SVB testimony, inflation update, and earnings- everything you need to know for t...

source link: https://finance.yahoo.com/video/svb-testimony-inflation-earnings-everything-100035229.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

SVB testimony, inflation update, and earnings- everything you need to know for the week ahead

SVB testimony, inflation update, and earnings- everything you need to know for the week ahead

SVB hearings, major economic data, and some heavy hitters reporting earnings. There’s a lot going on in the week ahead. Here’s what you need to know: For the first time, members of Congress will grill top banking regulators over the collapse of Silicon Valley Bank and Signature Bank. Top officials from the Federal Reserve, FDIC, and Treasury Department are expected to testify on Tuesday and Wednesday on Capitol Hill, as lawmakers try to get to the bottom of why the banks failed. Wall Street will be watching this week for the latest round of economic figures. We’re set to receive 2022 Q4 GDP (final), PCE inflation data, consumer confidence, and fresh information on the health of the housing market. And big time market movers Walgreens (WBA), Carnival Cruise Line (CCL), and Lululemon (LULU) are primed to post their quarterly earnings. Investors will want to keep a close eye for news coming out of those reports. Find more of the latest earnings headlines here.

-

SVB testimony, inflation update, and earnings- everything you need to know for the week ahead Yahoo Finance Video

-

Will AI Take Your Job? How Artificial Intelligence is Shaping the Future of Work

-

Why being public could complicate Manchester United sale

-

Blockbuster Video has a live website, sparking comeback rumors

-

Why Netflix is a top tech pick, according to one analyst

-

Deutsche Bank concerns, TikTok hearing, Fed rate hike: 3 things to know from the week

-

TikTok looks nothing like what was described in Congressional Hearing: Bookstore Owner

-

Why Credit Suisse, Deutsche Bank woes matter to the U.S. markets, economy

-

Bitcoin still pricing close $28k to end the week

-

FCC Commissioner Brendan Carr: We need to move forward quickly on a TikTok ban

-

Jerome Powell is in 'a position that none of us want to be in,' financial expert says

-

TikTok hearing: Representatives' views on TikTok was 'sort of devastating,' small business owner says

-

Fed's Powell says inflation is still too high after Fed hikes rates 0.25%

SVB hearings, major economic data, and some heavy hitters reporting earnings. There’s a lot going on in the week ahead. Here’s what you need to know:

For the first time, members of Congress will grill top banking regulators over the collapse of Silicon Valley Bank and Signature Bank. Top officials from the Federal Reserve, FDIC, and Treasury Department are expected to testify on Tuesday and Wednesday on Capitol Hill, as lawmakers try to get to the bottom of why the banks failed.

Wall Street will be watching this week for the latest round of economic figures. We’re set to receive 2022 Q4 GDP (final), PCE inflation data, consumer confidence, and fresh information on the health of the housing market.

And big time market movers Walgreens (WBA), Carnival Cruise Line (CCL), and Lululemon (LULU) are primed to post their quarterly earnings. Investors will want to keep a close eye for news coming out of those reports.

Find more of the latest earnings headlines here.

Yahoo Finance

Yahoo Finance5 things you may have missed during a pivotal week for the Fed and markets

So much for market calm.

15h ago Barrons.com

Barrons.comNBA Players Were Defrauded by Ex-Morgan Stanley Advisor, Authorities Allege

The Securities and Exchange Commission and Department of Justice have announced civil and criminal charges in an alleged $5 million fraud involving three NBA players.

1d ago Bloomberg

BloombergSan Francisco Fed’s Mary Daly Skips Conference Remarks After SVB Collapse

(Bloomberg) -- Federal Reserve Bank of San Francisco President Mary Daly, who is among senior central bankers whose role in the collapse of Silicon Valley Bank is under scrutiny, has pulled out of an appearance at a conference hosted by her bank.Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push

1d ago Bloomberg

BloombergSVB Collapse Could Mean a $500 Billion Venture Capital ‘Haircut’

(Bloomberg) -- The $2 trillion venture capital industry could see portfolio markdowns of 25% to 30% — a “haircut” of possibly $500 billion — following the Silicon Valley Bank debacle, according to Bloomberg Intelligence. Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Explo

1d ago Fox Business

Fox BusinessSpring home buying season shows 'steady demand' as mortgage rates slip for second week

Demand for home buying has been "steady" as mortgage rates continue to slip. Mortgage rates fell for the second week to 6.42%, according to Freddie Mac, after the Federal Reserve said it would modestly hike rates.

1d ago TheStreet.com

TheStreet.comFour Banks Collapsed. Worries About Two Others Persist. Will They Fall?

For the third consecutive week, the weekend promises to be decisive for the banking sector, as investors fear that Silicon Valley Bank's difficulties will spread. On March 10 regulators had to shut down the bank, resulting in the second-biggest bank failure in American history, after the collapse of Washington Mutual in the financial crisis of 2008. The crisis also reached Europe, pushing the Swiss government to force UBS to urgently buy its compatriot Credit Suisse for the modest sum of $3.24 billion.

1d ago Barrons.com

Barrons.comCharles Schwab Stock Got Hit in the Bank Mess. Be Careful.

The brokerage’s stock has plunged by more than a third this year as customers yank cash from low-yielding “sweep” accounts. What’s ahead.

1d ago MoneyWise

MoneyWiseJeremy Siegel says there's a silver lining to the current bank crisis — making him more optimistic about 2024. Is the famed economist onto something?

Recent turmoil = a more bullish outlook? Here's how

11h ago Reuters

ReutersUS mulls more support for banks while giving First Republic time - Bloomberg News

All deliberations are at an early stage and an expansion of the Federal Reserve's emergency lending program is one of the many considerations by officials to support the failing lender, the report said, citing people with knowledge of the situation. While any changes to the Fed's liquidity offerings would apply to all eligible users, the adjustments could be designed to ensure that First Republic benefits from the changes, Bloomberg said. Representatives for the U.S. Treasury and the Federal Reserve did not immediately respond to Reuters' request for a comment.

3h ago SmartAsset

SmartAssetRoth IRA Withdrawal Rules and Penalties You Probably Don't Know About But Should

Roth IRAs are one of the many ways you can save for retirement. Their key benefit – you can withdraw funds in retirement without paying taxes on the distributions – has made them very popular among tax-savvy investors. Still, there … Continue reading → The post Roth IRA Withdrawal Rules and Penalties appeared first on SmartAsset Blog.

12h ago Bloomberg

BloombergUS Mulls More Support for Banks While Giving First Republic Time

(Bloomberg) -- US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet, according to people with knowledge of the situation.Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom

8h ago The Wall Street Journal

The Wall Street JournalHere’s What Retirement With Less Than $1 Million Looks Like in America

Total household balances in retirement accounts for those 55 to 64 years old are $413,814 on average, according to its estimates based on 2019 data, the most recent available. “For many, the expectation of retirement doesn’t match the facts of their everyday financial lives,” said Larry Raffone, chief executive of Edelman Financial Engines. Dana and Elsie Jones hoped to become snowbirds in retirement, living half the year in Florida.

1d ago Fortune

FortuneEurope will pay the price for wiping out Credit Suisse bondholders as its ex-CEO warns U.S. banks are ‘rubbing their hands’

Tidjane Thiam says the controversial decision by Swiss authorities will mean U.S. and Asian lenders could come out of banking crisis stronger.

1d ago South China Morning Post

South China Morning PostApple CEO Tim Cook to meet top China officials amid growing risks of supply chain decoupling with the US

Apple CEO Tim Cook will be among a small group of top US executives attending a high-profile summit hosted by the Chinese government this weekend, in a show of commitment to the market amid decoupling risks and supply chain adjustments. The head of the world's most valuable company will join Jon Moeller, CEO of consumer goods giant Procter & Gamble; Stephen Schwarzman, CEO of investment firm Blackstone; and Ray Dalio, founder of the world's largest hedge fund Bridgewater Associates, at the China

2d ago The Wall Street Journal

The Wall Street JournalWhere to Put Your Money During a Banking Crisis

Market turmoil is sending nervous investors into cash, but there are several options better than parking it in a mattress.

1d ago SmartAsset

SmartAssetIs There Actually an RMD Cut-Off Age?

Required minimum distributions (RMDs) are the minimum amount that you must withdraw from certain tax-advantaged retirement accounts. They begin at age 72 or 73, depending on your circumstances and continue indefinitely. There is, unfortunately, no age when RMDs stop. You … Continue reading → The post At What Age Do RMDs Stop? appeared first on SmartAsset Blog.

12h ago Bloomberg

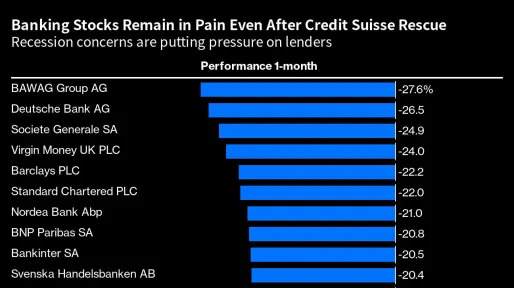

BloombergThe Flight to Safety Is About the Next Recession, Not Banks

(Bloomberg) -- Fears of tightening financial conditions leading to a recession are driving traders to rethink their risk exposure and seek out safety in the stock market. Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Home Era. Now New Residents A

12h ago SmartAsset

SmartAssetAre You Rich? Biden Might Double Your Capital Gains Taxes

While social issues have dominated news coverage recently, one of the most contentious and important issues in Washington never changes - tax policy. One of former President Donald Trump's biggest victories was his 2017 tax plan that drastically reduced taxes … Continue reading → The post Are You Rich? Biden Wants to Double Your Capital Gains Taxes and Implement a Wealth Tax appeared first on SmartAsset Blog.

1d ago Bloomberg

BloombergValley National, First Citizens Said to Bid on Silicon Valley

(Bloomberg) -- Valley National Bancorp and First Citizens BancShares Inc. are both vying for Silicon Valley Bank after its collapse earlier this month, according to people familiar with the matter. Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Ho

1h ago Bloomberg

BloombergBond Traders Go All-In on US Recession Bets That Defy Fed View

(Bloomberg) -- Bond investors are piling into wagers that a US recession is around the corner amid a growing dissonance between how markets and the Federal Reserve see the outlook for the economy.Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Home

5h ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK