Stock market news live updates: November 18, 2022

source link: https://finance.yahoo.com/news/stock-market-news-live-updates-november-18-2022-115340261.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

but some subtle differences

Stock market news live updates: Stock futures rise but head toward weekly losses

U.S. stock futures pointed to modest gains at Friday’s open as investors neared the end of a turbulent trading week marked by mixed retail earnings and a chorus of hawkish Fedspeak.

Futures tied to the S&P 500 (^GSPC) rose 0.6%, while futures on the Dow Jones Industrial Average (^DJI) added about 135 points, or 0.4%. Contracts on the technology-heavy Nasdaq Composite (^IXIC) were up by 0.8%. Treasury yields continued their ascent, with the benchmark 10-year not back above 3.8% and the rate-sensitive 2-year yield inching towards 4.5%.

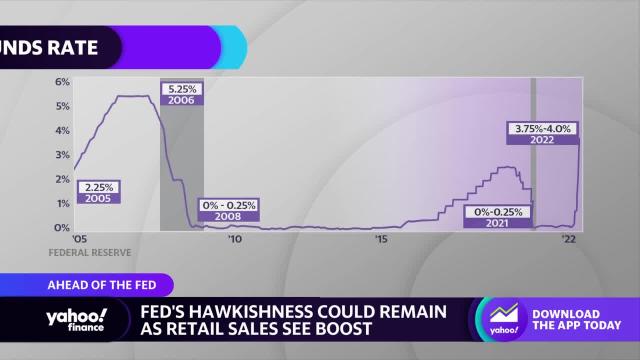

An assembly of Fed officials on Thursday pushed back against speculation that a pause on monetary tightening is close. The remarks made in separate speaking engagements across the country sent stocks and bonds into disarray after a fleeting uptrend propelled by lighter inflation data.

Inflation has only recently shown signs of moderation, with consumer and producer price data still stubbornly high despite retreating in October. Meanwhile, U.S retail sales rose at the fastest clip in eight months over the same period, prompting policymakers to hammer down on strict messaging about the work still needed to be done to tamp down elevated costs.

Minneapolis Federal Reserve Bank President Neel Kashkari said in a Minnesota Chamber of Commerce event webcast that the extent policymakers expect to raise their key federal funds rate remains an “open question.” His comments came after St. Louis Fed President James Bullard and San Francisco Fed President Mary Daly each said the central bank is looking at a terminal rate of up to 5.25%.

“Fed Chair Powell recalibrated monetary policy at the November FOMC meeting by adopting a new ‘speed vs. destination’ paradigm – indicating an intention to reach a higher terminal fed funds rate while doing so at a slower pace,” EY Parthenon Chief Economist Gregory Daco said in a note. “The difficulty for the Fed will be to prevent an excessive and counter-productive loosening of financial conditions in the face of weaker-than-expected inflation.”

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK