Is A Bitcoin Price “Double Bubble” Imminent?

source link: https://www.hodlalert.com/2021/08/31/is-a-bitcoin-price-double-bubble-imminent/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

With the bitcoin price hovering near $50,000, it appears a 2013-style “double bubble” is in the cards.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

With the price of bitcoin hovering near $50,000, momentum has returned to the market and strong hands have accumulated more bitcoin than ever. A 2013-style double bubble is in the cards.

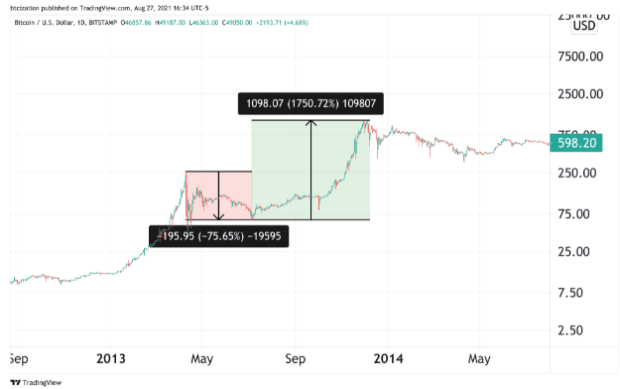

The 2013 cycle saw the price of bitcoin draw down 75% from the highs before rallying a staggering 1,750% in less than six months. We aren’t suggesting that the rally will occur again with the same performance, but rather an explosive “double bubble” within the traditional four-year boom-and-bust cycle.

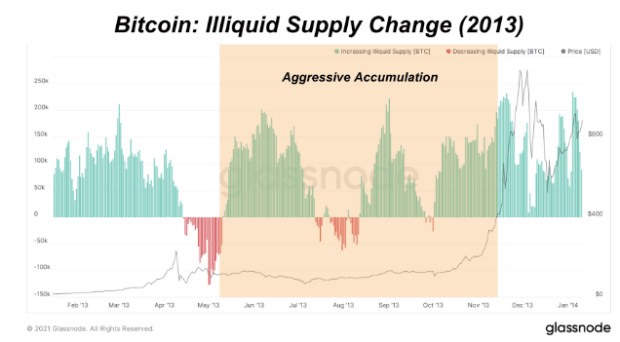

The market has gone through quite a similar cycle compared to 2013 as well, with an initial parabolic run up, a large amount of coins becoming liquid before an aggressive reaccumulation and parabolic run up.

Bitcoin: Illiquid Supply Change 2013

Bitcoin: Illiquid Supply Change 2013 If bitcoin continues to transfer to strong hands at the current pace, a parabolic run-up will commence that most in the world cannot fathom. Bitcoin, at nearly a $1 trillion asset today, can elevate to a $5 trillion asset in 2022 with relative ease.

After all, $1 of capital that flows into bitcoin adds far more than just $1 of market cap to the asset, and during a bull market when most market participants are holding, the market value to realized value of bitcoin explodes upwards. If 1% of capital flows out of global debt funds into bitcoin as a safe haven, as the global economy experiences massive supply chain disruptions causing rising prices across the board.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK