To fight inflation, fight monopolies

source link: https://doctorow.medium.com/to-fight-inflation-fight-monopolies-58442ed9187

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

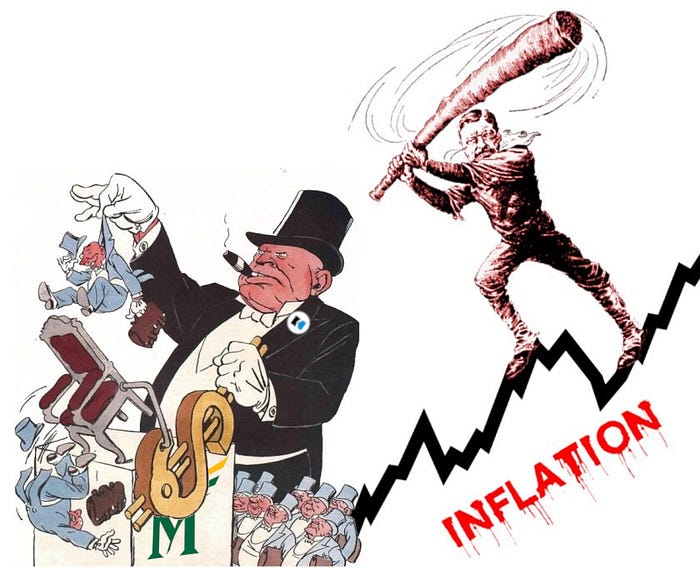

To fight inflation, fight monopolies

Cartels raise prices using supply chain and “generous” benefits as cover for price-gouging.

The majority of the public blames inflation on price-gouging. That’s not surprising, because the CEOs of monopolistic companies keep boasting about their record profits even as they raise prices. If a company raises prices and margins, then we don’t have an “inflation” problem, we have a price-fixing problem.

https://pluralistic.net/2021/11/20/quiet-part-out-loud/#profiteering

And yet, the majority of economists insist that this is impossible. They hew to the Reagan-era doctrine that says that inflation is always the result of giving poor people too much money, which leads to the “wage-price spiral.” The answer is to hike interest rates, cut “generous” benefits and take away labor rights.

Writing for The American Prospect, Georgetown University economist Hal Singer identifies and dissects the brain-worms that infect neoliberal economists, and the way their dying orthodoxy punishes working people and lets monopolists off the hook.

https://prospect.org/economy/antitrust-should-be-used-to-fight-inflation/

In particular, he demolishes the argument that since market concentration hasn’t increased much over the past two years (a dubious assertion!), it can’t be to blame for inflation. Singer points out that cartels and monopolists can (and do) use things like supply chain shocks and expanded unemployment benefits as cover for price-gouging.

Price-fixing requires either explicit or tacit collusion, and collusion is easier when industries grow more concentrated. If all the execs that control an industry can fit around a single table, eventually they will sit down at a table and start rigging prices. If an industry is so diverse that the execs who control it barely fit in a large conference center, they won’t be able to agree on the lunch catering, much less a conspiracy to rig prices.

This obvious fact has been systematically denied by orthodox economists since the Reagan era. Frank Easterbrook’s 1984 “Limits of Antitrust” — one of the bibles of the pro-monopoly movement — holds that monopolies are usually efficient, and that the consequences of breaking up a “good” monopoly are much worse than the consequences of tolerating a “bad” monopoly (which probably doesn’t exist, and if it does, will likely be addressed by “market forces” if left alone).

This is a doctrine that counsels leaving monopolists alone, lest a hasty regulator get rid of an “efficient” monopoly that is doing nothing but good in the world. And so it is that 40 years later, nearly every industry is monopolized, with control in the hands of five or fewer firms, a tractable number for engaging in conspiracy.

Today, antitrust orthodoxy is crumbling and new proposals are competing to replace it. Singer proposes a fascinating one: there should be automatic antitrust investigations into any industry that 1) is highly concentrated; 2) has rising margins; and 3) raises prices by more than 10% each year.

That would trigger a hell of a lot of automatic investigations! The WSJ reports that two-thirds of US companies have increased their margins during the pandemic.

Singer says that the main impact of this rule would be to discourage collusion, and that there is no such thing as “efficient collusion” that benefits society, so even if you buy Easterbrook’s idea that monopolies are mostly efficient, this rule will only target “bad monopolies” not “good ones.”

Singer also points out that presidents can do a lot to discourage price rigging. JFK railed against the steel industry’s profiteering and they slashed their margins rather than risk an investigation. Biden did the same for beef, with the same result.

Now, Trump also did this, but his approach had significant differences. Trump practiced “gangster antitrust,” asking agencies to target his political enemies.

Antitrust will always be political, but it needn’t be partisan. The Chicago School of Economics’ war on antitrust enforcement was a political movement, and so is the fight to restore it. The criticism that FTC Chair Lina Khan is political when she promotes small businesses requires that we pretend that promoting monopolies wasn’t political.

Politics and economics can’t be separated. The Sam Vimes Boots Index, lately launched by Jack Monroe, tracks the price-hikes in the cheapest goods, finding that they are far steeper than in goods targeted at wealthier people.

https://www.tor.com/2022/01/26/terry-pratchett-vimes-boots-index/

And of course they are. Poor peoples’ complaints are less damaging to cartels than rich peoples’ complaints. Companies gouge when they can get away with it. Supply-chain shocks let them get away with it. Expanded covid benefits let them get away with it. A powerless customer-base lets them get away with it.

Inflation scare-talk is a whip used to scourge working people by accusing them of endangering the economy because they have too much money. It is a political project. There is no “politicizing” these issues — they were political from the start.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK