Silicon Valley Bank Loans Could Be Letdown for PE Giants

source link: https://finance.yahoo.com/news/silicon-valley-bank-loans-could-233939507.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Silicon Valley Bank Loans Could Be Letdown for PE Giants

Silicon Valley Bank Loans Could Be Letdown for PE Giants

(Bloomberg) -- Private equity firms circling the $74 billion loan book at Silicon Valley Bank may find that the Federal Deposit Insurance Corp. is unwilling to sell the assets — or at least not at bargain-basement prices.

Most Read from Bloomberg

More than half of the bank’s lending program — $40.5 billion as of the fourth quarter — consists of lines of credit to firms backed by capital-call commitments from their investors, according to bank documents. Those loans typically have terms of one to two years, with low interest and default rates, meaning they’re not likely to deliver high-octane returns.

During the 2008 financial crisis, private equity investors negotiated huge discounts on distressed and defaulted assets purchased from troubled banks. That’s not likely to be the case with Silicon Valley Bank, whose performing loan book might not yield the kind of discounts that private equity buyers typically look for, according to lawyers.

The FDIC has a broad mandate to try to sell Silicon Valley Bank and Signature Bank assets at the best possible price to aid recoveries, whether that’s as a whole or in pieces.

Historically it has a preference for selling a bank as close to whole as possible, said Ken Achenbach, a partner at Bryan Cave Leighton Paisner who focuses on bank regulation and corporate risk.

“Any asset is sellable at the right price,” he said in an interview. But assets being marketed by the FDIC in this cycle “should be assets that, in many ways, are less distressed from a credit quality perspective than the assets we saw coming out of receivership in 2008 and 2009.”

Apollo Global Management Inc., Ares Management Corp., Blackstone Inc., Carlyle Group Inc. and KKR & Co. are among the alternative-asset managers looking to buy pieces of Silicon Valley Bank, Bloomberg previously reported. The private equity firms declined to comment.

Investor's Business Daily

Investor's Business DailyIBD Screen Of The Day: AMD, Chipotle Boast Rising Profit Estimates

AMD stock is nearing a new buy point in today's stock market sell-off, while Chipotle boasts rising profit estimates.

10h ago Fox Business

Fox BusinessSilicon Valley Bank committed 'one of the most elementary errors in banking,' Larry Summers says

Former Treasury Secretary Larry Summers said Silicon Valley Bank made an "elementary" mistake in banking that led to its collapse and takeover by federal regulators.

2d ago Zacks

ZacksWhy Is Cleveland-Cliffs (CLF) Down 5.1% Since Last Earnings Report?

Cleveland-Cliffs (CLF) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

13h ago Barrons.com

Barrons.comWas Berkshire Hathaway Buying Bank of America Stock? We’ll Find Out Soon.

Berkshire Hathaway has been a steady seller of bank stocks in the past few years, eliminating holdings in JPMorgan Chase Wells Fargo and Goldman Sachs Group while sharply reducing stakes in U.S. Bancorp and Bank of New York Mellon in 2022. B) CEO Warren Buffett has left alone is Bank of America (BAC). Berkshire owns just over one billion shares of the bank, which were worth about $28 billion with the stock down 2.7% to $27.98 on Wednesday.

11h ago TipRanks

TipRanksKevin O’Leary Says Avoid Bank Stocks and Buy Energy Instead. Here Are 2 Names to Consider

In the wake of multiple bank collapses over the past week, many banking stocks’ valuations have fallen sharply and are trading at deep discounts right now. One investor, however, that definitely won’t be looking for any bargains amongst the carnage is ‘Shark Tank’ star Kevin O’Leary. With the government having stepped in to ensure depositors walk away unscathed from the SVB and Signature Bank debacles, O’Leary anticipates a flurry of tighter regulation around banks, regional or not, and that wil

1d ago Fortune

FortuneCharles Schwab’s fortune battered by SVB collapse, with his wealth plunging more than any other American billionaire’s in 2023

The failure of Silicon Valley Bank has had a widespread impact.

2d ago MarketWatch

MarketWatchI’m 70 and weighing whether to ‘sell everything’ and put it all in Treasuries, or hire a financial adviser even though it would cost $20K a year. What should I do?

THE ADVICER MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. Links in this content may result in us earning a commission, but our recommendations are independent of any compensation that we may receive.

19h ago Investor's Business Daily

Investor's Business DailyReport: 10 Banks Are Most Exposed To Uninsured Deposits

High levels of uninsured deposits helped do in Silicon Valley Bank and Signature Bank. But it turns out they're not alone.

17h ago TipRanks

TipRanksBuy These 2 EV Charging Stocks, Needham Says, Forecasting Over 50% Upside

While electric vehicles (EVs) are currently a small part of the world’s auto fleets, their numbers are growing. EVs are benefitting from a mix of tailwinds, including improved technologies, social approval, and political will, combining to give a strong impetus to the EV industry. The rapid expansion of EVs has opened up wide fields of opportunity for investors. While the car makers tend to soak up the headlines (think Elon Musk’s Tesla), there are also companies working on charging stations, ba

5h ago Zacks

ZacksUpstart Holdings, Inc. (UPST) is Attracting Investor Attention: Here is What You Should Know

Upstart Holdings, Inc. (UPST) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2d ago TheStreet.com

TheStreet.comCrude Oil: Let's Get to the Bottom of Where Prices Are Headed

Oil is breaking downward from a three-month sideways consolidation pattern. Here's what it means for the commodity and energy stocks.

11h ago Zacks

ZacksIntel (INTC) Gains As Market Dips: What You Should Know

In the latest trading session, Intel (INTC) closed at $28.41, marking a +1.43% move from the previous day.

7h ago TipRanks

TipRanksInflation at 6%: 2 ‘Strong Buy’ Dividend Stocks That Beat This Rate

Markets are in a state of flux right now, with heavy changes on the near horizon. The collapse of Silicon Valley Bank – and the Fed’s takeovers of it and the crypto-heavy Silvergate and Signature banks – have sparked fears of a new banking or financial crisis, as well as calls for the Federal Reserve to pare back on its policy of interest rate hikes and monetary tightening. The inflation numbers for February were in-line with expectations, with a monthly gain of 0.4% and an annualized rate of 6%

2d ago Zacks

ZacksUnited Rentals (URI) Outpaces Stock Market Gains: What You Should Know

United Rentals (URI) closed the most recent trading day at $416.09, moving +1.95% from the previous trading session.

1d ago Zacks

ZacksDow Inc. (DOW) Stock Sinks As Market Gains: What You Should Know

Dow Inc. (DOW) closed the most recent trading day at $52.29, moving -0.21% from the previous trading session.

1d ago Reuters

ReutersSwiss government holds talks on options to stabilize Credit Suisse - Bloomberg News

Credit Suisse leaders and government officials have talked about options that range from a public statement of support to a potential liquidity backstop, the report said. Other suggested potential moves for Credit Suisse could be a potential separation of their Swiss unit and a tie-up with their larger Swiss competitor, UBS Group AG, the report said, adding that it's unclear which, if any of these steps will actually be executed. Switzerland is under pressure from at least one major government to intervene quickly on Credit Suisse, a source familiar with the situation told Reuters, after the Swiss bank led a rout of European bank stocks on Wednesday.

10h ago Reuters

ReutersTyson Foods to shut two US chicken plants with nearly 1,700 workers

CHICAGO (Reuters) -Tyson Foods Inc will close two U.S. chicken plants with almost 1,700 employees on May 12, the company said on Tuesday. The closures show the biggest U.S. meat company by sales is still trying to figure out how to improve its chicken business that has struggled for years. Tyson will shut a plant in Glen Allen, Virginia, with 692 employees and a plant in Van Buren, Arkansas, with 969 employees, according to a statement.

2d ago The Telegraph

The TelegraphHow Credit Suisse turned Switzerland’s banking industry into a national embarrassment

Once the pride of the Swiss banking industry, Credit Suisse’s fall from grace shows few signs of abating.

16h ago Bloomberg

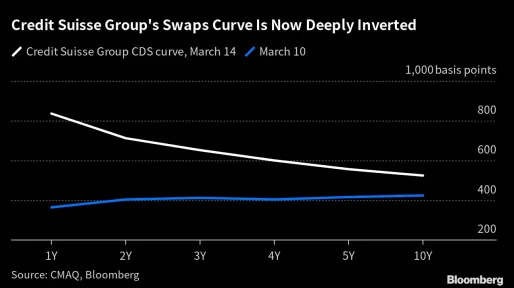

BloombergCredit Suisse Default Swaps Are 18 Times UBS, 9 Times Deutsche Bank

(Bloomberg) -- The cost of insuring the bonds of Credit Suisse Group AG against default in the near-term is approaching a rarely-seen level that typically signals serious investor concerns.Most Read from BloombergCredit Suisse Reels After Top Shareholder Rules Out Raising StakeRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 BillionSignature Bank Faced Criminal Probe Ahead of Firm’s CollapseBofA Gets More Than $15 Billion in Deposits After SVB FailsWall Street’s Fear Gauge Surges With B

18h ago Zacks

ZacksZacks.com featured highlights include Steel Dynamics, Primerica and CVR Energy

Steel Dynamics, Primerica and CVR Energy are part of the Zacks Screen of the Week article.

16h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK