China Smartphone Sales Underwent the Highest YoY Decline in Q1 2020, But 5G Smar...

source link: https://www.counterpointresearch.com/china-smartphone-sales-underwent-highest-yoy-decline-q1-2020-5g-smartphone-sales-grew-120-sequentially/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

China Smartphone Sales Underwent the Highest YoY Decline in Q1 2020, But 5G Smartphone Sales Grew by 120% Sequentially

- China’s Smartphone sales fell by 22% YoY (Year-on-Year) in Q1 2020.

- Except for Huawei, all major OEMs underwent YoY decline.

- However,5G smartphone sales grew sequentially by about 120%. 5G smartphones now capture over 15% of the total smartphone sales.

Beijing, Hong Kong, Taipei, Seoul, San Diego, Buenos Aires, London, New Delhi

– Apr 29th, 2020

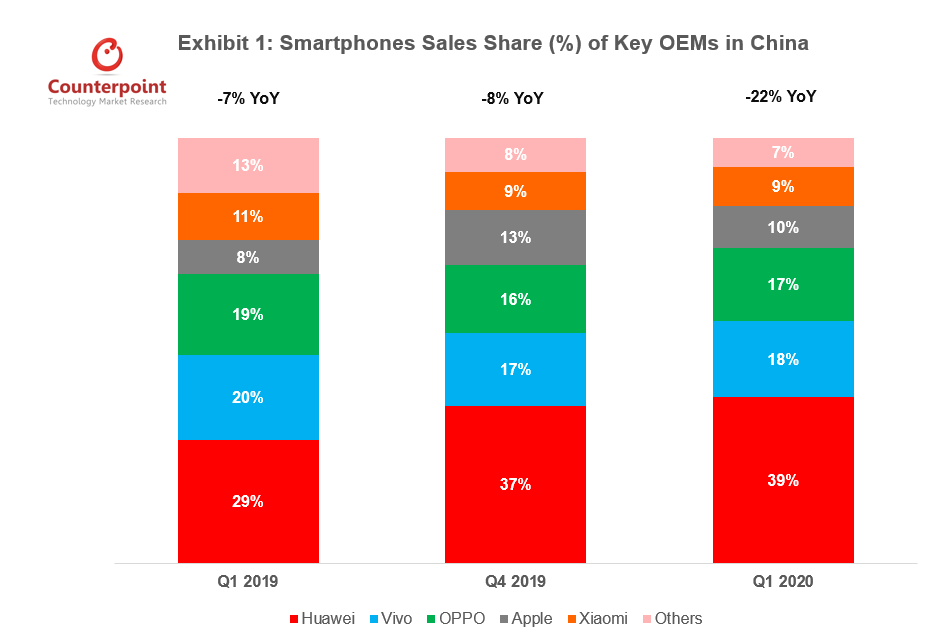

Smartphone sales in China fell by 22% YoY and 24% QoQ in Q1 2020 due to the impact of COVID-19 Pandemic, according to the latest research from Counterpoint’s Market Pulse—Monthly Smartphone Sales Tracking service. The top five OEMs HOVX (Huawei, OPPO, Vivo, Xiaomi) and Apple accounted for a record 93% of the market, up by 6 percentage points compared to last year. The market share of the leading OEM, Huawei, rose to near 40% during the COVID-19 crisis. Huawei was the only smartphone player that achieved positive YoY growth even amid the COVID-19 pandemic.

Source: Counterpoint Research Market Pulse Service Mar 2020

(Note: Huawei includes HONOR, Vivo includes IQOO, Xiaomi includes Redmi, OPPO excludes realme)

Commenting on the overall Chinese smartphone market, Flora Tang, Research Analyst at Counterpoint Research, said, “The drastic fall in Q1 China market was primarily dragged down by the dismal sales of smartphones in February (-35% YoY), when the country was severely impacted by the COVID-19 pandemic and commerce activities were minimal. However, during the lockdown period in China, local e-Commerce giants such as Alibaba and JD.com managed to sustain efficient business operations and delivery services in major Chinese cities outside of Hubei province. For the strong support from these e-Commerce players, China’s smartphone sales appeared less negative than our original expectation. We also estimate that the online share of smartphone sales in China surged to over 50% during Q1, from about 30% in 2019, though the share is likely to drop in Q2 after the pandemic is largely contained.”

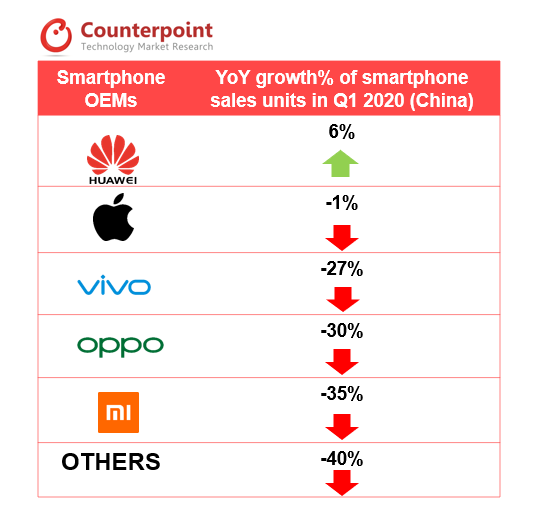

About the competitive landscape of smartphone OEMs during the crisis, Ethan Qi, Senior Analyst at Counterpoint, commented, “Apple and Huawei group, managed to increase market share from the same period last year, clearly out-performing the overall market in Q1 2020. Huawei smartphone sales achieved 6% YoY growth and sales of iPhones mildly dropped by 1% only, while their counterparts suffered plummeting sales with double-digit declines. iPhone 11 was the best-selling smartphone model in Q1; it has topped China’s best-selling models list for 7 consecutive months. Consumers continued to purchase iPhones from e-commerce platforms despite the shutdown of Apple stores across China during February. As for the Huawei group, it continued to lead and gained share with a complete product portfolio covering the entry-level to premium segments. Huawei Mate 30 5G, Mate 30 Pro 5G, Huawei Nova 6 5G, and HONOR 9X were all among the top-selling models list during the quarter.”

Exhibit 2: YoY growth of smartphone sales units in Q1 2020 by OEMs

Source: Counterpoint Research Market Pulse Service Mar 2020

Talking about the development of 5G smartphones in China, Research Analyst, Mengmeng Zheng, highlighted, “We’ve closely tracked the global 5G market and found that within 6 months after commercialization of 5G in China, the penetration of 5G smartphone sales jumped to over 15% in Q1 2020. Sales units of 5G smartphones grew by nearly 120% QoQ. The dominance of Huawei in China’s 5G smartphone market was more evident— it contributed to over half of the total 5G phone sales in Q1, followed by Vivo, OPPO, and Xiaomi. By Q1 2020, various vendors had launched the sub-US$400 5G smartphones in China, such as Vivo Z6 5G, Xiaomi K30 5G, realme X50 5G, and ZTE AXON 11 5G. For the aggressiveness of Chinese OEMs to grow the penetration of 5G phones to lower-tier price bands, we expect 5G smartphones to rise to account for over 40% of total smartphone sales in China by the end of 2020.”

The comprehensive and in-depth Q1 2020 Mobile Phone Market Analysis is available for subscribing clients. Please feel free to contact us at [email protected] for further questions regarding our latest research, insights, or press inquiries.

Analyst Contacts:

Flora Tang

Mengmeng Zhang

Ethan Qi

Press Inquiry

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK