Nigeria Expects $4.3 Billion Cash to Be Returned to Banks by January 31 2023 – E...

source link: https://bitcoinke.io/2023/01/naira-to-be-returned-to-bank/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Nigeria Expects $4.3 Billion Cash to Be Returned to Banks by January 31 2023 – Extends Deadline to February 10 – BitcoinKE

The Central Bank of Nigeria (CBN) anticipates a minimum of 2 trillion naira ($4.3 billion) to flow back into banks by January 31st when the cut off for exchanging large denomination bills was expected to end. However, the deadline has been extended until February 10 2023 to allow for more collection of the old notes.

Central Bank of Nigeria extends the deadline for the return of old series of 200, 500 and 1000 naira notes from January 31, 2023, to February 10, 2023, to allow for the collection of more old notes…https://t.co/HkT4ES90vK pic.twitter.com/hrdS4bJqbe

— Central Bank of Nigeria (@cenbank) January 29, 2023

The deadline follows a CBN direction which required that old notes be exchanged for the new ones by end of January 2023.

According to CBN Governor, Godwin Emefiele, residents have swapped as much as 1.5 trillion naira worth of old notes as of last week. He made the statement to reporters in Abuja on January 24 2022.

“We are hoping that getting to this week, we will move closer to 2 trillion naira,” he told Bloomberg magazine.

In November 2022, Central Bank of Nigeria, for the first time in 19 years, unveiled re-designed notes to replace the previous N1,000, N500 and N200 notes.

President Muhammadu Buhari launches the newly redesigned Naira Notes at the State House, Abuja. pic.twitter.com/LieMvYl87e

— Government of Nigeria (@NigeriaGov) November 23, 2022

According to Governor Emefiele, Nigeria’s cash in circulation has more than doubled since 2015 to 3.23 trillion naira, which suggests that people are hoarding it, people are keeping vaults in their homes.

“We cannot allow them to be banks in their homes, they don’t have the license to build bank vaults in their homes. They should release that money back to CBN because what they are doing is undermining monetary policy, they are keeping those monies to speculate against a currency, which is making our work more difficult.” Emefiele said.

The Central Bank of Nigeria has allowed citizens in rural areas without bank accounts or limited access to financial services to exchange old notes for up to 10,000 Naira per person without having to open a bank account. The exchange can be done through banks or agents.

CBN is collaborating with 1.4 million agents and lenders to reach citizens nationwide and exchange old notes for new ones or open bank accounts. The Governor stated that using representatives to reach rural areas eliminates the need for an extension of the deadline.

Emefiele warned that those who do not exchange their old notes by January 31 2022 will be left with ‘useless’ cash.

__________________________________

Follow us on Twitter for latest posts and updates

Join and interact with our Telegram community

__________________________________

__________________________________

The National Bank of Angola has cut its benchmark interest rate by 150 basis point to 18% down from 19.5% as inflation dropped again in December 2022.

The central bank Governor, José Massano, said the bank made the decision to cut the interest rate after inflation last month came in below the central bank’s forecast.

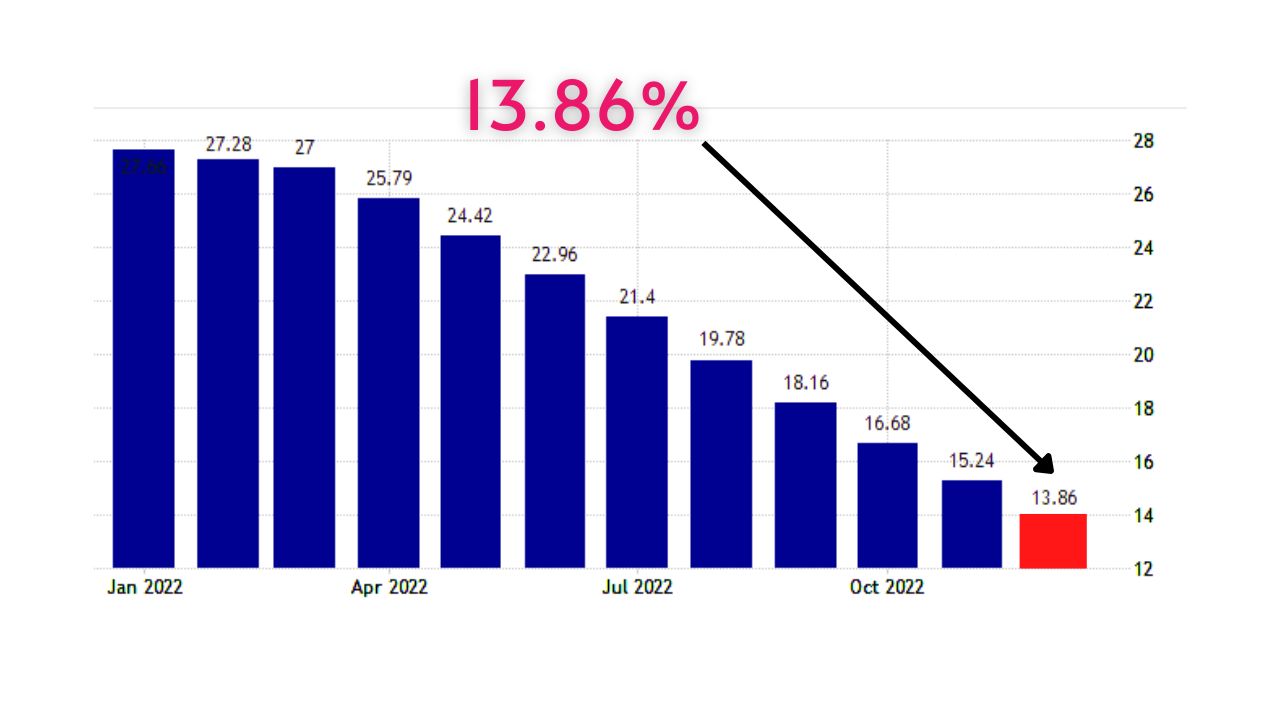

According to data from the country’s national institute, the annual inflation rate was 13.86% in December 2022, from as high as 27.66% in January with inflation dropping for 11 consecutive months in the oil rich nation.

The December 2022 rate was also the lowest reading since November of 2015 amid a broadly stable local Kwanza currency and as food prices continued to ease on the back of a strong harvest.

On a monthly basis, consumer prices inched up by 0.87%, the most in seven months, after increasing by 0.82% in the prior month.

Massano added that he expects inflation to drop further in 2023 to the 9% – 11% region. He also expects the economy to grow by 3.3% in gross domestic product (GDP) in 2023.

In September 2022, Angola cut its domestic rate by 50 basis points to 19.5% becoming one of the few central banks to be going that direction.

“Today, we have interest rates in Angola above 20%. So those are too high. And if we have room to keep on reducing them, we’ll do it,” Massano said at the time.

The action by the Central Bank of Angola in September 2022 came on the backdrop of the positive inflation data throughout 2022, at a time most African nations were dealing with rising inflation. This performance looks to be sustaining in 2023 while Angola was joined by several nations reporting better inflation numbers in December 2022.

These include:

- Namibia

- Mozambique

- Kenya

- Nigeria

- South Africa

- Uganda

- Ethiopia

- Rwanda

- Tanzania

- Senegal and

all which reported a drop in inflation in December 2022.

____________________________________

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

____________________________________

____________________________________

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK