How U.S. workers can understand, strategize around economic data

source link: https://finance.yahoo.com/video/u-workers-understand-strategize-around-220100738.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

How U.S. workers can understand, strategize around economic data

How U.S. workers can understand, strategize around economic data

Yahoo Finance contributor Mandi Woodruff-Santos highlights how workers should be paying attention to economic data when paying off debt, making moves in the labor market, and leveraging sign-on benefits with a new job.

-

How U.S. workers can understand, strategize around economic data

-

FanDuel prepares first live Super Bowl ad featuring Rob Gronkowski

-

Bed Bath & Beyond stock surges ahead of Tuesday morning's Q3 earnings report

-

Elon Musk’s leadership is ‘eroding’ Twitter’s trust with users: Reporter

-

JPMorgan CEO Jamie Dimon addresses 41st Healthcare Conference

-

Cannabis: Tilray has to ‘depend upon its own future’ amid regulation uncertainties, CEO says

-

Former McDonald’s CEO fined for allegedly misleading investors around his termination

-

‘Avatar’ sequel reportedly hasn’t broken even, 'M3GAN' debuts to $30 million domestically

-

Seattle school district sues social media platforms over mental health impacts on children, teens

-

Over 7,000 NYC nurses strike for fairer contracts, working conditions

-

Markets: It’s not time to ‘shelter up and hide away’ from risk assets, strategist says

-

Stocks moving ahead of mixed close: Duck Creek, Alibaba, Macy’s

-

Disney CEO Bob Iger orders staff return to office four days a week in new memo

How U.S. workers can understand, strategize around economic data

Yahoo Finance contributor Mandi Woodruff-Santos highlights how workers should be paying attention to economic data when paying off debt, making moves in the labor market, and leveraging sign-on benefits with a new job.

Video Transcript

DAVE BRIGGS: A slew of economic information-- interest rate hikes, jobs reports, CPI data-- can be a lot for people to absorb. To help us make sense of what all this means for workers, Yahoo Finance contributor and "Brown Ambition" podcast co-host Mandi Woodruff-Santos joining us now. Mandi, nice to see you. So what should employees be doing to prepare for the worst?

MANDI WOODRUFF-SANTOS: Honestly, I think the first thing is to just take a deep breath. Things are a little shaky right now. And they're highly confusing. There are several signs that the job market is still really hot. I mean, we see quit rates still inching their way actually up a little bit. Wage growth, although down slightly, is still fairly steady, especially relative to where we were before the pandemic. So for workers, what can this mean for you?

Also, we see, like, tech layoffs happening. My first tip is really for you to think about your own financial house, and what can you do to create some sense of financial security, because even though things are good now, I'm a realist, and it's very likely that businesses could continue to make big pivots throughout this year if a recession continues to loom over us. And by pivots, of course, that means potential layoffs. So definitely be saving and paying down your debt. But I wouldn't let that stop you from making some big career moves if that's what you want to do in 2023.

SEANA SMITH: Well, Mandi, for those out there who are looking to make a move, I think some of them are struggling with what they need to pay attention to, what they can kind of just ignore at this point. What are the most important things that they need to pay attention to at this point?

MANDI WOODRUFF-SANTOS: You've got to look at your personal professional economy. So what sector are you in? And look for data and research that supports what are job openings look like, what are hiring rates looking like for your particular sector. Maybe if you're in tech, you know that things are going to be highly competitive because even though tech companies are still-- some of them are still hiring, of course, you have lots of competition with tens of thousands of workers hitting the job market at the same time due to layoffs.

Yahoo Finance Video

Yahoo Finance VideoElon Musk’s leadership is ‘eroding’ Twitter’s trust with users: Reporter

The Washington Post Technology Columnist Geoffrey Fowler joins Yahoo Finance Live to discuss how he was able to impersonate a U.S. senator on Twitter after Elon Musk updated the verification process for blue checks and how Musk’s leadership at the social media platform has impacted users' trust in Twitter.

6h ago Yahoo Finance Video

Yahoo Finance VideoBed Bath & Beyond stock surges ahead of Tuesday morning's Q3 earnings report

Yahoo Finance Live's Dave Briggs looks at Bed Bath & Beyond shares ahead of the retail chain's latest earnings due out tomorrow morning ahead of the opening bell.

6h ago Motley Fool

Motley FoolTop Semiconductor Stocks for 2023 and Beyond: Nvidia, Qualcomm, and ASML Holding

In today's video, Jose Najarro and Nick Rossolillo discuss Nvidia (NASDAQ: NVDA), Qualcomm (NASDAQ: QCOM), and ASML Holding (NASDAQ: ASML). Nick has high confidence in these three semiconductor stocks, but does Jose feel the same way? Check out the short video to learn more, consider subscribing, and click the special offer link below.

2d ago TipRanks

TipRanksAre BABA and NIO Stocks a Buy Right Now? This Is What You Need to Know

China eased back on its harsh COVID restrictions, the lockdowns and the travel quarantines, and that nation’s stock markets jumped, rising some 40% from their recent low points. The bullish sentiment in the world’s largest country – and second largest economy – was infectious, and the MSCI Asia Pacific Index is up some 20% from its October low. In fact, the Asian benchmark has outperformed the S&P 500 in the first week of 2023. What this means, at the bottom line, is that Chinese stocks are look

5h ago TipRanks

TipRanksBillionaire Leon Cooperman Says the Bear Market Is Expected to Continue in 2023 — Here Are 2 ‘Safe Haven’ Stocks That Analysts Like

Feeling optimistic the new year will usher in a change in stock market dynamics and shift sentiment from bear to bull? Well, Leon Cooperman has some bad news for you. The billionaire investor has been a fully-fledged bear for a while now and 2023 has done little to change his stance. "Anybody looking for a new bull market any time soon is looking the wrong way,” Cooperman said. In fact, Cooperman thinks there’s only a 5% chance the S&P 500 sees out 2023 above the 4,400 mark (up 13% from current

1d ago Yahoo Finance

Yahoo FinanceStocks: Millennials more likely to use pullbacks to buy, says TD Ameritrade strategist

Millennials are more apt to step in and buy equities during sell-offs, according to data compiled by TD Ameritrade.

6h ago MarketWatch

MarketWatchLook for a big cut to TSMC’s 2023 outlook as a bullish sign for chips, one analyst says ahead of earnings

The best thing Taiwan Semiconductor Manufacturing Co. can do in its earnings report Thursday is to cut its outlook for 2023 big, indicating a bottoming in the first half of the year, according to one analyst Monday. TSMC (TSM) is scheduled to report fourth-quarter earnings on Thursday at 1 a.m. Eastern Time. Needham analyst Charles Shi, who keeps TSMC as his top pick for 2023, said that the bigger the cut to TSMC’s full year guidance, the better shape 2024 will be.

11h ago TipRanks

TipRanks‘Too Cheap to Ignore’: J.P. Morgan Says These 2 Stocks Could Rebound in 2023

We are yet to find out what lies in store for the stock market in 2023. However, we do know that the previous year was one of the worst ever, with the S&P 500 putting in its 7th most abject annual performance since 1929. Whichever way you look at it, then, most investors did not enjoy the past 12 months’ market action. One positive takeaway, however, is that the overall bearish trend has driven share prices down across the board and that has left some stocks at levels that are now just too cheap

12h ago Reuters

ReutersDollar at 7-month low vs euro on slower Fed rate hike expectations

NEW YORK (Reuters) -The U.S. dollar on Monday slid to a seven-month low against the euro as traders bet recent economic data would prompt the Federal Reserve to slow the pace of interest rate hikes, while riskier currencies benefited from China reopening its borders. Two separate reports on Friday painted a picture of an economy that is growing and adding jobs, but where overall activity is tilting into recession territory, prompting traders to sell the dollar against a range of currencies.

1d ago Yahoo Finance

Yahoo FinanceYahoo Finance trending tickers: Lululemon, Chico's, Macy's all issue warnings

Retailers struggled through the holiday season, new data shows.

15h ago Motley Fool

Motley Fool5 Simple Steps to Take Now to Get Recession-Ready

Many financial experts warn of a coming recession, or period of prolonged economic downturn that is characterized by slow growth and high rates of unemployment. Whether you already have an emergency fund or not, it may be time to put some extra cash away for a rainy day because recessions tend to increase the chances of that day coming. Interest rates may also be higher as the Federal Reserve has been raising rates.

5h ago SmartAsset

SmartAssetYour Required Minimum Distributions (RMDs) Have Officially Been Pushed Back

The SECURE 2.0 Act, signed by President Biden in December 2022, includes dozens of changes to provisions related to tax-advantaged retirement accounts. Among the most important changes is a provision, which took effect Jan. 1 of this year, that delays … Continue reading → The post Your Required Minimum Distributions (RMDs) Have Officially Been Pushed Back appeared first on SmartAsset Blog.

12h ago MoneyWise

MoneyWiseBill Gates is using these dividend stocks right now to produce a big inflation-fighting income stream — you might want to do the same in 2023

Bill Gates looks for income, too. This is how he gets it.

17h ago Motley Fool

Motley FoolWhy Rivian, Lucid, and ChargePoint Shares Jumped Today

U.S.-based electric vehicle (EV) company stocks took off today after what had been a relatively rough start to 2023. After the first week of the year, stocks of EV makers Rivian Automotive (NASDAQ: RIVN) and Lucid Group (NASDAQ: LCID) along with charging network company ChargePoint (NYSE: CHPT) were down between 5% and 11%. Lucid and ChargePoint stocks were up 7% and 13.6%, respectively, at that time.

9h ago Yahoo Finance Video

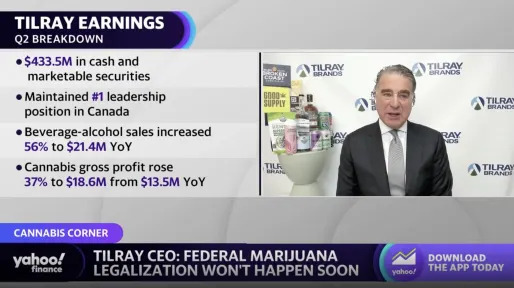

Yahoo Finance VideoCannabis: Tilray has to ‘depend upon its own future’ amid regulation uncertainties, CEO says

Tilray Brands Chairman and CEO Irwin Simon joins Yahoo Finance Live to discuss the cannabis company's second-quarter earnings and growth outlook, while also commenting on the prospects of marijuana legalization amid a new Congress.

7h ago Motley Fool

Motley FoolWhy Qualcomm Stock Got Mashed on Monday

Specialty tech stock Qualcomm (NASDAQ: QCOM) didn't have such a special start to the trading week. Apparently, that customer is none other than Apple (NASDAQ: AAPL). On Monday, Bloomberg reported that Apple will replace third-party components in its iPhones and iPads with its own goods.

4h ago Motley Fool

Motley FoolWhy Novocure Stock Is Sinking Today

What happened Shares of Novocure (NASDAQ: NVCR) are sinking today, down by 15.4% as of 10:44 a.m. ET. The decline came after the company announced its preliminary full-year and fourth-quarter 2022 net revenue numbers.

12h ago TheStreet.com

TheStreet.comElon Musk Sends Subtle Message to Disenchanted Tesla Shareholders

Elon Musk is used to facing critics, haters and detractors. He even likes these battles very much. Sometimes he even tends to provoke his supposed enemies. The Techno King, as he's known at Tesla , likes to turn his opponents' attacks into counterattacks.

1d ago TheStreet.com

TheStreet.comWarren Buffett's Berkshire Hathaway Stock Is Breaking Out

For its part, Berkshire Hathaway has seen its shares outperform the S&P 500. Now, despite the recent underperformance of Apple -- Berkshire's largest position -- shares of Berkshire Hathaway are trying to break out. Before we dive into the setup, notice how Berkshire stock was hitting all-time highs in late March.

11h ago Motley Fool

Motley FoolWhy Riot Platforms Is Absolutely Skyrocketing Today

As of 2:45 p.m. ET, RIOT stock has rocketed 15.4%, among the leaders in the tech-heavy Nasdaq. The price of Bitcoin (CRYPTO: BTC) has continued to move higher, appreciating 2.3% over the past 24 hours. For Bitcoin miners such as Riot, this is a key fundamental metric, which is typically the directional driver for price movements on a given day.

8h ago

Recommend

-

5

5

Random notes around service workers development and testingJun 18, 2022Hey! Here are a few random tips and tricks I learned through the years around service workers development and testing.

-

10

10

TechSoutheast Asia's start-ups have fired hundreds of workers, and this may be just...

-

5

5

Analyze, listen, engage & strategize Twitter growth with AIHey Product Hunters! ❤️ It all started as a teenager when I fell in love with coding games, small apps and mapping tools in my spare time. After that, I just listened to what...

-

12

12

Community Data sovereignty: The hidden economic trade-offs

-

8

8

Community How to leverage your data in an economic downturn

-

8

8

Freight Rail Workers Voted to Strike. Here’s Why They Can’t (Yet).Unlike most industries, the federal government has to allow freight rail workers to strike.August 3, 2022, 1:00pm

-

8

8

Around 300 QA workers at Microsoft-owned ZeniMax are organizing a union / The union would be Microsoft’s first and the biggest union of video game workers in the US so far.By

-

10

10

Home

-

3

3

Warehouse workers around the world are bei...

-

10

10

T-Mobile is laying off around 5,000 workers / T-Mobile execs promised to add jobs after merging with Sprint, but now, it’s announced another round of layoffs.By

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK