DeFi Picks #1 - BagderDAO, BasisCash, Rari Capital & AlphaHomora

source link: https://tokenbrice.xyz/posts/2020/defi-picks-1/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

DeFi Picks #1 - BagderDAO, BasisCash, Rari Capital & AlphaHomora

Welcome to the DeFi picks! With this format, I’ll share about the DeFi projects I’m currently looking at and why I think they are interesting. It’s not all shiny and new, we’ll also look at updates and developments from existing projects. I’ll keep this to the point and include resources if you want to learn about one.

BadgerDAO

Badger’s initial vision is to offer something similar to Yearn vaults but focused on tokenized Bitcoin on Ethereum like wBTC, sBTC, or renBTC. For the initial token distribution, tokens were airdropped to actors in the community who took actions on services related to tokenized BTC, got involved in the governance of some projects, or donated on Gitcoin.

With the launch a couple of days ago, Badger is now offering interesting returns on tokenized BTC as well as staking on their own token. There is even a joint vault with Harvest farming both BADGER and FARM.

In the longer term, Badger’s plan is to expand its service offering for BTC on Ethereum, with another token - DIGG, a BTC-pegged elastic supply currency (think AMPL).

You can learn more about Badger on their docs.

BasisCash

Basis was a hyped 2017 algorithmic stablecoin project that ran into legal issues. About three months ago, the Basis Cash team announced that it will harness the initial research to finally deliver on the vision.

Basis Cash works as a token pair:

- BAC, the stablecoin

- BAS, representing a share of the network

BAC was initially distributed to people staking stablecoins. BAS could and can still be earned by providing liquidity to the BAS/DAI pool (low rate) or BAC/DAI pool (higher rate).

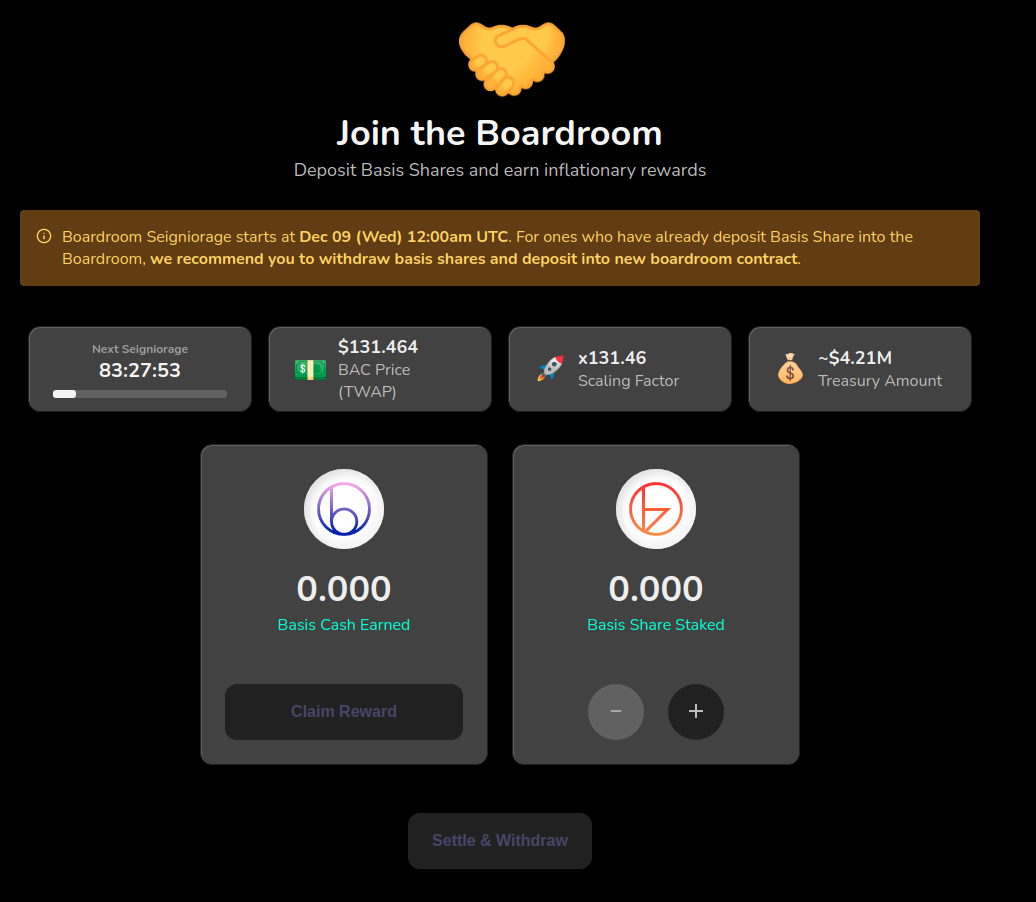

The system is currently not operating, only the token distribution. As it starts (stated for Wed 12/9), the treasury will start producing BAC if its price is superior to the dollar. Holders of BAS can stake them in the boardroom to earn most of the BAC produced by the system in this scenario. On top of this, a bond system (BAB) will help to further stabilize BAC.

Feel join the Discord to learn more.

Earning on ETH: Rari & Alpha Homora

More than anything, I’m an ETH bull so I’m always closely monitoring for earning opportunities directly on ETH.

The first one that comes to mind is Rari Capital, still offering an attractive APY (~40% in RGT) on ETH deposits. The program is still ongoing for a couple of weeks and incurs a slight burn if you claim rewards before the end.

If you’d like to skip this extra step through an ERC-20, there are options to earn ETH directly on ETH. One of the most promising ones in my view is Alpha Homora. It provides leverage for users who are looking to farm on Uniswap or SushiSwap. This means that on top of all the ERC-20 tokens involved, the system needs liquidity to get leverage on ETH too.

Which means, finally, that you can deposit ETH on Alpha Homora to fulfill these needs and earn a premium. It’s quite neat, as the ALPHA token is not involved. You simply deposit ETH for ibETH which exchange rates constantly grow against ETH.

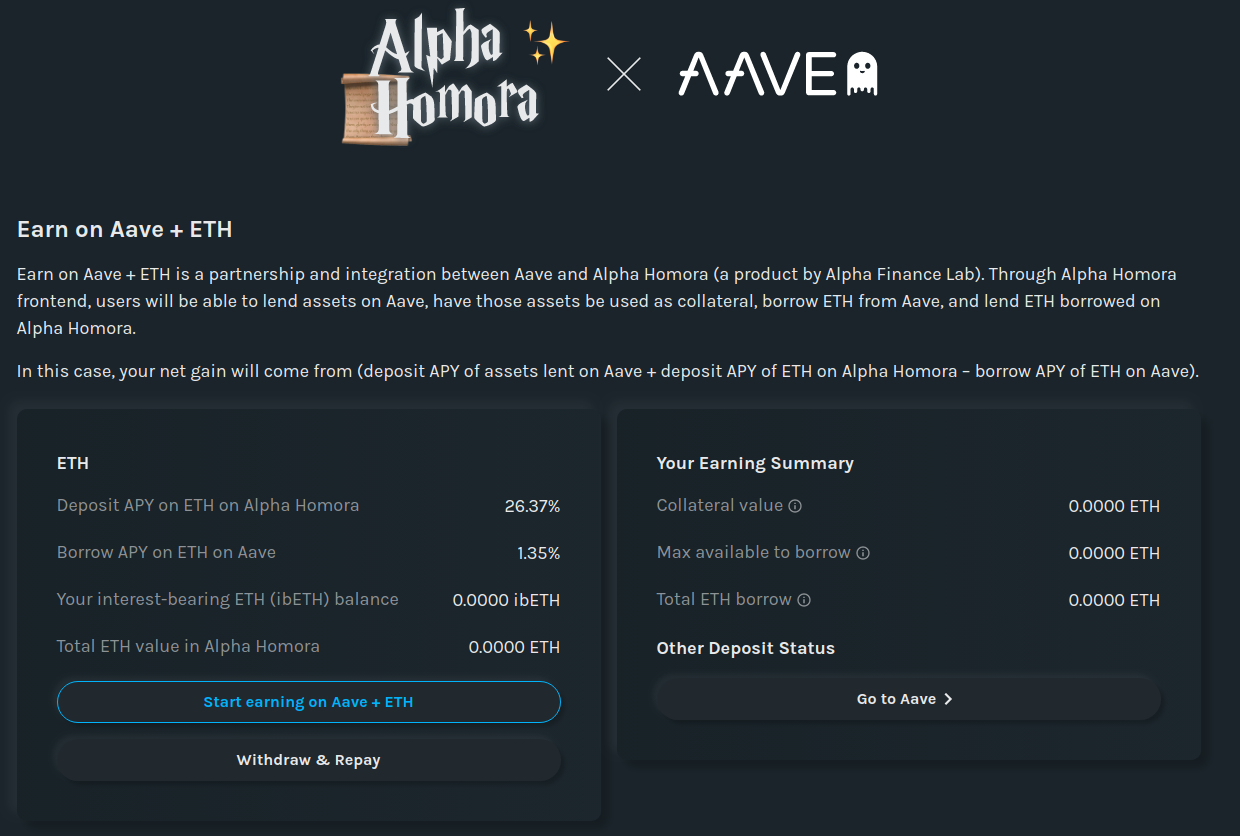

The APY fluctuates heavily, roughly in the 7-20% range. This week, Alpha Homora unveiled a new wrapper on top of ibETH - Earn on Aave + ETH. It enables you to harness the difference between Aave’s ETH’s borrow rate (currently ~1.5%) and Alpha’s Homora’s deposit rate. To do so, you’ll need ERC-20 tokens supported on Aave to use as collateral, such as wBTC or stablecoins.

While we’re on it - Aave just launched the V2. It brings several significant improvements, such as collateral swaps, flash loans upgrades, and quality of life changes like gas optimizations or the ability to directly repay with the collateral. Just like Uniswap, V1 & V2 will cohabit for a bit of time for a smooth transition.

Of course, when it comes to earning on ETH, you could also fulfill your duty and stake for ETH 2.0 for a ~15% APY. Check Ethstaker to learn more about doing it yourself, or check delegated solutions.

PS: It’s Gitcoin Grants season! If you like this blog, you can support it on Gitcoin - 1 DAI can go a long way with the matching!

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK