First Republic stock investors face 'wipe out,' analyst says

source link: https://finance.yahoo.com/news/first-republic-stock-investors-face-wipe-out-analyst-says-190031923.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

First Republic stock investors face 'wipe-out,' analyst says

be just around the corner.

JPMorgan Chase (JPM) purchased First Republic Bank (FRC) in the latest fallout from the collapse of Silicon Valley Bank. While JPMorgan CEO Jamie Dimon said Monday that the "crisis is over," the same can't be said for First Republic investors.

JPMorgan did not assume First Republic’s corporate debt or preferred stock, meaning institutional investors will not be made whole.

NeitherJPMorgan nor the Federal Deposit Insurance Corporation have explicitly said what the purchase means for First Republic common shareholders. Those shareholders are not expected to be made whole either, though, according to the banking equity analyst team at Wedbush Securities.

“We expect a wipe-out of common shareholders following FRC entering receivership and being sold to JPM,” Wedbush Securities equity analyst David J. Chiaverini wrote in a note to clients on Monday.

After entering the banking crisis at $115 per share, First Republic stock stopped trading on the New York Stock Exchange at $3.51 on Monday.

Regulators seized First Republic early Monday morning and sold the majority of the bank’s operations to JPMorgan Chase. JPMorgan Chase acquired $173 billion of loans and $30 billion of securities in the deal. The largest banking failure since the 2008 financial crisis came less than a week after the company revealed deposit losses exceeding $100 billion in the first quarter.

Since FDIC seized the bank, investors would need to file their grievances with the agency, a former FDIC attorney John Popeo told Yahoo Finance.

Stockholders can file a claim with the FDIC to seek payment for their shares via an online portal or mail. But on a new FDIC web page answering questions for those impacted by First Republic's failure, stockholders are listed as the fourth and final group of creditors to be paid out. Depositors, general unsecured creditors and subordinated debt would be paid out first. All of those claims will be paid out after administrative expenses, according to the FDIC.

USA TODAY

USA TODAYGM terminates hundreds of contract workers as it tries to shave $2 billion from its budget

General Motors confirms it cut several hundred contract jobs over the weekend as the company continues to trim costs.

19h ago Quartz

QuartzDisney countersued by Florida board handpicked by DeSantis, slams previous 'puppet government'

The Florida board handpicked by governor Ron DeSantis to exert control over Disney’s district has countersued the company in the latest escalation of a feud originating from a dispute over LGBTQ rights.

2h ago Business Insider

Business InsiderStocks could soon retest all-time highs as markets react to possible 'thesis-changing' final rate hike from the Fed, Fundstrat says

"This will likely be the last hike of the cycle. This is thesis changing," Fundstrat said, predicting the S&P 500 could notch 4,750 by year-end.

6h ago Fortune

FortuneThe skills gap is so big that nearly half of workers will need to retrain this decade. These 10 skills are most in demand

Hint: They’re mostly soft skills.

15h ago TipRanks

TipRanks‘Investment opportunity of a lifetime’: Cathie Wood says the robotaxi market could be worth trillions — here are 3 stocks to invest in it (besides Tesla)

Advances in technology often come loaded with financial opportunities and scanning the one presented by the nascent autonomous driving sector, Cathie Wood thinks there is a huge one at play. The Ark Invest CEO has not been shy about making some bold predictions in the past and thinks investors should not underestimate what’s in store for this up-and-coming industry. “We think that the robotaxi opportunity globally will deliver $8 to $10 trillion in revenue by 2030 and is one of the most importan

21h ago Investor's Business Daily

Investor's Business DailyFord Earnings To Mark Big Break From The Past; This EV Stock Plummets

The Ford earnings report comes after the auto giant saw delivery volumes grow, and EV sales jump, during the quarter.

15h ago Investor's Business Daily

Investor's Business DailyFour Stocks Turn $10,000 Into $50,000 In Four Months

April turned out to be great month for most S&P 500 investors. But it was stupendous for those who picked the best stocks.

23h ago TipRanks

TipRanksInsiders Pour Millions Into These 2 Beaten-Down Stocks — Here’s Why You Might Want to Ride Their Coattails

Whether you’re a seasoned trader or a novice, the oldest piece of advice in economics still holds true: buy low and sell high. The challenge lies in determining the right time to purchase stocks that are undervalued or to sell those that are overpriced. There are plenty of signs to crack that code, but one of the clearest is the insiders’ trading patterns. The insiders are corporate officers, companies’ higher-ups, whose positions put them ‘in the know.’ Therefore, monitoring their trades, espec

1d ago Zacks

ZacksTop Stock Reports for AMD, Cigna & Moderna

Today's Research Daily features new research reports on 12 major stocks, including Advanced Micro Devices, Cigna and Moderna.

14h ago Barrons.com

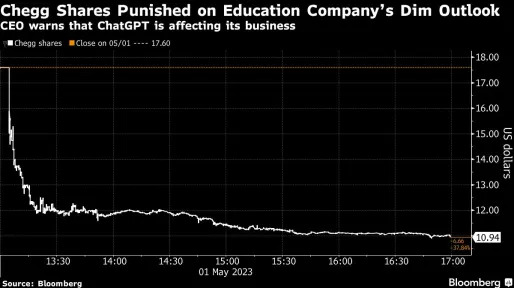

Barrons.comThese Stocks Are Moving the Most Today: Chegg, Arista, BP, BlackBerry, and More

Chegg stock falls sharply after the online-education company says it has been seeing a 'significant spike in student interest in ChatGPT,' while Arista anticipates some of its biggest cloud customers soon could begin cutting back on spending.

1h ago Bloomberg

BloombergChatGPT Threat Sparks 38% Selloff in Homework-Help Firm Chegg

(Bloomberg) -- Chegg Inc. plummeted 42% after warning that the ChatGPT tool is threatening growth of its homework-help services, one of the most notable market reactions yet to signs that generative AI is upending industries.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoMorgan Stanley Plans 3,000 More Job Cuts as Dealmaking SlumpsNigeria Targeted a UK Mansion;

2h ago Business Insider

Business InsiderThe stock market is poised for a sell-off as an overly hawkish Fed could dash hopes for interest rate cuts, Morgan Stanley's Mike Wilson says

"If the message delivered at this meeting is more hawkish, it could provide a near-term negative surprise for equities," Mike Wilson said.

11h ago Bloomberg

BloombergCoinbase Insiders Sued for Dumping Stock, Saving $1 Billion

(Bloomberg) -- Coinbase Inc. Chairman and Chief Executive Officer Brian Armstrong, board member Marc Andreessen and other officers avoided more than $1 billion in losses by using inside information to sell stock within days of the cryptocurrency platform’s public listing two years ago, before bad news sent the share price tumbling, according to a lawsuit filed by an investor.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought

7h ago Yahoo Finance

Yahoo FinanceFed decision, Apple earnings, April jobs report: What to know this week

The next major test for markets awaits Wednesday when the Federal Reserve makes its next decision on rate hikes.

22h ago Investor's Business Daily

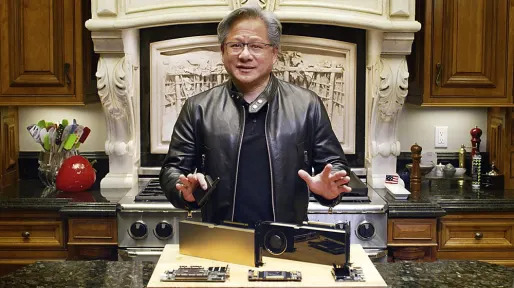

Investor's Business DailyNvidia Stock In Buy Zone After Nearly Doubling In 2023 — Is It A Buy?

Nvidia earnings are set to rebound while AI leadership has excited investors in the leading chip stock. Nvidia stock is on a tear.

13h ago Zacks

ZacksNikola (NKLA) to Report Q1 Earnings: What's in the Offing?

The Zacks Consensus Estimate for Nikola's (NKLA) loss per share and revenues is pegged at 28 cents and $16.25 million, respectively, for the first quarter of 2023.

19h ago Yahoo Finance

Yahoo FinanceNew lower I bond rate comes with 'a pleasant surprise'

The annualized yield for the Treasury Department’s inflation-protected assets is 4.3% for new purchases made until October 31.

19h ago Bloomberg

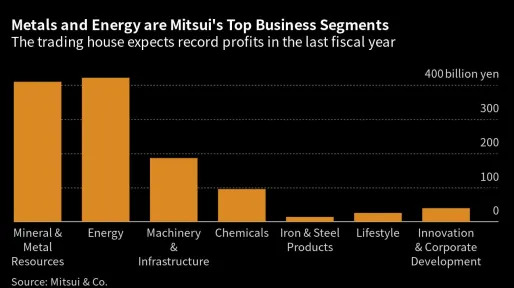

BloombergThe Inside Story of Buffett’s Big Japan Bet, Over Glasses of Coke at Four Seasons

(Bloomberg) -- One after another, Japanese executives from some of the country’s most elite firms filed into Warren Buffett’s suite at the luxury Four Seasons Hotel in central Tokyo. Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoMorgan Stanley Plans 3,000 More Job Cuts as Dealmaking SlumpsNigeria Targeted a UK Mansion; Its Next Leader’s Son Now Owns ItThe lege

12h ago Bloomberg

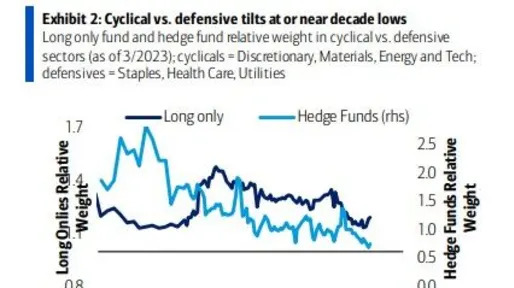

BloombergStock Pickers on Wall Street Are Going All-In on Recession Bets

(Bloomberg) -- As Wall Street economists and central bankers debate if and when the US economy will slip into a recession, big money managers aren’t waiting to find out. Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureIBM to Pause Hiring for Jobs That AI Could DoMorgan Stanley Plans 3,000 More Job Cuts as Dealmaking SlumpsBuffett Will Beat the Market as Recession Looms, Investors SayIncreasingly, professio

15h ago Zacks

ZacksRivian (RIVN) to Report Q1 Earnings: Here's What to Expect

The Zacks Consensus Estimate for Rivian's (RIVN) Q1 loss per share and revenues is pegged at $1.51 and $686.82 million, respectively.

20h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK