Stock market news today: Stock futures rise, regional bank stocks rebound

source link: https://finance.yahoo.com/news/stock-market-news-today-live-updates-march-21-2023-120030781.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Stock market news today: Stock futures rise, regional bank stocks rebound

Here's what's moving markets on Tuesday, March 21, 2023.

U.S. stock futures were higher ahead of the open on Tuesday following U.S. and European efforts to stabilize the banking system.

The ripples of the bank failures comes on the heels of the Federal Reserve’s next interest rate decision Wednesday. Its policy meeting kicks off Tuesday.

Futures tied to the S&P 500 (^GSPC) added 0.6%, while futures on the Dow Jones Industrial Average (^DJI) gained 0.7%. Contracts on the technology-heavy Nasdaq Composite (^IXIC) edged up by 0.4%.

Bond yields are rising, “potentially indicating less of a recessionary impulse from the banking system,” according to the US Market Intelligence team at JPMorgan. The yield on the benchmark 10-year U.S. Treasury note rose 3.5% Tuesday morning. On the front end of the yield curve, two-year yields jumped to 4.1%.

The S&P 500 rallied nearly 1% to kick off the new week. According to data from Bespoke Investment Group, energy and materials were the top sector performers, each gaining over 2%. Tech, consumer discretionary, and communication services underperformed following last week’s strength.

The headliner event of the week will be a crucial two-day meeting of the Federal Reserve's policy-making committee, where central bank officials face a tough decision whether to raise interest rates again or take a pause amid the turmoil in the banking sector.

Prior to the Silicon Valley Bank fallout, policy makers were poised to hike rates by as much as 50 basis points following a flurry of data showing a resilient economy. But given the crisis in the banking sector, many market participants forecast a smaller point increase — or none at all.

“Based on Powell’s recent hawkish shift in early March, the market is still giving the Fed room to hike 25bps at this upcoming meeting, but will not allow the Fed to get away with more tightening beyond that,” Victor Masotti, Director of Repo Trading at Clear Street, wrote in a statement.

The European Central Bank was confronted by a similar scenario on Thursday. As a result, the ECB raised interest rates by 50 basis points, saying it remains committed to dampening inflation while monitoring the turmoil in the banking sector.

The Wall Street Journal

The Wall Street JournalCredit Suisse Collapse Burns Saudi Investors

Saudi Crown Prince Mohammed bin Salman last year directed government-backed Saudi National Bank to make a $1.5 billion investment in Credit Suisse that his financial advisers harbored doubts about.

15h ago TipRanks

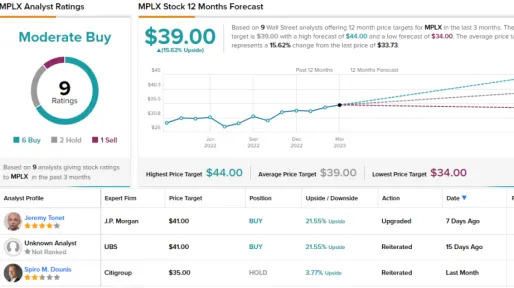

TipRanksJPMorgan Says Buy These 2 High-Yield Dividend Stocks — Including One With a 9% Yield

Bank runs and extreme market volatility – are the shades of 1929 upon us? Probably not, the current situation, while dangerous, is unlikely to trigger an economy-wide depression. The real test, at least according to David Kelly, JPMorgan’s chief global strategist for asset management, will come on Wednesday, at the Federal Reserve’s next interest rate policy meeting. The central bank will have to determine which risk is more urgent, persistent high inflation or a bank crisis, and adjust its rece

2h ago Investor's Business Daily

Investor's Business DailyAnalysts Warn Investors To Dump 10 Big Stocks Before It's Too Late

Analysts don't usually tell investors to sell S&P 500 stocks. So when they do, it's wise to pay attention.

1d ago Benzinga

BenzingaCredit Suisse's $17B Of AT1 Debt Written Down To Zero, Richard Branson's Virgin Orbit Plans Insolvency, Court Freezes Volkswagen's Russian Assets: Today's Top Stories

Reuters Credit Suisse Bondholders Enraged As $17B Of AT1 Debt To Be Written Down To Zero: What It Means Credit Suisse Group AG (NYSE: CS) said 16 billion Swiss francs ($17.24 billion) of its additional tier 1 (AT1) debt, a type of bond, will be written down to zero on the orders of the Swiss regulator FINMA as part of its rescue merger with UBS Group AG (NYSE: UBS). The decision by the Swiss regulator would mean AT1 bondholders may be left with nothing while shareholders, who sit below bonds in

20h ago Benzinga

BenzingaIs Silver the Next Gamestop? How Retail Investors Challenged Wall Street Giants Again

In the wake of unprecedented short squeezes involving stocks like GameStop and AMC in early 2021, a group of retail investors from the Reddit forum r/WallStreetBets (and the spinoff called r/WallStreetSilver) set their sights on the silver market, attempting to challenge Wall Street giants with a so-called "silver short squeeze." The silver short squeeze movement was sparked on the r/WallStreetBets forum, where users urged each other to buy silver and silver-related assets to drive up prices and

21h ago Bloomberg

BloombergCredit Suisse’s Collapse Reveals Some Ugly Truths About Switzerland for Investors

(Bloomberg) -- For decades, Switzerland has sold itself as a haven of legal certainty for bond and equity investors. The collapse of Credit Suisse Group AG revealed some unpleasant home truths. In the race to secure UBS Group AG’s purchase of its smaller rival over the weekend, the government invoked the need for stability and emergency legislation to override two key aspects of open markets: competition law and shareholder rights. Then bondholders discovered that $17 billion worth of so-called

18h ago Investor's Business Daily

Investor's Business Daily16 Top Growth Stocks Expecting A 50% To 439% Rise This Year

Palo Alto Networks and Salesforce lead this list of 16 top-rated growth stocks eyeing 50% to 439% EPS growth this year.

16h ago Bloomberg

BloombergFirst Republic Rebounds From Record Low With Aid Plan in Focus

(Bloomberg) -- First Republic Bank shares rallied in US premarket trading after falling to a record low Monday, as investors ponder what’s next for the struggling midsize lender following an offer of help from JPMorgan Chase & Co.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS

2h ago Bloomberg

BloombergJPMorgan’s Kolanovic Sees Increasing Chances of ‘Minsky Moment’

(Bloomberg) -- Bank failures, market turmoil and ongoing economic uncertainty as central banks battle high inflation have increased the chances of a “Minsky moment,” according to JPMorgan Chase & Co.’s Marko Kolanovic.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealUS Studies Ways to Guarantee All Bank Deposits If Crisis ExpandsThe

16h ago TheStreet.com

TheStreet.comElon Musk Warns the Banking Crisis May Lead to Something Bigger

The crisis of confidence affecting regional banks poses a serious risk to the economy, the billionaire entrepreneur warns.

21h ago MoneyWise

MoneyWiseHome Depot co-founder blames ‘woke diversity’ for businesses failing to ‘hit the bottom line’ — don't sleep on these 3 stock picks if you agree

Invest in what matters to you.

20h ago Investor's Business Daily

Investor's Business DailyDow Jones Rallies As Powell Looms; Donald Trump Stock Surges Amid Legal Drama

The Dow Jones rallied even as the latest Fed meeting, led by Jerome Powell, looms. First Republic stock plunged. A Donald Trump stock surged.

16h ago TipRanks

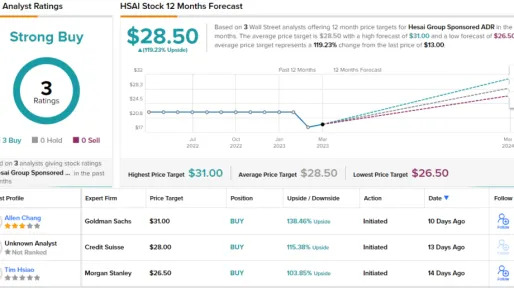

TipRanksGoldman Sachs Says These 2 Automotive LiDAR Stocks Should Be On Your Radar; Sees at Least 90% Upside Potential

While electric vehicles (EVs) are getting the headlines in the automotive industry, there are two other trends that will reward closer investor attention. These are driver assistance and autonomous vehicles. These are based on similar technologies – advanced sensor systems, machine learning and AI, and interactive interfaces for the human operator – but they fill different roles. For investors, however, these technologies will offer a realm of opportunities where the rubber meets the road. The a

22h ago Barrons.com

Barrons.comCrypto and Coinbase Bull Run Call. Stock Price Seen Tripling.

Bitcoin is up almost 70% this year and could keep going, says one analyst—a trend that could push Coinbase stock back above levels not seen in 12 months.

39m ago Zacks

ZacksGold is Pushing $2000: 2 Stocks to Trade the Breakout

High inflation, a banking crisis, rising interest rates, and geopolitical tensions...

15h ago SmartAsset

SmartAssetVanguard Says Don't Give Up on the 60/40 Portfolio

Of all the choices an investor has to make, asset allocation could be the most important. Deciding how to split up the money you invest among different asset classes requires clarity of purpose and an understanding of each category's advantages … Continue reading → The post Vanguard Says Don't Give Up on the 60/40 Portfolio appeared first on SmartAsset Blog.

16h ago Zacks

ZacksSarepta Therapeutics (SRPT) Soars 7.1%: Is Further Upside Left in the Stock?

Sarepta Therapeutics (SRPT) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

5h ago Bloomberg

BloombergFirst Republic Dives 47% to Record Low on Downgrade, Bank Talks

(Bloomberg) -- First Republic Bank’s shares tumbled 47% to an all-time low after S&P Global lowered its credit rating for the second time in a week and as executives from major banks discussed fresh efforts to stabilize the lender.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndUS Studies Ways to Guarantee All Bank Deposits If Cris

14h ago TheStreet.com

TheStreet.comStocks Higher, Deposit Guarantees, Nvidia AI, Tesla Upgrade, Nike Earnings - Five Things To Know

Stock futures add to gains as bank crisis concerns ease; Treasury Said To Mull Expanded U.S. Bank Deposit Guarantees; Nvidia CEO Jensen Huang set for keynote address on AI technology; Tesla edges higher after Moody's lifts 'junk status' rating and Nike Q3 earnings on deck as rival Adidas staggers from Kanye West split.

2h ago Barrons.com

Barrons.comFirst Republic Stock Fights Back as Jamie Dimon Leads Rescue Talks

First Republic Bank stock regained some ground early Tuesday after a report that JPMorgan Chase CEO Jamie Dimon was leading talks to stabilize the beleaguered regional bank. First Republic stock pointed 16% higher at $14.13 ahead of the open, but is still close to 90% down in March. There were gains for other regional banks too, with New York Community Bancorp (NYCB) up 6%, and Western Alliance (WAL) and PacWest Bancorp (PACW) both climbing around 4% in premarket trading.

45m ago

Recommend

-

13

13

Stocks rebound to close higher following back-to-back sessions of lossesS&P Futures4,408.75-0.25 (-0.01%)Dow Futures34,196.00-23.00...

-

9

9

-

6

6

Stocks rebound to close higher as investors weigh flurry of earnings reportsS&P Futures4,444.50-14.75 (-0.33%)Dow Futures34,806.00-3...

-

5

5

11:32...

-

8

8

11:32...

-

6

6

Home ...

-

10

10

Home ...

-

9

9

Stocks extend rally as Wall Street looks to end of quarter: Stock market news todayHere's what's moving markets on Thursday, March 30, 2023. Investor...

-

9

9

Stock market news today: Stocks fall, bond...

-

8

8

Stocks edge higher, look to rebound from losing streak: Stock market news today Yahoo Finance LIVE - Jun 27 AM THOSE TRANSITIONS ARE MADE ACROSS DELIV...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK