Malignant. The closer you look … the more shades… | by Scott Galloway | Sep, 202...

source link: https://medium.com/@profgalloway/malignant-c6130dbc0151

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

No Mercy / No Malice

Malignant

The closer you look … the more shades of gray appear

Last week President Biden issued an executive order to forgive billions of dollars in student loan debt. It was met with mixed reviews. For some, it’s a miracle, others think it’s a “bailout for the wealthy.” Representative Lauren Boebert believes it’s “robbing hard-working Americans to pay for Karen’s daughter’s degree in lesbian dance theory.” She says that like it’s a bad thing. At UCLA I took (no joke) Ellingtonia: The Study of Duke Ellington.

As with most political conversations, this one lacks nuance. Upon initial review, Biden’s act bothered me. However, like most things in life, the closer you look … the more shades of gray appear. What the executive order does:

- Forgives $10,000 in federal student debt to any borrower who earns less than $125,000 per year ($250,000 for a household of two or more). Pell Grant recipients get an additional $10,000 forgiven.

- Extends the pause on current student loan payments through to the end of the calendar year.

- Reduces the existing cap on monthly loan repayments from 10% of the borrower’s discretionary income to 5%.

Diagnosis

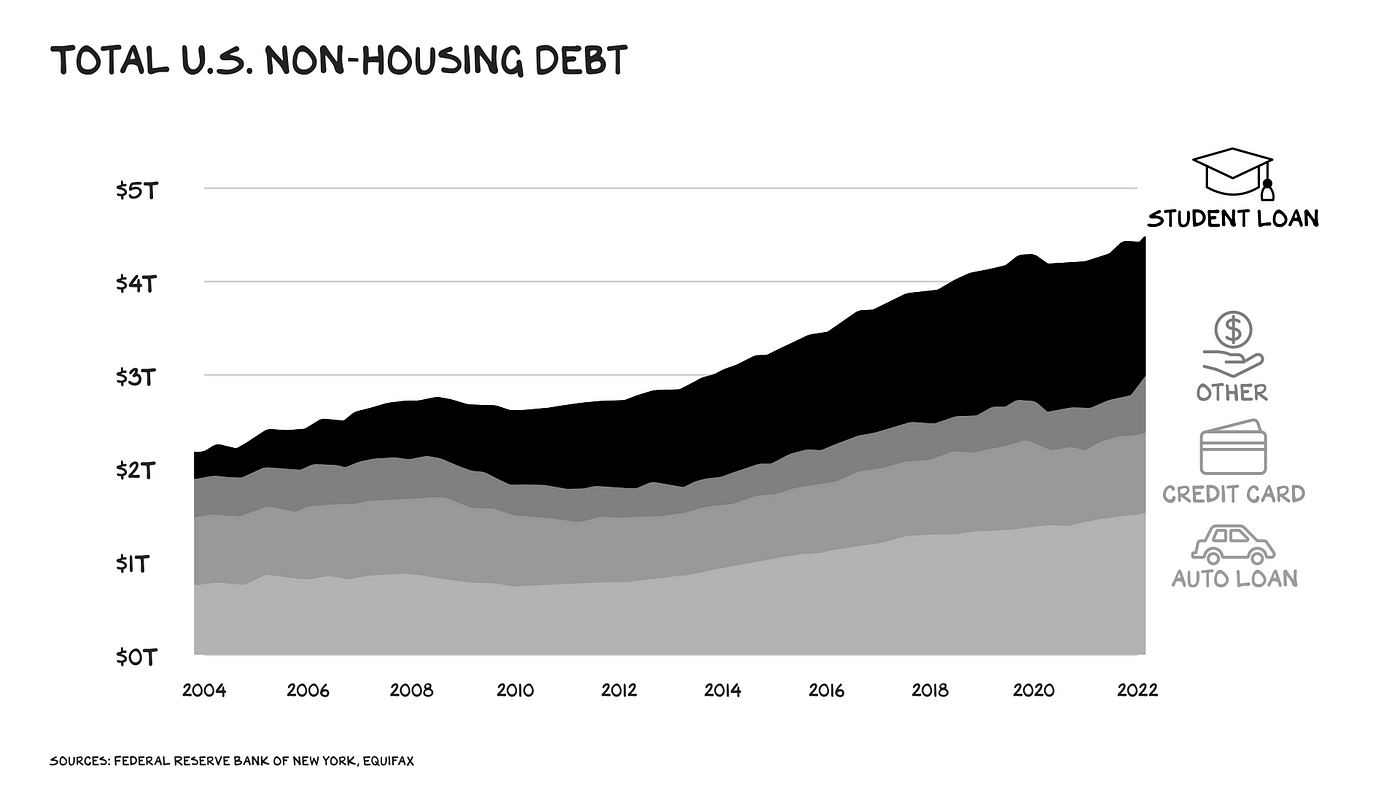

The tumor of student debt, initially benign, swelled into a malignant mass. We’re now dealing with a $1.6 trillion student debt load that affects 45 million people. More money is owed on student loans than credit cards, car loans, or any other consumer debt. It now accounts for 36% of all non-housing debt in America — up from 12% in 2004.

That debt is burdensome. Before the pandemic moratorium on loan payments, 7 million people had defaulted on their student loans — 1 in every 5 borrowers. Of those, 70% hadn’t completed college. Put another way, a tenth of people who took out student loans don’t have a degree, just debt.

Treatment

In isolation, Biden’s plan is a good one: Shrink the size of the tumor — by 20%-40%.

Estimates of the cost of treatment range between $300 billion and $1 trillion. However, many of these estimates don’t account for the additional payments to Pell Grant recipients, or the $125,000 income cut off. When you price in other factors, including the moratorium extension and the 5% income cap, the bill is roughly $600 billion over 10 years. This is real cabbage. Implementing universal pre-K and extending the child tax credit would have cost $350 billion and $545 billion over 10 years, respectively. Fun fact: Neither made it into the Inflation Reduction Act, as — unlike college attendees, old people, and private equity partners — kids don’t vote. Breaks my heart. But I digress. Many taxpayers, including the nearly two thirds of Americans who didn’t go to college or those who already paid off their loans, are understandably unhappy.

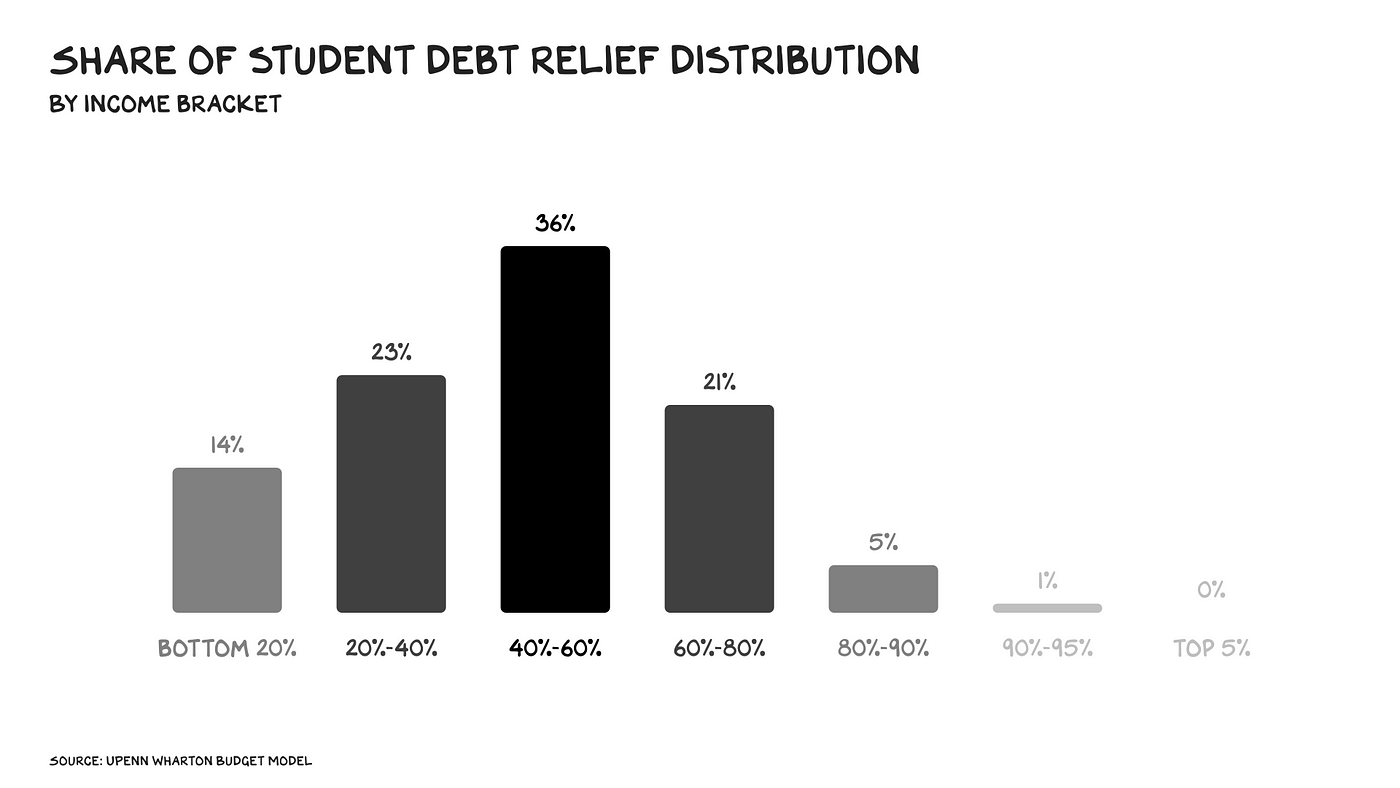

Also, college grads are rich(er), no? Well, maybe … in general, the demographic makeup of student loan borrowers is not affluent. Sixty percent of borrowers are Pell Grant recipients — and two thirds of those recipients come from households making less than $30,000 per year. In sum, 90% of relief dollars will go to people earning less than $75,000 per year. Some people who don’t really need relief will receive it — but they will be a statistical anomaly, and a pin drop compared to the share who are struggling. As for the burden of paying for this debt relief, even the National Taxpayers Union, a research group opposed to Biden’s plan, estimates it will cost taxpayers who make less than $50,000 per year a modest $190 in taxes; the long-term tax burden on those making more than $200,000 per year will be about $12,000. As for inflation, the impact is expected to be negligible: Moody’s estimates it’ll increase inflation by 0.08%; Goldman Sachs expects it’ll increase GDP by 0.1% and affect inflation only “slightly.”

Cancer

The bad news: We’ve treated the symptom but not the disease. When dealing with a malignant tumor, standard procedure is first to shrink it. But cancer is the underlying disease, and the day after the debt is forgiven, this tumor will resume its growth.

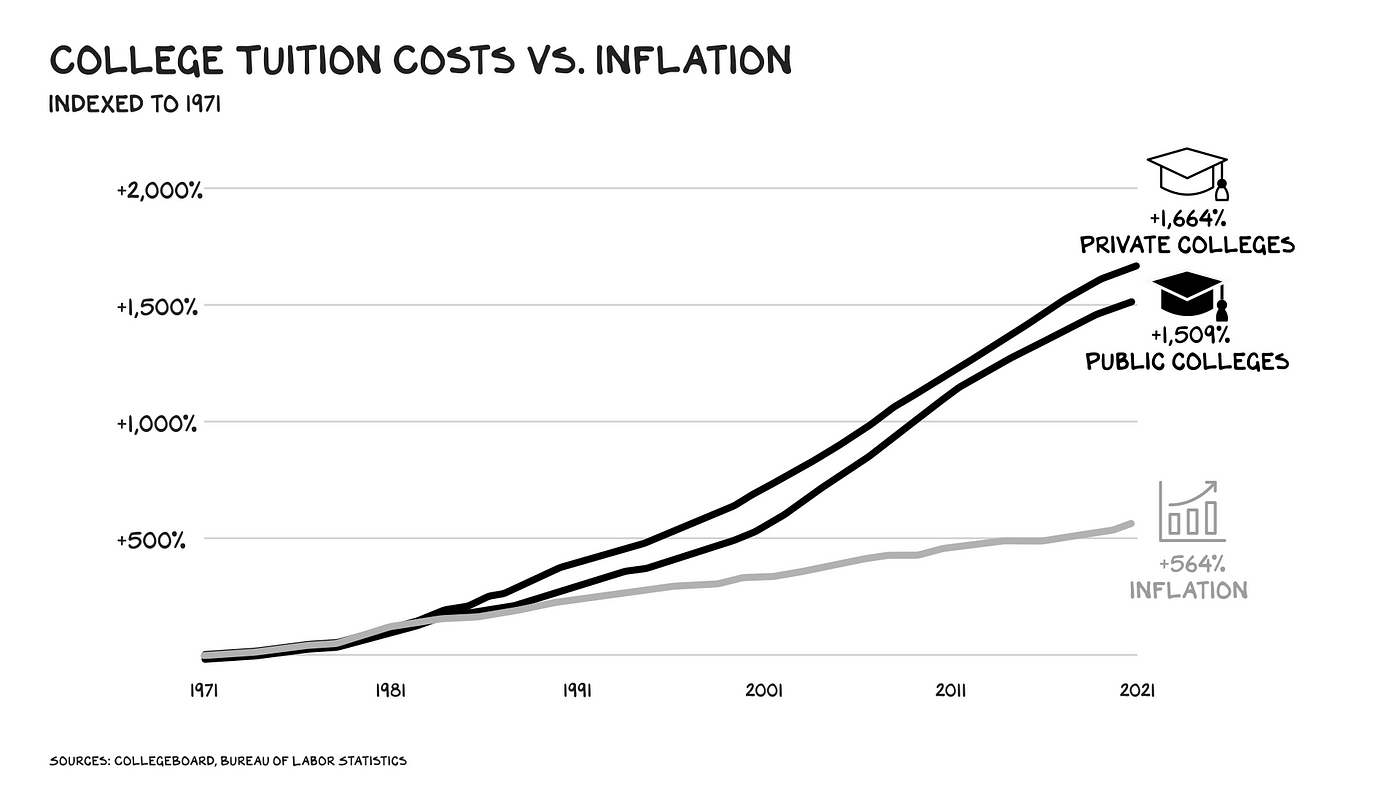

In the past five decades, the price of college has accelerated three times faster than inflation. Pell Grants used to cover 80% of tuition costs, now it’s 30%. Since 1990, tuition has risen three times faster than U.S. college enrollment. Higher ed has become a luxury good subsidized by BNPL-like loans that prey on young people and parents who’ve been taught to believe if their kids don’t graduate from college they’ve failed … on a cosmic level. I’ve railed against this system again, and again, and again, and again, and again, and again, and again.

I am also complicit. At NYU, we charge students more than $74,000 per year, making us one of the most expensive schools in the nation. Many of our students can afford it; most can’t. NYU parents and graduates have borrowed $3.5 billion in federal loans — more than at any other university in America. And in 4 out of 5 graduate programs, our students have borrowed more than they earned two years out of school. The median NYU loan size is the price of entry: $74,000. The dynamic is best summarized by the great philosopher Otter from Animal House: “You [the student] fucked up, you trusted us [NYU].” Note: There are exceptional leaders and donors at NYU committed to changing this.

Despite exorbitant price hikes, the product hasn’t changed materially. You’re still paying for a four-year tour of auditoriums and projectors, and access has barely increased. Critics of the debt relief plan argue that whatever the cost of higher ed, students chose to take out the loans, so why should we bail them out? I’m sympathetic to that view, but my experience inside higher ed tempers it. The truth is, we (universities, employers, society) haven’t held up our side of the deal.

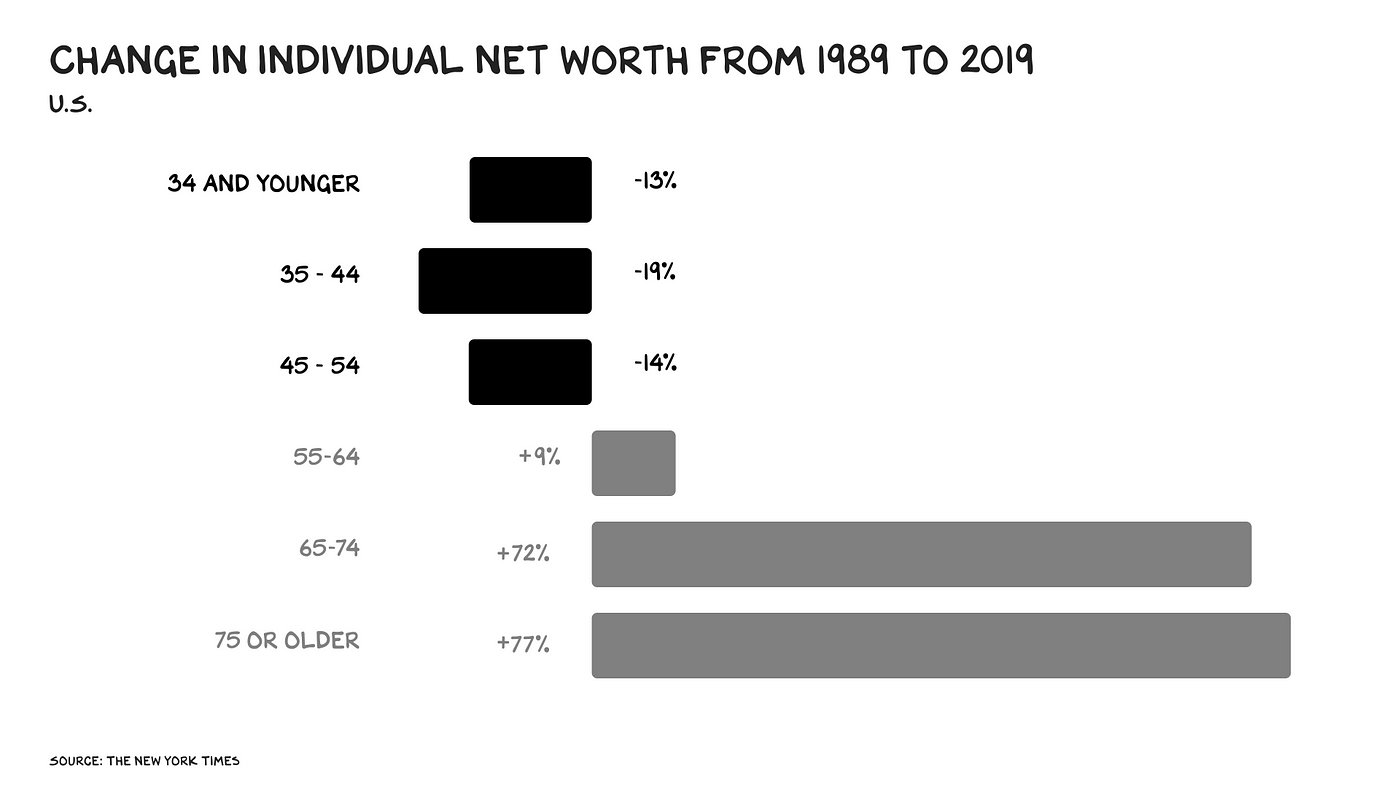

When I applied to UCLA (for the second time) in 1982, the acceptance rate was 74%. Today, it’s 9%. My Pell Grants covered all of my tuition and much of my living expenses. Fast forward, we have embraced an exclusionary, rejectionist culture such that the beneficiaries of great public education and infrastructure can entrench their own wealth and influence and limit new entrants into the market. The problem of income inequality in America is well documented. What gets less attention is age inequality. In sum, my generation has earned the moniker “the greediest generation.” In terms of wealth by age, there’s never been a more unfortunate time to be young in America — or a more fortunate time to be old. The average 75-year-old today is 77% wealthier than the average 75-year-old 30 years ago; the average 35-year-old is 19% poorer.

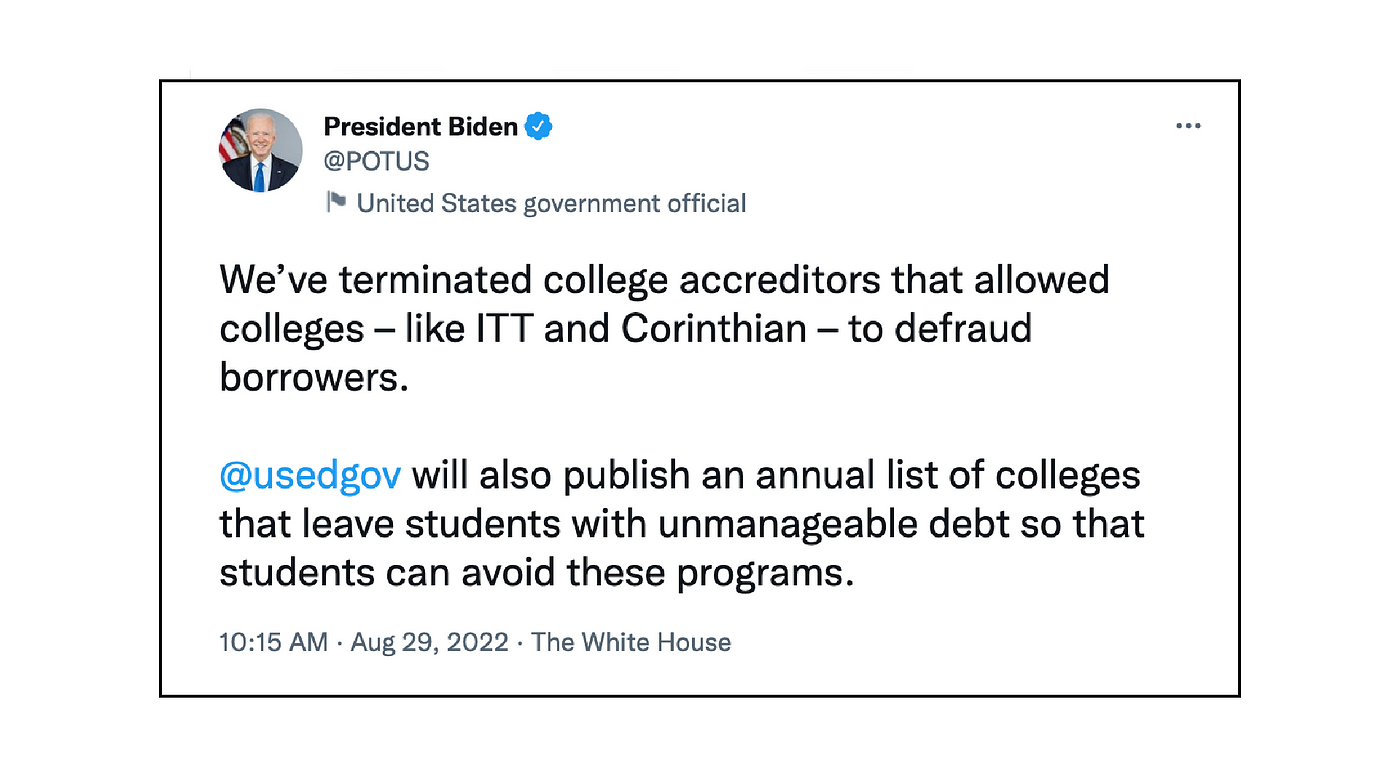

So, leveling up a younger generation that has seen its wealth as a percentage of GDP cut in half over the past 40 years is a worthy objective. After we’ve treated the tumor (debt), we have to cure the cancer (costs). Biden’s addressed the tumor, but he has no real plan for a cure. On Monday, the president tweeted he’s “holding colleges accountable for jacking up costs without delivering value to students.” How? He’s going to create … a naughty list. However, Mr. President, I can confirm we (university faculty and leadership) no longer see ourselves as public servants, but Birkin bags … and we have no shame. The last class I taught, at the peak of Covid, was 300 NYU Stern students (all via Zoom). We charged each student $7,000 to take the class. That’s $2.1 million (much of it in debt) for 36 hours of bad Netflix.

It’s true Biden did right by terminating federal loans for fraudulent for-profit college institutions, including Corinthian Colleges. But the notion that defunct for-profit colleges are the only institutions guilty of defrauding students is laughable. There are more than 1,800 colleges across the U.S. with student loan default rates of 15% or higher. The national average is 14%. Aunt Becky wasn’t sent to prison for fraud, but for cheaping out. (If she’d paid $1 million to USC directly vs. $500,000 to a middleman, her kids would have gotten in and she’d have stayed out of prison.) Similarly, for-profit universities have been punished as they are not part of the cartel and don’t charge enough to have tenured faculty and “ethics” centers.

Apart from the Department of Education’s unmanageable debt list, our government has done nothing to disincentivize colleges from raising prices. The only guardrail in place is this: If a university’s student-loan default rate breaches 25%, it can no longer access federally backed loans. In other words … 1 in 4 students must default before a college pays any penalty. One. In. Four. The bottom line is the culprit is universities — not taxpayers — and they should be on the hook for this, and any subsequent bailouts.

The missed opportunity here was a well-structured relief package paired with a plan to address the underlying problems. It’s easy to spend other people’s money and play Monday morning quarterback. However, we might actually be forced to step back to the plate, as Biden’s executive order is expected to be met with legal scrutiny and could be overturned. Then debt relief will require Congress to act, and that’s the opportunity to treat the cancer: cost, access, and format.

Beyond the existing treatment plan, here are three suggestions for creating systemic change:

- Offer expanded enrollment subsidies. This is the Grand Bargain. For public universities, which educate three quarters of our students, a carrot: extend federal/state funding to pay for the infrastructure (mostly technology) to expand enrollment through a mix of hybrid programs and year-round classes in exchange for tuition caps and reductions. If we have $600 billion to reduce the tumor we can find another $600 billion to cure the cancer. Private universities, on the other hand, get the stick: Increase freshman enrollment faster than population growth, or we dispense with the fiction that these are nonprofit institutions and start taxing endowments.

- Make colleges pay penalties for defaults. We need to implement harsher penalties on schools when former students default on their loan payments. So here’s an idea from former Education Secretary Bill Bennett: Make colleges pay a fee for every default. This would not only offload the debt relief from taxpayers onto our colleges, but incentivize colleges to bring education and cost in line with the economics of the Main Street economy. Another Bennett idea (similar but different) is to force colleges to take a 10%-20% equity stake in each loan that originates at their school. In other words, we engineer downsides into raising costs. (Specifically, downsides harsher than some bullshit naughty list.)

- Fund nontraditional one- and two-year vocational certificates. This would be especially powerful for the cohort that’s fallen the furthest fastest — young men. Vocational training in health tech, cybersecurity, specialty construction, and a plethora of other trades that don’t involve SaaS software are in demand. We need more mixing among young people who are going to Google and those doing apprenticeships to install energy-efficient HVAC. (BTW, great job — you can make almost $100,000 a year.)

Silver Lining

There are missed opportunities in the debt relief package. But there’s a lot to like. (See above: shades of gray.)

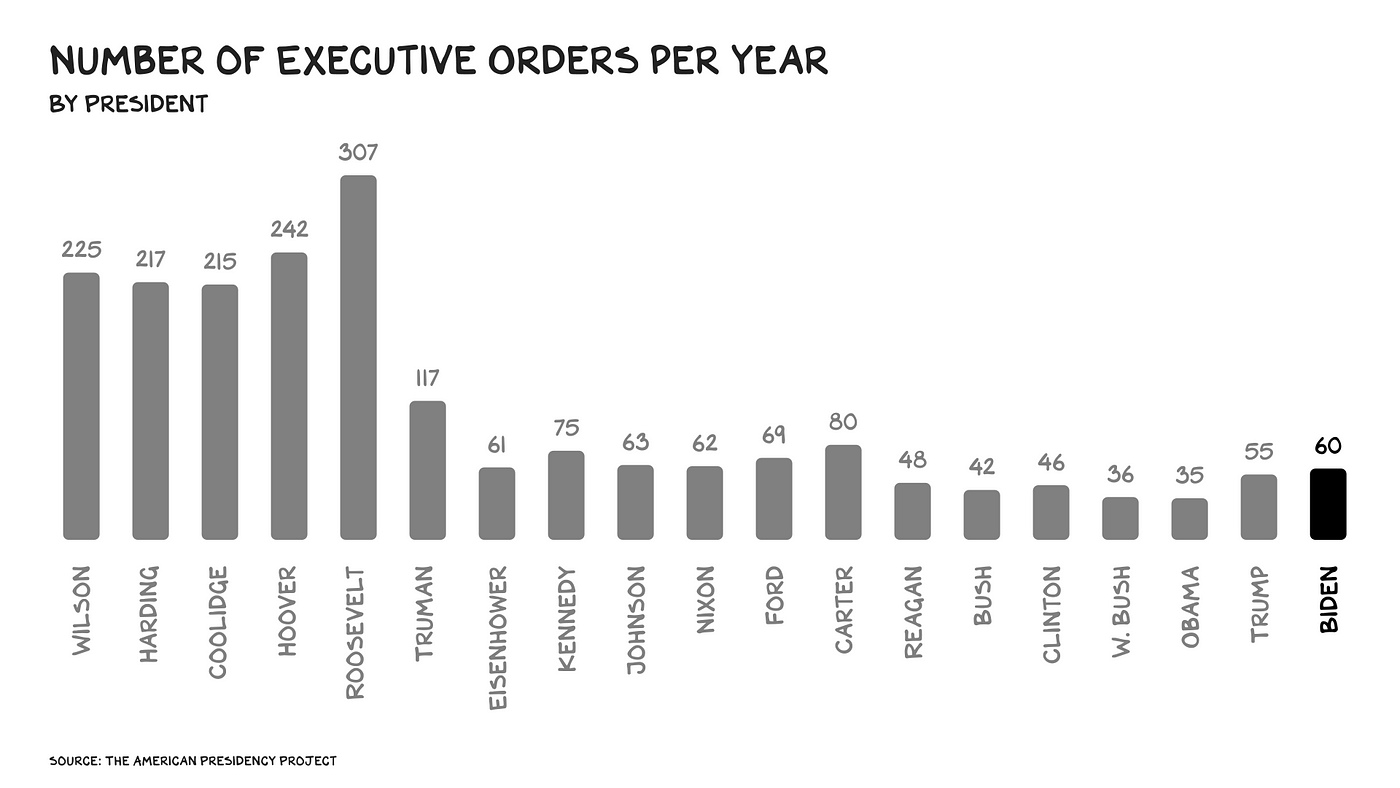

It’s also a positive sign for our government. Specifically, our government’s ability to get something done. The past four decades of policy have been characterized by gridlock and lethargy. Filibusters have become the norm; cloture motion filings have quintupled over 20 years. Our nation’s wealthiest call on government not to take action but to “get out of the way.” Eighty years ago, FDR was issuing more than 300 executive orders per year; these days, we get around 40.

A Higher … Higher Ed

A society built on rejectionism and frequent bailouts inspires moral hazard and class warfare. Many people approach me at conferences claiming their kid “doesn’t need college.” Yes, college isn’t for some people, but higher ed (affordable, different formats) could benefit most American youth. Jay-Z didn’t go to college and is a billionaire; assume your kid is not Jay-Z.

I was (seriously) an unremarkable kid, raised by a single mother who lived and died a secretary. The access and affordability offered by public higher ed not only gave me the opportunity to achieve things I wouldn’t have otherwise, but to be a better father, son, and citizen — more engaged in our society, more able to care for others. We need more, much more of this.

These are problems of our own making: a rejectionist culture, university presidents making $5 million a year, and an obsession with a four-year degree format. Where to start? Simple, where we came from: 76% admissions rates, Pell Grants that cover 70% of costs, different formats, and university accountability.

Universities are the tip of the spear for America. Our idolatry of innovators was fomented by a creeping, insidious gestalt on campuses that perverted our mission to identify the remarkable and make them billionaires. No, that’s not our purpose nor the soul of America. Our country is about giving as many people a shot as possible, as no institution or bloodline can predict greatness. Instead, we need to love the unremarkable … again … at scale.

Life is so rich,

P.S. One way to scale higher ed — do it online, with other people, at a much lower cost. This is exactly what we do at Section4. Check it out if you haven’t already.

Recommend

-

16

16

#200a: Conversations with Jon Galloway#200a: Conversations with Jon Galloway - YouTube

-

7

7

Home Chevron iconIt indicates an expandable section or menu, or sometimes previous / next navigation options.Tech

-

10

10

Jon Galloway on Visual Studio Mac About Jesse Liberty Jesse Liberty has three decades of experience writing and delivering software projects and is the author of 2 doze...

-

7

7

0:00 / 1:07:05 ...

-

7

7

No Mercy / No MaliceTikTok BoomThe secret of TikTok’s success is how it eliminates the burden of consumer choi...

-

7

7

No Mercy / No MaliceBottom’s Up?It’s become a foregone conclusion that we’re going into recession, which often...

-

6

6

No Mercy / No MaliceLabor DayA more honest name for a holiday describing who/what we value would be “Capital” Day.I’ve been thinking about labor and the holid...

-

2

2

No Mercy / No MaliceAttentiveWe’ve moved from an oil economy to an attention economy.For the better part of the past century, the most important commodity has...

-

9

9

No Mercy / No MaliceStorytellingThe weapon of mass attraction is the ability to communicate. I wish I’d figured this out earlier: Money, mates, and meaning are all moths to the flame...

-

5

5

Diablo IV Season 1, Season of the Malignant, begins July 20: New dungeons, monsters and more...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK