Bud Light sales decline sends ABInBev shares sliding

source link: https://finance.yahoo.com/news/bud-light-sales-decline-sends-abinbev-shares-sliding-195946845.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Bud Light sales decline sends ABInBev shares sliding

quarterly earnings

Bud Light sales declines are accelerating, and shares of parent company Anheuser-Busch InBev (BUD) are falling alongside them.

New data from Nielsen revealed Bud Light sales declined 24.3% year-over-year in the week ending May 20 while Budweiser sales were down 20.4% during the same period. Last week sales were down 21.6% and 17.6% respectively. Driven by backlash from an advertising campaign with transgender influencer Dylan Mulvaney, Bud Light sales have now declined for six weeks, per Nielsen.

Shares of AbInBev fell nearly 5% on Tuesday, the worst intraday action on the stock since Mulvaney's post on April 1. Since the day of the post, ABInBev shares have fallen roughly 18%.

Citi analyst Simon Hales argues the drop in Budweiser sales could provide a buying opportunity for investors.

"There continues to be contagion to the wider ABInBev brand portfolio, with Budweiser, Busch and Michelob all weak again," Hales wrote in a note on Tuesday. "Meanwhile, Coors Light continue to see share gains accelerate. The latest data shows little sign that consumers are moving on from the Bud Light controversy, and we expect these issues will continue to weigh on investor sentiment. Nevertheless, we believe the pullback creates an interesting entry point for longer-term investors."

Citi expects the declining Bud Light sales to "continue to dominate news flow and weigh on short-term investor sentiment." But the firm believes AbInBev shares are oversold when considering the current declines in the context of AbInBev's overall business.

AbInBev echoed as much in early May when the company issued full-year EBITDA guidance in line with previously stated business goals.

On a call with investors following the release on May 4, AbInBev CEO Michel Dimitrios Doukeris didn't sound any alarms about the controversy's impact.

"With respect to the current situation and the impact of Bud Light sales, it is too early to have a full view," Doukeris said. "The Bud Light volume decline in the US over the first 3 weeks of April, as publicly reported, would represent around 1% of our overall global volumes for that period."

CBS MoneyWatch

CBS MoneyWatchMany Americans face "hunger crisis" as food insecurity rises

With pandemic aid ending earlier this year, some food-stamp recipients are skipping meals or watering down baby formula.

14h ago Engadget

EngadgetRansomware attack exposes sensitive data for nearly 9 million dental patients

A ransomware attack has compromised a dental insurance company, exposing sensitive data for almost 9 million patients.

10h ago Engadget

EngadgetAmazon will pay $25 million to settle FTC lawsuit over Alexa privacy for kids

Amazon has agreed to pay $25 million to settle FTC claims it violated kids' privacy rights with Alexa.

7h ago Barrons.com

Barrons.comThe Case For Buying BUD Stock After Its Bud Light-Induced Tumble

Nielson data through May 20 shows that Bud Light volume declines are continuing to accelerate, slumping 27.2%, compared with a 25% fall the prior week.

10h ago Bloomberg

BloombergTrump Stays Quiet on McCarthy's Debt Deal as Other 2024 GOP Contenders Trash It

(Bloomberg) -- Republican presidential contenders are lining up against Kevin McCarthy’s compromise on the US debt ceiling, giving a boost to restive conservatives the House speaker is trying to keep in his corner.Most Read from BloombergChina Is Drilling a 10,000-Meter-Deep Hole Into Earth’s CrustS&P 500 Almost Wipes Out Its Monthly Advance: Markets WrapHedge Funds Are Deploying ChatGPT to Handle All the Grunt WorkTwitter Is Now Worth Just 33% of Elon Musk’s Purchase Price, Fidelity SaysDebt-Li

9h ago The Wall Street Journal

The Wall Street JournalNot Just Bud Light: Culture Wars Hit Other Anheuser-Busch Beers

A consumer backlash [to Bud Light beer](https://www.wsj.com/articles/bud-light-boycott-sales-dylan-mulvaney-6c23bb86) has spread to other Anheuser-Busch beers, according to a Bank of America report, further dragging down shares that have been sliding since the start of May.

12h ago Fortune

FortuneNvidia’s CEO just gave a graduation speech about the future of work and said that A.I. won’t steal jobs but ‘someone who’s an expert with A.I. will’

Nvidia CEO Jensen Huang urged businesses and workers to take advantage of A.I. to “supercharge” their performance.

8h ago Bloomberg

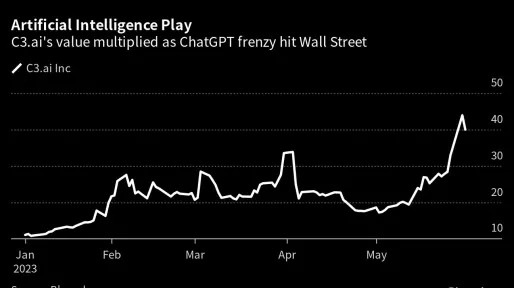

BloombergC3.ai Tumbles on Underwhelming Sales Outlook After Rallying on AI Hype

(Bloomberg) -- C3.ai Inc. plunged 20% in extended trading after providing a fiscal-year revenue outlook that fell short of analysts’ estimates, fueling concerns the artificial intelligence software company is not living up to the investor enthusiasm that has seen its stock price more than triple this year.Most Read from BloombergChina Is Drilling a 10,000-Meter-Deep Hole Into Earth’s CrustS&P 500 Almost Wipes Out Its Monthly Advance: Markets WrapHedge Funds Are Deploying ChatGPT to Handle All th

3h ago Barrons.com

Barrons.comTarget Stock Falls for 9th Day After Pride Merch Backlash

Target said on May 24 that it had removed some Pride Month-related offerings and changed its LGBTQ-friendly merchandise assortment after a backlash.

9h ago Bloomberg

BloombergCathie Wood Says Software Stocks Are Next AI Bet After Nvidia

(Bloomberg) -- Cathie Wood said software providers will be the next to ride on the artificial intelligence frenzy driven by Nvidia Corp.Most Read from BloombergWinklevoss Twins Attempt Pivot After Gemini Loses Money and EmployeesTwitter Is Now Worth Just 33% of Elon Musk’s Purchase Price, Fidelity SaysMcCarthy Confident on Debt Vote Despite Hard-Line Ouster ThreatPutin Orders Tighter Defenses After Drone Strikes on MoscowJPMorgan Builds Unit for World’s Richest Families in Wealth Bet“We are look

23h ago Zacks

ZacksHere is What to Know Beyond Why Plug Power, Inc. (PLUG) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Plug Power (PLUG). This makes it worthwhile to examine what the stock has in store.

14h ago TipRanks

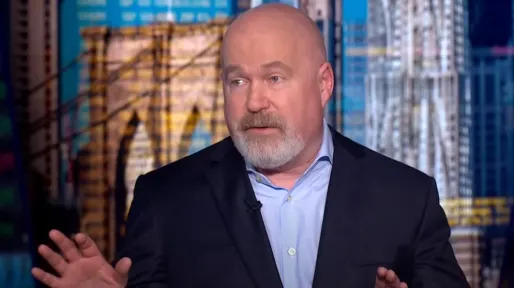

TipRanksBillionaire Cliff Asness Says Recession Is a Pretty Scary Risk, but Has Been Loading Up on These 2 Stocks

Fears of a recession causing havoc to the markets are not reserved solely to the average investor. Even some of Wall Street’s most lauded stock pickers are worried about the implications. Citing an unnerving disconnect between the current positioning of stocks and bonds – essentially, the bond market pricing in a recession while stocks appear to factor in a more optimistic outlook – billionaire Cliff Asness thinks things could get hairy if a recession comes into play. “If inflation stays sticky

6h ago Benzinga

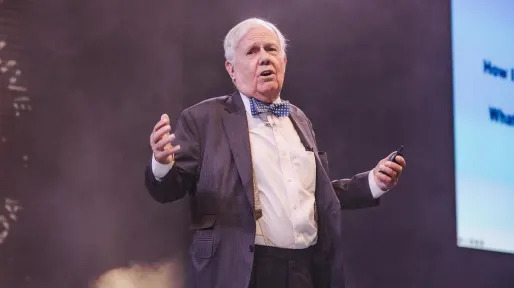

Benzinga'You Should Be Extremely Worried': Jim Rogers Warns That The Next Bear Market Will Be The 'Worst In His Lifetime,' Suggests A Bigger Crash Than 2008. Here's What He Owns Now

Stocks have climbed in 2023 after suffering through a bear market in 2022. But according to legendary investor Jim Rogers, the next downturn could be more painful. In a recent interview with Real Vision, Rogers explained why his outlook is so bleak. “[In] 2008, we had a bear market because of too much debt,” he said. “Look out the window since 2008, debt everywhere has skyrocketed.” And that does not bode well for investors. “It’s a simple statement that the next bear market will be the worst in

7h ago TipRanks

TipRanksInsiders Load Up on These 2 Dividend Stocks With Impressive Yields of 8% or More

Saying ‘insider trading’ conjures up images of smoky back rooms and shady deals, but that’s only for the movies. In real life, insiders refer to corporate officers, such as CEOs, CFOs, COOs, and directors, who are responsible for running their companies profitably. They don’t take trading their own companies’ stocks lightly. While they may sell for various reasons, they only buy when they anticipate a rise in the share price. That makes the insiders’ trading moves one of the surest signs that in

53m ago Benzinga

BenzingaOccidental Petroleum and Warren Buffett: What's Going On

Occidental Petroleum Corp (NYSE: OXY) stock is down Wednesday as Berkshire Hathaway Inc (NYSE: BRK-A) (NYSE: BRK-B) ramps up its stake in the oil company. The Warren Buffett-backed conglomerate owns 24.9% of Occidental Petroleum after buying about $275 million of stock in the energy company recently, Barron's reports. The firm procured 4.66 million shares of Occidental Petroleum on Thursday, Friday, and Tuesday in the open market, bringing its total ownership to 222 million shares worth $13 bill

12h ago Barrons.com

Barrons.comMicrosoft Stock Gets 2 New Price Targets. What’s Behind the Moves.

The first half of the year has been bright for Microsoft —and Wall Street is paying close attention. In January, Microsoft (ticker: MSFT) agreed to expand its investment in OpenAI, the software company behind popular artificial intelligence platform ChatGPT. A month later, Microsoft announced it was bringing ChatGPT to search engine Bing.

10h ago Investopedia

InvestopediaIntel Shares Rise on Upbeat Sales Forecast

Intel was best-performing stock in the DOW after the company said current quarter revenue would be at the high end of its guidance.

7h ago Investor's Business Daily

Investor's Business DailyCrowdStrike Earnings Top Estimates, But Recurring Revenue Metric Disappoints

CrowdStrike reported first-quarter profit and revenue that topped analyst estimates but the company's own sales outlook only edged by views.

5h ago Yahoo Finance

Yahoo FinanceAdvance Auto Parts tanks 35% after slashing guidance and dividend

Advance Auto Parts plunged 35% after cutting the company cut its dividend and slashed its full year guidance.

6h ago Barrons.com

Barrons.comSalesforce Stock Falls Despite Strong Earnings Report

Software giant Salesforce had a blockbuster January quarter. April quarter results weren't quite as impressive.

5h ago Fortune

FortuneGetting rich is ‘surprisingly simple’ if you follow a 3-step strategy, says an expert on self-made wealth

There will always be a limit to how many expenses you can cut. But there’s no limit to how much you can earn.

1d ago Zacks

ZacksTesla (TSLA) Gains As Market Dips: What You Should Know

Tesla (TSLA) closed at $203.93 in the latest trading session, marking a +1.38% move from the prior day.

5h ago Investor's Business Daily

Investor's Business DailyFive Stocks Turn $10,000 To $44,175 In Five Months

May was only a so-so month for most S&P 500 investors. But some investors who hit the tech-stock boom just right this month did really well.

15h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures: House OKs Debt-Limit Bill; Salesforce, AI Stock Lead Earnings Movers

The House OK'd the debt-limit bill. Salesforce and C3.ai stock led earnings movers late. Tesla is set to unveil a new Model 3.

20m ago Barrons.com

Barrons.comOkta Results Easily Beat Estimates. Macro Concerns Send Stock Lower.

The identity management software company posted April quarter results that topped guidance for sales and earnings.

7h ago Zacks

ZacksBroadcom (AVGO) to Report Q2 Earnings: What's in the Cards?

Broadcom's (AVGO) fiscal second-quarter performance is likely to reflect strong networking solutions and broadband solutions.

1d ago American City Business Journals

American City Business JournalsAdvance Auto Parts stock craters on poor earnings, persistent challenges

Advance Auto Parts continues to struggle amid higher costs and inflationary pressures, opening a door for its competitors.

8h ago Investor's Business Daily

Investor's Business DailyBank Stocks Tumble As FDIC Warns Of 'Downside Risks.' Full Fallout From March Panic Unclear.

Bank stocks fell Wednesday after the FDIC chairman said in a quarterly report that "downside risks" remain for the banking industry.

6h ago Investopedia

InvestopediaDow Jones Today: Intel Soars While Index Dives

The Dow Jones Industrial Average fell about 0.4%, or 134 points, ahead of a key vote in the House of Representatives to extend the U.S. debt limit.

5h ago Zacks

Zacks3M Company (MMM) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to 3M (MMM). This makes it worthwhile to examine what the stock has in store.

14h ago Zacks

ZacksNetApp (NTAP) Q4 Earnings and Revenues Surpass Estimates

NetApp (NTAP) delivered earnings and revenue surprises of 14.07% and 2.36%, respectively, for the quarter ended April 2023. Do the numbers hold clues to what lies ahead for the stock?

5h ago SmartAsset

SmartAssetHow You Can Protect My Parents' Assets From Nursing Homes

Long-term care for seniors is one of the biggest gaps in America's safety net. For many of us, as we get older we will require longer and better care. In some cases, this can mean a health aide or other … Continue reading → The post How to Protect Your Parents' Assets From Nursing Homes appeared first on SmartAsset Blog.

2d ago Bloomberg

BloombergSalesforce Gives Forecast for Slowing Sales Growth in Push for Profit

(Bloomberg) -- Salesforce Inc. isn’t growing as fast as it used to while the software company shifts its focus to generating higher profits instead. Investors are concerned.Most Read from BloombergChina Is Drilling a 10,000-Meter-Deep Hole Into Earth’s CrustS&P 500 Almost Wipes Out Its Monthly Advance: Markets WrapHedge Funds Are Deploying ChatGPT to Handle All the Grunt WorkTwitter Is Now Worth Just 33% of Elon Musk’s Purchase Price, Fidelity SaysDebt-Limit Deal Heads to House Vote After Cleari

4h ago Investor's Business Daily

Investor's Business DailyAnalysts Aren't Sweating Over Lululemon Earnings. Here's Why.

Athleisure giant Lululemon reports earnings late Thursday in a mixed season for retailers. Analysts expect international sales to be key.

6h ago Investor's Business Daily

Investor's Business DailyPure Storage Growth Streak Ends With First-Quarter Report, But Shares Jump

Pure Storage beat Wall Street's targets for its fiscal first quarter and guided higher than views for the current period.

5h ago Barrons.com

Barrons.comHow to Play Nvidia Without Buying the Stock

Such is the paradox that now confronts investors after Nvidia recent earnings report inadvertently created a large-scale ethics experiment on Wall Street. On Tuesday, days after Nvidia (ticker: NVDA) stunned investors with a financial forecast that some have said augurs a new Industrial Revolution, AI experts released an ominous warning. Shares of Nvidia, which makes semiconductor chips that are used to power AI, have continued to surge ever higher.

15h ago Zacks

ZacksNordstrom (JWN) Q1 Earnings and Revenues Beat Estimates

Nordstrom (JWN) delivered earnings and revenue surprises of 158.33% and 2.17%, respectively, for the quarter ended April 2023. Do the numbers hold clues to what lies ahead for the stock?

5h ago SmartAsset

SmartAssetAsk an Advisor: I'm 31, Make $80k Per Year and Have About $250k in Assets. Should I Switch to a Roth 401(k)?

My company provides both a traditional and Roth 401(k) option. My question is whether I should contribute to a traditional 401(k), Roth 401(k) or a mix of both. I am 31 years old, single and live in San Francisco. My … Continue reading → The post Ask an Advisor: I'm 31, Make $80k Per Year and Have About $250k in Assets. Should I Switch to a Roth 401(k)? appeared first on SmartAsset Blog.

11h ago Investor's Business Daily

Investor's Business DailySalesforce Delivers On Margin Improvement But Sales Outlook Only Edges By Views

Salesforce reported first-quarter sales and earnings that topped estimates but shares fell as its revenue outlook only edged by views.

5h ago Investor's Business Daily

Investor's Business Daily'Best-In-Class' EV Charging Stock ChargePoint Has Earnings Due

Bank of America analysts see line of sight to profitability. ChargePoint earnings Thursday follow Tesla-Ford EV charging pact.

6h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK