Understanding Accounting Basics (ALOE and Balance Sheets)

source link: https://betterexplained.com/articles/understand-accounting-basics-aloe-and-balance-sheets/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

In accounting, the math usually isn't worse than multiplication. But accounting isn't about math -- it's about concepts, and some had me confused. Accounting has simple and surprisingly elegant ways to track a business.

So What's Accounting About, Anyway?

To be blunt, accounting is about tracking stuff (yes, there's more to it, but hang with me). What kind of stuff can we track?

- Assets: Stuff inside the company

- Liabilities: Stuff that belongs to others

- Owner's Equity (aka Capital): Stuff that belongs to the owners

Simple enough. Now how are these related?

Assets = Liabilities + Owner's Equity

In layman's terms, everything the company has belongs to the owners or someone else. Think of the equation like this:

- assets = liabilities + owner's equity

- stuff the company has = other people's stuff + owner's stuff

This formula (also called ALOE) might seem strange at first. Why do we add liabilities and equity? Because we're looking from the point of view of the company, not the shareholders. If the company has something, it could be owed to someone else.

From the owner's point of view, owner's equity = assets - liabilities. This equation looks more natural, but often we aren't interested in the owner's point of view. We want to know about the company.

What's a balance sheet?

A balance sheet is a document that tracks a company's assets, liabilities and owner's equity at a specific point in time. As you know, if the company's has something, it belongs to someone. The sides must balance. So let's do an example.

Suppose we start a company with $100 cash:

Assets:

Cash: 100

Liabilities:

None

Owner's Equity:

Stock: 100

The company has $100 in short-term investments, and the owners have $100 worth of stock (how ownership is represented in a company).

Now suppose we take a bank loan for $150. The balance sheet becomes this:

Assets:

Cash: 250

Liabilities:

Loans: 150

Owner's Equity

Stock: 100

Now our company has $250, but $150 belongs to the bank and $100 belongs to the owners. Sorry guys -- you can't take out a loan and make your share of the company more valuable.

Next, let's buy a building for $200:

Assets:

Cash: 50

Building: 200

Liabilities:

Loans: 150

Owner's Equity

Stock: 100

Buying a building doesn't make our company more valuable: we re-arranged our assets. Instead of $250 in cash, we have $50 in cash and $200 in "building". Our share of the company ($100) didn't change a lick. And we still owe the bank $150.

That's not how it really works, is it?

It is. Well, real accountants use fancier terms ("accounts receivable" vs "deadbeats who owe me"), and have a bigger, badder balance sheet. But the core idea is the same: show what the company's worth, and who owns what.

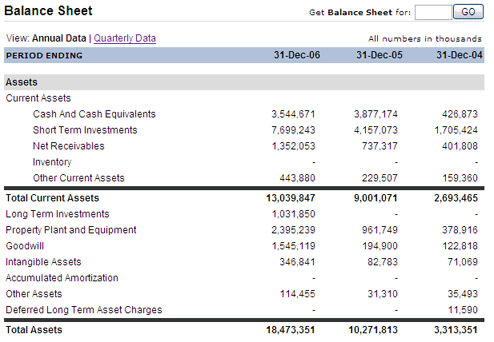

Take a look at the balance sheet for a small internet company:

Assets are broken into short-and long-term categories; the company is worth about $18 billion on the books (as of Dec 2006). This is up from $10B in 2005.

There's many, many reasons why assets may be over or under-valued on the books. How do you measure momentum? Employee morale? A brand? Customer loyalty?

Accountants try to quantify items like this with intangible terms like "Goodwill", but it's not easy. In reality, most companies are worth several times their reported assets; Google's market cap is over 10x the book value (but read more about stocks to see why market cap is not quite right).

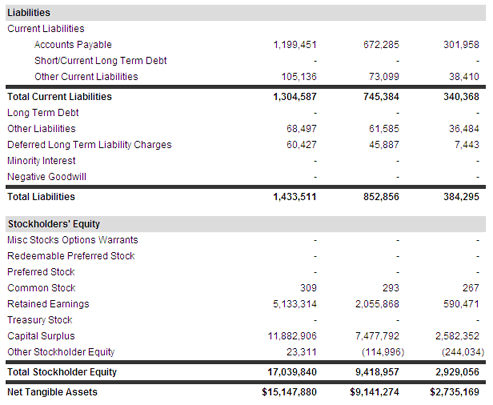

Now examine the other side of the equation, liabilities and owner's equity:

Wow -- Google doesn't have many liabilities! Only $1.4B (of the total $18B) and there's no long-term debt. What it does owe are "accounts payable" -- the equivalent of a credit-card bill (usually paid within a short timeframe).

Now you can examine a company and see what it's worth (on paper) and where the value lies. Google has no "inventory" (ever bought an off-the-shelf product from them?) but has a lot of cash, investments, and equipment. There's very little debt and other liabilities, so it seems like a very stable company on paper; they won't be going bankrupt anytime soon (there's other documents that show how profitable the company is).

Blockbuster, for example, has 2.5B in assets but 1.9B is owed to others (saved balance sheet here). Shareholders aren't left with much. In fact, it has 700M in "intangible assets", so it actually has a negative amount of real, tangible assets. Not a good sign -- if you liquidated the company today, it couldn't pay off its debt.

The Rules of the Game

Accounting has many rules, but a basic one is this: use double-entry bookkeeping.

This fancy term means that all changes happen in pairs:

- If assets go down, liabilities or owner's equity should decrease also

- If assets go up, liabilities or owner's equity must increase as well

Every change to assets must have a corresponding change to keep the equation in balance. There's a formal system of "debits and credits" that describes these changes, but the concept is simple: if you make a change to one side, you must make one on the other as well.

There's More to Learn

There's much more to accounting, but you've got an idea of the basics:

- If a company has something, someone had better own it

- A balance sheet lists assets, liabilities and owner's equity at a point in time; everything must add up

- Changes must be made in pairs: if assets, liabilities or owner's equity changes, something else much change as well

Any system can be interesting (even "fun") if you look at the reasons it was created and the problem it's trying to solve. Could you have made a simpler way to report what a company is worth and who is owed what?

Enjoy.

Other Posts In This Series

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK