Silvergate Bet Everything on Crypto, Then Watched It Evaporate

source link: https://finance.yahoo.com/news/silvergate-bet-everything-crypto-then-042922549.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Silvergate Bet Everything on Crypto, Then Watched It Evaporate

Silvergate Bet Everything on Crypto, Then Watched It Evaporate

(Bloomberg) -- Silvergate Capital Corp. spent its final days under siege.

Most Read from Bloomberg

Bombarded by shortsellers, deserted by depositors and shunned by business partners, executives at the crypto-focused bank were face-to-face with US regulators at its La Jolla, California headquarters.

Officials from the Federal Deposit Insurance Corp. had arrived at the firm’s offices, intent on averting the US banking system’s first casualty from the crypto implosion. Among options they discussed were finding crypto-investors to help shore up liquidity amid the bank’s mounting losses. But a desperate round of calls to potential investors failed, with no firm willing to shoulder the burden of associating with a bank mired so deeply in the industry’s upheaval.

With survival looking increasingly implausible and no buyer in sight, Silvergate said Wednesday it was closing its doors, ending a decade-long crypto dream that made it a central player while the industry boomed.

The decision to wind down and voluntarily liquidate, described by people familiar with the matter who spoke on condition of anonymity, capped months of turmoil at the bank stemming from its ties to Sam Bankman-Fried’s FTX. The crypto exchange’s November collapse into bankruptcy, followed by allegations of fraud, placed a harsh spotlight on Silvergate and simultaneously ignited a regulatory crackdown on the industry’s ties to banking.

And as Silvergate buckled under the strain, posting $1 billion of losses in the fourth quarter and bleeding more capital this year, it was forced to delay its annual report and raised questions about whether it could stay in business. After hitching its wagon so firmly to the new world of crypto, the bank had exposed itself to an old-world banking risk: When the industry’s prospects soured, Silvergate had little other business to lean on.

Forkast News

Forkast NewsCrypto mining rig maker Canaan shares slump after Q4 revenue sank 82%

Canaan’s shares on Nasdaq closed 3.83% lower at US$2.51 on Wednesday after the cryptocurrency mining rig maker reported an 82% year-on-year drop in revenue on Tuesday for the fourth quarter of last year, citing “lackluster market demand” for mining machines as the price of Bitcoin fell.

7h ago CoinDesk

CoinDeskCrypto Bank Silvergate Announces 'Voluntary Liquidation'

The Federal Deposit Insurance Corporation has taken over Silvergate Bank, which saw prominent customers abandon it and its stock price plunge after revealing it faced regulatory scrutiny and had to sell assets to pay off loans.

7h ago Forkast News

Forkast NewsChina’s parliament member to propose NFT regulation at ‘Two Sessions’

NFTs have entered China’s Two Sessions, with a delegate to propose an NFT regulatory framework.

3h ago TheStreet.com

TheStreet.comSilvergate Bank Collapses

The California bank's stock fell nearly 44% on Wall Street, after it announced it was going out of business.

5h ago Forkast News

Forkast NewsHow Singapore’s crypto ambitions are taking shape and what other nations can learn

Unique in the world, Singapore is a big investor and player in digital assets while advancing regulations that favor institutions over individual crypto users, writes Danny Chong of Tranchess.

8h ago Bloomberg

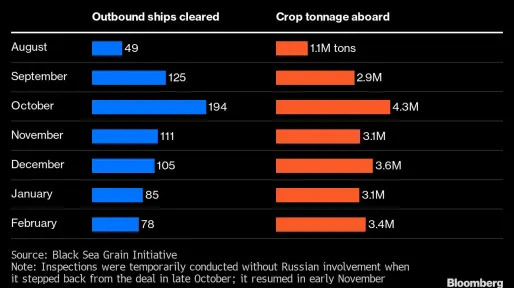

BloombergGrain Traders Bank On Renewal of Vital Ukraine Crop Deal

(Bloomberg) -- The crucial grain deal that revived Ukraine’s crop exports and helped bring down global prices is up for renewal again, and the market is betting on another extension.Most Read from BloombergBiden to Urge 25% Billionaire Tax, Levies on Rich InvestorsMeta Plans Thousands More Layoffs as Soon as This WeekYour Next Holiday Flight Will Cost a FortuneRookie Traders Are Earning $400,000 in One Unlikely Markets HubSri Lanka Rupee to Reverse and Plummet 23%, Fitch Solutions SaysThe curren

3h ago News Direct

News DirectBybit Launches Unified Trading Fest: Unlock $700K Prize Pool and Optimize Trades!

Bybit, the world’s third most visited crypto exchange, is proud to announce the launch of its first Unified Trading Fest competition. With over $700,000 in rewards up for grabs, this is an event fo...

1d ago CoinDesk

CoinDeskThree Arrows-Backed Crypto Liquidity Protocol Rook Surges 23% on Fundraise Speculation

Liquidity protocol Rook has experienced a surge in activity with its token rising by 23% on speculation that Three Arrows Capital founders Zhu Su and Kyle Davies have completed a fundraise for the bankruptcy-claims exchange.

1d ago Forkast News

Forkast NewsForkast 500 NFT index dips, Vitalik-linked NFT token gains momentum

The Forkast 500 NFT Index dipped 1.25% to 4,235.97 in the 24 hours through 10:00 a.m. in Hong Kong on Thursday.

7h ago Forkast News

Forkast NewsCrypto bank Silvergate to close, return all deposits; becomes latest victim of 2022 crypto turmoil

Silvergate Capital said Wednesday it will cease operations and liquidate its bank unit.

7h ago Yahoo Finance

Yahoo FinanceSilvergate Capital will liquidate after crypto collapse wipes out bank

Silvergate said late Wednesday it would wind down operations after a run on the bank caused by crypto outflows led to mounting losses for the firm.

13h ago MarketWatch

MarketWatchElon Musk apologizes to laid-off Twitter employee who was Iceland’s person of the year in 2022

Haraldur "Halli" Thorleifsson, from Reykjavík, Iceland, appealed to Musk over the weekend to determine his employment status.

22h ago TheStreet.com

TheStreet.comForget The Fed: Stocks Will Slump Even If Jerome Powell Slays Inflation Beast

With Wall Street talking about a 6% Fed Funds rate, stocks are facing renewed Fed pressures. But a hawkish Powell isn't the market's only concern.

18h ago Bloomberg

BloombergApple Supplier’s Vietnam Chief Exits After Outlining China Shift

(Bloomberg) -- AirPods maker GoerTek Inc.’s Vietnam business chief is leaving the company, days after the executive outlined how Apple Inc.’s Chinese suppliers are likely to move capacity out of the country far faster than anticipated to pre-empt fallout from escalating Beijing-Washington tensions.Most Read from BloombergBiden to Urge 25% Billionaire Tax, Levies on Rich InvestorsMeta Plans Thousands More Layoffs as Soon as This WeekYour Next Holiday Flight Will Cost a FortuneRookie Traders Are E

4h ago Zacks

ZacksEtsy (ETSY) is an Incredible Growth Stock: 3 Reasons Why

Etsy (ETSY) possesses solid growth attributes, which could help it handily outperform the market.

18h ago TheStreet.com

TheStreet.comThree Dividend Stocks to Consider Now: Morningstar

The firm's analysts give them all wide moats, meaning they will have competitive advantages for at least 20 years.

2d ago Barrons.com

Barrons.comThese Stocks Are Moving the Most Today: Asana, MongoDB, Silvergate, JD.com, GE, and More

Asana Chairman and CEO Dustin Moskovitz, the company's founder, discloses plans to buy up to 30 million shares of the software company’s Class A common stock, MongoDB issues revenue forecasts that miss analysts' expectations, and Silvergate Capital is winding down crypto-focused lender Silvergate Bank.

18m ago Zacks

ZacksOracle (ORCL) to Report Q3 Earnings: What's in the Cards?

Oracle's (ORCL) fiscal third-quarter 2023 performance is expected to have benefited from continued momentum in the cloud infrastructure services and Autonomous Database solutions.

21h ago MarketWatch

MarketWatchWe are in our 50s, living in California, and have $2 million in retirement savings. We want someone to tell us whether we can feasibly retire — what’s our best bet there?

House is paid off, kid’s education also largely paid off, roughly $2 million in retirement savings plus sizable other assets/non-retirement savings. Answer: Many advisers offer a retirement readiness consultation for a fee — though how this will look and what it will cost will vary. You may want to look for a certified financial planner who works on a per-project basis, using sites like LetsMakeAPlan.org, Garrett Planning Network or XY Planning Network.

1d ago SmartAsset

SmartAssetAsk an Advisor: ‘Am I Getting Fleeced?' I'm 66, Contributing $272 Per Month to an IRA and Paying $136 Monthly in Fees. That's 50% of My Contribution

I am 66 years old, still working and with very good health insurance. My company does not have a 401(k). I do have an individual retirement account (IRA) with approximately $120,000 invested. I contribute $272 per month, yet my program … Continue reading → The post Ask an Advisor: ‘Am I Getting Fleeced?' I'm 66, Contributing $272 Per Month to an IRA and Paying $136 Monthly in Fees. That's 50% of My Contribution appeared first on SmartAsset Blog.

19h ago

Recommend

-

18

18

[Updated (09/12/13): Fixed or removed some broken links; updated some others.] [ Updated (06/16/08): Here’s a real-world proje...

-

8

8

I Watched a Painting Burn then Re-emerge as an NFTWhen NFT technology started back in 2015, I was just as much a skeptic as anyone else, mainly because it initially seemed complicated. After all, it is a unique digital token, but isn’t...

-

3

3

They Watched a YouTuber With Tourette’s—Then Adopted His TicsHundreds of people are displaying similar behaviors to that of YouTube star Jan Zimmermann. Do they have a disorder or something more mysterious...

-

7

7

MarketsSilvergate Capital tanks more than 40% after crypto bank discloses massive fourt...

-

5

5

US bank Silvergate hit with $8bn in crypto withdrawalsPublished4 days ago

-

9

9

Crypt...

-

11

11

More Crypto Market Downturn Looms Ahead Over Delayed Silvergate Bank Filing March 2, 2023

-

8

8

Crypto银行Silvergate Capital能否经受市场震荡的考验? • 13 小时前...

-

3

3

Silve...

-

12

12

Home ...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK