The ‘sandwich generation’ is racking up an average of $7,000 on their credit car...

source link: https://finance.yahoo.com/news/sandwich-generation-racking-average-7-130000824.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The ‘sandwich generation’ is racking up an average of $7,000 on their credit cards as the Americans' total balances spike to $930 billion — here are 4 ways to dig your way out of debt faster

data out from Bank of America

Credit card balances hit record levels at the end of last year, and experts are predicting they will only continue to increase over 2023.

“Whether it’s shopping for a new car or buying eggs in the grocery store, consumers continue to be impacted in ways big and small by both high inflation and the interest rate hikes implemented by the Federal Reserve, which we anticipate may continue for at least a few more months,” Michele Raneri, vice president of U.S. research and consulting at TransUnion, said in a press release.

Don't miss

The release from the credit reporting agency also showed total credit card balances in the U.S. hit $930 billion in the fourth quarter of 2022. This marks an 18.5% increase over Q4 of 2021 when balances were sitting at $785 billion.

However, just how much you owe on your card could vary depending on what generation you were born into. A study from life insurance company New York Life found that Gen X actually has the most credit card debt, at an average of $7,004 per person.

But no matter your age, if you’re buried in bills, there are things you can do to help dig your way out faster.

How much does each generation owe?

Gen X is racking up the bills, with over $7,000 in credit card debt — and the boomers aren’t far behind.

According to the New York Life study, here’s how much each generation owes on average:

Gen Z: $2,876

Millennials: $5,928

Gen X: $7,004

Baby boomers: $6,785

Raneri tells Moneywise that Gen X is in their high earning years in their careers. “I think that they're getting just more money in general, and spending more money.”

MoneyWise

MoneyWise'The Big Quit': Close to 70% of US workers plan to leave their jobs in 2023 — with Gen Z, millennials leading the way. 3 tips to successfully carve a new career path this year

Leave your job but don't resign yourself to a frugal future.

18h ago Barrons.com

Barrons.comThe Way Americans Retire Has Changed Forever. Why Saving a Nest Egg Isn’t Enough.

Retirees are exposed to a lot of risk. Employers, and the government, need to do more to help them manage it, writes Martin Neil Baily.

23h ago Fortune

FortuneMeta just gave thousands of employees poor performance reviews that could clear the way for more layoffs during its ‘Year of Efficiency’

Threat comes after 11,000 workers lost their jobs in November.

14h ago MarketWatch

MarketWatch‘I will work until I die’ — I’m 74, have little money saved and battle medical issues. ‘I want to retire so I can have a few years to enjoy life.’

See: We’re in our 60s, my husband plans to work until he ‘drops dead’ and our medical bills are overwhelming — how can we retire like this? My first suggestion would be to find a qualified financial planner who offers pro bono work. You can find these advisers a few ways: the Financial Planning Association, the Certified Financial Planner Board and the National Association of Personal Financial Advisors, to name a few.

19h ago MoneyWise

MoneyWiseThe US is about to sell another 26M barrels of oil reserves — depleting the 'oil piggy bank' even further. But here's President Biden's 3-part plan to replenish it

The SPR is already at its lowest level in 40 years.

2d ago MarketWatch

MarketWatchMy fiancé’s adult daughter is opposed to our marriage — and wants to inherit her father’s $3.2 million esate. How should we handle her?

‘She wants the family home retitled in a trust. She wants all life insurance and brokerage beneficiaries in her name.’

4h ago Yahoo Finance

Yahoo FinanceTax refunds shrink even more versus last year, latest IRS data shows

The average refund amount was $1,997, down 14% from $2,323 during the same period last year.

8h ago MarketWatch

MarketWatch‘Siblings betray family members, even their own mother, just to get a bigger payout for themselves.’ Watch out for these scam attempts.

Based on interviews with Alan and my own personal experience, I created a list of red flags that may help you successfully survive family financial transactions: inheritances; insurance payouts; real estate deals, loans and stock sales are fraught with opportunities for scammers, even among family members. Sometimes the family member you least suspect of being unethical is the biggest scammer.

12h ago Benzinga

BenzingaIllegal for 79 Years, This Loophole Lets Regular Americans Invest Alongside Silicon Valley Insiders

For 79 years, if you wanted the right to invest in early-stage companies like Apple in the 1970s, Facebook in 2004, or Airbnb in 2009, you had to be an “accredited investor.” The concept came from a 1933 law that created the U.S. Securities & Exchange Commission (SEC) to guard against some of the excesses on Wall Street that had led to the 1929 crash and the ensuing Great Depression. The Securities Act also held a provision barring any non-founders or other company insiders from investing in a p

2d ago MarketWatch

MarketWatchNikki Haley called Social Security ‘the heart of what’s causing government to grow’

Haley’s comment was made back when she was South Carolina’s governor-elect. The health and future of Social Security are still top concerns.

14h ago American City Business Journals

American City Business JournalsExperts: Disney likely won't fight Reedy Creek district law in court. Here’s why.

There's little chance The Walt Disney Co. will challenge the legality of Florida House Bill 9B, which will revamp the name and power structure of Walt Disney World's Reedy Creek Improvement District, several experts said.

11h ago MarketWatch

MarketWatchAnother ‘Volmageddon’? JPMorgan becomes the latest to warn about an increasingly popular short-term options strategy.

"While history doesn’t repeat, it often rhymes, and current selling of 0DTE (zero day to expiry), daily and weekly options is having a similar impact on markets," says JPM's Marko Kolanovic.

2d ago MarketWatch

MarketWatchRussia’s year-old war on Ukraine has informed U.S. planning for prospective conflict with China

‘[T]here are clear parallels between the Russian invasion of Ukraine and a possible Chinese attack on Taiwan,’ concluded a report early this year by the Center for Strategic and International Studies.

1d ago Reuters

ReutersAmazon asks employees to be in office at least three days a week

In a message that was posted on Amazon's blog, chief executive Andy Jassy wrote the decision was taken at a meeting earlier this week and the move would make it easier to learn and collaborate. "This shift will provide a boost for the thousands of businesses located around our urban headquarter locations in the Puget Sound, Virginia, Nashville, and the dozens of cities around the world where our employees go to the office," Jassy wrote. Amazon had said in October 2021 it would let individual teams decide how many days corporate employees would be expected to work from office in a week.

12h ago Benzinga

BenzingaPennsylvania Farmer Behind $5 Trillion Trend Speaks Out: I Created A Monster

Add up the market valuation of Apple Inc. (NASDAQ: AAPL), all the cryptos in the world and entrepreneur Jeff Bezos’s fortune, and you get to over $3 trillion. But one 80-year-old man has created something bigger than all three of these combined. These days, he shuns the spotlight and lives on a modest farm in rural Pennsylvania. You would never guess the farm’s owner set in motion a $5 trillion force that grows each fortnight. It’s a comfortable enough retirement, but Ted Benna has some regrets.

2d ago TipRanks

TipRanks‘Long-term investors will be rewarded’: Goldman Sachs explains why you should ‘buy’ these 2 cybersecurity stocks

Our digital world runs on computer tech, and that tech is only going to become more autonomous and more ubiquitous. And that, in turn, only underscores the ongoing importance of online security. With digital automation growing, it’s more important than ever, right now, to start firming up the digital protections. Against this backdrop, Goldman Sachs' Gabriela Borges has turned her eye on the cybersecurity sector. The analyst sees several industry dynamics that are favorable for long-term investo

1d ago Fortune

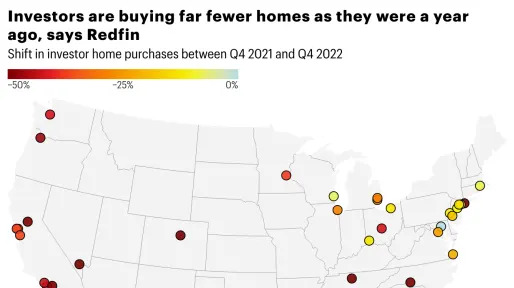

FortuneThe housing market has cooled so much that even deep-pocketed investors are backing off

Not since the 2008 housing crisis have investors backed off buying homes like this, according to Redfin’s new report.

9h ago Barrons.com

Barrons.comIs the Stock Market Open for Presidents Day? Here Are the Trading Hours.

Presidents Day is just around the corner. On Friday, the Dow Industrial Average rose 0.4%, the S&P 500 dropped 0.3%, and the tech-heavy Nasdaq Composite slipped 0.6%. Here’s what you need to know if you’re looking to trade on Presidents Day.

1d ago The Telegraph

The TelegraphPutin losing energy war as European gas supplies near record levels

Europe is on course to end the winter with near record volumes of gas in storage, dealing a blow to Vladimir Putin's efforts to fund his war in Ukraine.

12h ago Fortune

FortuneJPMorgan’s top strategist warns markets could be heading for another ‘Volmageddon’

“While history doesn’t repeat, it often rhymes,” Marko Kolanovic warned.

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK