How companies like Figma compound unexpectedly

source link: https://nextbigwhat.com/how-companies-like-figma-compound-unexpectedly/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

I didn’t get the job. They said my analysis was “unrealistic”

A thread on how the best companies compound unexpectedly…

I remember even folks at SoftBank thought that was crazy (and this was the Vision Fund at its most aggressive)

“Over 100x ARR? Insanity.”

This was before the world got crazy in 2020

(1) I believed Figma would grow faster than they realistically could

(2) My revenue multiple on exit was unrealistic.

Let’s start with revenue.

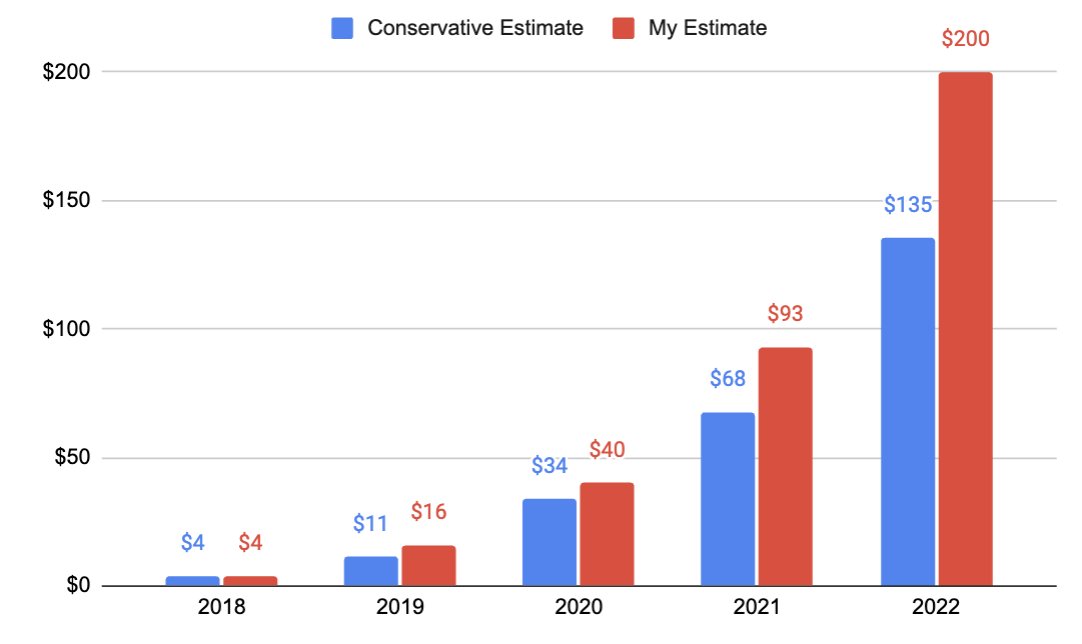

Based on Figma’s trajectory, that would get them to ~$135M ARR by 2022. My estimate? $200M ARR. I felt pretty dumb when they pointed that out.

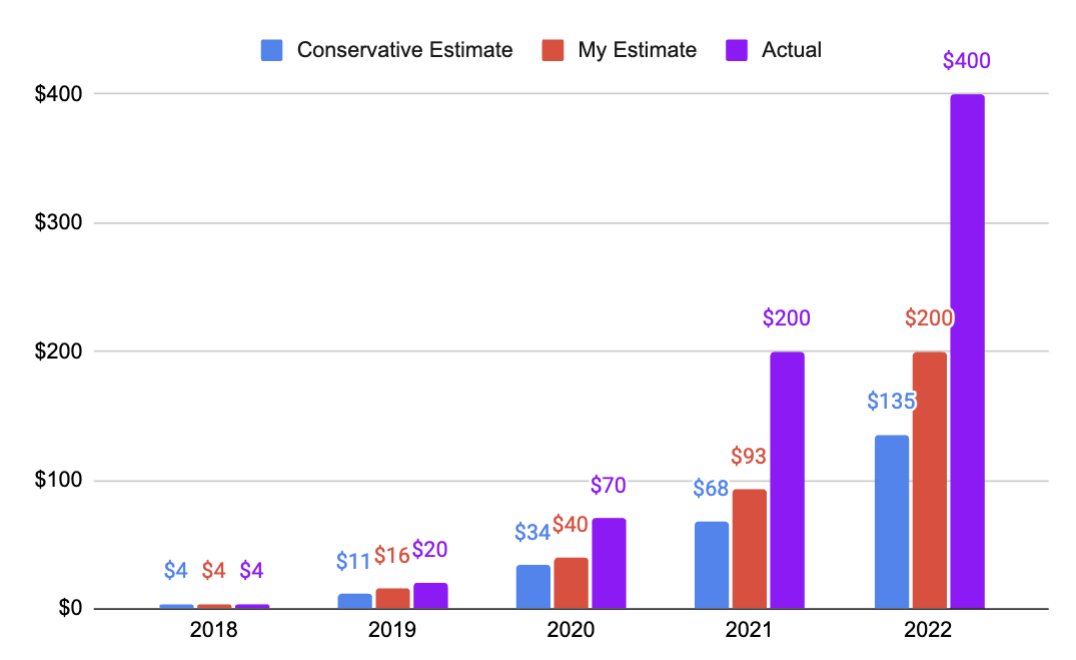

They smashed that forecast. Based on what I’ve read they’re currently at ~$400M ARR and doubling.

When Crowdstrike ($CRWD) went public in 2019 they had ~$250M of revenue

The consensus then was that their 2022 revenue would be under $1B.

Today? On track to surpass $2B.

In early 2019 the average SaaS company was trading at ~10-11x revenue.

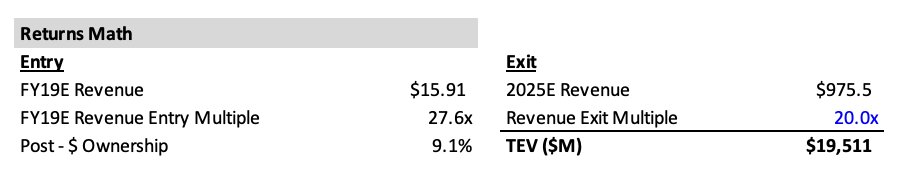

I was forecasting for a 2025 IPO. I thought, “I think Figma could be $700M ARR, growing 60%+… this deserves a premium.”

So I had it trading at 20x

Instead, I was told “Sequoia will probably expect a 3-5x return on their investment.”

3-5x on $440M? $1.3B – $2.2B

“That should be the expected exit value. Make the math work.”

I had dramatically overestimated their revenue growth, showing them get to almost $1B ARR in 2025.

And then I had them trade at an “insane” 20x multiple.

The result? A $19.5B IPO in 2025.

Instead of $200M ARR in 2022? Figma would do $400M (and the year isn’t over yet).

Instead of $19.5B in 2025? They’d be acquired for $20B in 2022.

“Every company will crush it and deserves a ‘crazy’ multiple along the way?” No.

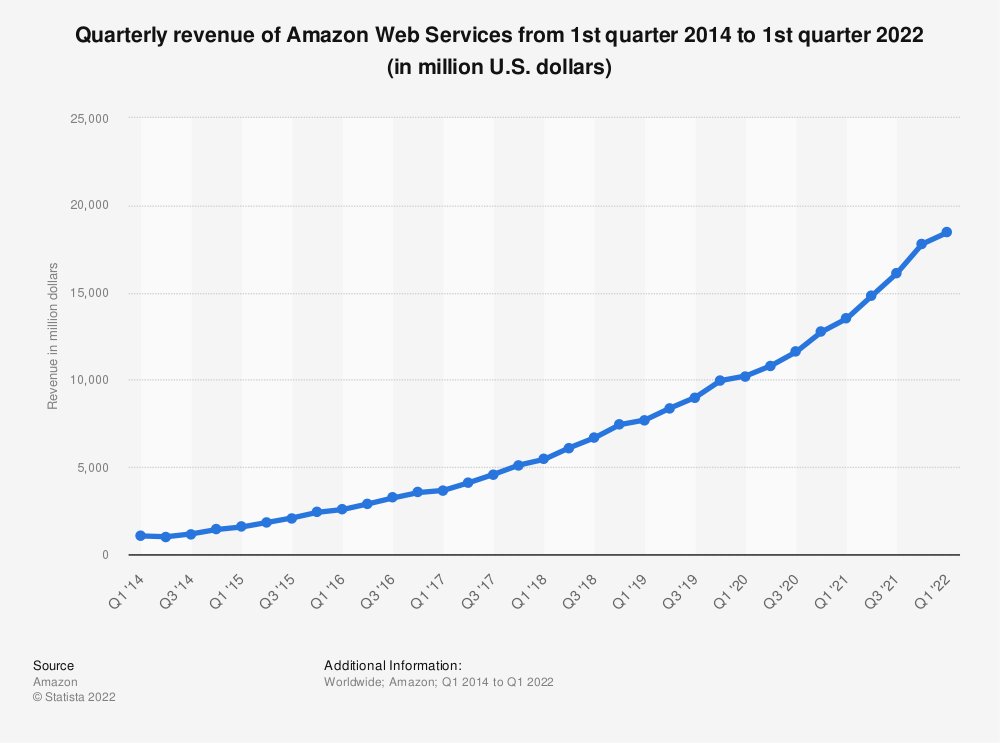

There is a concept of financial gravity. It is REALLY difficult for companies to continue to grow at exponential rates.

Eventually, financial gravity slows them down.

Like AWS, just continuing to experience monster growth to $62B+ of revenue in 2021.

How did Adobe decide to pay $20B? It was less about an excel model.

“What percent of our market cap do we need to spend to protect the rest of it?”

But the very best companies will have something special that allows them to defy financial gravity. So look for that.

Or subscribe to my writing: https://investing1012dot0.substack.com/

Follow: @kwharrison13

[Via]

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK