More signs that a major shift in the economic narrative could be underway

source link: https://finance.yahoo.com/news/more-signs-that-a-major-shift-in-the-economic-narrative-could-be-underway-153719966.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

More signs that a major shift in the economic narrative could be underway

This post was originally published on Tker.co.

There’s more evidence that the economic narrative could be undergoing a major shift.

For months, we’ve been living in an economy in which strong demand has been met with lagging supply, causing inflation inflation to surge. We now appear to be shifting to a phase where demand growth is cooling and supply chains are easing, which should cause inflation to come down.

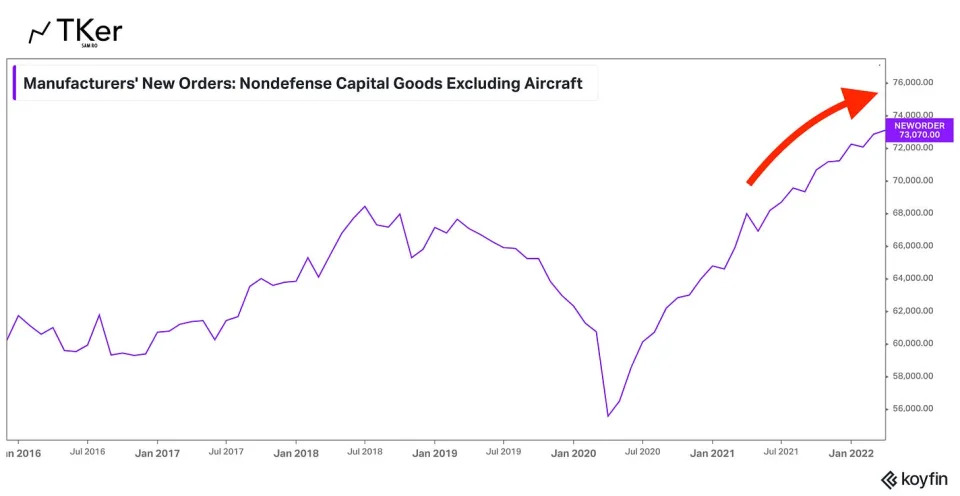

According to Census Bureau data released Wednesday, orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — climbed 0.3% to a record $73.1 billion in April.

While the 0.3% growth rate represents a deceleration from the 1.1% rate in March, it’s the kind of slowing that’s welcome news for folks like the Federal Reserve, which is actively working to cool economic growth in its effort to bring down inflation.

“That is consistent with our view that economic activity is bending rather than breaking under the impact of higher rates,” Michael Pearce, senior U.S. economist for Capital Economics, said in a note on Wednesday.

Core capex growth represents a massive economic tailwind. And the fact that it continues to grow, albeit at a decelerating pace, is a good sign for economy-wide growth.

According to S&P Global Flash US Manufacturing PMI report released on Wednesday, these emerging economic trends have continued into May. Specifically, the composite output index fell to a four-month low of 53.8 in May. For this index, any reading above 50 signals growth, and so the declining number suggests growth is decelerating.

“Growth has slowed since peaking in March, most notably in the service sector, as pent up demand following the reopening of the economy after the Omicron wave shows signs of waning,” Chris Williamson, chief business economist at S&P Global Market Intelligence, wrote on Wednesday.

Consumer spending growth cools as excess savings get tapped

Growth appears to be cooling on the consumer front too.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK