The Day George Soros Broke the Bank of England To Make $1.1B

source link: https://historyofyesterday.com/the-day-george-soros-broke-the-bank-of-england-to-make-1-1b-4834df0605d1

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The Day George Soros Broke the Bank of England To Make $1.1B

A look back at a large-scale speculative attack led by the American billionaire in the early 90s

Less known by the general public than Warren Buffett or Peter Lynch, George Soros is nevertheless a legend in the investment world. George Soros’ most brilliant move was probably the one that saw him literally broke the Bank of England on September 16th, 1992.

Less known by the general public than Warren Buffett or Peter Lynch, George Soros is nevertheless a legend in the investment world. George Soros’ most brilliant move was probably the one that saw him literally broke the Bank of England on September 16th, 1992.

To do this, the American investor took advantage of the European Monetary System (EMS) to carry out a speculative attack that I propose to rediscover in detail in what follows.

Back to the end of the 1980s and the beginning of the 1990s in England.

England joins the European Exchange Rate Mechanism as the country enters a recession

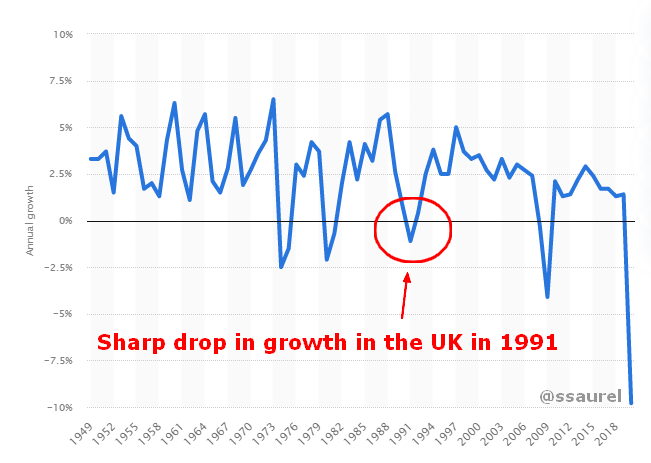

After a period of sustained growth, associated with a moderate rate of inflation and a gradual decline in unemployment between 1983 and 1988, the situation began to reverse from 1989–1990. Inflation rose from 3.3% in January 1988 to a high of 10.9% in September 1990.

During this period, the United Kingdom decided to join the Exchange Rate Mechanism (ERM) in addition to its membership in the European Monetary System.

This exchange rate mechanism obliges the central bank of the participating country to defend an exchange rate pivot, intervening in the market if necessary. The idea behind the decision taken by the British in October 1990 was that joining the exchange rate mechanism would reduce inflation and bring stability to exporting companies, by controlling the exchange rate to limit its volatility.

The pound sterling entered the ERM at a relatively high rate compared to the historical rate of the British currency.

For many, it was obvious that the pound sterling was overvalued. This was a way of calming inflation. Indeed, the latter made it possible to reduce the price of imports such as raw materials and energy. However, this overvalued pound quickly penalized exporting companies.

In 1990–1991, interest rates were very high in the United Kingdom to control the exchange rate as much as possible. Combined with an overvalued exchange rate and the bursting of the real estate bubble, this situation led the country into a recession:

Faced with the situation in England, George Soros had an idea that was brilliant for some and demonic for others

It is at this precise moment that George Soros comes into action.

He has a brilliant or demonic idea. It all depends on how you look at it. Given the economic situation in England and the level of foreign exchange reserves, a major speculative attack could force England to leave the EMS and devalue its currency.

George Soros figures that by shorting the British pound, it would be a jackpot.

To keep the pound within the fluctuation range allowed by the EMS and to avoid a forced devaluation, the Bank of England has two options:

- Counterattacks by using/selling its foreign exchange reserves.

- Raise interest rates to attract foreign capital and counter depreciation.

Both options come with major drawbacks.

The first solution is limited by the number of reserves available, while the second would have an impact on the level of investment and therefore on growth. You can see here the inverse relationship between interest rates and investment.

George Soros convinces other major investors to lead a large-scale speculative attack on the Bank of England

The situation is clear for George Soros. If he and his partners manage to deplete the reserves of the Bank of England, by shorting the pound sterling and ensuring that the Bank of England does not have enough money to meet this attack, then the only solution for England would be devaluation.

Indeed, a significant increase in interest rates is unthinkable in a period of recession like the one England is going through.

On September 16, 1992, George Soros took short positions on the British pound for an amount of 10 billion pounds. Even better, Soros managed to convince other investors and investment banks (JP Morgan, Bank of America, Jones Investment, …) that the pound sterling would collapse in the event of a massive and coordinated attack.

To counteract the massive sales of sterling, the Bank of England first used its reserves to buy back sterling. But foreign exchange reserves were too low at the time for such a powerful speculative attack.

The Bank of England was finally forced to give up the fight a few hours after the attack, announcing its exit from the European monetary system with a devaluation of about 15%.

George Soros’ legendary stunt blows up the Bank of England and earns him $1.1 billion

George Soros and all the funds and banks that participated in this large-scale attack were then able to repay the loans they had taken out in sterling, but with a devalued pound against the US dollar. By selling short, i.e. by betting on the fall of the pound, George Soros’ capital gain on this operation was estimated at 1.1 billion dollars.

This legendary move will forever be associated with George Soros.

However, this operation was not without risk. Indeed, three major risks could have allowed the British currency to resist and the speculators to lose a lot of money:

- Poor coordination between speculators.

- Anticipation and a strong response from the Bank of England.

- Coordinated interventions by other central banks to support the pound sterling.

Nevertheless, it is almost impossible to maintain a fixed exchange rate in the long run when there are asymmetric shocks and the disparities between countries become too great.

Final Thoughts

At just over 90 years old, George Soros is still alive. He continues to give his views on many economic issues to this day. He is clearly one of the legendary investors whose journey and legendary moves you should study.

I hope this story has inspired you to take a closer look at the career of the American billionaire investor.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK