Nordstrom, Salesforce, CrowdStrike, C3 AI: After-hours movers

source link: https://finance.yahoo.com/video/nordstrom-salesforce-crowdstrike-c3-ai-210742552.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Nordstrom, Salesforce, CrowdStrike, C3 AI: After-hours movers

Nordstrom, Salesforce, CrowdStrike, C3 AI: After-hours movers

Yahoo Finance Live breaks down some of the biggest stock movers in after-hours trading.

-

Nordstrom, Salesforce, CrowdStrike, C3 AI: After-hours movers

-

House set to vote on debt ceiling bill, Dem congresswoman explains how she plans to vote

-

Nvidia's rise: Why retail traders may want to wait to buy

-

College enrollment drops, ESPN's women's sports contracts, Adidas Yeezy sale: Triple Play

-

Intuit CEO: Government's free e-file software not 'a great use of taxpayer money'

-

SoFi's debt deal boost, Advance Auto Parts' plunge, HP earnings: Market check

-

Bitcoin prices fall 7% in May, on pace for first monthly loss of 2023

-

Dimon for president? Hedge fund manager Bill Ackman urges JPMorgan CEO to run

-

AI stocks to buy if you want to play the AI 'supercycle': Strategist

-

Meta shareholder takeaways: Cost-cutting, metaverse, user privacy

-

Economist explains why she sees two more Fed rate hikes ahead

-

Fed's Jefferson, Harker hint at temporary rate pause ahead of June meeting

-

Apple's App Store generated $1.1 trillion in billings, sales in 2022: Study

Yahoo Finance Live breaks down some of the biggest stock movers in after-hours trading.

Video Transcript

- Let's get it right over to Seana Smith for some after hours mover. Seana.

SEANA SMITH: All right. Thanks there, Diane. We're looking at four names up on the board for you. Nordstrom, Salesforce, Crowdstrike, and C3.ai. Kicking off with the gainer here in extended trading, and that is Nordstrom. We're looking at gains of just about 9% here from the retailer. A strong report, beating on both the top and bottom lines, even though they did report a year-over-year decline in some of these major categories here. Sales were off 11% compared to a year ago. Nordstrom Rack did beat. But it was a decline from a year-over-year basis.

Digital sales was also off 17% on a year-over-year basis. But it did come in better than what the Street was bracing itself for. Year to date, we're looking at losses of just about 5%. Over the last year, Nordstrom off 42%. We've talked time and time again about this retailer struggling to regain its momentum, struggling with this turnaround strategy to move the retailer forward. We'll see whether or not the gains in extended trading stick.

Moving on here to Salesforce, another mover in extended trading, that stock off just over 3% right now. The earnings were decent. But the revenue growth outlook, that disappointed the Street. This focus here on a profit, that's a little cause of concern just in terms of what that would mean for future revenue growth. Year to date, we're looking at gains of nearly 70%. When it comes to Salesforce's most recent performance, Q1 did beat on sales and earnings. But we are seeing the stock drop because of that sales outlook. Again, off just about 3%.

Crowdstrike, another mover here, off just around 11 and 1/2%. Full-year profit forecast on the low end of expectations. That's a big driver in after hours action. The company did raise its full-year revenue forecast. They also did beat during the first quarter revenue $692 million. But the guidance once again the driver here.

And C3.ai, a stock that is up 257% year to date. We're looking at losses just about 13% in extended trading here. Taking a look at these numbers, the AI boom clearly really riding that wave here to the upside since the start of the year. When it comes to revenue, that did beat. They also posted a narrower than expected loss. But, again, when you're looking at a return of 257% since the start of the year, you could give back some of those gains. And that's why we're seeing the stock off just about 13%, Diane.

- Yeah. Definitely there was some room for giveback there.

Investor's Business Daily

Investor's Business DailyDow Jones Futures: House OKs Debt-Limit Bill; Salesforce, AI Stock Lead Earnings Movers

The House OK'd the debt-limit bill. Salesforce and C3.ai stock led earnings movers late. Tesla is set to unveil a new Model 3.

15m ago Yahoo Finance

Yahoo FinanceC3.ai stock plummets after Q1 earnings beat expectations

C3.ai posted better than expected fourth quarter earnings on Wednesday, but shares of the company fell more than 12% in after hours trading.

6h ago Investor's Business Daily

Investor's Business DailyCrowdStrike Earnings Top Estimates, But Recurring Revenue Metric Disappoints

CrowdStrike reported first-quarter profit and revenue that topped analyst estimates but the company's own sales outlook only edged by views.

5h ago Yahoo Finance

Yahoo FinanceFord stock pops as analyst cheers move 'back to basics'

As Ford partners with Tesla, Wall Street is growing increasingly bullish on the legacy automaker's position in the EV wars.

1d ago TipRanks

TipRanksWarren Buffett and Goldman Sachs Have One Thing in Common: They Both Like These 3 Stocks

Some people’s exploits in their chosen profession transcend beyond the industry they operate in – making them household names. It’s pretty safe to claim that even those not interested in the investing world are familiar with Warren Buffett. Buffett embodies the term ‘legendary investor’ probably more than any other and considering his decades of almost unrivalled stock picking success, it’s a thoroughly deserved epithet. For those looking to emulate a fraction of Buffett’s success and get ahead

1d ago Zacks

ZacksNordstrom (JWN) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Nordstrom (JWN) give insight into how the company performed in the quarter ended April 2023, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

4h ago Zacks

ZacksC3.ai, Inc. (AI) Reports Q4 Loss, Tops Revenue Estimates

C3.ai, Inc. (AI) delivered earnings and revenue surprises of 23.53% and 0.12%, respectively, for the quarter ended April 2023. Do the numbers hold clues to what lies ahead for the stock?

4h ago Bloomberg

BloombergAI Is Driving Force for Revenue, HPE CEO Says

Revenue for Hewlett Packard Enterprise rose 4% in the second quarter but fell short of analyst estimates. HPE President and CEO Antonio Neri still says it was a strong quarter. He speaks to Bloomberg's Romaine Bostick. Follow Bloomberg for business news & analysis, up-to-the-minute market data, features, profiles and more: http://www.bloomberg.com Connect with us on... Twitter: https://twitter.com/business Facebook: https://www.facebook.com/bloombergbusiness/ Instagram: https://www.instagram.com/quicktake/?hl=en

6h ago Yahoo Finance

Yahoo FinanceFed's Jefferson and Harker suggest central bank will pause in June

Philip Jefferson and Patrick Harker emphasized that a pause in June wouldn't necessarily mean the Fed was done hiking rates.

9h ago Zacks

ZacksCrowdStrike Holdings (CRWD) Surpasses Q1 Earnings and Revenue Estimates

CrowdStrike (CRWD) delivered earnings and revenue surprises of 14% and 2.26%, respectively, for the quarter ended April 2023. Do the numbers hold clues to what lies ahead for the stock?

5h ago Barrons.com

Barrons.comSalesforce Stock Falls Despite Strong Earnings Report

Software giant Salesforce had a blockbuster January quarter. April quarter results weren't quite as impressive.

5h ago American City Business Journals

American City Business JournalsAdvance Auto Parts stock craters on poor earnings, persistent challenges

Advance Auto Parts continues to struggle amid higher costs and inflationary pressures, opening a door for its competitors.

8h ago Barrons.com

Barrons.comThese Stocks Moved the Most Today: Nvidia, Marvell, C3.ai, Palantir, and More

STOCKSTOWATCHTODAY BLOG Stocks were mixed Tuesday after an agreement to extend the U.S. debt ceiling for two years was made over the Memorial Day weekend. Tech stocks—and AI-focused companies, in particular—were once again leading the Nasdaq Composite higher.

1d ago Bloomberg

BloombergPerot Jr Sees Recession for Commercial Real Estate Without Bank Lending

Hillwood Chairman Ross Perot Jr. says commercial real estate developers are having difficulty obtaining construction loans, and warns of a recession for the industry if banks don't start lending again. He speaks on "Bloomberg Markets."

8h ago Investor's Business Daily

Investor's Business DailyBest Dividend Stocks: Stable Cisco Connects Yield With Conservative Investors

Cisco Systems was featured in Income Investor in February as a conservative stock with a plethora of cash and an enviable AA- debt rating. The company said it expects "moderate" revenue growth in the fiscal year ending in July 2024. Cisco has a steady track record of dividend increases, with 11 years in a row of dividend hikes.

5h ago Barrons.com

Barrons.comC3.ai Stock Falls After Earnings Outlook Fails to Justify the Hype

The AI stock tumbled after the company's fiscal year earnings outlook fell shy of Wall Street estimates.

5h ago Reuters

ReutersInvestors relieved after US House votes to suspend debt ceiling; focus turns to Senate

Investors gave a muted welcome to the U.S. House of Representatives passing a bill that would suspend the government's borrowing limit and avert default, with market focus now turning to the Senate and the interest rate outlook. Asian markets were trading higher when the bill cleared the house and held their gains. Investors nudged S&P 500 futures from slightly negative back to flat.

4h ago

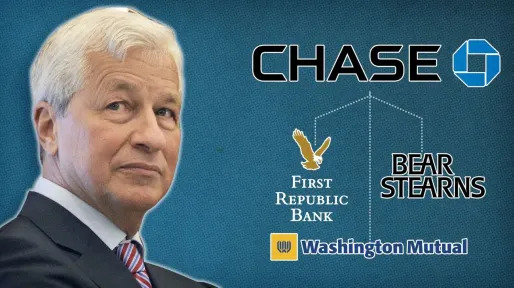

How Jamie Dimon Turned Chase Into the Most Powerful Bank in the U.S.

When JPMorgan Chase bought First Republic Bank in May, all eyes were on its CEO, Jamie Dimon. Here’s how the executive’s strategy for managing risk propelled him to the top of the banking world. Photo illustration: John McColgan

2d ago Business Insider

Business InsiderA 24-year-old stock trader who made over $8 million in 2 years shares the 4 indicators he uses as his guides to buy and sell

He sticks to these four indicators regardless of his strategy. His versatile approach has allowed him to remain profitable in different markets.

2d ago Benzinga

BenzingaBillionaire Charlie Munger Reveals The Reason Berkshire Hathaway Is Sitting On $88 Billion in Cash

The S&P 500 dipped by 19% in 2022, but stocks still don’t seem cheap to Charlie Munger, Warren Buffett’s billionaire partner at Berkshire Hathaway. Don't Miss: Why Jason Calacanis and Other Silicon Valley Elites Are Betting On This Startups Vision For Re-Uniting American Families “In my whole adult life, I have never hoarded cash, waiting for better conditions,” Munger said in an interview in late 2022. “I’ve just invested in the best thing I could find.” Yet he acknowledged that Berkshire Hatha

1d ago Barrons.com

Barrons.comTarget Stock Falls for 9th Day After Pride Merch Backlash

Target said on May 24 that it had removed some Pride Month-related offerings and changed its LGBTQ-friendly merchandise assortment after a backlash.

9h ago Bloomberg

BloombergCathie Wood Says Software Stocks Are Next AI Bet After Nvidia

(Bloomberg) -- Cathie Wood said software providers will be the next to ride on the artificial intelligence frenzy driven by Nvidia Corp.Most Read from BloombergWinklevoss Twins Attempt Pivot After Gemini Loses Money and EmployeesTwitter Is Now Worth Just 33% of Elon Musk’s Purchase Price, Fidelity SaysMcCarthy Confident on Debt Vote Despite Hard-Line Ouster ThreatPutin Orders Tighter Defenses After Drone Strikes on MoscowJPMorgan Builds Unit for World’s Richest Families in Wealth Bet“We are look

23h ago TipRanks

TipRanksInsiders Load Up on These 2 Dividend Stocks With Impressive Yields of 8% or More

Saying ‘insider trading’ conjures up images of smoky back rooms and shady deals, but that’s only for the movies. In real life, insiders refer to corporate officers, such as CEOs, CFOs, COOs, and directors, who are responsible for running their companies profitably. They don’t take trading their own companies’ stocks lightly. While they may sell for various reasons, they only buy when they anticipate a rise in the share price. That makes the insiders’ trading moves one of the surest signs that in

48m ago Fortune

FortuneI got rich in Russia and got out in time, twice. Here’s what I learned about democracy and free markets

Most totalitarian regimes never prosper for more than a generation or two. The parasitic behaviors of such governments eventually drain the economy.

15h ago Investopedia

InvestopediaIntel Shares Rise on Upbeat Sales Forecast

Intel was best-performing stock in the DOW after the company said current quarter revenue would be at the high end of its guidance.

7h ago Business Insider

Business InsiderMeet the average American millennial, who's a parent and homeowner with a net worth of $128,000 and hoping for student-debt relief

Millennials may no longer be the economic victims of years past. While they're making up lost ground, three major hurdles still stand in their way.

21h ago Fortune

FortuneGetting rich is ‘surprisingly simple’ if you follow a 3-step strategy, says an expert on self-made wealth

There will always be a limit to how many expenses you can cut. But there’s no limit to how much you can earn.

1d ago Zacks

ZacksTesla (TSLA) Gains As Market Dips: What You Should Know

Tesla (TSLA) closed at $203.93 in the latest trading session, marking a +1.38% move from the prior day.

5h ago Investor's Business Daily

Investor's Business DailyFive Stocks Turn $10,000 To $44,175 In Five Months

May was only a so-so month for most S&P 500 investors. But some investors who hit the tech-stock boom just right this month did really well.

15h ago Business Insider

Business InsiderPrepare for more stock-market jitters after the debt-ceiling deal, Morgan Stanley warns

The S&P 500 plunged 12% in three weeks when the US government narrowly avoided defaulting on its debt repayments in 2011.

1d ago Zacks

ZacksNetApp (NTAP) Reports Q4 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for NetApp (NTAP) give a sense of how the business performed in the quarter ended April 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

4h ago Barrons.com

Barrons.comOkta Results Easily Beat Estimates. Macro Concerns Send Stock Lower.

The identity management software company posted April quarter results that topped guidance for sales and earnings.

7h ago Investor's Business Daily

Investor's Business DailyBank Stocks Tumble As FDIC Warns Of 'Downside Risks.' Full Fallout From March Panic Unclear.

Bank stocks fell Wednesday after the FDIC chairman said in a quarterly report that "downside risks" remain for the banking industry.

6h ago Zacks

ZacksInvestors Heavily Search Medical Properties Trust, Inc. (MPW): Here is What You Need to Know

Medical Properties (MPW) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

14h ago Zacks

ZacksRevenue Growth Supports U.S. Bancorp (USB) Amid High Cost

U.S. Bancorp's (USB) organic growth is aided by solid loan and deposit balances. Also, rising NII and inorganic growth moves support revenues. Yet, high costs and loan concentration are headwinds.

10h ago Yahoo Finance

Yahoo FinanceStocks slide as debt ceiling vote looms, jobs data stays hot : Stock market news today

US stocks closed lower Wednesday as investors kept a watchful eye on the prospects for the debt-limit deal in an expected House floor vote later. Meanwhile, strong US jobs data and China’s economic woes pressured global markets.

7h ago Benzinga

BenzingaTesla Just Made This Unknown Family $1.2 Billion

A single deal with Elon Musk's Tesla Inc. propelled a little-known family to a staggering $1.2 billion fortune. Don’t Miss: Thanks to changes in federal law, anyone can invest in EV startups L&F Co. Ltd., a South Korean company that produces high-nickel cathodes for electric vehicle batteries, received a $2.9 billion order from the electric car maker, causing its share price to soar 82% in the past year. As a result, the listed holdings of Hur Jae-hong and his family, the owners of L&F, have sur

11h ago Barrons.com

Barrons.comTesla Stock Cracked $200 Again. Is It Time to Take Profits?

Tesla stock repierced the $200 level, leaving investors to wonder if they should take some profits, double down, or do nothing. A look at the auto maker’s stock charts can help. For starters, Tesla (ticker: TSLA) is a volatile stock.

7h ago Reuters

ReutersDow cuts second-quarter revenue forecast on demand, pricing woes

Dow had previously projected revenue for the ongoing quarter in the range of $11.75 billion to $12.25 billion. At a Bernstein conference, Dow flagged that demand in China continues to be "uneven", and said it witnessed lower-than-expected demand for home appliances and building materials in April. Weaker demand in other sectors affect Dow, which sells its products such as coatings and adhesives to industries ranging from automobiles and food packaging to electronics.

7h ago Business Insider

Business InsiderElon Musk rang the alarm on house prices and commercial real estate this week. Here's why he's worried about a property disaster.

Elon Musk expects residential and commercial property values to slide as higher interest rates, recession fears, and tighter lending take their toll.

6h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK