Fed Chair Powell says 'disinflationary process has begun' in the US economy

source link: https://finance.yahoo.com/news/fed-chair-powell-says-disinflationary-process-has-begun-in-the-us-economy-175915718.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Fed Chair Powell says 'disinflationary process has begun' in the US economy

Federal Reserve Chair Jerome Powell said Tuesday the "disinflationary process" in the U.S. economy has begun, and said additional rate hikes will likely be necessary to bring inflation back to its 2% target.

Speaking in an interview with David Rubenstein at the Economic Club of Washington, D.C., Powell reiterated his comments from last week regarding inflation pressures, saying: "The disinflationary process has begun. It has begun in the goods sector, which is about 25% of the economy."

Powell said this process, "is going to take quite a bit of time, and is not going to be smooth."

"We will likely need to do additional rate increases," Powell said, as the Fed works to bring inflation back to its target.

Asked about Friday's stronger-than-expected December jobs report, Powell said the strong labor market, "shows you why we think [disinflation] will be a process that takes a significant period of time."

"The labor market is extraordinarily strong," Powell added, noting it is "good inflation has started to come down with a strong labor market."

Still, Powell's comments did not suggest Friday's strong jobs report would change the central bank's approach to future rate increases. As Powell spoke, stocks rallied to session highs, though markets later gave up those gains in afternoon trading.

Though Powell added the caveat that if we continue to get higher inflation reports or jobs reports the Fed may need to raise rates more than what’s been price in by investors.

Powell says the strength of the job market is structural and due somewhat to the pandemic, which shut off immigration and contributed to a shortage of workers in the U.S. He thinks these pressures are starting to abate now. And while the job market remains strong, Powell noted that increases in wages are coming down.

"The Fed is wedded to a stale outlook," Neil Dutta, head of economics at Renaissance Macro, said in an email on Tuesday. "That is dovish because it gives the current momentum in the economy more room to run. [Powell] had the opportunity to lean against what happened last week and he took a pass."

Yahoo Finance

Yahoo FinanceStock market news live updates: Stocks soar after Powell embraces 'disinflation'

U.S. stocks closed out a volatile session sharply higher Tuesday after Federal Reserve Chair Jerome Powell embraced the presence of disinflation in the economy during a speech in Washington D.C.

2h ago Yahoo Finance

Yahoo FinanceUber earnings preview: Here's what to expect

Uber (UBER) is set to report its Q4 2022 earnings on Feb. 8 before the market open.

24m ago Barrons.com

Barrons.comFed Chair Jerome Powell Sticks to the Script. More Rate Hikes Are Coming.

The Fed chair used last month's robust hiring to highlight exactly why the central bank can't ease up in its inflation battle yet.

2h ago Reuters

ReutersPowell: A "couple of years" before Fed nears end of balance sheet decline

(Reuters) -Federal Reserve Chairman Jerome Powell said Tuesday the U.S. central bank has some distance left to run in terms of shrinking its balance sheet. When it comes to setting a stopping point for shedding bonds from the central bank's holdings, "we haven’t put a specific target on it,” Powell said at an appearance before the Economic Club of Washington. "It will be a couple of years" before the balance sheet reduction process concludes, Powell said.

5h ago Yahoo Finance Video

Yahoo Finance VideoInflation, deflation and disinflation: What's the difference?

The Federal Reserve raised short-term interest rates this week by a quarter percentage point, bringing the central bank's benchmark rate to a range of 4.50% and 4.75%. During Jerome Powell's press conference on Wednesday, the Federal Reserve Chairman used terms like inflation, deflation and disinflation, but what do those terms actually mean for you and your money? Yahoo Finance's Brian Sozzi, Brad Smith and Julie Hyman break down the three widely used terms For more coverage of the Federal Reserve's interest rate decision, check out: - Federal Reserve raises interest rates another 0.25% to highest since October 2007 - The word that made stocks fall in love with the Fed: Morning Brief For more live financial news and analysis, make sure to tune into Yahoo Finance Live

1d ago Yahoo Finance

Yahoo FinanceChipotle earnings misses estimates on revenue, earnings, same-store sales

Chipotle Mexican Grill (CMG) reported earnings that missed expectations.

2h ago MarketWatch

MarketWatchDow snaps 3-day losing streak after Fed chief Powell says the peak policy interest rate may be higher

U.S. stocks ended higher on Tuesday after a volatile session in the wake of Federal Reserve Chair Jerome Powell's comments that inflation will decline significantly in 2023 but more interest-rate hikes will be necessary.

2h ago Yahoo Finance

Yahoo FinanceCourt keeps secret for now who backed bail for FTX's Bankman-Fried

Bankman-Fried's lawyers filed court documents indicating they plan to appeal a judge's January 30 decision to unseal the names.

2h ago SmartAsset

SmartAsset84% of Retirees Are Making This RMD Mistake. Are You One of Them?

Though retirees are only required to take a certain portion of their retirement savings out as distributions each year, a study from JPMorgan Chase shows that there is likely good reason to take out more. A withdrawal approach based solely on … Continue reading → The post 84% of Retirees Are Making This RMD Mistake appeared first on SmartAsset Blog.

9h ago Reuters

ReutersUS STOCKS-Wall Street rises as investors digest Powell comments

U.S. stocks closed higher after a choppy trading session on Tuesday, as investors digested comments from Federal Reserve Chair Jerome Powell about how long central bank may need to tame inflation. Powell said 2023 should be a year of "significant declines in inflation." "We didn't expect it to be this strong," Powell said at the Economic Club of Washington, referring to the nonfarm payrolls report for January, but it "shows why we think this will be a process that takes quite a bit of time."

2h ago Fortune

Fortune‘Big Short’ hedge funder says he thinks we’re headed for a ‘run-of-the-mill’ recession—but the bigger ‘paradigm shift’ is really on his mind

Steve Eisman says some market paradigms get deeply embedded in people’s minds. “They can’t even imagine, at times, that there could be anything else.”

1d ago Yahoo Finance

Yahoo FinanceWhy recent layoff announcements signal the end of 'corporate stimulus'

Corporate America can’t seem to be laying off workers fast enough. Yet job growth is still robust across the U.S. economy.

12h ago Yahoo Finance

Yahoo FinancePinterest CEO: We are aiming to 'build a positive platform'

Pinterest CEO Bill Ready reveals his transformation plan for the social platform to Yahoo Finance.

51m ago Yahoo Finance Video

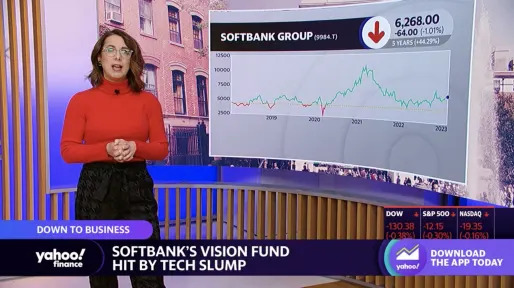

Yahoo Finance VideoBP hikes dividend, Apollo in talks for Credit Suisse unit, SoftBank battles slumping valuations

Yahoo Finance's Julie Hyman breaks down notable business headlines, which include BP posting record profits and slowing its shift away from oil, Apollo Global Management exploring a stake in a Credit Suisse unit, and SoftBank's vision fund battling hit by a tech slump. (Apollo Global Management is Yahoo Finance's parent company.)

8h ago Motley Fool

Motley FoolWhy C3.ai Stock Just Crashed 10%

C3.ai (NYSE: AI) has had an amazing run this year. Inspired by the wildfire popularity of ChatGPT, and investor dreams of AI-fueled riches, shares of the artificial intelligence stock were up nearly 150% since the start of this year -- until all of a sudden, C3.ai stock turned tail this morning and retreated.

7h ago Motley Fool

Motley FoolWhere Will Intel Be in 3 Years?

In this video, I will be talking about Intel's (NASDAQ: INTC) future, specifically what it needs to do in the next three years, and the lessons we can learn from AMD's remarkable turnaround. *Stock prices used were from the trading day of Feb.

7h ago 7h ago

7h ago Motley Fool

Motley FoolWhy Skyworks Solutions Stock Soared Today

The wireless communication chip designer posted first-quarter results in the Goldilocks zone -- not too hot, not too cold -- and management saw better days coming in a few months.

2h ago Motley Fool

Motley FoolWhy Plug Power Stock Fell 5% Today

Shares of hydrogen fuel cell company Plug Power (NASDAQ: PLUG) were down about 5.5% as of 1:30 p.m. ET on Monday, presumably responding to a report from Euronews that suggested the prospects for building a hydrogen economy may no longer be as bright as once thought. Citing data from non-governmental organization Global Witness, Euronews noted today that converting Europe's economy alone to run on hydrogen gas would cost 240 billion euros -- and double the cost of electricity for consumers. Over the past few years, predictions for the growth rate of the hydrogen economy have been ... optimistic, shall we say.

1d ago Motley Fool

Motley FoolBetter Buy: AT&T vs. Verizon

The rivalry between AT&T (NYSE: T) and Verizon Communications (NYSE: VZ) has raged for decades. Now that AT&T has divested its media assets, both companies focus primarily on developing 5G broadband.

13h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK