Stay out of 'Financial La La Land': Suze Orman says most Americans need to do th...

source link: https://finance.yahoo.com/news/stay-financial-la-la-land-130000040.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

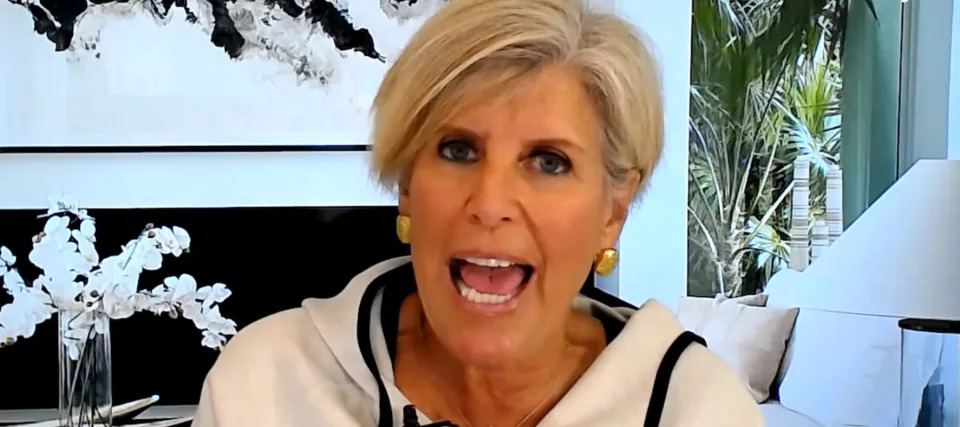

Stay out of 'Financial La La Land': Suze Orman says most Americans need to do this to survive their next crisis

It’s never been easy to save money — to think about future needs when present ones are so pressing. Americans have failed to do so for decades, says financial expert Suze Orman.

“The majority of the people in the United States have never had more than $400 in a savings account to their name,” Orman tells MoneyWise. “So if something happened, an emergency happened, they wouldn't have that money.”

WATCH NOW: MoneyWise speaks with Suze Orman and Devin Miller of SecureSave

That’s when a momentary crisis becomes a long-term disaster: People tap into their retirement savings and their credit cards, losing even more money in the form of fees, interest and missed earnings.

Orman has written several books on personal finance and hosts the podcast Women & Money, but now she says it’s time to go beyond advice.

“For 40 years, I've tried to change the mindset of people. People change when they're ready to — they don't do what they're told to do. They do it when they know they have to do it.”

Two proposals before Congress would make new saving options available through employers, but Orman is refusing to wait. She’s created her own system she says will help Americans finally put money away — by taking the decision out of their hands.

Don’t miss

Want to invest your spare change but don't know where to start? There's an app for that

You could be the landlord of Walmart, Whole Foods and Kroger (and collect fat grocery store-anchored income every quarter)

A TikToker paid off $17,000 in credit card debt by cash stuffing – can it work for you?

Congress steps in

Orman is right about how fragile most Americans’ finances are: Last year, only 32% said they could handle a sudden $400 expense.

It’s only becoming harder this year thanks to inflation and higher interest rates, but Orman argues this is “not a new phenomenon.”

“It may feel like it's new because of inflation — many people alive today never experienced inflation back in the ’70s … and now they're going, ‘Oh my God, inflation is eating up our money,’” says Orman.

Recommend

-

6

6

NFL wants Sunday Ticket to land at Apple, report says ...

-

4

4

Five things that need to happen before the market turns around, according to one strategist [MUSIC PLAYING]

-

10

10

Maybe I can Stay in NuShell -or- Living in a Diverse Land of Shells Jul 20, 2022 I really, really like NuShell. The realization that maybe I had to leave was, I'll...

-

6

6

Suze Orman says 'the worst thing you can do right now' is overspend — here are 8 things she thinks you shouldn't do as a recession loomsSamantha EmannSat, July 23, 2022,...

-

8

8

AdvertisementCloseSpace

-

4

4

Her company's new survey shows 67% of Americans can't cover a $400 emergency expense — here's how to make sure you can

-

7

7

Suze Orman 'was so upset, honest to God’ when the government made it easier to tap your 401(k) in a time of need — she has one big reason why you should never borrow from your retirement

-

5

5

Americans lost a lot of financial ground l...

-

10

10

Americans lost an average of over $1,800 to financial errors in 2022 — here are 3 big money mistakes you could be making right now

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK