Venture Capitalists Convince Startups to Keep Money With New SVB

source link: https://finance.yahoo.com/news/venture-capitalists-convince-startups-keep-200901313.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Venture Capitalists Convince Startups to Keep Money With New SVB

(Bloomberg) -- Venture capitalists have largely kept the promise they made the day after Silicon Valley Bank dramatically collapsed: They would continue doing business with the bank if it was able to continue operating.

Most Read from Bloomberg

In a private call on Tuesday, the new chief executive officer of Silicon Valley Bridge Bank, Tim Mayopoulos, said that private markets have been instrumental for the institution in maintaining its deposit base, according to a readout of the call reviewed by Bloomberg. During the conversation with the Institutional Limited Partners Association, a trade association, Mayopoulos said that VCs had returned significant deposits that were moved from the bank when it was in crisis, and were publicly encouraging portfolio companies to do the same.

The ILPA declined to comment.

In the chaotic hours shortly after the bank collapsed, many VCs signed onto a statement calling for the bank to be saved, and saying they would keep money with the new iteration of it. Last week, General Catalyst CEO Hemant Taneja tweeted a follow-up statement co-signed by many of the same investors, recommending that portfolio companies keep 50% of their deposits with the new SVB.

High-profile investors have voiced their support for Silicon Valley Bank. In an interview with Bloomberg Television, investor Vinod Khosla said he was encouraging companies to keep funds with the bank and stressed that their “money was safe” there.

In a statement, a representative for General Catalyst said, “From the start we have been advising portfolio companies to keep approximately 50% of deposits in the bank. Many venture firms are giving that guidance to their companies.” The firm has emphasized that SVB is an important piece of Silicon Valley infrastructure. Adding: “In fact, we have been using them in current investing activity.”

Bloomberg

BloombergTycoon Who Made ‘Lucky’ US Wind Power Bet Plans to Invest More

(Bloomberg) -- Gim Seong-gon, who became an early wind-power tycoon after realizing time was running out for his business of building chimneys for fossil fuel plants, was about to make his next surprising move.Most Read from BloombergBomb Threat Called In to New York Court Where Trump Hearing HeldBiden Stunts Growth in China for Chipmakers Getting US FundsFed Caught Between Inflation and Bank CrisisFirst Republic Rescue May Rely on US Backing to Reach a DealSVB’s Loans to Insiders Tripled to $21

1d ago The Wall Street Journal

The Wall Street JournalYellen Says Treasury Isn’t Considering Guaranteeing All Bank Deposits

After two banks collapsed this month, some lawmakers and banks are discussing whether to expand deposit insurance.

10h ago Reuters

ReutersModerna CEO defends $130 US COVID vaccine price in Senate hearing

(Reuters) -Moderna Inc's chief executive on Wednesday defended the company's plan to quadruple the price of its COVID-19 vaccine, telling a U.S. Senate committee hearing it will no longer have the economies of scale from government procurement when the shots move into the private market. Moderna CEO Stephane Bancel was called to testify after the company flagged plans to raise the vaccine's price to as much as $130 per dose, drawing the ire of Democratic U.S. Senator Bernie Sanders, who chairs the influential Committee on Health, Education, Labor and Pensions (HELP). Sanders on Wednesday asked Bancel to reconsider the price hikes, saying they could make it unaffordable for millions of Americans and were unjustified given the government's research contributions and $1.7 billion in assistance in developing the vaccine.

16h ago Reuters

ReutersBank deposits have stabilized in last week, Powell says

"We took powerful actions with Treasury and the FDIC, which demonstrate that all depositors' savings are safe," Powell told a news conference following the central bank's decision to raise interest rates for a ninth straight meeting despite what he acknowledged were substantial questions about the banking turmoil's impact on the economy. The issue of the safety of trillions of dollars in the banking system was a key focus of questions put to Powell after the Federal Open Market Committee raised its benchmark overnight lending rate by a quarter percentage point to a range of 4.75-5.00%.

10h ago Bloomberg

BloombergNick Leeson, Former Rogue Trader, Reemerges as a Private Spy

(Bloomberg) -- Nick Leeson, the former derivatives trader who brought down Barings Bank, has joined a corporate intelligence firm run by ex-Black Cube operative Seth Freedman. Most Read from BloombergBomb Threat Called In to New York Court Where Trump Hearing HeldFed Caught Between Inflation and Bank CrisisA New Chapter of Capitalism Emerges From the Banking CrisisFirst Republic Rescue May Rely on US Backing to Reach a DealXi Aligns With Putin Against US, But Hesitates on Gas DealLeeson, 56, wil

23h ago Bloomberg

BloombergSnap Can’t Count on a TikTok Ban to Help It Recover

(Bloomberg) -- Snap Inc. shares need more than the talked up possibility of a TikTok ban to recover from a near 70% slump in the past year.Most Read from BloombergBomb Threat Called In to New York Court Where Trump Hearing HeldFed Caught Between Inflation and Bank CrisisA New Chapter of Capitalism Emerges From the Banking CrisisFinally, a Serious Offer to Take Putin Off Russia’s HandsStocks Roiled by Fed Day’s Nerve-Wracking Rhetoric: Markets WrapTikTok Chief Executive Officer Shou Chew testifie

17h ago Bloomberg

BloombergSpotify Has Spent Less Than 10% of Its $100 Million Diversity Fund

(Bloomberg) -- Spotify Technology SA’s $100 million Creator Equity Fund, designed to promote diversity in music and podcasts following controversial comments by the company’s star podcaster Joe Rogan, spent less than 10% of the money on that work as it rounded out its first year.Most Read from BloombergFinally, a Serious Offer to Take Putin Off Russia’s HandsBomb Threat Called In to New York Court Where Trump Hearing HeldAckman Warns of Accelerated Deposit Outflows After Fed DecisionA New Chapte

10h ago TheStreet.com

TheStreet.comThe Most Important Thing Powell Needs to Do Wednesday

'KISS' (Keep It Simple Stupid) seems perfectly American, while 'Too Clever by Half' is quintessential British. Maybe he talks about various lending programs, or hints that implicit deposit guarantees are pretty much explicit once the FDIC gets control (as opposed to needing congressional approval). The fact that there is minimal cost to moving deposits from one bank to the next is what nags at me, and why I think it is so important for Powell to focus on this.

15h ago Fortune

FortuneSVB was a hedge fund in disguise–and the banking crisis is an overreaction

The data thus far is telling us not to overreact. Yet, markets have already overreacted. That's an opportunity for savvy investors.

2d ago Fortune

Fortune3 ways to make the most of your home equity loan

You can use your home equity loan to consolidate debt, renovate your home, or as an emergency fund. Here’s how they work.

15h ago 2d ago

2d ago Fox Business

Fox BusinessFed rate hikes will trigger a downturn of greater 'speed and magnitude' than the Great Recession: Economist

The market's bubble has now "burst," and will impact "everything everywhere all at once" in the U.S. economy, economists Stephanie Pomboy and Art Laffer argue.

16h ago Investor's Business Daily

Investor's Business DailyDow Jones Falls 530 Points As Banks Lead Fed Sell-Off; Apple, 5 Titans Mask Market Weakness

The major indexes fell sharply despite the Fed signaling just one more rate hike. Apple and other titans have masked weak market breadth in recent weeks.

4h ago Reuters

ReutersFirst Republic shares fall as Yellen says not considering 'blanket insurance' on bank deposits

A "bull case" scenario for the shares of beleaguered First Republic Bank as it considers its options became more difficult on Wednesday after Treasury Secretary Janet Yellen said there is no discussion on insurance for all bank deposits without approval from the U.S. Congress. First Republic, whose shares have lost much of their value since the banking crisis started in the U.S. on March 8, is among banks speaking to peers and investment firms about potential deals in the wake of U.S. regulators' taking over Silicon Valley Bank and Signature Bank following bank runs. Morgan Stanley analyst Manan Gosalia, in a report earlier this week, set a target price of $54 for First Republic shares in a best-case scenario.

14h ago TheStreet.com

TheStreet.com'Big Short' Michael Burry Sounds the Alarm on U.S. Banks

The legendary investor published a chart which quantifies the uninsured clients and unrealized capital losses for major regional banks.

12h ago SmartAsset

SmartAssetHow Do I Avoid Paying Tax on Dividends?

Dividends are payments that some companies make to shareholders to reward them for investing in them. Dividends can provide regular, predictable income to investors who also preserve the chance of profiting from price appreciation. Dividends can qualify for advantageous capital … Continue reading → The post How Do I Avoid Paying Tax on Dividends? appeared first on SmartAsset Blog.

17h ago Barrons.com

Barrons.comHarley-Davidson Got Crushed as Bank Stocks Slid. Now It’s ‘Too Inexpensive.’

The stock was trading at 7.9 times its fiscal 2023 earnings on Tuesday versus its historical five-year average of 10.7, data on FactSet shows.

1d ago Barrons.com

Barrons.comNvidia Is Less Than $10 Billion Away From Passing Berkshire as Market’s 5th Largest Stock

Nvidia ‘s latest rally has the stock less than $10 billion away from passing Berkshire Hathaway to become the fifth largest by market capitalization. At that point Nvidia stock had fallen 62% from the start of 2022 through its low on Oct. 14, leaving it with a market cap of just $279.6 billion, as worries about the chip sector and valuation weighed on the shares. Berkshire, on the other hand, dropped 12% through its own low on Oct. 12, when it was valued at $588.5 billion.

13h ago Bloomberg

BloombergDiffering Powell and Yellen Messages Were a Lot for the Stock Market to Digest

(Bloomberg) -- Traders are accustomed to a bumpy ride whenever Jerome Powell speaks. But when Powell speaks at the same time Janet Yellen is talking to Congress about the health of the banking sector, the turbulence can get overwhelming.Most Read from BloombergFinally, a Serious Offer to Take Putin Off Russia’s HandsBomb Threat Called In to New York Court Where Trump Hearing HeldAckman Warns of Accelerated Deposit Outflows After Fed DecisionA New Chapter of Capitalism Emerges From the Banking Cr

6h ago TipRanks

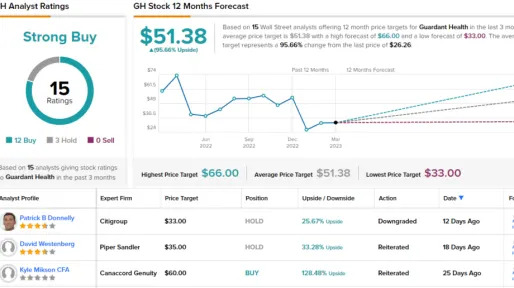

TipRanksInsiders pour millions into these 2 stocks — this is what makes them attractive buys

After January’s stock rally, the story in the markets for the past two months has been volatility. Stocks were on a seesaw even before the recent SVB crash, and the banking woes of the last two weeks have simply exacerbated the up and down swings. The increased uncertainty in the market conditions has put a premium on data analysis, the ability to collect and decipher the mass of information generated by Wall Street’s aggregated trading activity. Fortunately, there are already experts out there

2d ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK