The Good Thing About Hard Things

source link: https://www.notboring.co/p/the-good-thing-about-hard-things

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The Good Thing About Hard Things

Software has spent a decade eating the world. What's next?

Welcome to the 678 newly Not Boring people who have joined us since Thursday! If you haven’t subscribed, join 137,816 smart, curious folks by subscribing here:

Today’s Not Boring is brought to you by… WorkOS

Building for the enterprise is typically complex, time-consuming, and distracting. Deals sometimes slip away due to strict requirements and technological demands from IT admins.

With WorkOS, startups can sell to large enterprise customers from day one. It’s a set of building blocks for quickly adding features like Single Sign-On (SAML), Directory Sync (SCIM), and Multi-Factor Authentication (MFA) with just a few lines of code.

Fast-growing B2B SaaS companies like Loom, Hopin, Airbase, and many others use WorkOS to abstract the integrations between dozens of identity providers. Webflow uses WorkOS to serve customers like Zendesk. Vercel leverages WorkOS to land enterprise customers like The Washington Post.

WorkOS is an API that increases your TAM.

You can try it now – WorkOS is free to get started and scales with you as you grow.

Hi friends 👋,

Happy Monday!

Each quarter since I started Not Boring Capital, I’ve been sharing my LP Updates in the newsletter. This quarter, there was one specific question that I wanted to address in the LP Update that I ended up going so deep on that I actually finished this part before I finished the rest of the update, so that’s what I’m sending today.

The question: why invest in hard startups?

I’m learning how to be a better venture investor every day, so this is a work-in-progress and a snapshot of how I’m thinking about it today. Don’t take it as gospel — push back! — but I thought it would be interesting to share how I’m thinking through it.

Let’s get to it.

The Good Thing About Hard Things

In a 2015 blog post, The Carlota Perez Framework, USV’s Fred Wilson wrote:

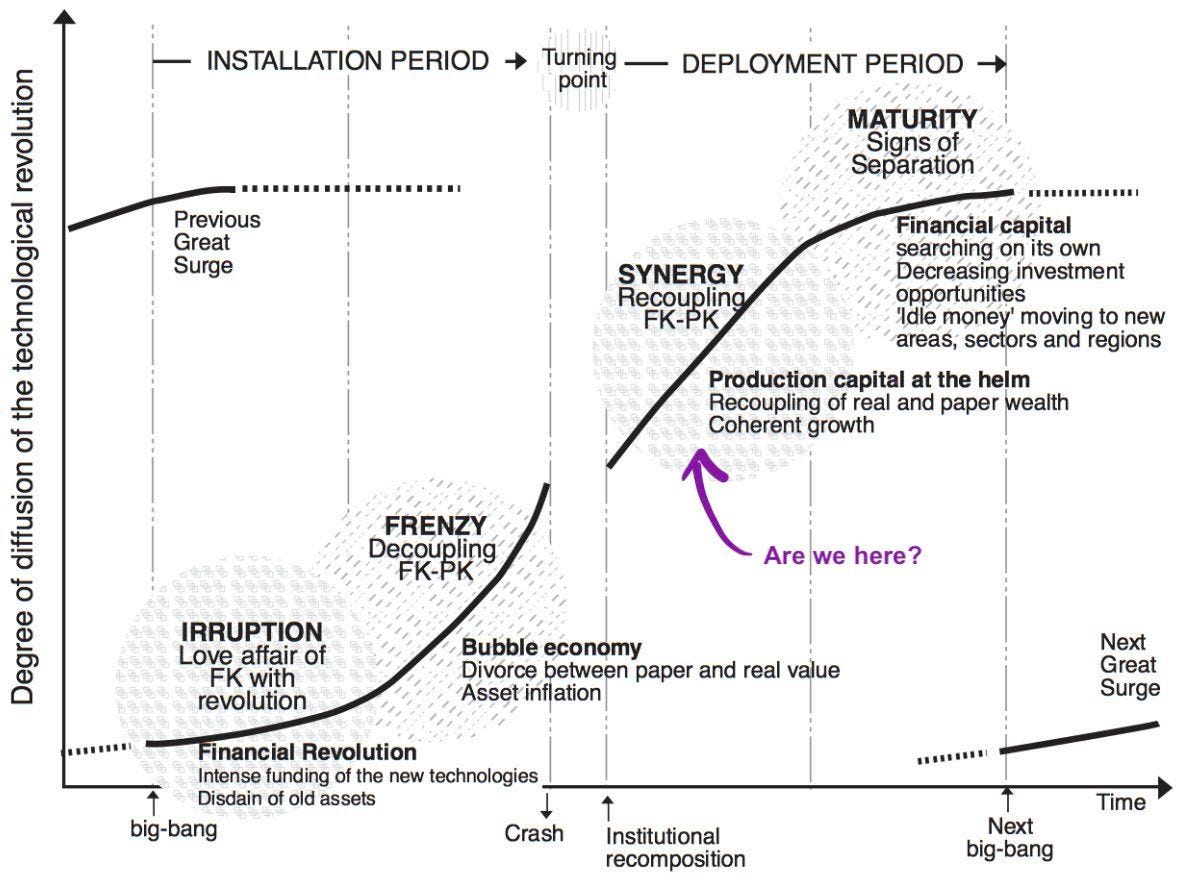

The Carlota Perez corollary to that is “nothing important happens without crashes”. And the lesson I’ve learned in my career is to invest into the post crash cycle. When you do that, and do it intelligently, you are rewarded greatly.

Now that the market has crashed – with Nasdaq down 28% from November highs – it’s become popular to talk, tweet, and write about the fact that companies like Uber and Airbnb were born in the midst of the Global Financial Crisis. And that of course there were a lot of scams in the dot com bubble, but there was Amazon, too. And that Google came public in the aftermath, the same year Facebook was founded, the year after Tesla was founded. Those four companies – Amazon, Google, Facebook, and Tesla – are now four of the eight largest non-Saudi companies by market cap in the world.

History bears Wilson’s experience out. It makes sense to invest in the post crash cycle. Prices are cheaper. The weaker companies get shaken out, leaving the strong companies with less competition for customers and employees. Historically, the Nasdaq has recovered and exceeded previous highs after every crash (eventually).

The more important question is in the third sentence: how to invest intelligently post-crash?

The answer has a couple parts: when and what.

When the exact right time to invest is is a tricky question that no one has the answer to. Historically, if you’d invested after a crash, you would have had a positive ROI, but timing does have IRR implications. I have neither the crystal ball nor the intelligence to nail the timing.

The part that’s more in an investor’s hand is the what. In other words, what should we invest in coming out of this crash, and as importantly, what should we not invest in? Typically, the same companies and categories that lead the previous run-up aren’t the ones that produce the best returns on the other side of a crash.

In Not Boring Capital’s last LP Update, I shared that we were tightening our focus: we’ll remain generalist, but put a “strong emphasis on the frontiers of bits and atoms – web3, AI, ML, and security on one side, climate, energy, space, defense, healthcare and bio, on the other.”

Putting web3 and defense in the same bucket seems odd. If I’m being critical of myself, that list seems a bit “buzzword BINGO.” What do those categories have in common?

They’re hard. They don’t have playbooks. They require “speculative Financial Capital.’”

As Ben Thompson wrote in October’s The Death and Birth of Technological Revolutions:

Venture capital, meanwhile, which is theoretically speculative “Financial Capital”, has increasingly become professionalized and standardized, thanks in part to the rise of cloud platforms like AWS; building a new SaaS company to take on another old-world vertical certainly takes hard work, but the playbook is fairly well-known.

I believe that investing intelligently in venture post-crash means investing in businesses for which the playbook is unknown. There are two filters that I’m trying to apply more consistently:

So what?

How hard is it?

I’ve written about the “So what?” filter before. Essentially, the way I like to frame this question is “What does the world look like in a decade if this company succeeds?” That’s important to me on a personal level: I want to back companies that make an impact. It’s important on the Not Boring level: companies with good “So what?” answers have more compelling stories. And I think it will be important for returns: the smartest, most driven people want to work on solving the biggest problems, and there are a lot up for grabs.

If that world is compelling, I dig in further. I look at the usual things: exceptional founders, big markets (or the potential for big markets), business models that make sense at scale, strong customer understanding and product chops.

Then I ask the question: “How hard is it?”

Investing in hard businesses might seem counterintuitive, but at this point in the cycle (the long arc of history, not specifically the current market cycle), I think investing in hard businesses is the best way to generate outsized returns. I’ll explain.

The Hard Thing About Easy Things

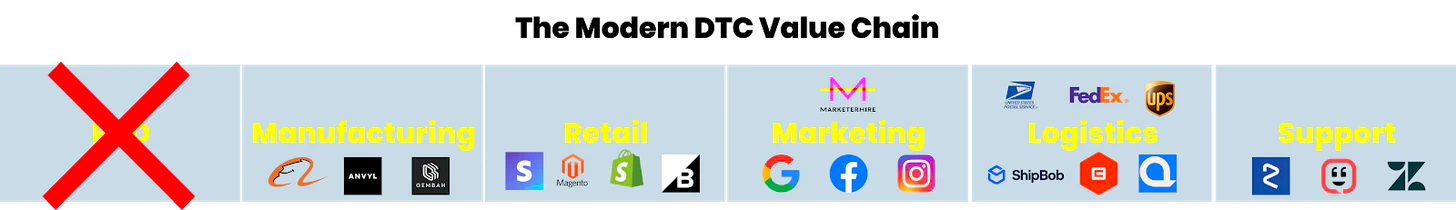

One of the first Not Boring pieces that did really well, back in August 2020, was Shopify and the Hard Thing About Easy Things. A play on the title of Ben Horowitz’s book, the piece was about the fact that with so many pieces of the ecommerce stack built out, DTC brands, with rare exceptions, are largely forced to compete on brand and paid acquisition. It’s a tough position to be in. I wrote:

Here’s the hard thing about easy things: if everyone can do something, there’s no advantage to doing it, but you still have to do it anyway just to keep up.

When everyone has the same plug-and-play tools, the profit flows away from the rebels, and towards the arms dealers, forcing rebels to devise new guerilla tactics to take back profits.

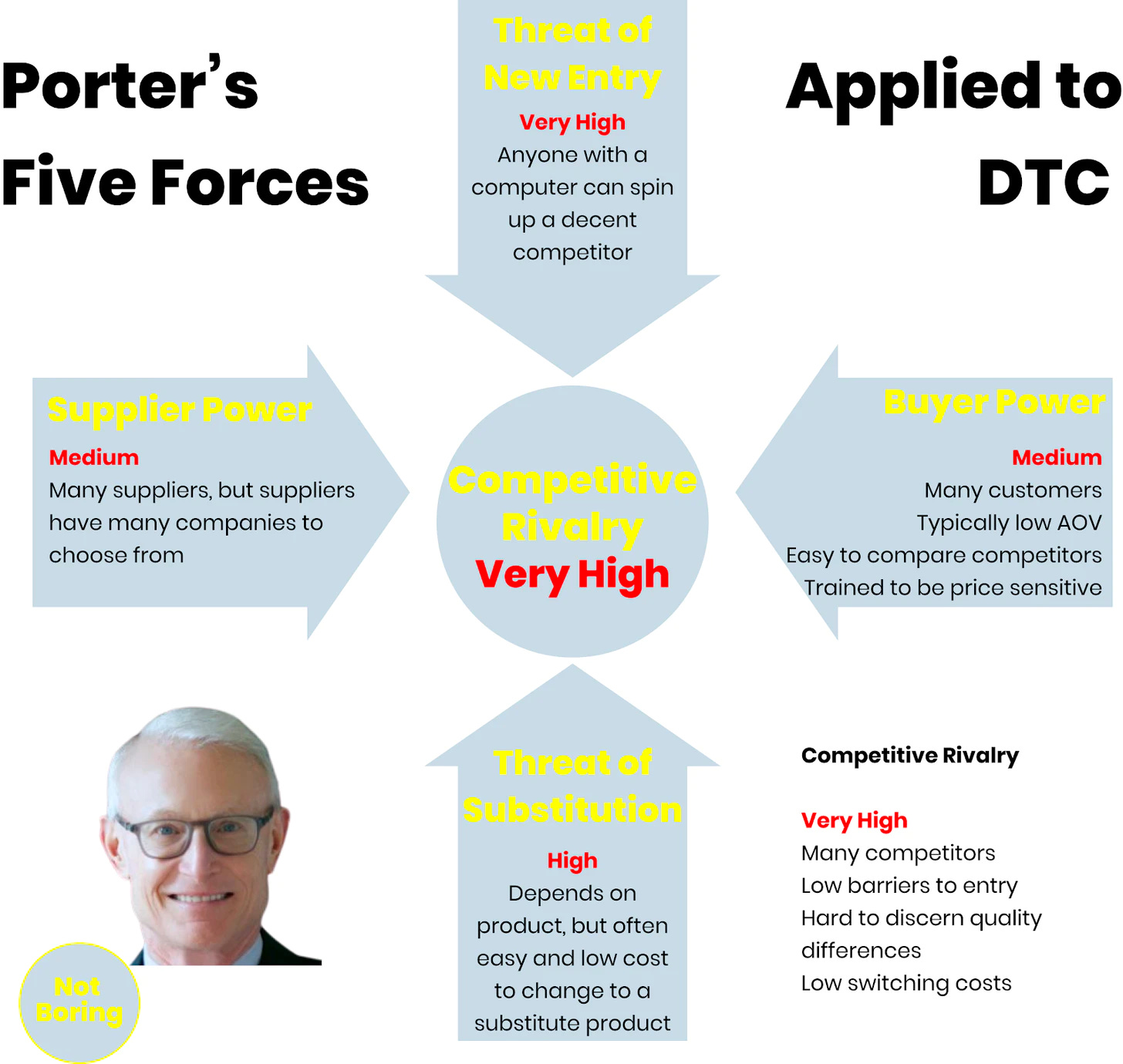

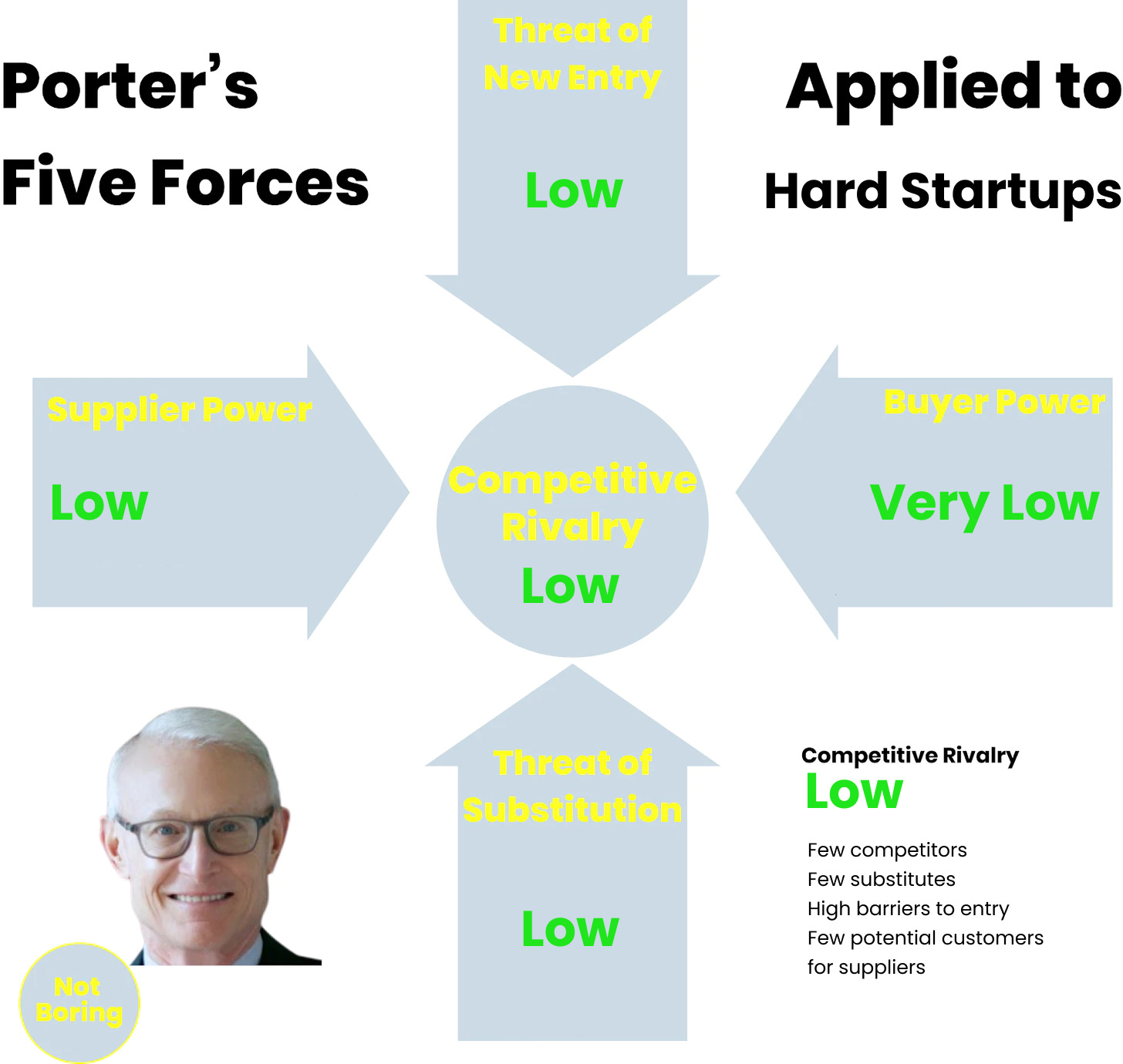

To describe why that’s true, I used two Michael Porter concepts – Five Forces and Value Chain – to explain why it’s so difficult to build venture-scale DTC companies.

It wasn’t obvious in the early days of DTC that DTC brands would rarely generate enormous, venture-scale outcomes. Great VCs invested in a ton of DTC brands. But the success of pioneers like Harry’s and Warby Parker’s, along with Shopify’s improving product, attracted a bunch of other DTC companies, which attracted a bunch of software and services companies to serve the new wave of DTC companies. As I wrote, “There are so many high-quality, modularized inputs, that one person with a computer can spin up a company and start shipping product in under a week.”

All of a sudden, Porter’s Five Forces painted a dire picture for DTC brands. The threat of new entry was very high, the threat of substitution was high, both suppliers and buyers had a bunch of customers and products to choose from, and all of it created a situation in which the competitive rivalry in the space was very high.

The battlefield moved to brand, which works for some category leaders, and paid acquisition, where it’s expensive to compete and you get practically no long-term competitive advantage from doing so. This has gotten worse as Google and Facebook and even Amazon get more expensive and harder. The worst part is this: even if you have a better product than competitors or substitutes, you still have to compete for the same ad slots with them, and you have to pay to educate consumers on the superiority of your product.

This is now obvious to everyone reading this. It’s fairly easy to build a $1 million revenue DTC brand. It’s reasonably easy to build a DTC brand to a $50-100 million outcome, which is an incredible outcome if you don’t raise a ton of money. It’s practically impossible to create a venture-scale, multi-billion-dollar outcome in DTC. The companies who have the best shot use DTC as a channel, but really have some differentiated and hard ways to create an obviously better product. Cometeer comes to mind; it’s a frozen coffee company that happens to use DTC as its first channel.

Anyway, we don’t really invest in DTC or CPG companies at Not Boring Capital, so why did I just spill all that ink on them?

I don’t think I went far enough in the original piece. The piece was about DTC companies (or any CPG-esque ecommerce retail business), but increasingly, the hard thing about easy things describes software companies.

The Hard Thing About the Easy Thing About Software

There’s this Ben Thompson line that I can’t find but am pretty sure that he wrote, something to the effect of, “New models hit media businesses first, because those businesses are simpler, before hitting other industries.” That holds for ecommerce, too. Maybe it’s something like:

Media → Ecommerce → Software → Harder, More Complex Businesses

After decades of pure-play software businesses generating huge returns, I think that trade is on the decline. Software has spent a decade eating the world, gorging on the low-hanging fruit first, and it’s getting full.

On August 20, 2011, nearly eleven years ago, Marc Andreessen penned his famous essay in the Wall Street Journal, predicting:

Over the next 10 years, I expect many more industries to be disrupted by software, with new world-beating Silicon Valley companies doing the disruption in more cases than not.

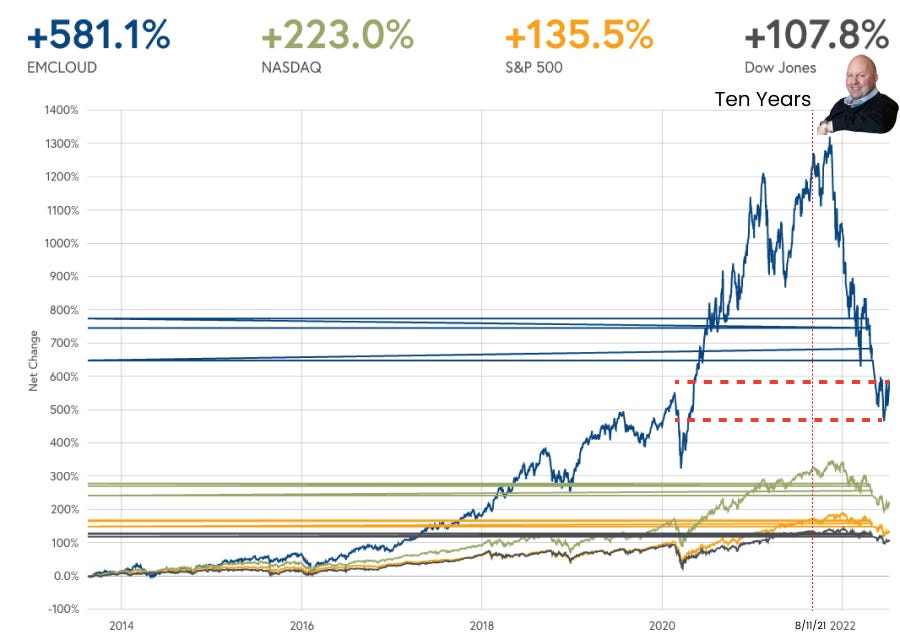

He was, of course, spot on. The decade from August 11, 2011 to August 11, 2021 saw the tech-heavy NASDAQ rise 514.6% compared to 291.9% for the S&P 500 and 230.89% for the DJIA. That’s a rough proxy, and it doesn’t capture the transformative impact that software has had on so many industries and our daily lives, but you get the point. It was a great decade for software.

Eerily, almost exactly a decade later, three months after the essay’s anniversary, the NASDAQ hit its peak in November 2021. It has fallen 28% since. The BVP Nasdaq Emerging Cloud Index, which is “designed to track the performance of emerging public companies primarily involved in providing cloud software to their customers,” was up over 1300% since its 2014 inception before dropping 52.1% from its November high. At one point, it traded below pre-COVID levels, and today, it’s trading just above the pre-COVID high.

Software is not dead. There are other reasons that tech stocks have struggled alongside, and even worse than, the rest of the economy in recent months. A lot of software spend was pulled forward during COVID; they over-earned. Discount rates are higher and tech companies’ projected cash flows are further in the future, so they get hit harder. And there was too much exuberance. Founders Fund’s John Luttig wrote an excellent piece, Reversion to the mean: the real long COVID, exploring many of the factors.

But it’s more than the market. Luttig wrote a more prescient piece, two years too early, in April 2020: When Tailwinds Vanish. I highly recommend you read it; it’s more appropriate now than ever.

In different words, Luttig talks about the same challenges I wrote about in The Hard Thing About Easy Things. Specifically, he writes that competition among internet startups is becoming more zero-sum as all of the easiest opportunities have already been seized:

We are building an exponential number of Internet companies that compete over ever-shrinking slices of consumer attention and enterprise spend, increasingly locked down by incumbents.

It’s easier than ever to build the average software company – plug into AWS, snap in a bunch of APIs, follow established playbooks – and harder than ever to make it really big. Modularized inputs and playbooks lead to more competition, smaller opportunities, and lower margins.

This isn’t true for the exceptional, ambitious software companies. Luttig wrote a piece called Rippling and the return of ambition, with the subtitle “In an era of software incrementalism, Rippling is bringing ambition back.” Rippling is a SaaS company on its face, but it would fit my criteria. Ramp and Replit are two examples of ambitious software companies in the portfolio, and there are more. I’d invest in those all day. It’s software incrementalism I’m avoiding.

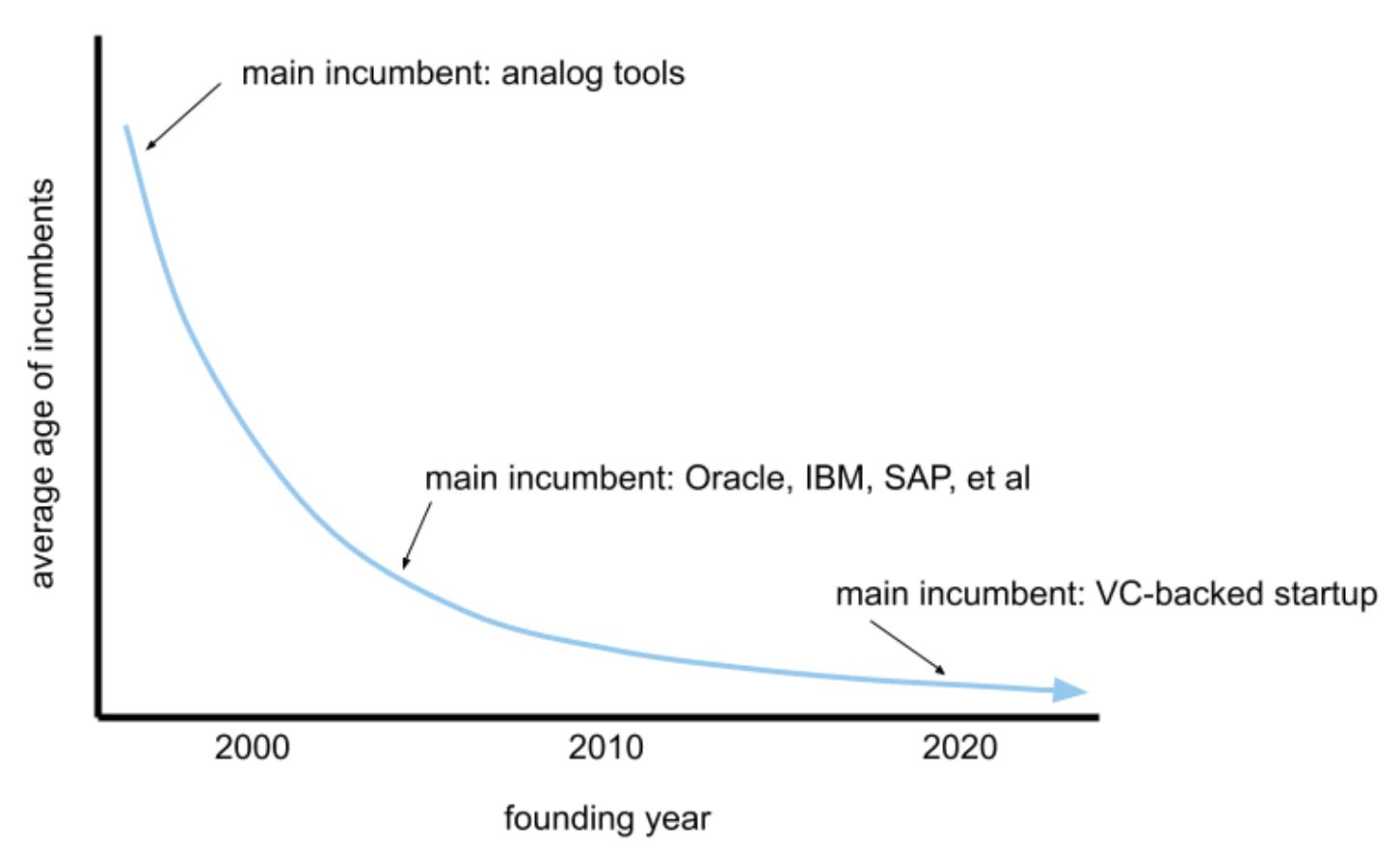

It won’t be as easy for the average, or even very good, software startups to get really big as it was in the past decade. There’s too much competition. Worse, competitors have many of the same weapons. The incumbents that new entrants face will themselves be relatively new startups. They’ll be able to adjust more quickly to the new entrants’ attacks, and if the new entrant succeeds, there will be another, newer new entrant there to try to steal the prize.

As happened with DTC with the rise of Shopify, Alibaba, and the rest, Luttig points out that internet companies are shifting spend from R&D to SG&A, from product to sales & marketing. Hire a salesperson, generate predictable additional revenue. Businesses will be able to generate a lot of revenue this way, but as he and Alex Danco both point out, pulling from the work of Carlota Perez, venture might not be the best money for software businesses in this stage of the technological revolution; something like debt might be.

All of this means that, while the theoretical margins of pure software and SaaS businesses are juicier and more predictable than those of hard startups, at this point in a cycle, they may be a mirage for new startups. Put another way, gross margins – revenue minus COGS – might be high, companies can generate cash on each sale, but net margins – which include overhead and sales & marketing – might come under pressure in the face of more competition.

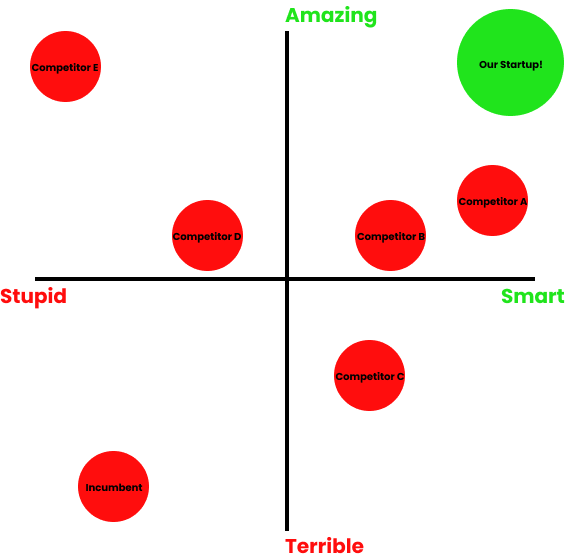

Again, even if you have the best product, you still have to convince customers of that, which costs money. Whenever I see a slide like this in a deck, I weep:

First, because the startup is likely picking axes that make them look like the best no matter what customers actually care about. Second and as importantly, even if the slide is honest, because they’re still going to have to spend money to sell against all of those competitors to so many companies. And all of their competitors will have sales decks that show different four-quadrant or checkmark slides that highlight where they’re better.

And often, even if the startup’s product is better, and even if they can convince customers that it’s better, at this point, it may not be a product that the customer actually needs or is willing to spend money on. A lot of software companies have made a lot of money selling to other startups and tech companies – particularly during COVID, when companies were making a lot of money and willing to spend to make sure that remote work actually worked – but those companies are all now looking for ways to tighten their belts. It’s emotionally easier to fire software than people.

I’m going broad strokes here, and there are obviously exceptions. For example, selling SaaS into a newly-exploding industry like synthetic biology or many of the harder atoms-based categories I listed above will come with less competition and more nuanced needs, and I still love APIs and infrastructure businesses, which I view separately. But in many cases, venture capital might no longer be the best or only money for SaaS companies. It’s reaching the Maturity stage.

More personally, I don’t have any edge investing in many of those companies. Because there are playbooks and standard metrics, funds and investors with decades of experience, working inside of and on the boards of the most successful SaaS companies, have a fine-tuned understanding of what makes them tick that I’ll never have.

But just as venture didn’t die when semiconductors or networking equipment reached the deployment phase, the decline of SaaS as a surefire VC investment doesn’t mean there’s nothing for venture investors to invest in. Luttig wrote that there are “several risks VCs will continue to be uniquely good at taking”:

R&D risk – can this technology be built?

Founder risk – can this team build it?

Vision risk – can this idea become huge?

Macro risk – will this startup win in 2030’s political, economic, and competitive climate?

We’re on to the next meta. It’s time to invest in hard startups.

Hard Startups

Hard startups are ones with no playbook, the ones that have R&D risk or some other hair on them that keeps competition at bay and gives them a clear path to short-term sales and long-term defensibility if they get a great product to market.

I put them into two categories: bits and atoms.

On the bits side, software is still eating the world, but its palette has matured. It’s eating things like oysters and foie gras and escargot that it had no desire to eat when it was a kid, because those things are often gross and hard to eat. I’ll stop torturing the analogy, but what I mean is that hard startups on the bits side are solving difficult technical challenges, creating new business models, or touching industries that previously didn’t make sense to touch.

In this category, I include companies in:

web3: the ongoing web3 debate, if nothing else, shows that the winning business models and playbooks in web3 are yet to be written. I’ve written enough on this topic that I won’t go into it here, but I think the opportunities for, and potential impact of, the eventual winners will be enormous.

AI/ML: At this point, it seems clear that AI/ML will touch more and more of the digital economy and give people wild new capabilities – OpenAI’s GPT-3 and DALL•E 2 are early examples – but the field for both infrastructure and applications is still wide open. We’ve invested in infrastructure companies like Chroma and Scale, along with applications like ScienceIO and Diagram (read Jordan’s Founder’s Letter.)

APIs/Infrastructure: While many of the biggest opportunities in this category have been taken, and many are in the portfolio already, there will always be opportunities to abstract away the newest complicated technology and deliver it via APIs. Plus, these companies are often 100x harder below the surface than above it; there’s a lot of schlep.

VR/AR: We’ve invested in a couple companies at the intersection of web3 and AR/VR – Anima and Cyber – and while we likely won’t do many more investments in the category for now, we’ll be on the lookout for new types of infrastructure and products that can be built as this new computing platform develops and grows.

Software Supporting Hard Atoms Startups: New categories come with new software needs. Founder-led biotech companies, for example, need different software than ecommerce or SaaS businesses, and the impending need for every business to lower their carbon footprints will require new software for tracking and offsetting emissions. The line between bits and atoms is blurry.

The atoms category is full of what Rahul Rana called moonshot companies in his Not Boring essay last week. It’s more straightforward to understand how hard it is to build these companies.

In this category, I include startups in biotech, climate, space, defense, healthcare, transportation, manufacturing, real estate, logistics & supply chain, and similar industries.

In these industries, the hardest part is typically actually building something that works in a way that has the potential to generate strong unit economics at scale. Often, there’s a clear need for the products this group makes, but they haven’t been possible to build before, require cutting edge science, and often need both great hardware and great software.

Hadrian, which I wrote about in April, is a perfect example of the kind of hard startup I’m talking about. In the piece, I wrote:

Hadrian is modernizing this supply chain by building a network of vertically-integrated advanced manufacturing factories. It’s doing everything itself: building factories, buying machines, and pairing machinists and software engineers to automate manual manufacturing processes. It’s building a factory operating system, Flow, to make internal processes more efficient, prepare to hire and train thousands of workers, and better communicate with clients.

It’s building from scratch to meet modern demands.

Hard startups in the atoms category often have to build everything from scratch. They often need to figure out how to sell into buyers that don’t traditionally buy from startups, as Palantir and Anduril have in government and defense. They need to compete for some of the same talent as deep-pocketed tech companies with cushier jobs to offer and they need to hire people with skills that Silicon Valley doesn’t typically hire for. They need to innovate on both electrical and mechanical engineering. Sometimes, they need to convince local, state, and national governments to even let them operate. To do so, and to meet safety requirements, they often need to build rigorous testing into their operations. They need to deal with all of the messiness and complexity and delays that come with building physical things in the physical world.

Plus, if everything goes right, they’ll often need to raise tremendous amounts of money to scale, which can dilute earlier investors without the bank accounts to keep up. The pressure to raise dilutive venture capital should decline as these companies begin to produce consistent cashflows and they’re able to access credit earlier. Multiple hard startups in our portfolio have already secured large lines of credit to fund capital intensive pieces of their businesses.

Hard startups are hard to build. Definitionally, there’s no playbook. They’re often expensive to build, too. And they demand a tremendous amount from employees. But when they work, they have the potential to create lasting, defensible businesses, enormous outcomes, and meaningful improvement in peoples’ lives.

The Good Thing About Hard Things

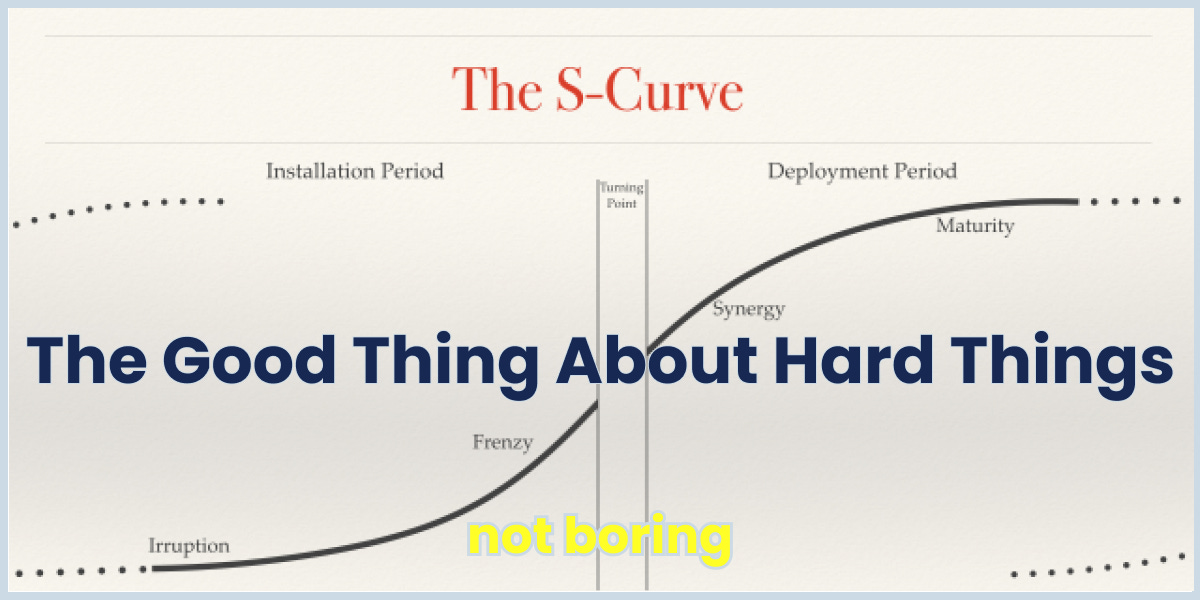

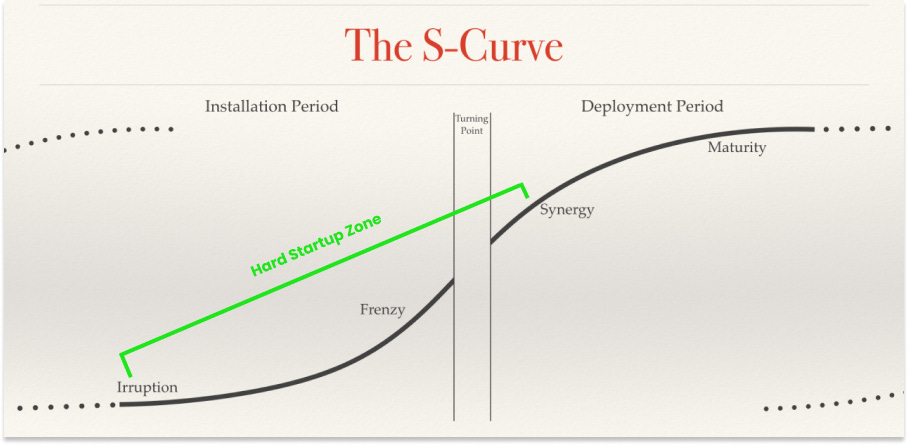

Another way of thinking about hard startups is that they exist in industries that are still in the installation phase, and potentially early in the deployment phase, but not yet at maturity.

There’s something exciting about hard startups, in that early stage before success is guaranteed, the technology is ubiquitous, or incumbents have caught on.

The main reason hard startups can be great businesses is that, because they are hard, they’ll face less competition if they succeed. All of the things that make it hard for them to succeed in the first place makes it hard for others to copy them. That’s doubly true because, by being first, they’ll often attract the best talent, lock down the most willing buyers, build a strong brand, and achieve economies of scale.

It’s not a coincidence that the biggest DTC companies today were all founded before 2014, the biggest social media companies were all founded before 2011 (other than TikTok, which is an AI company that does entertainment), and the four biggest SaaS companies by market cap (Microsoft, Adobe, Salesforce, and Intuit) were founded in the last century, even though it’s become a lot easier for the companies that followed to get started. Those were all hard startups at the time; thanks largely to their success, getting started in those categories has become easier.

So the trick is figuring out what’s next: what hard startups today will produce the enormous companies and categories of the future?

The categories we’ve discussed operate on different parts of that curve, and with very different business models, so it’s impossible to draw too many comparisons among them. But there are some key ones that I look out for.

First, they all require answering the four questions that Luttig said VCs are uniquely well-suited to answer:

R&D risk – can this technology be built?

Founder risk – can this team build it?

Vision risk – can this idea become huge?

Macro risk – will this startup win in 2030’s political, economic, and competitive climate?

Elliot and Rahul joined the team to help figure out R&D risk at the earliest stages, and we rely on a network of people smarter than me to help understand whether certain technologies can actually be built. If they can, I’ve gotten a lot of reps in analyzing founder, vision, and macro risk by talking to thousands of founders, studying hundreds of businesses, and projecting trends into the future for Not Boring.

Second, if they can build what they plan to build, hard startups often tap into large pools of unserved or underserved demand.

If Hadrian is able to deliver parts faster and cheaper than its mom & pop competitors, there’s $30 billion of existing spend there for the taking, and they should be able to grow that pie by making it easier for other companies to build space and defense products.

If Varda is able to manufacture things in the vacuum of space that can’t be manufactured on earth, they’ll have billions of dollars of existing demand to tap into.

If Pipedream can build out an underground network of tubes in cities across the country that deliver goods faster and cheaper than humans, it will find willing customers in food and delivery companies.

If Wander can continue to deliver on creating homes and experiences that have the uniqueness and privacy of an Airbnb with the consistency and quality of a hotel, they’ll eat into the billions of dollars of revenue both generate.

If Vibe Bio can find and fund treatments and cures for rare diseases, there will be pharmaceutical companies, patients, and insurers lined up to pay for the treatments and cures it provides.

If these companies do the hard things they’re trying to do, the demand is often waiting. (Obviously, this isn’t always true: some of the most cutting-edge, hardest companies solve technical problems first without a clear market pull; the trick there is figuring out whether the innovation is compelling enough that there will be a market that others can’t see yet.)

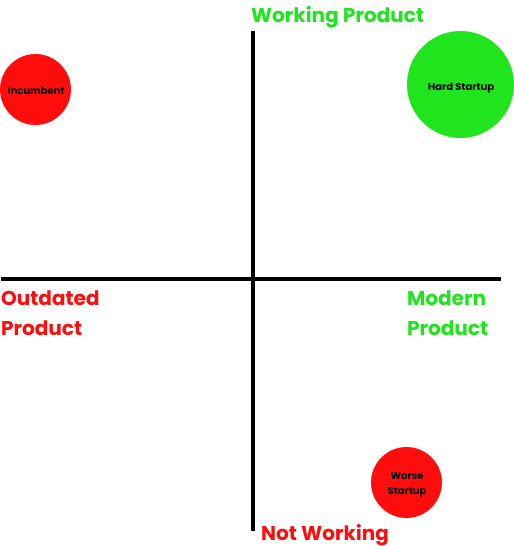

Fourth, hard startups face less competition to serve that demand. Hard businesses can be more defensible. Remember that competitor chart from earlier? For many hard startups, the chart can look more like this:

Worst case, in the earlier days, they might face an incumbent with an outdated and expensive product that doesn’t meet the modern customer’s needs, and maybe a startup or two claiming to be able to build the new thing with no evidence that they actually can.

Over time, they attract more competitors, but in the process of solving and building the hard thing, they’ve dug moats around the business.

Bringing back Michael Porter, hard startups often operate in environments with low competitive rivalry.

It’s hard for new entrants to come in, there often aren’t substitutes, buyers don’t have other options, and suppliers compete for the business. One current example of this supplier dynamic is how many DAO tooling companies are competing to serve the handful of DAOs that have achieved meaningful scale.

While each hard startup is different, I try to quickly run through Hamilton Helmer’s 7 Powers to figure out which moats will potentially protect the startup’s profits over time. When I wrote about Hadrian, for example, I found that “Hadrian is stacking (at least) three powers to build a unique moat: Cornered Resource → Process Power → Scale Economies.” When we’re investing, these moats haven’t been established – the product might not even be built yet – but it’s useful to consider how the dynamics might play out in the success case.

Fifth, by pursuing something that hasn’t been done before, and may not work, hard startups are differentiated from the beginning. That’s important from a defensibility perspective, but it’s also important for softer reasons.

I need to write a full piece on this one day, but I believe that differentiation is good for its own sake. It helps attract and retain talent, and helps employees rally around the mission. If they don’t pull it off, it’s possible no one else will. And it attracts a certain type of employee, the one who’s passionate about solving the problem at-hand, even if success is non-obvious and the path may be uncomfortable.

I recently spoke to a company, Traba, that has as one of its two values, “Olympian’s Work Ethic.” The company operates six days a week, 9am-9pm, in the office, and it’s clear with potential employees upfront that the work is going to be hard. The founder, Mike Shebat, told me that by differentiating on culture, Traba has actually had an easier time hiring great people than they would have otherwise.

Anduril is another example of the value of differentiation. As founder Palmer Luckey pointed out on his All-In podcast appearance, building a company that worked with the Department of Defense was unpopular for years with a lot of people in Silicon Valley… until it wasn’t. After Russia invaded Ukraine, the rest of the industry woke up to the importance of a strong US military, years after Anduril had started scooping up the best mission-aligned people and building a seemingly insurmountable lead.

Finally, I think hard startups actually have a more clear path to future funding assuming they can solve the hard problems they need to solve. One of my LPs, someone who’s worked in finance for a long time and whose opinion I respect deeply, asked me for my thoughts on the “supply chain (as in capital) in venture and how long it will last before it rebalances.” In other words, if you’re investing in earlier stage companies, how sure are you that there will be investors there when they’re ready to raise their Series A, B, C, D and beyond?

Assuming that venture and growth capital don’t disappear altogether, in which case all of this is moot, part of the answer to this question lies in figuring out what other investors are going to be excited about in a couple of years and beyond.

The best venture funds, and the ones with the biggest war chests, recognized the value of funding hard startups long before I did. Luttig wrote When Tailwinds Vanish in 2020, and Founders Fund’s website says, “We invest in smart people solving difficult problems.” Lux Capital’s Josh Wolfe often talks about “turning sci-fi into sci-fact.” a16z has been investing in crypto since 2013, when it was a very weird, hard bet to make. The firm just launched an American Dynamism practice to invest in the companies, like Hadrian, building things so hard and necessary that incumbent institutions should but can’t. Chris Sacca talks about the trillion-dollar companies they’re backing at his climate fund, LowerCarbon Capital. Even in this market, the startups that have proven they can solve the hardest problems are raising the biggest rounds at the best valuations.

I suspect that, like clockwork, other growth funds will see the returns being generated by these hard startups and shift dollars away from more mature industries better suited for non-dilutive financing or public markets.

Each hard startup is different – that’s the point – but those are some of the reasons that I think it’s worth doing the work to uncover the gems.

Investing in Hard Startups and Telling Their Stories

I’ve always had a fascination, sometimes to my detriment, with incredibly complex businesses. One of the first pieces I ever wrote about on the internet was about Natively Integrated Companies, and one of the first I wrote for Not Boring was about Worldbuilders, both early pulls on this hard startups thread.

A question I always ask myself to check my enthusiasm is whether, had I seen Theranos at the Seed or A, I would have invested. I think before Elliot joined the team, I almost certainly would have; now that he’s here, I think we’d have passed.

Before Not Boring, I spent six long years of my life trying to build Breather, which combined the complexities of office leasing, construction and design, on-demand booking, multiple markets, contract manufacturing custom furniture, a large full-time operations team that went space-to-space to clean and deliver amenities, multiple booking durations (from an hour to a year). The 150-person team that I led, the Experience Team, had a weird name because it did so many different things – real estate, design & construction, operations, customer care, and research – all of which went into, somehow, delivering a consistent and high-quality experience over hundreds of reservations in ten markets, seven days a week.

I learned a lot of lessons from Breather. I was so fascinated by trying to figure out the puzzle that I failed to acknowledge the inherent challenges in the business model. Importantly, I learned that hard doesn’t necessarily mean good; sometimes, hard just means hard.

Hard is important, but it’s just one piece of the puzzle.

Writing Not Boring, maybe informed by my time at Breather, I’ve developed a muscle for understanding complex businesses and explaining them simply. At the end of the day, no matter how difficult the product is to build or the community is to develop, there needs to be a customer willing to pay you more for something that only you can deliver than it costs you to deliver it in order to build an enduring business with the potential for a big outcome. You need a great product, a strong grasp of unit economics, potential moats, and the ability to communicate why what you’re building is important.

We’ve invested in hard businesses via Not Boring Capital, too. I gave some examples above, but there are many more in the portfolio. Some will undoubtedly fail, some will do OK, and some will grow to become incredibly big and impactful. I’m trying to refine my own playbook for understanding which companies are likely to fall into which buckets – I’d love your feedback and pushback on this essay to help me sharpen my thesis – but that’s a never-ending quest. Businesses at this point of the technology cycle require speculative capital for a reason.

Not Boring’s mission is to make the world more optimistic. By solving the most difficult and most important problems, hard startups push human knowledge and capabilities forward and free the next generation to pursue even bigger, harder challenges.

I want Not Boring Capital to be the best non-lead partner to the best hard startups in the world.

I think that, by studying, investing in, and telling the stories of so many hard startups, I’ve developed a skill for evaluating three of the four risk categories: founder, vision, and macro. I’m building out a team and a network of geniuses who can help me evaluate the fourth, R&D risk. Combined, I think we are well-suited to back hard companies.

Once we do, because these companies often have the most complex businesses and the most ambitious visions, I think we can add a ton of value by helping them tell their stories to the world in a way that makes people want to root for them, work for them, buy from them, and support them.

And if everything goes just right, Not Boring will be the place where you learn about the next decade’s most important companies, today, while pulling it off is still so hard.

Thanks to Dan for editing!

That’s all for today! We’ll be back on Thursday with a Deep Dive on one of the most important companies in crypto.

Thanks for reading,

Packy

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK