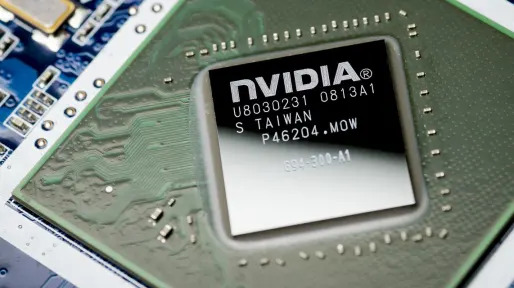

Why Nvidia's boom isn't a bubble

source link: https://finance.yahoo.com/news/why-nvidias-boom-isnt-a-bubble-morning-brief-120022475.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Why Nvidia's boom isn't a bubble: Morning Brief

the way just chips.

This is The Takeaway from today's Morning Brief, which you can receive in your inbox every Monday to Friday by 6:30 a.m. ET along with:

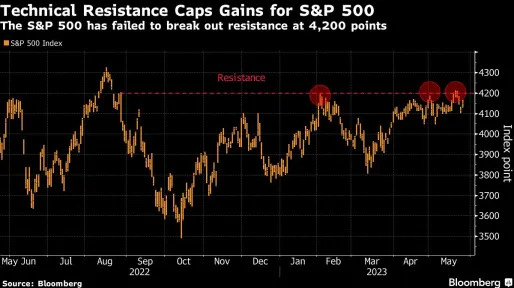

The chart of the day

What we're watching

What we're reading

Economic data releases and earnings

Did you think Yahoo Finance was done covering Nvidia's eye-popping week of stock price gains on the back of a mind-bending earnings call and longer-term outlook?

Well, boy did you think wrong!

The question on my mind today is whether we are witnessing a good ole' fashioned stock price bubble in Nvidia.

I am inclined to say no.

But I am tossing onto the field a ton of caveats for investors who should be careful getting into a stock (or even considering getting into it) that just gained $200 billion plus in market cap in a single trading session.

For perspective, McDonald's ENTIRE market cap is $209 billion!

A stock price bubble could be loosely defined as a situation when the price of a stock completely detaches from reality to the upside. This is often when a sexy investment thesis captivates Wall Street trading desks, sending the stock higher. Then retail investors get excited and buy without doing their fundamental homework.

The bullishness feeds on itself. Until it doesn't.

We've seen countless stock price bubbles over the past 20 plus years.

There was the dot.com bubble when money-losing tech stocks such as Pets.com were artificially propped up on pure hype.

We've had the cannabis stock price bubble of 2020 and early 2021 on hopes of federal legalization bringing big profits to money-losing pot upstarts like Tilray and Canopy Growth.

There was the famous meme stock bubble at height of the pandemic that saw astronomic gains in GameStop, AMC, Bed Bath & Beyond and other fundamentally weak stocks, seemingly overnight.

Artificial intelligence (AI) stocks this year have felt bubblicious many times, especially when you pick apart the fundamentals of the companies being hyped on trading desks, Twitter, and in chat rooms.

Benzinga

BenzingaWarren Buffett Makes Mistakes Too — This One Cost $11 Billion

Even financial gurus like Warren Buffett, CEO of Berkshire Hathaway Inc., are not immune to making mistakes or bad investments. Buffett has acknowledged a costly “mistake” that impacted the conglomerate’s financials. Despite earning $42.5 billion in 2020, Buffett revealed in his annual letter to shareholders that the company had incurred a substantial loss of $11 billion because of an ill-fated acquisition. Don't Miss: Why Jason Calacanis and Other Silicon Valley Elites Are Betting On This Start

18h ago The Wall Street Journal

The Wall Street JournalA Cheaper Way to Bet on AI Than Investing in Nvidia

Nvidia shares jumped after it forecast a revenue tailwind from the artificial-intelligence race, but if you don’t want to shell out for the expensive stock, there are other options.

1d ago Barrons.com

Barrons.comCathie Wood’s Top Fund Missed Nvidia’s Stock Surge. But ARK Made This AI Bet.

Cathie Wood's Ark Innovation ETF sold its Nvidia shares before the majority of the chip maker's stock rally but is backing automation software maker UiPath.

45m ago TipRanks

TipRanks‘We’re Going Up’: Billionaire Steve Cohen Loads Up on These 2 ‘Strong Buy’ Stocks — Here’s Why You Should Follow

The phrase ‘a recession is coming’ has attained a mantra-like quality in recent times, reflecting the prevailing belief that a downturn in the economy is imminent. However, taking a stance in opposition to the doom sayers, billionaire Steve Cohen is keeping an optimistic outlook. “I’m making a prognostication — we’re going up,” Cohen said recently. “I’m actually pretty bullish.” That might be a bold statement to make right now, but it’s not as if Cohen has had no success in taking the fearless r

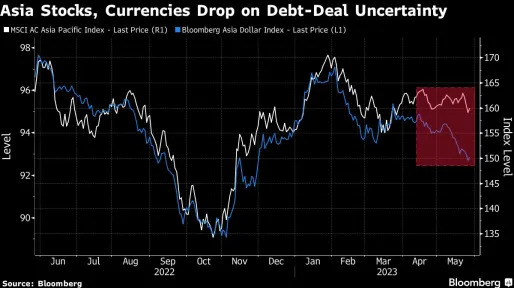

23h ago Bloomberg

BloombergMarket Optimism Over Debt Deal May Pave Way for Monday Selloff

(Bloomberg) -- Markets are largely in the green Friday but strategists warn there’s still a prospect US debt-ceiling negotiations break down over the weekend or result in draconian spending cuts that crimp global economic growth.Most Read from BloombergCathie Wood’s ARKK Dumped Nvidia Stock Before $560 Billion SurgeEmerging US Debt Deal Would Raise Limit, Cap Spending for Two YearsEurope’s Economic Engine Is Breaking DownCredit Suisse Loses Singapore Case Against Georgian Billionaire Ivanishvili

5h ago Barrons.com

Barrons.com2 Stocks to Play the AI Boom, From Nvidia CEO’s Earnings Call Remarks

Nvidia is approaching the trillion-dollar-value club after the chip maker’s latest revenue forecast sent the stock soaring. Investors are now looking for other opportunities to benefit from the AI trend, which has already sparked Nvidia stock’s triple-digit gains this year. Ironically, the best ideas for the potential next big winners might have been mentioned by the CEO of Nvidia himself.

17h ago Zacks

ZacksWhy Is 3M (MMM) Down 5.8% Since Last Earnings Report?

3M (MMM) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

21h ago Fortune

FortuneNvidia stock gained $184 billion in a day, vaulting it far past Tesla. But a top analyst now calls it ‘priced for fantasy.’

David Trainer, founder of investment research firm New Constructs, ran a model showing Nvidia stock is unlikely to reward future investors at this level.

15h ago TipRanks

TipRanks‘More Rate Hikes Are Coming’: Here Are 2 Stocks Goldman Sachs Likes in This Market Environment

The US markets are showing some conflicting signs, making forecasting difficult. The main headwind, inflation, is down – but the labor market is strong, with unemployment falling and wages rising. The Federal Reserve raised interest rates at the fastest rate since the 1980s, bringing them from near-zero to more than 5% in the last 12 months, risking recession to try and keep a cap on prices. But will the Fed’s efforts come to naught? Interest rate increases tend to affect the markets with a lag

12h ago Investopedia

InvestopediaNvidia's Success Will Carry Some Chip Stocks But Not Intel and AMD

Chipmaker Nvidia stunned analysts with its first quarter results which will have a knock-on effect on other stocks such as ASML, TSM and SMCI, but not AMD and Intel.

20h ago Barrons.com

Barrons.comAmazon Was the Rare AI and Cloud Play Left Out of the Nvidia Bump. Here’s Why.

Amazon is the world's largest cloud-computing company. But investors ignored the stock on a day when many other plays were up sharply.

14h ago Barrons.com

Barrons.comU.S. Stock Futures Rise Ahead of Key Inflation Data

U.S. stock futures rose early Friday as investors held tight for updates on the debt ceiling negotiations and awaited the Federal Reserve’s preferred inflation metric. While tech outperformance, following Nvidia’s earnings, largely drove Thursday’s gains on Wall Street, there were also positive signs on the U.S. debt limit. President Joe Biden and House Speaker Kevin McCarthy both said negotiators were making progress Thursday.

1h ago Zacks

ZacksHere's Why You Should Retain CVS Health (CVS) Stock for Now

Investors are optimistic about CVS Health (CVS) on continued growth across the entire range of insured and self-insured medical, pharmacy, dental and behavioral health products and services.

18h ago AP Finance

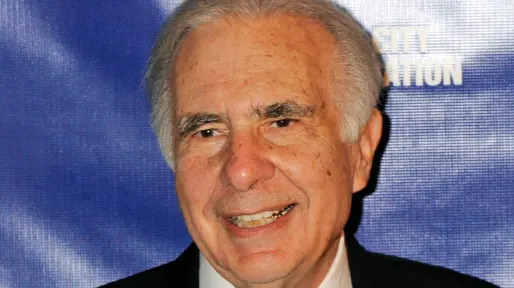

AP FinanceIcahn Enterprises continues to tumble following Hindenburg short report, Bill Ackman's responses

The business empire of corporate raider and activist investor Carl Icahn continues to tumble amid the fallout following a recent report from short-selling firm Hindenburg Research — and losses are accelerating as a longtime rival echoes the firm's allegations. In the report, published on May 2, Hindenburg claimed that Icahn Enterprises has been using inflated asset valuations. Based in Sunny Isles Beach, Florida, Icahn Enterprises has stakes in businesses ranging from food packaging and automotive to real estate and pharmaceuticals.

16h ago Yahoo Finance

Yahoo FinanceQualcomm: Why its stock, along with Nvidia, should get a boost from the AI boom, too

Though the AI boom has massively benefited Nvidia, AI – and generative AI specifically – also marks a major opportunity for other chip companies like Qualcomm, the company's SVP of Product Management Ziad Asghar told Yahoo Finance Live.

16h ago Investor's Business Daily

Investor's Business DailyJust 2 AAA-Rated Companies Remain As U.S. Risks Being A Deadbeat

Lawmakers are playing chicken with the debt ceiling. Luckily there are still two U.S. S&P 500 companies left with AAA credit ratings.

20h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures Rise On Debt-Ceiling Buzz; Nvidia, Chip, AI Plays Soar, But Market Breadth Terrible

The Nasdaq jumped as Nvidia skyrocketed on an AI boom. But market breadth was terrible. Workday was a big winner late.

12m ago Barrons.com

Barrons.comNvidia Stock Surge Is a Warning to Tesla—and Vice Versa

The chip maker's incredible quarter—and share price gain—holds both promise and peril for another stock market darling.

15h ago Bloomberg

BloombergBofA Strategist Warns of Equity Stress as 2023 Flows Turn Flat

(Bloomberg) -- The three-year run of investors pouring cash into stocks has run out of steam, according to a note from Bank of America Corp.Most Read from BloombergCathie Wood’s ARKK Dumped Nvidia Stock Before $560 Billion SurgeEmerging US Debt Deal Would Raise Limit, Cap Spending for Two YearsEurope’s Economic Engine Is Breaking DownCredit Suisse Loses Singapore Case Against Georgian Billionaire IvanishviliJPMorgan Tells 1,000 First Republic Employees They'll Lose Their JobsStrategist Michael H

46m ago Zacks

ZacksUlta (ULTA) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

While the top- and bottom-line numbers for Ulta (ULTA) give a sense of how the business performed in the quarter ended April 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

14h ago Benzinga

BenzingaWhat's Going On With Stratasys Stock Today

Stratasys, Ltd (NASDAQ: SSYS) stock is trading higher Thursday following Nano Dimension Ltd's (NASDAQ: NNDM) unsolicited special tender offer to acquire between 53% and 55% ownership of Stratasys. Nano Dimension proposed to acquire between 53% - 55% ownership of Stratasys for $18.00 per share in cash. Nano Dimension's all-cash special tender offer represents a premium of 26% to Stratasys' closing price of $14.26 as of March 3, 2023. Nano Dimension has been trying to woo Stratasys since at least

20h ago 23h ago

23h ago Investor's Business Daily

Investor's Business DailyMedtronic Slumps On Light Earnings Outlook; Announces $738 Million Buyout

Medtronic beat fiscal fourth-quarter expectations Thursday and announced a buyout, but MDT stock dipped in premarket action.

16h ago Zacks

ZacksIs It Worth Investing in Innovative Industrial Properties (IIPR) Based on Wall Street's Bullish Views?

Based on the average brokerage recommendation (ABR), Innovative Industrial Properties (IIPR) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

2d ago Business Insider

Business InsiderThe 'AI revolution has begun': Here's how Wall Street is reacting to Nvidia's jaw-dropping earnings report that added $199 billion to its market value

"In 22 years of covering tech stocks and large cap we have NEVER seen a guidance range of this magnitude on a large cap tech name," Wedbush said.

13h ago Zacks

ZacksDigital Turbine (APPS) Q4 Earnings Lag, Revenues Fall Y/Y

Digital Turbine's (APPS) fourth-quarter fiscal 2023 results reflect a negative impact of weak advertiser spending across business segments.

18h ago Business Insider

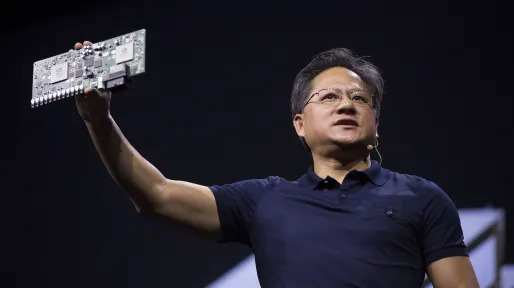

Business InsiderNvidia CEO Jensen Huang just added $7 billion to his net worth after AI frenzy drives the chipmaker's stock to its biggest 1-day market value gain in history

Nvidia co-founder Jensen Huang brought the company public in 1999 at a valuation of $626 million. The stock has since appreciated by 152,766%.

10h ago Bloomberg

BloombergUS Stocks, Bonds Rise on Hopes a Debt Deal Is Near: Markets Wrap

(Bloomberg) -- US equity futures rose and Treasuries advanced on signs that lawmakers are making progress on a deal to raise the debt ceiling. Most Read from BloombergCathie Wood’s ARKK Dumped Nvidia Stock Before $560 Billion SurgeEmerging US Debt Deal Would Raise Limit, Cap Spending for Two YearsEurope’s Economic Engine Is Breaking DownCredit Suisse Loses Singapore Case Against Georgian Billionaire IvanishviliJPMorgan Tells 1,000 First Republic Employees They'll Lose Their JobsContracts on the

52m ago Investopedia

Investopedia5 Things to Know Before Markets Open

The Labor Department will release its latest inflation reading and Ford electric vehicle owners will soon be able to use Tesla charging stations. Here’s what investors need to know today.

57m ago Barrons.com

Barrons.comRivian Is If ‘Google and Toyota Had a Baby.’ That’s Good for the Stock.

Rivian Automotive has hit a rough patch. Wall Street isn’t giving up on the stock, though, and vertical integration is one reason for that. Vertical integration refers to a company owning or participating in all parts of its value chain.

20h ago Zacks

ZacksWhy Is Verizon (VZ) Down 2.8% Since Last Earnings Report?

Verizon (VZ) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

21h ago Barrons.com

Barrons.comNvidia Stock Steady as Market Cap Sits Just Below $1 Trillion

Nvidia stock was largely unmoved in premarket trading after surging 24% to a new all-time high Thursday following its first-quarter earnings. The shares need to rise another 6.5% for Nvidia to become the first $1 trillion semiconductor company. The chip maker’s blowout revenue guidance for the second quarter, amid surging demand for its AI semiconductors, sparked the rally and also lifted other companies exposed to the technology.

3h ago Benzinga

BenzingaGlobal Net Lease Acquires Necessity Retail REIT: What Should Investors Do?

When two public companies merge with each other, the goal is to create one entity that will increase the overall value of both. Often the acquiring company’s stock will decline after the deal is announced, while the target company’s stock price rises. But what happens if both companies have been struggling in recent years? Can the merger of the two strengthen the earnings and revenue of each? Take a look at two real estate investment trusts (REITs) that have just merged after both have traded ne

18h ago Zacks

ZacksMarvell Technology (MRVL) Q1 Earnings and Revenues Top Estimates

Marvell (MRVL) delivered earnings and revenue surprises of 6.90% and 1.60%, respectively, for the quarter ended April 2023. Do the numbers hold clues to what lies ahead for the stock?

15h ago

Fires, Short Sellers and an EV Recall: Inside Lordstown Motors’ Decline

Lordstown Motors was once in the race to build America’s first EV pickup truck. But now – after vehicle fires, short seller reports and recalls – the company has turned to a reverse stock split to try and avoid filing for bankruptcy protection. Illustration: David Fang

17h ago Barrons.com

Barrons.comBiden, McCarthy Close to Deal on Debt Ceiling, According to Report

President Joe Biden and House Speaker Kevin McCarthy are coming close to a deal on the debt ceiling, according to a report from [Reuters](https://www.reuters.com/markets/us/slimmed-down-us-debt-ceiling-deal-takes-shape-sources-2023-05-25/) that cited a person familiar with the matter.

18h ago Zacks

Zacks2 Long-Term Bets for Struggling Semiconductor Industry

There are secular growth drivers in certain segments of the Analog/Mixed Signal Semiconductor industry despite near-term concerns including an economic slowdown. ADI and MCHP are worth keeping an eye on.

19h ago Zacks

ZacksC3.ai, Inc. (AI) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

C3.ai, Inc. (AI) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

2d ago Bloomberg

BloombergSnowflake Plunges by Most Ever as Cloud Spending Wobbles

(Bloomberg) -- Snowflake Inc.’s stock had its worst day ever after the company gave a quarterly sales outlook that fell short of expectations, suggesting that customers have continued trimming their spending for cloud software amid uncertain economic conditions. Most Read from BloombergCathie Wood’s ARKK Dumped Nvidia Stock Before $560 Billion SurgeEmerging US Debt Deal Would Raise Limit, Cap Spending for Two YearsEurope’s Economic Engine Is Breaking DownCredit Suisse Loses Singapore Case Agains

16h ago Zacks

ZacksZscaler (ZS) Reports Next Week: Wall Street Expects Earnings Growth

Zscaler (ZS) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

22h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK