Fed Scandal Bigger Than Watergate?

source link: https://occupythefed.substack.com/p/fed-scandal-bigger-than-watergate

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Fed Scandal Bigger Than Watergate?

Jay Powell traded during restricted blackout period; failed to disclose most trade dates; apparently lied about muni conflict; directed massive Wall St bailouts despite conflicts

These are turbulent times not unlike the 1970s. Supply shortages, rampant inflation, domestic upheaval, foreign affairs fiascos. But some inane desire for “continuity” at Fed Chair is not worth sacrificing every principle for which America stands.

The Biden administration chose to reward corruption at the highest level of government by renominating Jerome H. Powell to Chair of the Federal Reserve Board. Next week, the U.S. Senate wants to rush a vote to bless corruption and confirm Powell in that powerful role. But reinstalling Powell as Fed Chair, after he presided over and is directly implicated in the biggest government official stock trading scandal ever, will be a permanent stain on American history — a national disgrace from which our country and its real economy will never recover.

Fed Chair Powell — who is supposed to serve in the public interest and avoid even the appearance of conflicts — traded millions in personal stocks and bonds while obstructing required public disclosures about those trades for years. Yet, the information that has slipped out is damning. It shows Powell made trades *DURING* the restricted blackout period for pivotal Federal Open Market Committee (FOMC) meetings. This is a shocking revelation and constitutes grave and inexcusable misconduct by a high-ranking U.S. government official.

Moreover, Powell directed policy decisions that directly advantaged his personal bond holdings despite longstanding federal conflicts of interest law, 18 U.S.C. § 208. And then he apparently told a brazen lie about it to the press by suggesting the Office of Government Ethics (OGE) said his holdings posed no conflict. FOIA requests confirm that OGE provided no such guidance in writing.

Set aside the fact Powell presided over the massive Fed trading scandal. His personal actions plainly bar him from serving in any government position of trust, much less the extremely powerful role of Fed Chair. Why hasn’t the media reported any of this? It seems most financial journalist are some combination of: (1) totally delusional, (2) under gag orders from superiors, or (3) complicit when it comes to systemic corruption at the Federal Reserve and Wall Street. Since mainstream media has failed our country, we are compelled to do what we can to help the cause of smaller outlets like Revolving Door Project and Wall Street on Parade in exposing the truth.

Powell Consistently Obstructs Disclosure of Most Trade Dates but Even His Deficient Filings Show Illicit Trades During Restricted Fed Blackout Period

Since being nominated to a seat on the Fed Board in 2012, Powell has been required to publicly disclose the amount ranges and specific dates (“month, day, year”) for personal trade transactions on OGE Form 278e.1 He has materially failed to comply with the required disclosures. Instead of providing specific dates for the majority of his transactions, Powell improperly groups trades of like securities behind the phrase “Multiple” on every OGE form he has filed.

Ex-Fed Regional Bank President Robert Kaplan — who retired early in disgrace after getting caught trading millions and even trying to time the market with S&P futures — employed the same scheme to obstruct public disclosure of trade dates. Journalists who have pursued long overdue disclosure of trade details have been stonewalled to date.2 Even demands for trading details by sitting members of the Senate Banking Committee that oversees the Fed have been ignored by Chair Powell for months.3

The limited information we actually have still paints a deeply disturbing picture. For example, take Powell’s disclosure for 2015 - a pivotal year when the Fed was considering policy normalization after the GFC. Powell recorded _57_ separate transaction entries.4 But 34 of the entries obstruct disclosure of dates through use of the “Multiple” artifice. That means Powell must have executed more than NINETY (90) separate trades in just one year, all while sitting on the Fed Board with unfettered access to highly material non-public financial information.

Worse still, a significant number of trades were executed during the restricted blackout period leading up to and through the final day of FOMC meetings. Ironically, when the trading scandal broke, a Fed PR spokesperson touted that Fed officials like Powell are subject to stricter restrictions like no trading during the FOMC blackout period — “10 days ahead of policy meetings through midnight of the final meeting day.”5 Yet, Powell had at least 6 sales transactions and 1 purchase on April 29, 2015 — the day of the final FOMC meeting.6 He also made 2 purchases on December 11, 2015 — 3 days before the FOMC’s December 15-16, 2015 meetings.

How do we know Powell wasn’t using “Multiple” to hide disclosure of far more transactions during the restricted blackout period? We’re only scratching the surface, and this is just a single year of Powell’s long tenure. Moreover, Powell’s illicit trades were not isolated to 2016, it continues unchecked through the present.

Again Powell made 5 securities trades on December 11, 2019 — the day of the final FOMC meeting over which he presided as Fed Chair.7 This all may be a bit unbelievable, but the sources are publicly available and footnoted below. The size or success of Powell’s trades are irrelevant to whether Powell violated requirements.

Experts agree the problem with all this is Fed officials (and especially the Fed Chair) “have material nonpublic information all the time” — in fact it’s “the most important information that you can make the most money on in the quickest period of time.”8 While the Fed has touted new forthcoming trading rules that are more restrictive, one of the few existing restraints on Fed officials is the financial trading blackout around FOMC meetings. Powell could not even abide by that.

Powell’s trades during the pandemic have also drawn at least some scrutiny. Indeed, Powell sold between $1-5 million in stock in October 2020 just prior to a significant market downturn.9 See Robert Kuttner’s piece in the American Prospect (https://prospect.org/economy/powell-sold-more-than-million-dollars-of-stock-as-market-was-tanking/). Mr. Kuttner suggests a possible saving grace is that “[n]one of Powell’s sales happened during the blackout periods for 2020.” Of course, as you now realize, there is no way to verify that statement due to Powell’s obstruction.

President Biden and some Senators just want us to ignore these habitual violations and take Powell’s word for it that he didn’t trade on material non-public information. Now see, that’s a problem for us. Because not only did Powell make at least a dozen trades during the blackout period while also obstructing disclosure of the majority of his trade dates, he also seems to be covering up another major conflict.

Powell Failed to Recuse Himself from Matters Directly Impacting His Municipal Bond Holdings and Then Apparently Lied to Reporters About It

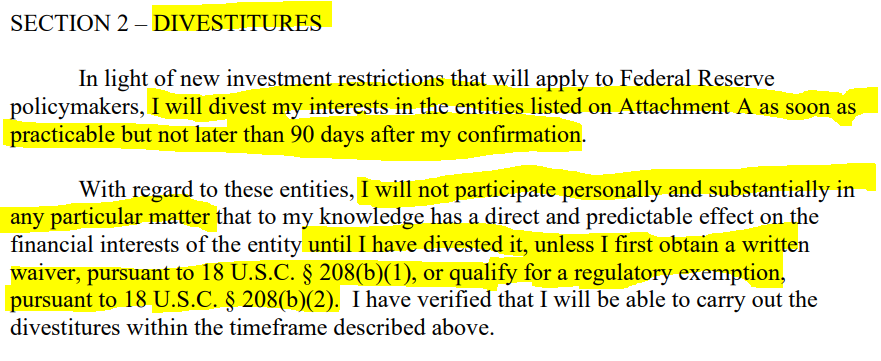

Federal conflicts of interest statute 18 U.S.C. § 208 has been on the books for decades. “Under 18 U.S.C. § 208, an employee is prohibited from participating personally and substantially in any particular matter in which the employee knows they have a financial interest directly and predictably affected by the matter…”10 The statute applies to all types of financial interests, including municipal bonds where the matter “would have a direct and predictable effect on the value of municipal bonds or, in rare cases, the financial stability of the issuer...”

In March 2020, Fed Chair Powell made the unprecedented decision to intervene in the municipal bond market and purchase municipal bonds and ETFs directly as part of its “kitchen sink” response to the COVID-19 pandemic. The Fed had never made such a move, even during the depths of the Great Financial Crisis. The Fed’s intervention rapidly “propped up” the muni market and then some. The Fed spurred muni borrowing to a 10-year high and drove “riskier issuers” into the market.11

Fed Chair Powell actively bought and sold both specific muni bonds and actively-managed muni funds leading up to his unprecedented decision. The widely-distributed financial magazine Barron's even wrote an article touting Powell’s moves as a potential trading strategy in 2019.12 The Fed even purchased one of the specific Illinois muni bonds also held by Powell’s trust.13

One of the few financial journalists left with some backbone is Steve Liesman at CNBC. At the September 2021 FOMC press conference, Mr. Liesman questioned Powell about the propriety of owning the same assets the Fed decided to buy.14 Instead of responding forthrightly about deciding to act despite his conflict due to emergency circumstances, Powell tried to cover up the nature of his conflict and made matters far worse.

Powell responded to CNBC’s Liesman: "I personally owned municipal securities for many, many years, and in 2019, I froze that...the lore was that the Fed would never buy municipal securities...and I reversed that." Powell did not "freeze" his muni trading in 2019 before the Fed decision. As reported by the Revolving Door Project, Powell "neglected to mention that he’d personally purchased shares [in 2020] in several actively-managed municipal bond funds [from Goldman Sachs]."15

Powell then dug himself deeper and asserted that he had "checked with the Office of Government Ethics … who looked at it carefully and said that I didn’t have a conflict." This broad, unsupported assertion is astonishing. Powell is suggesting that OGE undertook a careful analysis of whether his muni holdings posed a 18 U.S.C. § 208 conflict when directing Fed policy on the unprecedent muni intervention. And Powell asserts that OGE said he had no conflict.

Well, thankfully there is something called the Freedom of Information Act (FOIA) that helps the public to verify such a statement. And the Revolving Door Project used FOIA requests to do just that.16 The results are shocking as they yielded zero written communications or documents to support Powell’s assertion:

So what did OGE really think or say? Well, in December 2021, Powell signed a new Ethics Agreement that requires him to dump all of his muni bond holdings.17 And in it, OGE clearly believes that Powell’s muni holdings pose a potential 12 U.S.C. § 208 conflict.

Suffice to say, Powell should have obtained an express waiver or recused himself from all decisions relating to his muni bonds back in 2020 and allowed others on the Board to direct policy. Failing that, he should have just owned the fact that he mistakenly violated 18 U.S.C. § 208 due to emergency circumstances. We find it implausible that the Fed Chair didn’t brazenly lie about non-existent guidance from the Office of Government Ethics. Powell has utterly betrayed the public’s trust in this whole episode, and the press has failed to call him out on it.

Powell Directed Massive QE Purchases and Bailouts Despite Major Conflicts

Maybe it’d be easier to look past these grave personal transgressions if Powell’s entire net worth and career wasn’t riddled with massive conflicts. For example, despite owning millions in the investment firm’s proprietary equity funds, Powell awarded Wall Street behemoth BlackRock with large no-bid contracts to run trillions in ‘Quantitative Easing’ purchases that have doubled the Fed’s balance sheet to around $9 trillion!18

Back in 2020, many industry participants cried foul and rightfully so: “‘It is truly outrageous,’ said one asset management executive, who declined to speak on the record due to BlackRock’s influence on Wall Street. ‘BlackRock will be managing a fund and deciding if they want to use taxpayer money to purchase ETFs they manage. There’s probably another 100-200 managers who could do this, but BlackRock was chosen [in a no-bid contest].’”19

And BlackRock decided to do just that - directing the largest Fed purchases into its own proprietary securities funds.20 Jeanna Smialek of the NY Times questioned Powell about the BlackRock arrangement, Powell holding several private calls with BlackRock’s CEO Larry Fink, and how potential conflicts of interest were handled.21

This is yet another serious breach. The BlackRock Invesment Management Agreement of course provides for an ethical wall at Ex. G.22 As it recognizes, “certain BlackRock senior executives may sit atop of the information barrier between the FMA Group and the rest of BlackRock.” One such individual would be CEO Larry Fink. “In virtually all cases, persons who are ‘above the wall’ are precluded from having any involvement in advising the client in connection with the particular transaction.”23 So “exchanging information” and “checking in” on the arrangement regularly with someone who sits above the ethical wall is very wrong.

Despite his massive personal financial conflicts, Chair Powell has acted with impunity to advantage the Wall Street firms managing his investment fund holdings both before and after the pandemic. Indeed, in late 2019, prior to the COVID-19 pandemic, Powell directed the Fed to engage in an unprecedented emergency repo program that provided nearly $20 TRILLION in cumulative loans to Wall Street, including ~$3.7 trillion to Japan’s Nomura Securities and ~$1.4 trillion to Germany’s Deutsche Bank trading arms. Industry experts have opined that the program was in direct violation of the Dodd-Frank Act.24

The emergency repo program was not broad based, but rather appears to have been directed as aid to “failing financial firms” overly exposed to risky derivatives. Of course, one of the select major recipients of loans was Goldman Sachs at $1.67 trillion. And yes, Powell also owns millions in Goldman Sachs proprietary equity funds.

To date, there’s been a virtual media blackout on the 2019 repo bailouts, just like on Powell’s trading and disclosure violations.

Middle and Working Class Americans Cannot Afford Four More Years of Fed Chair Powell

What’s the end result of having a Fed Chair as conflicted as Powell? The vast majority of Americans, who own little to no stocks propped up by Fed bailouts and rent or carry a sizable mortgage on their homes, are being destroyed by skyrocketing inflation after shouldering the real burden of a lengthy pandemic. The Bureau of Labor Statistics currently estimates consumer inflation to be 7%. In reality, it’s more than double that.25 And worse still for housing inflation — the most heavily weighted metric which BLS has the gall to suggest is less than 4% year over year. You’d have to be living under a rock to believe that and perhaps that’s all most Americans will be able to afford soon.

On the other hand, Wall Street and the wealthiest Americans suffered less than a month of down days on the stock market and bask in record wealth inequality. Powell is guided in all his actions not only by his fealty to Wall Street cronies, but also by truly outrageous personal financial conflicts and violations. Powell has tried very hard to cover this up before his confirmation hearing. Sadly, there’s no Woodward and Bernstein of the day to shed light on the truth.

So the task falls to us ordinary Americans. We need to get the word out far and wide. Please do your part on every social media outlet (Twitter, Reddit, Tik Tok etc.), tell your friends, write and call your Senators, even consider joining a peaceable in-person demonstration to say NO to 4 more years of Jay Powell as Fed Chair!

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK