A Wells Fargo customer lost $68,000 after being tricked into making a wire trans...

source link: https://finance.yahoo.com/news/wells-fargo-customer-lost-68-153057933.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A Wells Fargo customer lost $68,000 after being tricked into making a wire transfer by a scammer, report says

A Wells Fargo customer was tricked into sending a scammer $68,000 of his own money.

Marc Beardsley told ABC7 he found that $70,000 had been put in his checking account.

The scammer had managed to transfer money between his savings and checking accounts.

A Wells Fargo customer lost nearly $70,000 after being tricked by a scammer into making a wire transfer, a report says.

ABC7 Eyewitness reported that California man Marc Beardsley was tricked into transferring the money after $70,000 appeared in his checking account.

He said a scammer gained access to his accounts and transferred money from his savings to his checking account.

Beardsley's wife, Rosilyn Nesler, told ABC7 the hacker then called Beardsley and pressured him to "return" the money claiming it had been transferred accidentally.

"He was worried," Nesler told the outlet. "He did not check the savings account to see that it was actually our money ... $70,000 was our money."

The scammer told Beardsley he only had to transfer $68,000 to make up for any trouble caused, leaving him with $2,000.

The couple said they weren't confident they would ever get their money back.

Their son, Tod Beardsley, told ABC7 he was upset that Wells Fargo hadn't queried the unusually large transfer before processing it.

"Anytime you can inject a pause into that process, your chances of not getting scammed go way, way up," he said.

A representative for Wells Fargo told ABC7: "We conducted a comprehensive investigation of this case, and shared the findings with our customer. After a thorough review, we confirmed this matter was handled appropriately by our team."

Wells Fargo didn't immediately respond to a request for comment from Insider.

Read the original article on Business Insider

Business Insider

Business InsiderElon Musk says the pile of dead banks proves more rate hikes will cause a severe recession: 'I may have more real-time global economic data in one head than anyone ever'

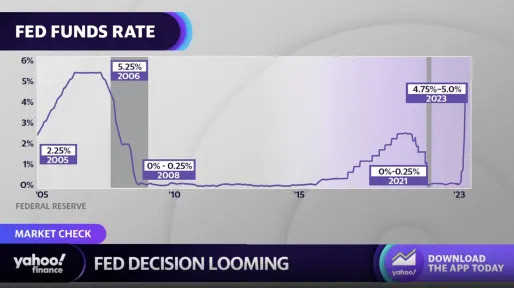

"Further rate hikes will trigger severe recession. Mark my words," Elon Musk said in a tweet on Sunday.

11h ago Business Insider

Business InsiderStocks could soon retest all-time highs as markets react to possible 'thesis-changing' final rate hike from the Fed, Fundstrat says

"This will likely be the last hike of the cycle. This is thesis changing," Fundstrat said, predicting the S&P 500 could notch 4,750 by year-end.

6h ago Fortune

FortuneFauci says the general public ‘somehow’ didn’t get his messaging ‘that the vulnerable are really, really heavily weighted toward the elderly’

“Did we say that the elderly were much more vulnerable? Yes. Did we say it over and over and over again? Yes, yes, yes.”

2d ago Barrons.com

Barrons.comTesla CEO Elon Musk Is Betting the Farm on a Product That Doesn’t Work Yet

Elon Musk believes that making money on selling cars might be secondary to making money on software sales one day. Investors aren't quite convinced yet.

14h ago Business Insider

Business InsiderThe US will suffer a recession – and don't expect the Fed to rescue stocks when that happens, top Macquarie economist says

The US economy is likely headed toward a more severe downturn than the central bank is forecasting, David Doyle told Insider.

2d ago Fortune

FortuneWarren Buffett’s right-hand man Charlie Munger says most money managers are little more than ‘fortune tellers or astrologers’

The 99-year-old Berkshire Hathaway vice chairman told the Financial Times Sunday there’s now a “glut of investment managers that’s bad for the country.”

17h ago Yahoo Finance

Yahoo FinanceThis is now the biggest problem in the housing market

A lack of homes for sale have taken center stage in the housing market, even eclipsing mortgage rates.

15h ago Fortune

FortuneMicrosoft’s Chief Scientific Officer, one of the world’s leading A.I. experts, doesn’t think a 6 month pause will fix A.I.—but has some ideas of how to safeguard it

In a rare interview, Eric Horvitz talks about A.I., humanity, and how the two can coexist.

1d ago Business Insider

Business InsiderDe-dollarization is undeniable, and the debate about the greenback's dominance is heating up. Here's what Elon Musk, Ray Dalio, Chamath Palihapitiya and 7 others are saying.

A number of countries are lining up plans to dethrone the greenback as part of an accelerating de-dollarization trend. Here's what Elon Musk, Ray Dalio, and others are saying.

16h ago Investopedia

InvestopediaWho’s Paying for All These Bank Failures?

With the collapse of First Republic Bank, now the third high-profile bank failure in the U.S. this year, you may be wondering who is on the hook for the government bailouts.

18h ago AP Finance

AP FinanceFDIC recommends raising insured deposit limit for businesses

U.S. businesses might be able to secure bank deposit insurance for accounts holding more than $250,000 if Congress agrees with the Federal Deposit Insurance Corp.'s new proposal to ease the industry turmoil that has sparked three bank failures in the past two months. The FDIC recommended the change Monday, rethinking the decades-old limit and seeking more flexibility to cover higher deposits on a “targeted” basis. Raising the insurance limit for business accounts that pay for company operations such as payroll would shore up accounts that pose the most risk to financial stability, the FDIC said.

17h ago Bankrate

BankrateWhat to expect when your bank fails

Find out if your accounts are protected and when you can get to your money again.

13h ago The Wall Street Journal

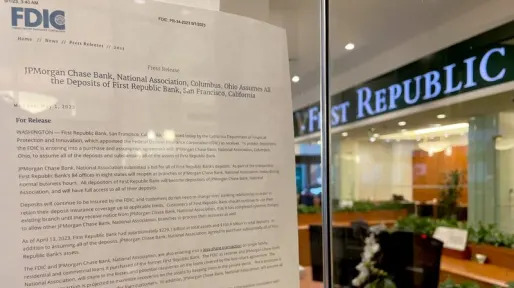

The Wall Street JournalChase Just Bought Your Bank: What First Republic Bank Customers Need to Know

First Republic Bank customers are now JPMorgan Chase & Co. customers after the banks and government officials announced a takeover deal early Monday morning. “You and your assets are now backed by the fortress balance sheet of JPMorgan Chase, and all of your deposits are protected,” JPMorgan told customers in a statement on First Republic’s website Monday. Bank branches opened as normal and accounts were accessible Monday morning.

17h ago Bankrate

BankrateBest brokerage account bonuses in May 2023

Have some extra cash you want to invest? Brokerages are rewarding new clients.

1d ago Bankrate

Bankrate10 best low-risk investments in May 2023

Can’t stand losing money? These play-it-safe investments may be a good fit for you.

1d ago SmartAsset

SmartAssetDo These 3 Things Now to Make the Most of Your IRA

An individual retirement account (IRA) is a very popular way to save for retirement - especially if you don't have access to a workplace retirement account like a 401(k). While there are several important decisions to make when saving with … Continue reading → The post Three Tips to Make the Most of Your IRA appeared first on SmartAsset Blog.

22h ago The Wall Street Journal

The Wall Street JournalWhy First Republic Bank Collapsed

It failed to reckon with the impact of rising interest rates, which sent its strategy of relying on wealthy depositors into reverse.

23h ago The Wall Street Journal

The Wall Street JournalJPMorgan, PNC Submit Bids to Buy First Republic in Government-Led Sale

The Federal Deposit Insurance Corp. is reviewing bids for First Republic Bank and preparing to seize the lender, according to people familiar with the matter, weeks after a $100 billion deposit run shattered its business model. Big banks including JPMorgan Chase & Co. and PNC Financial Services Group submitted offers for the troubled lender earlier Sunday, the people said, and the FDIC went back to the bidders with questions in the evening. The agency is expected to name a winner before First Republic opens Monday morning, the people said.

1d ago Bankrate

BankrateBest cash management accounts in May 2023

As fees decline, brokers and robo-advisors are competing on feature-rich services to differentiate themselves.

1d ago Bankrate

Bankrate8 best short-term investments in May 2023

Here’s where to turn when you’re searching for a safe place to stash cash for the short term.

1d ago AP Finance

AP FinanceIs my money safe? What you need to know about bank failures

Officials announced Monday that they closed San Francisco-based First Republic Bank, making it the third U.S. bank to collapse in the past two months. Most of First Republic’s assets are being acquired by JPMorgan. First Republic had wealthy clients who rarely defaulted on their loans.

23h ago Investopedia

InvestopediaFDIC Floats Proposal of Higher Insurance for Business Bank Accounts

In the future, businesses would be able to bank with little to no fear of losing all their money if their bank fails, if reforms suggested by the Federal Deposit Insurance Corporation become reality.

14h ago The Wall Street Journal

The Wall Street JournalThe Banking Crisis: A Timeline of Key Events Leading to First Republic Bank’s Failure

The failure of First Republic marks the latest fallout from the banking industry turmoil that began in March. The troubles initially arose with Silicon Valley Bank’s collapse, followed shortly after by the seizure of Signature Bank by federal regulators. The bank served startups and their investors, which were burning through cash last year as the Federal Reserve raised interest rates and venture capital dried up.

22h ago SmartAsset

SmartAssetCash in On These Banks' Sign-Up Bonuses Before They Expire

Some banks are offering bonus cash to consumers who open new accounts. These promotions trail the high-profile failure of several banks in March and the Federal Reserve's recent rate increases. New banking promotions may provide valuable incentives to new depositors. … Continue reading → The post Some Banks Are Offering Sign-Up Bonuses to New Clients, But These Perks May Expire Soon appeared first on SmartAsset Blog.

2d ago AP Finance

AP FinanceFirst Republic Bank seized, sold in fire sale to JPMorgan

Regulators seized troubled First Republic Bank early Monday, making it the second-largest bank failure in U.S. history, and promptly sold all of its deposits and most of its assets to JPMorgan Chase in a bid to end the turmoil that has raised questions about the health of the U.S. banking system. The only larger bank failure in U.S. history was Washington Mutual, which collapsed at the height of the 2008 financial crisis and was also taken over by JPMorgan in a similar government-orchestrated deal. “Our government invited us and others to step up, and we did,” said Jamie Dimon, chairman and CEO of JPMorgan Chase.

1d ago Yahoo Finance

Yahoo FinanceFDIC proposes Congress increase deposit insurance limits for payroll accounts

The FDIC on Monday outlined three possibilities for the future of deposit insurance, recommending to Congress new rules tailored to increase insured limits for some business accounts.

17h ago Reuters

ReutersFDIC report to reopen U.S. bank deposit insurance debate

A key U.S. banking regulator is set to publish a comprehensive overview of the federal deposit insurance system on Monday, teeing up fresh debate about whether the government should expand protections on bank deposits - and if so, by how much. The review will be the third report issued in the wake of the collapse of Silicon Valley Bank and Signature Bank in March, when regulators ended up backstopping all deposits - including those above the Federal Deposit Insurance Corp's guarantees of up to $250,000 per person, per bank - in an attempt to prevent contagion to the banking system. Now, the FDIC is planning to lay out policy options for changing the way deposits are guaranteed amidst calls from some lawmakers to raise the cap, or even ditch it altogether, in order to stem outflows from small and regional lenders that were large and lasting in the aftermath of the March bank failures and more recent troubles at First Republic Bank, which was seized by regulators on Monday and sold to JPMorgan Chase & Co.

22h ago Reuters

ReutersFDIC sees merits of increasing backstop for business accounts

A key U.S. banking regulator on Monday laid out a range of options for reforming the federal deposit insurance system and concluded that significantly increasing the backstop for bank accounts used for business purposes was the "most promising." In the wake of March's lightning-fast bank failures, expanding coverage for accounts used to cover payroll, invoices and other large business transactions has emerged as the Federal Deposit Insurance Corp's preferred route for balancing financial stability and depositor protection, relative to its cost. In order to effect any change to the government deposit protection scheme that has largely remained intact since its debut in the Great Depression in the 1930s, Congress would need to write a new statute describing what types of accounts would receive any additional coverage, FDIC officials said during a briefing with reporters.

17h ago Reuters

ReutersU.S. Treasury encouraged by First Republic resolution, says banking system remains sound

WASHINGTON (Reuters) -The U.S. Treasury Department is encouraged that First Republic Bank was resolved with the least cost to the Deposit Insurance Fund, and believes the U.S. banking system remains sound and resilient, a Treasury spokesperson said early Monday. U.S. regulators on Monday seized First Republic, the third major U.S. institution to fail in two months, with JPMorgan Chase & Co agreeing to take $173 billion of the bank's loans, $30 billion of securities and $92 billion of deposits. "Treasury is encouraged that this institution was resolved with the least cost to the Deposit Insurance Fund, and in a manner that protected all depositors," the spokesperson said.

1d ago Investopedia

InvestopediaWhat If You Could Bank With the Federal Reserve?

The government’s response to the Silicon Valley Bank failure has inspired renewed calls by some for the Federal Reserve to offer banking services to individual members of the public.

23h ago Bankrate

BankrateWhat happens when a bank fails?

You may be concerned about your bank in light of recent events. Here’s what you need to know.

20h ago Reuters

ReutersFOREX-Dollar gains before Fed meeting, jobs data

“Many people say the Fed will signal that it’s going to pause, and I don’t think it can afford to do that,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York, adding that “the Fed wants to maintain some optionality and flexibility.” Inflation is seen as possibly keeping the Fed in a tightening cycle if it remains high, assuming that the labor market and other parts of the economy remain solid. "Broadly, the data show that the manufacturing sector is still in a recession, but there are some encouraging signs of stabilization in the details," Thomas Simons, a money market economist at Jefferies, said in a note.

15h ago Bankrate

BankrateFirst bank failure since March a reminder to check your account insurance limits

The government insures bank deposits, but only up to certain limits.

22h ago Barrons.com

Barrons.comBud Light Sales Fall 26% as Transgender Backlash Worsens

Bud Light's sales declines accelerated in the week ended April 22, according to Beer Business Daily

16h ago Investor's Business Daily

Investor's Business DailyFour Stocks Turn $10,000 Into $50,000 In Four Months

April turned out to be great month for most S&P 500 investors. But it was stupendous for those who picked the best stocks.

23h ago TipRanks

TipRanks‘Investment opportunity of a lifetime’: Cathie Wood says the robotaxi market could be worth trillions — here are 3 stocks to invest in it (besides Tesla)

Advances in technology often come loaded with financial opportunities and scanning the one presented by the nascent autonomous driving sector, Cathie Wood thinks there is a huge one at play. The Ark Invest CEO has not been shy about making some bold predictions in the past and thinks investors should not underestimate what’s in store for this up-and-coming industry. “We think that the robotaxi opportunity globally will deliver $8 to $10 trillion in revenue by 2030 and is one of the most importan

21h ago Bloomberg

BloombergRivian’s Troubles Don’t End at a 93% Wipeout

(Bloomberg) -- The relentless erosion in Rivian Automotive Inc.’s share price is revealing an ugly truth: Investors have little faith left in the ability of the Amazon.com Inc.-backed company to compete in a crowded electric-vehicle market.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureRivian’s Troubles Don’t End at a 93% WipeoutBuffett Will Beat the Market as Recession Looms, Investors SayPeak Oil Spells

21h ago Bloomberg

BloombergFirst Republic’s Jumbo Mortgages Brought On Bank’s Failure

(Bloomberg) -- The seeds of First Republic Bank’s downfall were sown in the jumbo mortgages of Silicon Valley, where a unique strategy to loan wealthy individuals extraordinary sums of money blew up in spectacular fashion.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoBuffett Will Beat the Market as Recession Looms, Investors SayMorgan Stanley Plans 3,000 More

17h ago TipRanks

TipRanksInsiders Pour Millions Into These 2 Beaten-Down Stocks — Here’s Why You Might Want to Ride Their Coattails

Whether you’re a seasoned trader or a novice, the oldest piece of advice in economics still holds true: buy low and sell high. The challenge lies in determining the right time to purchase stocks that are undervalued or to sell those that are overpriced. There are plenty of signs to crack that code, but one of the clearest is the insiders’ trading patterns. The insiders are corporate officers, companies’ higher-ups, whose positions put them ‘in the know.’ Therefore, monitoring their trades, espec

1d ago TipRanks

TipRanks3 “Strong Buy” Stocks With Short Squeeze Potential

It might be logical to assume that stocks with heavy short interest – i.e., ones that many investors/traders are essentially betting against – are stocks to stay away from, but that is not always the case. Opinions on the stock market can be varied, and it’s not uncommon to find stocks with both high short interest and positive recommendations from Wall Street analysts. But only one can be right, right? And should the analysts turn out to be the ones to hit the nail on the head, panic-induced sh

10h ago

Recommend

-

6

6

Santa Clara 1962 to 2010: Wells Fargo Last time, we moved down Monroe a bit towards Washington and a SCU building. Just out of frame in...

-

4

4

Java Fullstack Engineers/Senior Engineers (AVP/VP) at Wells Fargo (7 to 12 Yrs) ExperienceWells Fargo is an international financial services firm with over $2.0 trillion in the assets & offices located across 37 countr...

-

6

6

.Net Engineer /Senior Engineer (C#/ASP.NET/WEBAPI/MVC) at Wells Fargo (7 to 12 Yrs) Exp

-

2

2

Well Fargo is looking for senior developer who will be involved in development and design of PEGA apps. Candidate has to serve as the technical consultant to the internal clients & technical management to make sure conformity with the Ent...

-

4

4

Scaling agile at Wells Fargo to deliver value for the customer By Derek du Preez April 12, 2022 Audio mode ...

-

9

9

Home ...

-

2

2

Wells Fargo CIO: AI and machine learning will move financial services industry forward

-

4

4

Home ...

-

5

5

Bakkt to Participate in The Wells Fargo 6th Annual TMT Summit N...

-

2

2

Home ...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK