DeFi Picks #2 - PowerPool YETI, Idle Finance (+Harvest) & more

source link: https://tokenbrice.xyz/posts/2020/defi-picks-2/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

DeFi Picks #2 - PowerPool YETI, Idle Finance (+Harvest) & more

Welcome to a fresh batch of DeFi picks, last week’s harvest has been bountiful so let’s see what’s on the menu for this one.

🌽 State of the Farms: Bountiful Harvest 🌽

Despite the ETH price looking for support, yields on ETH are still excellent, even though stablecoins have been topping the returns charts. Attractive options are emerging to generate returns on non-stable ERC-20 tokens too, as we’ll see below.

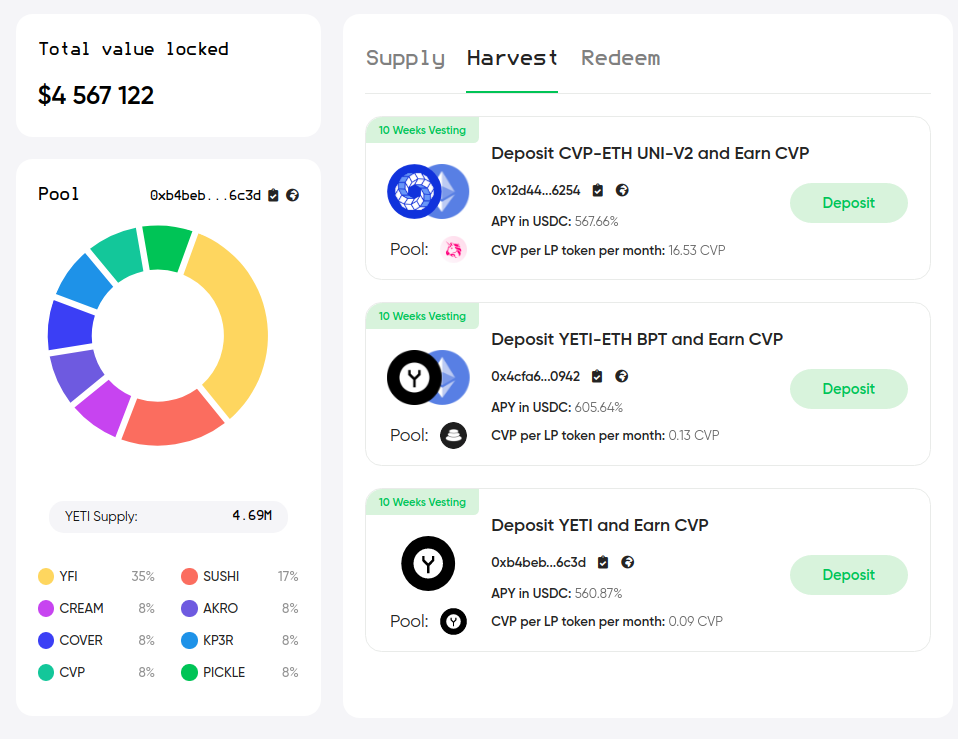

PowerPool & YETI

PowerIndex is one of the projects pioneering a novel front: meta-governance. Picture it as an intermediary-layer offering aggregated access to the governance of several DeFi protocols.

The YETI index, just launched, is particularly interesting as it provides a more convenient vehicle for investing in Yearn and all of its ecosystem. It’s essentially an index holding the following portfolio: YFI (35%), SUSHI (17%), CREAM, AKRO, COVER, KP3R, CVP, PICKLE (8% each).

An attractive liquidity mining program is also available, currently netting more than 1% a day to YETI stakers, paid in CVP tokens. Altogether, YETI is a fresh but attractive offering for someone looking to get a balanced exposure to Yearn’s ecosystem.

Further projects involve a more active usage of the tokens involved in the YETI index, such as staking the SUSHI tokens in the Sushibar for additional returns.

You can learn more about YETI on PowerPool’s blog.

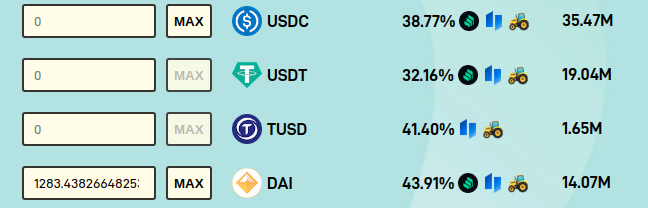

Harvest+Idle: Boosted Stablecoin Farming

Idle Finance has been offering yield optimization for stablecoins for months but this week they drew a lot of attention with the launch of the IDLE liquidity mining, as it offers an additional layer of return on top of their usual. In a few days, the total value of assets locked on the platform skyrocketed:

Idle just exceeded $100 millions in assets under management!

Just ~1.5 years after @Consensys hackathon and several @Quantstamp audits, this major milestone pushes Idle into the TOP20 #DeFi protocol for TVL 📈

That's a +4900% increase of TVL in just two weeks 🤯 pic.twitter.com/CTQrEtvkC4— idle (@idlefinance) December 10, 2020

Harvest Finance was quick to react and offer new USDC, USDT, DAI, and TUSD Idle-powered vaults delivering an attractive APR:

Update on last week’s picks

Last week, we looked at a few interesting DeFi projects: how are they doing?

- Alpha Homora is still delivering around ~10% APY on ETH.

- & Rari Capital around 40%, paid in RGT. The Rari Team announced that they will be moving to Melon protocol.

- Badger still offers attractive APY on its Bitcoin vaults and is about to launch DIGG next week!

- Basis Cash went through its first expansion phase, read more about it in the parting words.

🤗 If you find value in my work, feel free to support it through the Gitcoin grants.

Parting Words: Looking at algorithmic stablecoins

To conclude this week’s pick, I’d like to draw your attention not to a project in particular, but more broadly to a subset of the space. Stablecoins are everywhere in DeFi nowadays, despite none of the currently available ones being sufficiently trustless, even DAI (backed at ~60% by trusted collaterals like USDC or wBTC - daistats).

Recently, there have been some interesting developments in this space with the arrival of the next generation of algorithmic stablecoins, harnessing mechanisms similar to Ampleforth to deliver a token more closely tied to its dollar peg and yet more scalable.

Warning

Tokens with rebase mechanisms are highly asymmetric opportunities. Seems crazy, but I’ll write this here just in case: It’s generally a bad idea to buy a stablecoin over a dollar. When investing in such projects, timing is everything.

For a balanced introduction to the topic, Derebit’s piece is an absolute must-read as it provides a comprehensive overview of the algorithmic stablecoins experiment to date:

👉 Stability, Elasticity, and Reflexivity: A Deep Dive into Algorithmic Stablecoins

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK