Why more young Americans falling behind on auto loan payments

source link: https://finance.yahoo.com/news/no-wiggle-room-why-more-young-americans-are-falling-behind-on-auto-loan-payments-171330466.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

'No wiggle room': Why more young Americans are falling behind on auto loan payments

but they're still pretty

More young Americans are late paying their car loans – approaching levels not seen since the Great Recession, according to a report from the New York Fed.

In the last quarter, 4.6% of borrowers under 30 transitioned into serious delinquency – meaning they were at least 90 days overdue on an auto loan payment. This figure is up from a year ago and is the highest percentage since the tail end of the Great Recession in 2009, when it was 4.7%.

Across all ages, the number of new auto loans and leases totaled $162 billion last quarter, down from last year, but an increase from the volume before the pandemic. Of all borrowers, 2.3% were at least 90 days overdue on making their auto loan payments.

The highest rate of serious delinquency was observed among younger Americans. Torsten Sløk, the chief economist at Apollo Global Management, told Yahoo Finance that this age group was struggling because they are “more vulnerable” to the ongoing macroeconomic trends. (Apollo is the owner of Yahoo.)

For example, Sløk said, the Fed's interest rate hikes are presenting a challenge. Because younger Americans have comparatively less savings than older borrowers, they are less prepared to afford the additional costs incurred by the higher rates. Americans are paying around $50 to $60 more per month on new car loans this year because of the higher interest rates alone, according to Ivan Drury, the senior manager of insights at Edmunds.

Drury said that the financial outlook for car financing will only worsen if the Fed hikes interest rates again at its June 14 meeting.

The Fed has been increasing interest rates in an effort by the Fed to cool down inflation. That's contributed to new car prices sitting at record highs at the end of last year. Bankrate.com’s chief financial analyst Greg McBride said that Americans do not have the cash on hand to afford those rising car costs up front, so their average loan payments are getting higher – and less affordable.

Yahoo Finance

Yahoo FinanceTransportation Secretary Pete Buttigieg: Railroad safety is still a big concern

The country's major railroads need to put more priority on safety, says US Transportation Secretary Pete Buttigieg.

7h ago Engadget

EngadgetAmazon will pay $25 million to settle FTC lawsuit over Alexa privacy for kids

Amazon has agreed to pay $25 million to settle FTC claims it violated kids' privacy rights with Alexa.

7h ago Reuters

ReutersREFILE-US special counsel probes Trump firing of then-top cybersecurity official -NYT

A U.S. special counsel investigating former President Donald Trump and efforts to overturn his 2020 election loss are examining his firing of a cybersecurity official whose office said the vote was secure, the New York Times said on Wednesday. Special Counsel Jack Smith, who is also probing Trump's handling of classified documents, has subpoenaed former Trump White House staff as well as interviewed Christopher Krebs, who oversaw the Cybersecurity and Infrastructure Security Agency under Trump, the Times said, citing unnamed sources familiar with the matter. Trump fired Krebs in November 2020, days after the CISA issued a statement calling the Nov. 3, 2020, election "the most secure in American history" at a time of the then-president's unsupported accusations the vote had been rigged.

12h ago Bloomberg

BloombergTrump Stays Quiet on McCarthy's Debt Deal as Other 2024 GOP Contenders Trash It

(Bloomberg) -- Republican presidential contenders are lining up against Kevin McCarthy’s compromise on the US debt ceiling, giving a boost to restive conservatives the House speaker is trying to keep in his corner.Most Read from BloombergChina Is Drilling a 10,000-Meter-Deep Hole Into Earth’s CrustS&P 500 Almost Wipes Out Its Monthly Advance: Markets WrapHedge Funds Are Deploying ChatGPT to Handle All the Grunt WorkTwitter Is Now Worth Just 33% of Elon Musk’s Purchase Price, Fidelity SaysDebt-Li

9h ago Business Insider

Business InsiderReal estate investors are retreating from the housing market at a record pace

Home purchases by investors fell 48.6% in the first quarter from a year ago, the largest annual decline on record, Redfin said.

4h ago 2d ago

2d ago Fortune

FortuneNvidia’s CEO just gave a graduation speech about the future of work and said that A.I. won’t steal jobs but ‘someone who’s an expert with A.I. will’

Nvidia CEO Jensen Huang urged businesses and workers to take advantage of A.I. to “supercharge” their performance.

8h ago Benzinga

Benzinga'You Should Be Extremely Worried': Jim Rogers Warns That The Next Bear Market Will Be The 'Worst In His Lifetime,' Suggests A Bigger Crash Than 2008. Here's What He Owns Now

Stocks have climbed in 2023 after suffering through a bear market in 2022. But according to legendary investor Jim Rogers, the next downturn could be more painful. In a recent interview with Real Vision, Rogers explained why his outlook is so bleak. “[In] 2008, we had a bear market because of too much debt,” he said. “Look out the window since 2008, debt everywhere has skyrocketed.” And that does not bode well for investors. “It’s a simple statement that the next bear market will be the worst in

7h ago Business Insider

Business InsiderElon Musk rang the alarm on house prices and commercial real estate this week. Here's why he's worried about a property disaster.

Elon Musk expects residential and commercial property values to slide as higher interest rates, recession fears, and tighter lending take their toll.

6h ago Business Insider

Business InsiderMeet the average American millennial, who's a parent and homeowner with a net worth of $128,000 and hoping for student-debt relief

Millennials may no longer be the economic victims of years past. While they're making up lost ground, three major hurdles still stand in their way.

21h ago Business Insider

Business InsiderA 24-year-old stock trader who made over $8 million in 2 years shares the 4 indicators he uses as his guides to buy and sell

He sticks to these four indicators regardless of his strategy. His versatile approach has allowed him to remain profitable in different markets.

2d ago Bloomberg

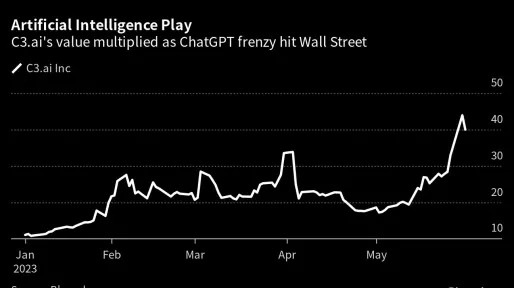

BloombergC3.ai Tumbles on Underwhelming Sales Outlook After Rallying on AI Hype

(Bloomberg) -- C3.ai Inc. plunged 20% in extended trading after providing a fiscal-year revenue outlook that fell short of analysts’ estimates, fueling concerns the artificial intelligence software company is not living up to the investor enthusiasm that has seen its stock price more than triple this year.Most Read from BloombergChina Is Drilling a 10,000-Meter-Deep Hole Into Earth’s CrustS&P 500 Almost Wipes Out Its Monthly Advance: Markets WrapHedge Funds Are Deploying ChatGPT to Handle All th

3h ago Barrons.com

Barrons.comTarget Stock Falls for 9th Day After Pride Merch Backlash

Target said on May 24 that it had removed some Pride Month-related offerings and changed its LGBTQ-friendly merchandise assortment after a backlash.

9h ago Bloomberg

BloombergCathie Wood Says Software Stocks Are Next AI Bet After Nvidia

(Bloomberg) -- Cathie Wood said software providers will be the next to ride on the artificial intelligence frenzy driven by Nvidia Corp.Most Read from BloombergWinklevoss Twins Attempt Pivot After Gemini Loses Money and EmployeesTwitter Is Now Worth Just 33% of Elon Musk’s Purchase Price, Fidelity SaysMcCarthy Confident on Debt Vote Despite Hard-Line Ouster ThreatPutin Orders Tighter Defenses After Drone Strikes on MoscowJPMorgan Builds Unit for World’s Richest Families in Wealth Bet“We are look

23h ago Benzinga

BenzingaTesla Just Made This Unknown Family $1.2 Billion

A single deal with Elon Musk's Tesla Inc. propelled a little-known family to a staggering $1.2 billion fortune. Don’t Miss: Thanks to changes in federal law, anyone can invest in EV startups L&F Co. Ltd., a South Korean company that produces high-nickel cathodes for electric vehicle batteries, received a $2.9 billion order from the electric car maker, causing its share price to soar 82% in the past year. As a result, the listed holdings of Hur Jae-hong and his family, the owners of L&F, have sur

11h ago TipRanks

TipRanksInsiders Load Up on These 2 Dividend Stocks With Impressive Yields of 8% or More

Saying ‘insider trading’ conjures up images of smoky back rooms and shady deals, but that’s only for the movies. In real life, insiders refer to corporate officers, such as CEOs, CFOs, COOs, and directors, who are responsible for running their companies profitably. They don’t take trading their own companies’ stocks lightly. While they may sell for various reasons, they only buy when they anticipate a rise in the share price. That makes the insiders’ trading moves one of the surest signs that in

52m ago SmartAsset

SmartAssetHow You Can Protect My Parents' Assets From Nursing Homes

Long-term care for seniors is one of the biggest gaps in America's safety net. For many of us, as we get older we will require longer and better care. In some cases, this can mean a health aide or other … Continue reading → The post How to Protect Your Parents' Assets From Nursing Homes appeared first on SmartAsset Blog.

2d ago Barrons.com

Barrons.comMicrosoft Stock Gets 2 New Price Targets. What’s Behind the Moves.

The first half of the year has been bright for Microsoft —and Wall Street is paying close attention. In January, Microsoft (ticker: MSFT) agreed to expand its investment in OpenAI, the software company behind popular artificial intelligence platform ChatGPT. A month later, Microsoft announced it was bringing ChatGPT to search engine Bing.

10h ago Investor's Business Daily

Investor's Business DailyAI Stock Tumbles As C3.ai's Revenue Outlook Misses Estimates

C3.ai issued a full-year fiscal 2024 revenue outlook that missed analyst estimates, sending AI stock tumbling in late trade Wednesday.

5h ago Investopedia

InvestopediaIntel Shares Rise on Upbeat Sales Forecast

Intel was best-performing stock in the DOW after the company said current quarter revenue would be at the high end of its guidance.

7h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK