How Much of Your Take-Home Pay Dave Ramsey Says Should Go Toward Your Mortgage

source link: https://finance.yahoo.com/news/much-home-pay-dave-ramsey-140642741.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

How Much of Your Take-Home Pay Dave Ramsey Says Should Go Toward Your Mortgage

Dani Romero is here with more.

In the world of financial advice, one of the top experts is fast-talking Dave Ramsey, a personal finance expert who has made a name for himself by publishing eight books on finance. He also hosts “The Ramsey Show,” where he dishes out practical advice on everything from budgets to retirement, and appears on numerous TV shows doing the same. Finally, he’s CEO of his own company, Ramsey Solutions.

Find Out: All the States That Don’t Tax Social Security

Tax Cuts: 50% of States Are Pushing For Reductions or Eliminating Taxes Altogether

One of Ramsey’s strongest pieces of financial advice centers on how much of your money you should put toward a mortgage payment each month, which, for many people, is the biggest monthly bill they have. This advice varies a bit among experts, but Ramsey caps this amount at 25%.

The reason Ramsey suggests this is that if your mortgage is no more than 25% of your income, you should be able to pay for all the rest of your expenses each month without a problem. In other words, you will not find yourself stuck with a mortgage payment you can’t pay, or not on time.

This 25% figure should come out of your net pay, the money you have left after other deductions such as taxes, retirement contributions or benefits have been taken out of your income. As Ramsey says on his website, “I want you to buy a home that’s a blessing, not a burden. And the only way to do that is to understand your home-buying budget and stick to it!”

To put this into perspective, Ramsey explains that if you take home $5,000 per month after taxes, according to his 25% rule, you should pay no more than $1,250 per month for a mortgage payment (and that includes the principal payment, property taxes, HOA fees and interest).

Take Our Poll: How Much Salary Would Buy You Happiness?

According to The Motley Fool, if you make $50,000 a year, and you live in the pricey state of California, you might think that means you can afford to pay $1,041 per month on a mortgage (though, frankly, there are few California cities where you can find mortgages that low). But, you first have to pay your federal and state taxes, and that would actually only leave about $830 per month for a mortgage. This is not especially sustainable in California! In other states, where housing is less expensive, this is a more realistic goal.

The Wall Street Journal

The Wall Street JournalCredit Suisse Collapse Burns Saudi Investors

Saudi Crown Prince Mohammed bin Salman last year directed government-backed Saudi National Bank to make a $1.5 billion investment in Credit Suisse that his financial advisers harbored doubts about.

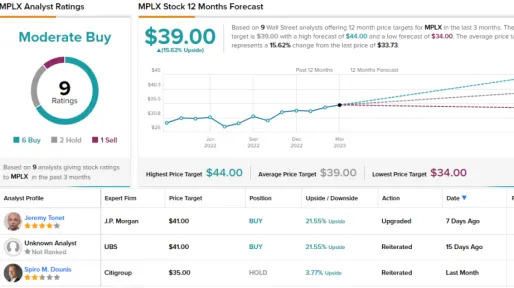

15h ago TipRanks

TipRanksJPMorgan Says Buy These 2 High-Yield Dividend Stocks — Including One With a 9% Yield

Bank runs and extreme market volatility – are the shades of 1929 upon us? Probably not, the current situation, while dangerous, is unlikely to trigger an economy-wide depression. The real test, at least according to David Kelly, JPMorgan’s chief global strategist for asset management, will come on Wednesday, at the Federal Reserve’s next interest rate policy meeting. The central bank will have to determine which risk is more urgent, persistent high inflation or a bank crisis, and adjust its rece

3h ago MarketWatch

MarketWatchBillionaire investor Leon Cooperman sees a ‘self-induced’ crisis and a stock picker’s market. Here’s what he’s buying.

Hedge-fund manager Leon Cooperman said the current financial crisis isn't much of surprise. He divulged some sectors and one stock that he's buying now.

20h ago Bloomberg

BloombergCredit Suisse’s Collapse Reveals Some Ugly Truths About Switzerland for Investors

(Bloomberg) -- For decades, Switzerland has sold itself as a haven of legal certainty for bond and equity investors. The collapse of Credit Suisse Group AG revealed some unpleasant home truths. In the race to secure UBS Group AG’s purchase of its smaller rival over the weekend, the government invoked the need for stability and emergency legislation to override two key aspects of open markets: competition law and shareholder rights. Then bondholders discovered that $17 billion worth of so-called

18h ago Benzinga

BenzingaIs Silver the Next Gamestop? How Retail Investors Challenged Wall Street Giants Again

In the wake of unprecedented short squeezes involving stocks like GameStop and AMC in early 2021, a group of retail investors from the Reddit forum r/WallStreetBets (and the spinoff called r/WallStreetSilver) set their sights on the silver market, attempting to challenge Wall Street giants with a so-called "silver short squeeze." The silver short squeeze movement was sparked on the r/WallStreetBets forum, where users urged each other to buy silver and silver-related assets to drive up prices and

21h ago Investor's Business Daily

Investor's Business Daily16 Top Growth Stocks Expecting A 50% To 439% Rise This Year

Palo Alto Networks and Salesforce lead this list of 16 top-rated growth stocks eyeing 50% to 439% EPS growth this year.

16h ago Bloomberg

BloombergFirst Republic Rebounds From Record Low With Aid Plan in Focus

(Bloomberg) -- First Republic Bank shares rallied in US premarket trading after falling to a record low Monday, as investors ponder what’s next for the struggling midsize lender following an offer of help from JPMorgan Chase & Co.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS

2h ago TheStreet.com

TheStreet.comCostco Shares Interesting Membership News

The warehouse club shared some insight that might be useful for members and people who are considering joining the warehouse club.

16h ago TheStreet.com

TheStreet.comWarren Buffett Offers Safety During New Bank Scare

Other financial institutions have been affected, including Signature Bank , First Republic Bank , and even Credit Suisse . During the chaos, prominent figures have been talking with Warren Buffett and his Omaha, Neb.-based diversified holding company Berkshire Hathaway . "We were not too surprised to see stories pop up over the weekend about Warren Buffett, CEO of wide-moat Berkshire Hathaway, being in conversations with the Biden administration about the banking crisis, as well as reports from the major news outlets that a large number of private jets have made their way to Omaha this weekend," wrote Morningstar's Greggory Warren on March 19.

17h ago Bloomberg

BloombergJPMorgan’s Kolanovic Sees Increasing Chances of ‘Minsky Moment’

(Bloomberg) -- Bank failures, market turmoil and ongoing economic uncertainty as central banks battle high inflation have increased the chances of a “Minsky moment,” according to JPMorgan Chase & Co.’s Marko Kolanovic.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealUS Studies Ways to Guarantee All Bank Deposits If Crisis ExpandsThe

16h ago Barrons.com

Barrons.comThese Stocks Are Moving the Most Today: Tesla, Meta, First Republic, Nvidia, GameStop, and More

First Republic Bank is rising after shares of the regional lender lost nearly half their value and sank to a new low on Monday, while Tesla's debt rating is upgraded to investment-grade status by Moody's.

38m ago MoneyWise

MoneyWiseHome Depot co-founder blames ‘woke diversity’ for businesses failing to ‘hit the bottom line’ — don't sleep on these 3 stock picks if you agree

Invest in what matters to you.

20h ago MoneyWise

MoneyWiseSuze Orman 'was so upset, honest to God’ when the government made it easier to tap your 401(k) in a time of need — she has one big reason why you should never borrow from your retirement

There's a much bigger cost to it than you might think.

2h ago Investopedia

InvestopediaIs My IRA Protected in a Bankruptcy?

Learn which types of IRA accounts are protected from creditors in a bankruptcy, and to what dollar value each type of IRA is protected.

16h ago SmartAsset

SmartAssetVanguard Says Don't Give Up on the 60/40 Portfolio

Of all the choices an investor has to make, asset allocation could be the most important. Deciding how to split up the money you invest among different asset classes requires clarity of purpose and an understanding of each category's advantages … Continue reading → The post Vanguard Says Don't Give Up on the 60/40 Portfolio appeared first on SmartAsset Blog.

16h ago Investopedia

InvestopediaWhat Biden's ESG Bill Veto Means For Your Retirement

President Biden vetoed a Republican attempt to strike down the DOL's new ESG rule Monday, which allows retirement plan fiduciaries to consider environmental, social, and governance (ESG) factors when making investments.

18h ago Zacks

ZacksIs the Options Market Predicting a Spike in Lumen (LUMN) Stock?

Investors need to pay close attention to Lumen (LUMN) stock based on the movements in the options market lately.

1d ago Reuters

ReutersNvidia set to reveal new AI technologies at annual conference

Nvidia Corp Chief Executive Jensen Huang is expected on Tuesday to disclose new artificial intelligence chips and technologies at the company's annual conference for software developers. Analysts will be watching for the Santa Clara, California-based company to give more details about how it plans to widen accessibility to processing power like to that used to develop fast-rising technologies such as the chatbot ChatGPT. Last month, Huang told investors it would launch its own cloud computing service to offer more readily available access to large systems built with its chips.

2h ago Zacks

ZacksSunrun (RUN) Stock Sinks As Market Gains: What You Should Know

Sunrun (RUN) closed at $17.03 in the latest trading session, marking a -1.67% move from the prior day.

14h ago Barrons.com

Barrons.com2 Things That Will Have Rivian Stock Acting Like Meta Shares

Based on how Rivian stock is trading, investors have given up on the electric truck maker. It may need a change in spending philosophy.

17h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK