Rivian stock tanks as it announces $1.3B 'green' bond offering

source link: https://finance.yahoo.com/news/rivian-stock-tanks-as-it-announces-13b-green-bond-offering-165542075.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Rivian stock tanks as it announces $1.3B 'green bond' offering

to raise more cash

Rivian (RIVN) shares are sliding today as the EV-maker announces plans for a “green” debt offering.

Rivian says it intends to sell $1.3 billion worth of “green” convertible senior notes due in 2029, with the option to grant an additional $200 million worth of convertible notes to the original purchasers.

In line with Rivian’s ethos as a company (it’s a Climate Pledge signatory and was the first to say it won’t use deep-sea mining for batteries), it intends to use the capital it raises for “green” or environmental purposes.

“Rivian intends to use the net proceeds from the offering to finance, refinance, make direct investments in, in whole or in part, one or more new or recently completed… current and/or future eligible green projects,” the company said in a statement. Rivian said these projects could include activities tied to clean transportation, renewable energy, circular economy (i.e., recycling batteries/metals), energy efficiency, and pollution prevention.

Rivian said the green-note offering meets the eligibility requirements as determined by International Capital Markets Association’s “Green Bond Principles” guidelines.

In its most recent earnings report, Rivian barely reached its production goal for the year but reported an adjusted EBITDA loss of $5.22 billion. With the company forecasting another adjusted EBITDA loss of $4.3 billion for 2023, that it's seeking additional sources of funding is not surprising. Rivian reported it had cash on hand of $12.01 billion at the end of the fourth quarter and expects capital expenditures to reach $2 billion for the year. Rivian is also in the midst of developing its next factory in Georgia, where its next-generation R2 vehicles will be built. Rivian says production of that vehicle will start in 2026.

With a long lead time until its next vehicle, Rivian’s cash situation is a key focus for analysts and investors.

“We're forecasting 2023 cash burn of $5.5B helped by working cap. RIVN guided to a 40% improvement in FCF in 2024 driven by their target of positive gross margins. We est. RIVN will need to raise financing by the end of 2024,” Wells Fargo analyst Colin Langan wrote in a note the day after Rivian’s latest earnings release predicting today’s announcement of a capital raise. Langan currently has an Equal Weight rating on the stock with an $18 price target.

Yahoo Finance

Yahoo FinanceTikTok ban: Senators to introduce legislation to shut down social app

Sens. Mark Warner (D-VA) and John Thune (R-SD) are set to introduce a bill that would ban TikTok.

9h ago Yahoo Finance

Yahoo FinanceStocks moving in after-hours: Stitch Fix, CrowdStrike

Stocks moving in after hours: Stitch Fix, CrowdStrike

2h ago Yahoo Finance

Yahoo FinanceTesla slashes prices of high-end Model S and Model X EVs

Tesla is bringing out its price chopper again, this time at the higher end.

1d ago Yahoo Finance

Yahoo FinancePowell tells Congress rates will likely be 'higher than previously anticipated'

Fed Chair Jerome Powell told lawmakers in prepared remarks on Tuesday interest rates are likely to rise "higher than previously anticipated" as the central bank struggles to bring inflation back to its 2% target.

11h ago Yahoo Finance

Yahoo FinanceHousing confidence craters once more as mortgage rates spike

Fannie Mae’s gauge of housing sentiment dropped 3.8 points in February to 58.0, falling close to its record low set last year.

4h ago Fortune

FortuneGoogle boss Sundar Pichai says staff are bemoaning office ghost towns—‘It’s just not a nice experience’

The search engine giant is facing what is likely its greatest competitive threat since it was founded in 1998, forcing Pichai to make tough choices on costs.

13h ago Reuters

ReutersRivian plans to sell $1.3 billion in bonds to shore up capital, shares fall

Rivian Automotive plans to sell bonds worth $1.3 billion, it said on Monday, as weakening demand and lofty costs tighten a cash crunch around electrical vehicle makers. Initial investors will get an option to buy an additional $200 million of the bonds for settlement 13 days after the bonds are issued, Rivian said in a statement. The capital from this offering will help facilitate the launch of Rivian's smaller R2 vehicle family, a Rivian spokesperson told Reuters, adding that convertible debt was "optimal cost of capital versus selling equity at today's levels."

1d ago TipRanks

TipRanksThis 11.8%-Yielding ETF Pays Large Monthly Dividends

There are few things investors enjoy more than receiving a dividend payment each quarter. However, a popular ETF from JPMorgan, the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), takes this approach and does it one better by paying investors a dividend on a monthly basis. Not only that, but JEPI’s dividend yield is a massive 11.8% on a trailing basis, which is more than seven times the average yield for the S&P 500 of 1.65% and nearly three times the yield that investors can get from 10-yea

21h ago TipRanks

TipRanksCathie Wood and Ken Griffin Have One Thing in Common: They Both Bet on These Stocks

In 2022, Cathie Wood and Ken Griffin’s paths couldn’t have diverged any more sharply. While Wood’s bet on innovative growth-flavored stocks proved disastrous with her flagship ARKK fund posting huge losses, Griffin’s Citadel hedge fund notched profits of $16 billion – the most Wall Street had ever seen. But while the two famous investors’ fortunes differed dramatically last year, the pair have some things in common; both try to beat the market using singular techniques whether it’s Wood’s pencha

9h ago MarketWatch

MarketWatchBond-market recession gauge plunges to triple digits below zero and reaches fresh four-decade milestone

The spread between 2- and 10-year Treasury yields plunges to minus 103.7 basis points, a level not seen since Sept. 22, 1981.

5h ago TheStreet.com

TheStreet.comThree Dividend Stocks to Consider Now: Morningstar

The firm's analysts give them all wide moats, meaning they will have competitive advantages for at least 20 years.

4h ago Investor's Business Daily

Investor's Business DailyDow Jones Tumbles Over 500 Points On 'Faster' Fed Chief Powell; Tesla Falls Below Key Level

Fed chief Jerome Powell signaled rate hikes will go higher and faster than previously expected. The major indexes fell sharply.

8m ago Reuters

ReutersHawkish Powell puts 50 bp Fed rate hikes back on table

The Federal Reserve will likely need to raise interest rates more than expected in response to recent strong data and is prepared to move in larger steps if the "totality" of incoming information suggests tougher measures are needed to control inflation, Fed Chair Jerome Powell told U.S. lawmakers on Tuesday. "The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," Powell said in prepared remarks for a hearing before the Senate Banking Committee. U.S. stocks sold off, Treasury yields rose and the dollar extended a gain after Powell's comments, his first since inflation unexpectedly jumped in January and the U.S. government reported an unusually large increase in payroll jobs for that month.

10h ago Fortune

FortuneMissing $96,000 is your problem, Coinbase allegedly told account holder who had life savings cleaned out

The crypto exchange’s response to the alleged theft “disclaimed any responsibility for the hacking of its customers’ accounts.”

12h ago MarketWatch

MarketWatchThe 6% CD has arrived. Should you bite?

Thanks to rapidly rising interest rates, many reputable banks and credit unions are now offering certificates of deposit with impressive rates above 4%. Security Plus Federal Credit Union offers an 11-month, 6% APY CD with a minimum $1,000 deposit and maximum $50,000 deposit to Baltimore City residents. Meanwhile, Frontwave Credit Union offers 6% on an 18-month CD for residents of Riverside, San Bernardino and San Diego Counties, California who can pony up a minimum deposit of $1,000.

2d ago Bloomberg

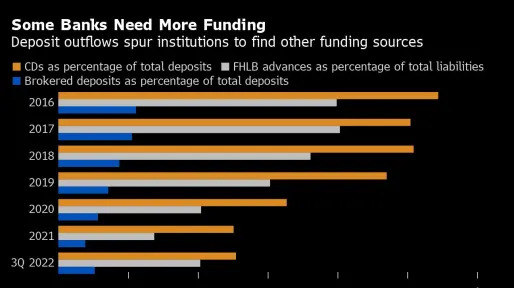

BloombergUS Banks Are Finally Being Forced to Raise Rates on Deposits

(Bloomberg) -- US banks are being forced to do something they haven’t done for 15 years: fight for deposits.Most Read from BloombergHolding Cash Will Be a Winning Strategy in 2023, Investors SayTrump’s Threat of a Third-Party Run Is Undercut by ‘Sore Loser’ LawsUS Banks Are Finally Being Forced to Raise Rates on DepositsTesla Slashes Model S and X Prices for the Second Time This YearTesla’s China Price War Sparks $18 Billion BYD Rout: Tech WatchAfter years of earning next to nothing, depositors

1d ago Zacks

ZacksIs NIO Inc. (NIO) a Buy as Wall Street Analysts Look Optimistic?

The average brokerage recommendation (ABR) for NIO Inc. (NIO) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

1d ago Reuters

ReutersSilvergate in talks with FDIC officials on ways to salvage bank - Bloomberg News

The company late on Friday said that effective immediately it made a "risk-based decision" to discontinue the Silvergate Exchange Network, which enabled round-the-clock transfers between investors and crypto exchanges, unlike traditional bank wires, which can often take days to settle. U.S. regulators have been sent to the headquarters of Silvergate as the company looks for a way to stay in business, the report said. One possible option involves lining up crypto-industry investors to help Silvergate shore up its liquidity, the report said.

2h ago MarketWatch

MarketWatch20 income-building stocks that the numbers say could become elite Dividend Aristocrats

DEEP DIVE Back in January, we took a deep look into three groups of Dividend Aristocrat stocks to show which ones had increased their payouts most significantly over the past five years. Now it is time for a follow-up on other companies that have the potential to earn the Aristocrat distinction.

1d ago Yahoo Finance

Yahoo FinanceGE stock has skyrocketed 80% in 5 months — JPMorgan says that's a problem

GE's stock is too richly valued, warns the influential JPM coverage team.

14h ago

</div

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK