deliveries after the US updated eligibility for EV tax credits, potentially threatening the company's growth prospects.

5h ago Zacks

ZacksFord Motor Company (F) Outpaces Stock Market Gains: What You Should Know

Ford Motor Company (F) closed the most recent trading day at $12.68, moving +0.63% from the previous trading session.

6h ago FX Empire

FX EmpireAUDUSD Forecast – Australian Dollar Rockets Higher

The Australian dollar initially pulled back during the trading session on Monday, but then shot straight up in the air to reach a major resistance block.

15h ago Bloomberg

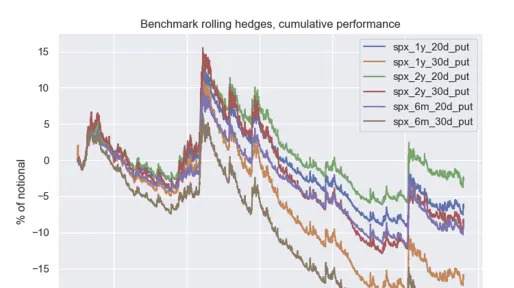

BloombergWhy One Firm's 3,612% Return Is Drawing the Ire of Hedge Funds

(Bloomberg) -- Mark Spitznagel is a master at generating buzz for his tail risk-protection business. From partnering with the man who coined the very term “Black Swan” to warning this January that we’re in “the greatest tinderbox-timebomb in financial history,” he makes sure Universa Investments is rarely far from the Wall Street spotlight. Most Read from BloombergOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenBillionaire Blocke

14h ago Barrons.com

Barrons.com7 Dividend Stocks for Uncertain Economic Times

Treasuries aren't the only refuge in a slowdown. Dividend names also "can provide a margin of safety," says UBS.

13h ago Zacks

ZacksPetrobras (PBR) Faces Pressure to Reconsider Asset Sales

The government is pushing Petrobras (PBR) to reconsider its asset sales plan in order to maintain a balance between immediate financial needs and long-term strategic objectives.

16h ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK