Canoo's multipurpose electric van looks like it's built out of Lego

source link: https://finance.yahoo.com/news/canoo-futuristic-multipurpose-electric-van-mpvd-203646691.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Canoo's multipurpose electric van looks like it's built out of Lego

Electric vehicle company Canoo caught our attention last year with its plan to offer a subscription-only EV. It’s back with its latest creation, a stylish multi-purpose delivery vehicle that’ll start at around $33,000. Pre-orders are open for the multipurpose delivery vehicle (MPDV), which will be available in two sizes at first. A limited number of the vans should be available in 2022 and production will scale up the following year.

The MPDV1 has 200 cubic feet of space behind the bulkhead and the MPDV2 has twice as much room. The two variants have Canoo’s skateboard base design and the same electric motor, which offers 200 horsepower and 236 pound-feet of torque.

The maximum payload depends on the battery size and there’ll be three options available at the outset. In the MPDV1, the 40 kWh pack should give you a range of 130 miles. The 60 kWh battery will provide a 190-mile range, Canoo estimates, and you should be able to drive for up to 230 miles on a single charge of the 80 kWh version. If you were to opt for the larger van, those ranges would be 30 to 40 miles lower. The van will also have level two autonomy as part of its driver assistance systems.

What makes the MPDV particularly interesting, though, is its design. Its Cybertruck-style flat panels make it look like Canoo snatched it from some point in the future (2077, perhaps). As Autoblog points out, the compact front end could help make parking a breeze.

A promo video shows off a number of neat interior design ideas that suggest the MPDV could be very useful as a work vehicle. The driver-side door, for instance, has power outlets and cup and phone holders as well as storage, while there should be plenty of space to walk around given the van’s interior height of just under 6.5 feet.

There are also ramp slide-outs, storage locker options, a 240-volt outlet for power tools and even a fold-up dolly. Owners could opt to have an opening on one side and fold-out tables on the other, so it could be a viable way to get a food truck business off the ground. You could even go with an adventure vehicle setup.

Investor's Business Daily

Investor's Business DailyBank Of America Names Top 11 Stock Picks For 2021

Bank of America just unveiled its top stocks for next year among the 11 S&P 500 sectors. But the bank might hope its picks do better than they did in 2020.

22h ago MoneyWise

MoneyWiseHow Biden's student loan forgiveness could blow up your tax bill

If the stars don't align, the resulting "tax bomb" would cost you thousands.

18h ago Yahoo Finance

Yahoo FinanceBill Gates-backed electric car battery startup is on the cusp of changing the industry

QuantumScape founder and CEO Jagdeep Singh chats with Yahoo Finance about the company's big battery breakthrough.

2d ago- Barrons.com

Here Are Barron’s 10 Top Stocks for the New Year

The group offers good appreciation potential, while providing some downside protection if the stock market falters in 2021.

11h ago  Investor's Business Daily

Investor's Business DailySix High Dividend Stocks You Can Count On

High-dividend stocks can be misleading. Here's a smart way to find stable stocks with high dividends. Watch these three dividend payers on IBD's radar.

16h ago Investor's Business Daily

Investor's Business DailyFastest-Growing Stocks: Square Stock Among 8 Stocks Expecting Up To 144% Growth In 2021

What are the fastest-growing stocks to watch in 2021? Here's a list featuring GRWG stock, Square, Micron and five other stocks expecting up to 144% growth.

2d ago Benzinga

BenzingaTesla Stops Gigafactory Berlin Construction Due To Missing $100M Deposit: Report

While Gigafactory Berlin construction has been moving at a fast pace, Tesla Inc (NASDAQ: TSLA) has had a few setbacks, including stopping tree clearing due to animal rights activists court cases.Now, a report from Electrek says Tesla has missed a $100 million security deposit, which is causing things to go on hold temporarily. Tesla didn't obtain overall approval to build Gigafactory Berlin, according to Electrek, and is operating with partial approvals to keep advancing the project at a quicker pace.Click here to check out Benzinga's EV Hub for the latest electric vehicle news.The deposit is needed in case the project is never finished. In the event that happens, Tesla would be responsible to pay for the demolition. The $100 million deposit covers that possibility, although at this point it seems unlikely.The payment was supposedly due on Dec. 17.Photo courtesy of TeslaSee more from Benzinga * Click here for options trades from Benzinga * Elon Musk Hopes To Visit China Next Month Amid Start Of Model Y Production * Video Shows Tesla Model Y Production Beginning In China(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

19h ago TipRanks

TipRanks3 Stocks Flashing Signs of Strong Insider Buying

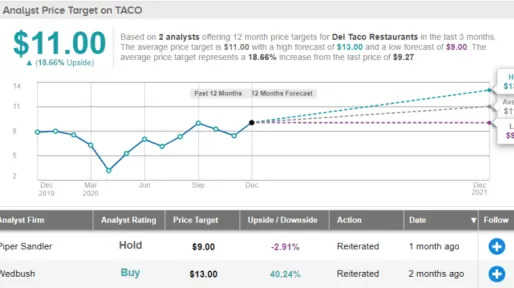

Sometimes, following a leader makes the best investment strategy. And corporate insiders have long been popular leaders to follow. Their combination of responsibility to their stockholders and access to ‘under the hood’ information on their companies gives their personal investment choices an air of authority.The most important thing about these insiders is that whatever else they do, they are expected to shepherd their companies to profitability. Shareholders want a return on investment, Boards of Directors want accountability, and company officers are held to both standards. So, when they start buying up their own company’s stock, it’s a sign that investors should investigate further.Government regulators, in an effort to level the informational playing field, have required that insiders regularly publish their stock transactions, making it a simple matter for investors to follow them. Even better, TipRanks collates the information in the Insiders’ Hot Stocks page, and provide tools and data filters to easily browse through raw data. We’ve picked three stocks with recent informative buys to show how the data works for you.Del Taco Restaurants (TACO)We’ll start with the popular Del Taco, the California-based taco chain. Del Taco boasts a $344 million market cap, over 600 restaurants, and a loyal fan base, giving it a solid foundation in the fast-food franchise market. Most of the company’s locations are west of the Mississippi, but the company has been making inroads to the eastern US.Like many brick-and-mortar, traffic-dependent businesses, Del Taco has had a hard year. The coronavirus crisis had dampened traffic, social and economic lockdown policies have reduced income streams. The company has started to recover, however. After heavy net losses early in the year, EPS has returned to positive numbers, and revenue in Q3, $120 million, was up more than 15% sequentially. The share price, which fell by two-thirds at the height of the economic crisis last winter, has regained its losses. TACO is now trading up 17% for the year.The insiders are bullish on the stock. The most recent purchase, helping tip the sentiment needle into positive territory, is from Board member Eileen Aptman, who bought up 88,952 shares, shelling out over $650,000. Wedbush analyst Nick Setyan covers Del Taco, and he rates the shares an Outperform (i.e. Buy). His $13 shows the extent of his confidence, indicating room for 40% upside growth. (To watch Setyan’s track record click here)Backing his stance, Setyan wrote, “We believe TACO's current valuation is predicated on an overly pessimistic assessment of its medium- to long-term fundamentals in a post-COVID QSR environment… Even with what we believe are conservative comp, unit growth, and margin assumptions through 2022, we estimate 12% EPS growth in 2022. We estimate 1% of incremental comp would equate to $0.04-0.06 in incremental EPS and every 10 bps of incremental margin equates to $0.01 in incremental EPS in our model.”Overall, there is little action on the Street heading Del Taco's way right now, with only one other analyst chiming in with a view on the stock. An additional Hold rating means TACO qualifies as a Moderate Buy. The average price target is $11, and implies a potential upside of ~19%. (See TACO stock analysis on TipRanks)CuriosityStream (CURI)Next up is CuriosityStream, an online video streaming channel in the educational segment. CuriosityStream specializes in factual video content, and offers services by subscription. The channel claims over 13 million subscribers globally. Its founder, John Hendricks, first gained fame creating the Discovery Channel, a similarly themed cable TV channel, in 1985.CuriosityStream is new to the public markets, having IPO’d earlier this year through a merger with Software Acquisition, a special purpose acquisition company (SPAC) formed as a ‘blank check’ company to make the deal. It’s no surprise to see insiders make large purchases in new stocks, but the moves on CuriosityStream deserve note. John Hendricks made three large purchases earlier this month, buying up blocs of 15,473 shares, 26,000 shares, and 11,684 shares over a four-day period. Hendricks paid $473,561 for the new shares.Covering the stock for B. Riley, analyst Zack Silver wrote, “We see CURI as well positioned to capitalize on the burgeoning global streaming market by establishing itself as the go-to factual programmer for the post pay TV era. CURI's subscription video-on-demand (SVOD) service is differentiated not only by the sheer volume of curated factual titles available on the platform but also by its compelling price point… we expect that CURI’s strategy of monetizing its content through multiple revenue streams will enable a more efficient path to scale…”Silver rates the stock a Buy, and his $16 price target implies a 40% one-year upside. (To watch Silver’s track record, click here)CURI has a Moderate Buy analyst consensus rating based on 2 recent Buy reviews. The average price target is $14, suggesting this stock has room to grow ~23% from the current trading price of $11.50. (See CURI stock analysis on TipRanks)Allegheny Technologies (ATI)Last but not least is Allegheny Technologies, a metallurgy company based in Pittsburgh, Pennsylvania. Allegheny has two business segments: High Performance Materials & Components, which specializes in titanium-based and nickel-based alloys, and Advanced Alloys & Solutions, which includes stainless and specialty steels, electrical steels, duplex alloys, and zirconium, hafnium, and niobium alloys. The company’s metal technology is used in the electrical industry, automotive sector, aerospace, and in oil & gas production.Allegheny’s revenues and shares are down this year, as the company has been buffeted by the corona crisis. Disruptions in supply chains, distributions networks, and customer orders have all had a negative impact, as have social and economic shutdown policies. Quarterly revenues have fallen by 37%, from $955 million in Q1 to $598 million in the third quarter. Shares are down 21% year-to-date.All of this would seem to make ATI a poor stock choice, but the company has used the time to retrench wisely, and reorient its production models.Benchmark analyst Josh Sullivan pointed this out when he bumped his stance earlier this month from Neutral to Buy. He wrote, “We are upgrading ATI to Buy from Hold following the Company’s planned exit from commodity stainless. This move alters ATI’s historical risk profile by removing the most volatile vertical… Parting with ATI’s heritage in stainless has been a long sought-after investor goal; exiting now also allows ATI to avoid maintenance and a potential inventory overbuild during the recovery phase.”In addition, Sullivan notes that business in the aerospace sector will likely recover soon, providing a boon for Allegheny: “with the 737-MAX return to service, Airbus A320 production upward pressure, and vaccines at hand the more focused aerospace ATI core will directly correlate to an aero recovery.”Sullivan's Buy rating comes with a $21 price target that implies room for 27% growth over the coming 12 months. (To watch Sullivan’s track record, click here)Turning to the insider trades, we find that the company’s CFO and SVP, Donald Newman, purchased 12,500 shares this month, paying over $210K for the bloc. His total holding is now 80,042 shares, valued at $1.3 million.All in all, Allegheny gets a Moderate Buy consensus rating, based on an even split among 4 reviews, of 2 Buys and 2 Holds. The shares are priced at $16.32 and the $18.25 average price target implies ~12% upside potential.(See ATI stock analysis on TipRanks)To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

20h ago Investor's Business Daily

Investor's Business DailyThis Is Your Last Chance To Buy Tesla Stock Before Its Big Day

Tesla stock rose as funds rush to buy shares on the last trading day before the automaker's debut on the S&P 500 on Monday.

13h ago Investor's Business Daily

Investor's Business DailyIs Nio Stock A Buy Now As Extra Capital Raised For Next Stage Of EV Boom?

Supercharged Nio stock taps demand for electric cars. Here is what the fundamentals and technical analysis say about buying Nio shares now.

19h ago Benzinga

BenzingaChip Stocks Fall On Report Microsoft Will Take Things In House

Microsoft Corp (NASDAQ: MSFT) is designing in-house processors for server computers running on the company's cloud services, a development which will reduce reliance on Intel Corporation's (NASDAQ: INTC) chip technology, according to a Bloomberg report.Several chips stocks fell on the news.Intel shares traded down 6.3% to $47.46. The stock has a 52-week high of $69.29 and a 52-week low of $43.61.Advanced Micro Devices, Inc. (NASDAQ: AMD) closed down 0.95% at $95.92 per share.Nvidia Corporation (NASDAQ: NVDA) shares traded down 0.52% to $530.88. The stock has a 52-week high of $589.07 and a 52-week low of $180.68.Xilinx, Inc. (NASDAQ: XLNX) shares traded down 1.76% to $149.19. The stock has a 52-week high of $154.12 and a 52-week low of $67.68.Micron Technology, Inc. (NASDAQ: MU) shares traded down 1.11% to $71.46. The stock has a 52-week high of $74.60 and a 52-week low of $31.13.See more from Benzinga * Click here for options trades from Benzinga * Why Tesla's Stock Is Trading Higher Today * Why DraftKings And Flutter Are Trading Lower Today(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

14h ago MarketWatch

MarketWatchWhy Robinhood’s $65M fine is a cautionary tale for retail investors. ‘You’re saving a penny to lose a nickel.’

‘If you’re not paying for something, you are going to pay for it in a way you can’t see,’ says one consumer advocate.

21h ago- Barrons.com

4 Chip Stocks That Can Rise Even More in 2021

The world’s growing appetite for 5G phones and other high-performance technology will mean more demand for semiconductors, according to Wells Fargo.

14h ago - Barrons.com

DraftKings and Square Are Growth Stocks With Ambitions to Be Like Amazon

Hypergrowers can be difficult to value. But understanding where they see opportunities for gains is a start.

10h ago  Bloomberg

BloombergVirgin Galactic Falls After Filing for Holders to Sell Stock

(Bloomberg) -- Virgin Galactic Holdings Inc. fell 3.5% on Friday after filing for shareholders to sell as much as 113 million shares.The registration includes up to about 105 million outstanding shares of common stock and up to 8 million shares issuable upon the exercise of warrants that were issued in connection with a private placement, according to a filing with the Securities and Exchange Commission. The filing effectively converts an S-1 statement from May into an S-3 and doesn’t necessarily indicate that a sale has begun, or will occur in the future.Shares of the Las Cruces, New Mexico-based aerospace company have surged 46% since the end of October and speculators have been betting that the stock will fall. Short interest, a measure of bearish bets on the company, has risen to almost 32% of the shares available for trading, according to data from IHS Markit Ltd.Last week, Virgin Galactic sank 17% after efforts to take tourists into space suffered a setback when a test flight was scrubbed shortly after takeoff because of a technical snag.(Updates with latest trading in first paragraph, background on the share registration in second paragraph.)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.

16h ago Benzinga

BenzingaTilson: Avoid Bitcoin And 'Lead A Happier And More Prosperous Life'

Bitcoin prices pulled back from their all-time highs above $23,000 on Friday, but the Grayscale Bitcoin Trust (OTC: GBTC) traded higher by 1.7% on investor optimism that the huge 2020 bitcoin rally will spill over into 2021.Former hedge fund manager Whitney Tilson predicted the bursting of the bitcoin bubble back in 2017, but Tilson has a different take on the cryptocurrency this time around. On Friday, Tilson said he doesn't recommend shorting bitcoin or any other cryptocurrency, even at all-time highs.Related Link: Will Bitcoin 'Rise 50% And Possibly Double' In 2021? These Pros Think SoBack in 2017, Tilson said bitcoin was demonstrating signs of a classic market bubble. One of the biggest red flags at the time was the type of investors that were asking questions about bitcoin. Tilson noted that 2017 bitcoin investors were among the "least-knowledgeable investors imaginable." This time around, Tilson said much more mainstream investors and firms are involved in the bitcoin rally, which suggests the 2020 gains may be more likely to hold.How To Play It: While 2021 may not bring another 2018-style bitcoin bubble bursting, Tilson still isn't recommending investors buy bitcoin."I would never short any cryptocurrency - ironically, for the exact same reason I would never own one: there's no intrinsic value," Tilson said.Without any intrinsic value, Tilson said the price of bitcoin could literally go anywhere from $100 to $1 million and anywhere in between. Tilson said it's never a good idea to short an open-ended situation like that, but there is also nothing supporting bitcoin's valuation to the downside."In summary, I think you will lead a happier and more prosperous life if you avoid cryptocurrencies altogether," Tilson said.Benzinga's Take: Stocks, bonds, real estate and even gold have long, well-established track records of investment performance, but bitcoin and other cryptocurrencies have only been around for a little over a decade.A cryptocurrency's supply is fixed, it doesn't have the intrinsic value of a share of stock or a plot of real estate, and it doesn't have the yield of a bond or certificate of deposit. Therefore, the prices of cryptocurrencies in the long term will be determined only by changes in long-term demand from investors and users.Latest Ratings for GBTC DateFirmActionFromTo Feb 2018BuckinghamInitiates Coverage OnSell Jul 2015WedbushInitiates Coverage onOutperform View More Analyst Ratings for GBTC View the Latest Analyst RatingsSee more from Benzinga * Click here for options trades from Benzinga * Will Bitcoin 'Rise 50% And Possibly Double' In 2021? These Pros Think So * Bitcoin Crosses K For The First Time. Is This Rally A Repeat Of 2017?(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

15h ago Yahoo Finance

Yahoo FinanceFed loosens restrictions on bank share buybacks after second stress test

The Fed concluded after a second round of stress tests that major U.S. banks had “strong capital levels.”

13h ago- MarketWatch

I’m retired and won’t live to see my mortgage paid off. Should I refinance to lower my monthly payment?

'I need to lower the principal to help me stay in my home, because the cost of living is increasing every year.'

1d ago  Investopedia

InvestopediaWhat Is the Roth IRA 5-Year Rule?

The Roth IRA 5-year rule applies in three situations and dictates whether withdrawals get dinged with penalties.

1d ago TipRanks

TipRanksLuminar Technologies: Breaking Down Deutsche Bank’s New Bullish Call

Luminar Technologies (LAZR) is only two weeks old, after going public via a SPAC merger, but already a firm favorite among investors. It appears Wall Street’s analyst corps are now slowly joining the fray.Enter Deutsche Bank analyst Emmanuel Rosner who initiates coverage on LAZR shares with a Buy rating and $37 price target. Investors are looking at upside of 40%, should Rosner’s thesis play out over the coming months. (To watch Rosner’s track record, click here)So, what’s tickling the analyst’s fancy?Rosner explained, “Luminar offers investors an attractive way to invest into higher-level vehicle autonomy whose adoption is poised to take off, as we expect the company to become a leader in LiDAR solutions, with a true addressable market of ~$40bn by 2030."The analyst added, "Its differentiated LiDAR technology, featuring proprietary architecture and components, is essentially the only one delivering the performance needed for highway-speed autonomy at the right cost, and already received external validation from Volvo, Daimler and Mobileye through production contracts.”While the company already boasts an $8 billion market cap and its valuation is “rich by near-term metrics,” Rosner argues it is justified due to Luminar’s “superior technology and the size of the mid-term market opportunity.”The lidar market is still in its early innings and lidar probably won’t be required by sub L3 autonomous vehicles. However, as higher-level vehicle autonomy becomes more commonplace deeper into the decade, the need for Lidar solutions will increase.Apart from Robotaxis -for which Mobileye has already signed on to use Luminar’s lidar in its fleet - Rosner expects commercial trucks will be quick to adopt advanced driverless features “given large operating costs savings.”Rosner expects Luminar’s sales to have a steep upwards curve over the coming years. The analyst thinks the company will shift from selling 500,000 sensors in 2025E to more than 6.5 million in 2030E. Revenue should follow accordingly and climb from $635 million in 2025E to $4.5 billion in 2030E.In terms of other analyst activity, it has been relatively quiet. 2 Buy ratings assigned in the last three months add up to a ‘Moderate Buy’ analyst consensus. In addition, the $39 average price target puts the upside potential at 48%. (See LAZR stock analysis on TipRanks)To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

16h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK