The journey to becoming a product-led company - Mind the Product

source link: https://www.mindtheproduct.com/a-case-study-the-journey-to-becoming-a-product-led-company/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The journey to becoming a product-led company

It can sometimes take a while to find your ideal customer. But it’s equally important that you know who else needs to be involved in either making the decision or giving their endorsement when purchasing your offering.

Reaching a critical mass of lighthouse customers is a significant milestone in understanding the mass-market appeal of your product. It is a positive sign that indicates you have gained sufficient influence to start attracting a broader base of more risk-averse and “everyday” consumers.

When making the transition from being service-led to product-led, the team needs guiding principles to help ground decision-making. It may also require a comprehensive overhaul of how all departments operate.

In late 2020, the amazing Brainmates CEO, Adrienne Tan, connected me to Prospection – a healthtech analytics company founded by some super smart people who were on a mission to get patients on the right treatment at the right time. The Prospection founders, nudged by their knowledgeable board and Adrienne’s special brand of tough love, had commenced the journey to become a product-led company. The first step was to secure an experienced product leader – that’s where I came in …

Prospection had many pieces of the product puzzle in place. They had several platforms, one of which had achieved market fit in Australia by taking the Australian PBS claims data and applying sophisticated algorithms to show which drugs resulted in the best treatment outcomes for different patient cohorts. It seemed that with a bit of tweaking, we would be blazing along the highway on our global product journey.

My first hint of what I was up for came a few weeks later when I was chatting to our CEO about needing to get into the headspace of our customers and understanding their needs better. He said to me:

“Oh we’re already incredibly customer-centric, we do everything our customers ask!”

The cold fear of realization gripped my heart …

Superior service

Prospection was wired to do “whatever it took to make a customer happy.” Whenever a customer requested something, our proactive team would aim to deliver. This is a “feel-good” model for all involved. Customers are happy because they get what they ask for. Staff feel happy as they have delivered what a customer wanted. So what’s the downside?

It’s a question of scalability. Prospection was a product business that delivered a significant percentage of its value through consulting, predominantly using its software products as consultant tools. In many cases, customers might never actually log into the software, instead requesting insights and data from their account managers directly.

At this point, many of you would recognise that Prospection was a service-led business. While extremely valuable to customers, and profitable as well, it’s not a scalable model. Or, at least, it’s not scalable without an enormous investment in people, people who can expand the reach of the business to deliver value to customers. A critical truth here is that it is not an attractive model to investors.

Product-led – the “exact same” principle

In a product-led company, you narrow in on a problem or set of problems that a particular type of customer is having. If this problem is painful enough that the target customer will pay money to solve it and that solution will work for many customers, and you can cost-effectively do that, then you’re on the way to having a product.

As a product company, everything we build is based on the need to sell the exact same thing to at least six customers to break even. Exact same. This is a non-negotiable. The profitability generated by scale is realized at numerous points across the product lifecycle – from sales and marketing to onboarding, from account management to product updates. Think about it: you fix a bug, you improve a feature, you roll it out … you’re able to push the exact same update to all your customers. Exact same. The minute you need to change an update, even slightly, for each customer, you’re no longer running a product-led business.

At your service

In a services-led software business, the primary focus is on delivering high-quality services to clients, building strong relationships with them, and generating revenue through ongoing service agreements. The software products developed by the company are often used to support or enhance the services provided, rather than being the primary revenue generator.

Customer satisfaction is critical for service-led businesses. It is essential to maintain long-term relationships with clients and generate repeat business. The company’s success is therefore heavily dependent on the quality of the services provided and the level of customer support offered.

Although Prospection generated revenue through subscription, the services component was built into the sub (with potential add-on sales for special one-time projects). The level of service provided to customers was high, and was highly valued by customers. This is a blessing and a curse – there’s significant goodwill and trust toward the brand, but there’s also an expectation that service will continue. This can be a complicating factor when attempting to move to a more product-led model.

Often, service businesses can be quite nimble. A services company can make a small investment to develop a tool or hire more capability for a customer, but it usually pays back pretty quickly, because the customer has essentially signed up to fund that investment. Prospection was very used to operating in this model. Understand a specific customer problem; solve that specific customer problem. (Then find a new specific problem to solve.)

However, in a product company, you do discovery across several customers and if there’s a viable business case, you quickly create an iteration of the product that will create value for as many customers as possible. That can mean there might be some delay between investing in a product solution and actually starting to see returns. Your revenue and cash burn might take a hit while you do the transition between services and product.

In the transition from services-led to product-led, it’s useful to help people understand how the two business models are valued from an acquisition or sale standpoint. It can be a considerable motivator when the stakes become clear …

Services-led businesses typically are valued at a maximum of two to three times revenue (so, at most, a services business generating $100M in revenue might be valued at $300M). In contrast, product companies offer greater potential for return on investment as product-led growth is typically modelled at ten times revenue for enterprise value.)

Swinging the pendulum from services to product

Moving from services-led to product-led is a significant transformation. It involves the redefinition of business strategy, organizational structure, relevant infrastructure and policies, as well as shift in mindset for how the new business and teams will operate throughout the product life cycles. The go-to-market strategies are markedly different. And of course, the product must be suitable for customer use as a primary requirement – it’s no longer a consultant tool for delivering customer value.

Let’s look at ten transformational changes we undertook. These weren’t linear in nature of course. Many happened (and are happening) in parallel.

Align the CEO and execs to the journey (and start working on the sales team)

The simple truth is that a transformation of this kind requires unified support from the top of the business. The CEO/founder(s) have to be ready to embrace this change. The outcome of 10x return can be a motivator, but embracing that change and walking the talk is critical. In all likelihood a services-led organization is wired to work with customers in a certain way, and people will resist this change.

It means an unwavering commitment from the leadership team will be required to adapt, change, and align all functions to work in harmony towards this product-centric common goal. All functions within the organization will need to be realigned. Perhaps the most challenging function to change will be sales. Salespeople in service-led companies have grown in the business understanding customer needs and desires, and then having it delivered by the services team. Adapting to having to sell a standardized product offering, in a repeatable way, isn’t an easy task. And remember, gifted sales folks are trained to not accept no and do whatever it takes to get their deals over the line. This can mean that their skills can suddenly be applied to counter product teams saying “no” to features – and since you’re trying to create a product-led org, not a sales-led org, this can be problematic.

The CEO and sales leaders need to be primed for this revolt. If they don’t start changing their behaviour and that of their teams, there’ll be more pain, in all kinds of different flavours.

Luckily product had another amazing leader supporting our remit, the cofounder of Prospection and CTO. I’ve previously shared one of the many reasons I joined Prospection was because of the opportunity for this to be a true partnership between technology and product. Our CTO and engineering leaders have held true to this vision and have been an essential part of our ability to undertake the journey to becoming product-led. It’s impossible to overstate the importance of product and technology being joined at the hip in this kind of transition. It would be easy for technology to continue servicing their internal stakeholders, building features and functionality on request. A strong relationship between product and technology helps resist those pressures and guides the business through the transition.

Identify your ideal customer

Whereas previously, services could be customized and adjusted to cater to a diverse range of customers, products must be tailored to fit a specific type of buyer and user. So it’s important to narrow and focus on a specific customer profile. This requires you to identify several things. What’s the customer’s goal, what’s their current pain, can you solve that pain effectively and if you can, do they have the budget to pay for it? Or can they get that budget from someone else who is also incentivized to solve this problem?

It can sometimes take a while to find your ideal customer. But it’s equally important that you know who else needs to be involved in either making the decision or giving their endorsement when purchasing your offering. In pharma, this stakeholder chain can be quite complex. Our customers often share their budgets and rely on other functions to endorse initiatives. It can lead to a long, complex and involved sales cycles.

Determine if you have a product and whether it’s scalable

While thinking about potential customers, you’ll also be assessing whether you actually have a product.

Services businesses grow consulting and deliver different projects to customers with quite specific needs. With so much value derived from human expertise, particularly in a complex environment like health and analytics, it can mean that the in-house software has become very focused on the needs of internal teams who need to deliver insights to customers in more “human” terms, like PowerPoint presentations. Internal consultants have learned to cope with the myriad of complexity that often comes with these tools. So complexity of the experience will usually need to be addressed – both to scale internal capabilities to deliver more and faster, but also to roll out a version to customers directly.

Additionally, the services approach can quickly involve bespoke project work. Working out which project-specific capabilities can be turned into a standardized SaaS product can be difficult, and then aligning founders, sales teams and the rest of the organization around that reality is challenging.

In the case of Prospection, we did have an appropriate platform, with the right product foundations to take forward. We needed to stand this up on its own, independent of legacy platforms, and expand its ability to ingest longitudinal datasets for markets other than Australia.

Nothing is ever completely straightforward of course. Alongside improving this go-forward platform, we had a primary customer base in Australia currently using a legacy product. This meant that the go-forward platform needed to account for the needs of customers using the legacy product at the same time as building it out for market-fit in new territories, like the US and Japan.

Dealing with the complexity of different global data sets and logic changes in our algorithms to accommodate these datasets has required us to tap into Prospection’s talented data scientists and analytical consultants. We’ve had to balance this knowledge with product experience principles as we strive to create products that solve our target customer’s problems in broad, repeatable ways.

Identify lighthouse customers

A customer who enthusiastically embraces a newly introduced product is referred to as an “early adopter” or a “lighthouse customer”.

Lighthouse customers have a significant impact and are crucial in ensuring the successful launch of a new product. They also often serve as a vital source of initial revenue for a new product.

Reaching a critical mass of lighthouse customers is a significant milestone in understanding the mass-market appeal of your product. It is a positive sign that indicates you have gained sufficient influence to start attracting a broader base of more risk-averse and “everyday” consumers.

Having lighthouse customers does not always guarantee that you have a scalable product offering though. This was exactly the case Prospection faced with one of our platforms. A leading global pharma had deeply invested in one of our platforms, along with several other lighthouse customers. This led to a product that had been developed to fit very specific business needs – its utility for new customers was severely diminished. On top of that, the market had moved on. Product capability that once was innovative had become mainstream, and many competitors could now solve the same problems in more cost-effective ways.

We had to make the difficult decision to deprecate this offering and double down on the go-forward platform with its more globally appealing feature set. This was not an easy decision and we had to push back against a “sunk cost fallacy” mindset as five years had gone into developing this offering. It was a good lesson in commercially minded product management, acknowledging in this case that the current costs of delivery and maintenance of that legacy product outweighed any future benefits or value.

Establish a capable product team

Prospection was established in 2012 and quickly became known as a smart company that could ingest longitudinal patient data, providing insights that others couldn’t. Data is in our DNA. We had several talented analytics, health and consulting people, but very few with product management and design backgrounds. It was important to build up a cross-functional product team to successfully embark on the journey to becoming product-led.

However, we quickly discovered that experience in product wasn’t enough. Many people we hired loved our mission and the “idea” of dealing with the health data…until reality kicked in. The data is complex, as are the algorithms. The learning curve for product people, getting their heads around the data and the industry proved to be long and challenging. We needed to rethink the profile of our team members and merge in expertise in innovating with data. We were fortunate in that some of the kinds of people we needed in product were already in the business. We seduced them to the product side, renaming our team to “Product and Data” – the two equal pillars in our group.

Establish a core set of product and principles

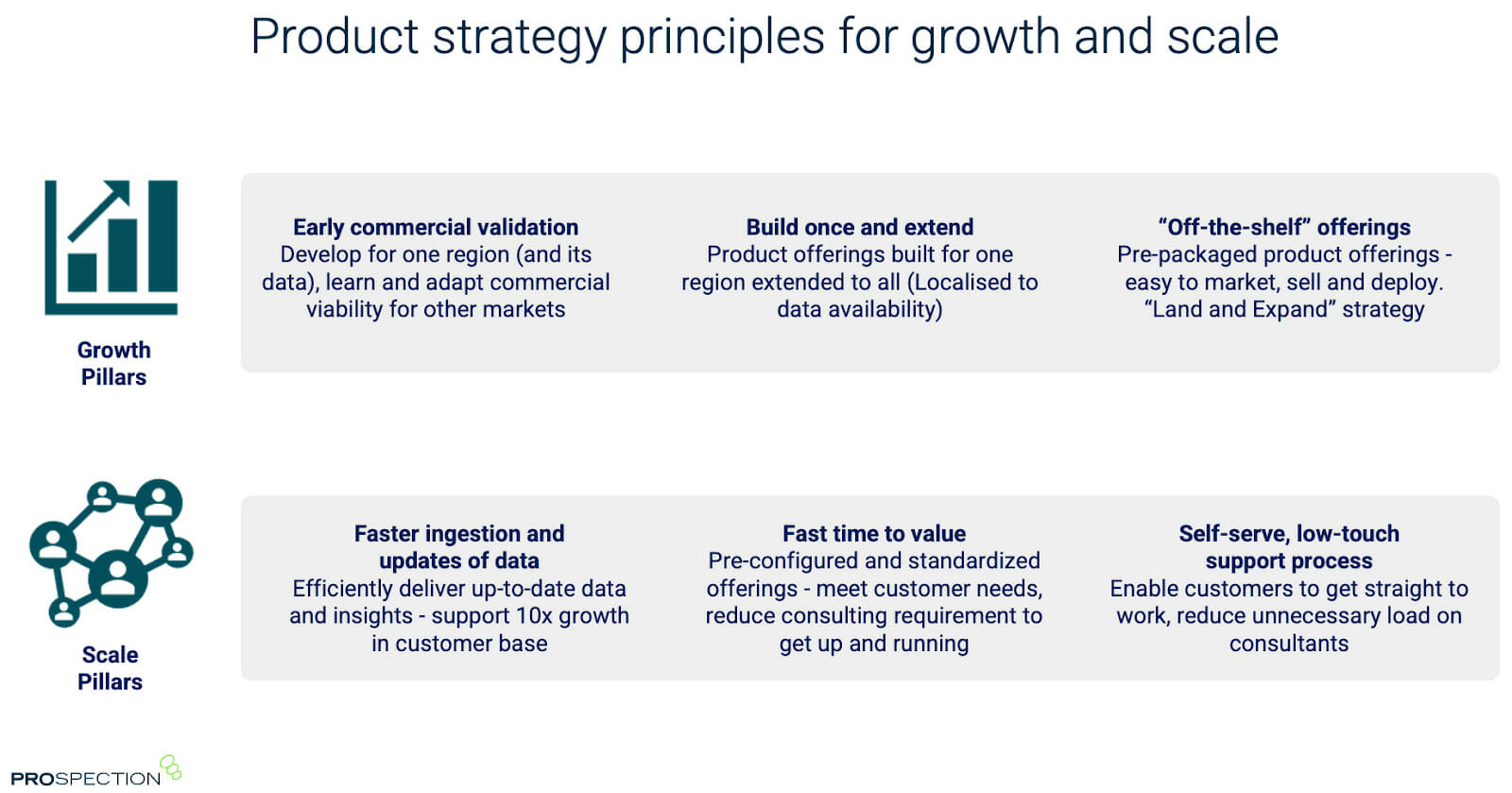

When making the transition from being service-led to product-led, the team needs guiding principles to help ground decision-making. Here are the principles we devised at Prospection:

These principles were structured around learning fast, building once and extending and scaling globally. For example, if we’re building a product offering for the US, how can we test its value as quickly as possible and how could any functionality created be applied to other markets like Australia or Japan.

We also wanted to focus on creating low-touch, low-service offerings, to making it easier for customers to be active participants in our transformation to product-led status. We wanted to make sure that value was in the hands of customers directly, and that they could self-serve as well as work with us to achieve their desired outcomes.

Selling with strategic development in mind

In addition to a heavy investment in go-to-market and sales enablement for our product offerings, we introduced guidelines for our sales team who were used to selling services in addition to product. This was to guide solutioning for more strategic projects that could provide insights into future product offerings. Some examples of things needing to be answered before we’d take on project work:

Why is the customer wanting this project?

- What problem are they solving and why is this important to them?

- What criteria or metrics will they use to determine success of the engagement?

- Who are the key stakeholders on the client side; Who is the sponsor?

What benefits will this project deliver for Prospection – and by when?

- You must cover the financial benefits (see financial model section below), but also include other benefits (e.g. Product learnings / Co. OKRs)

- New logo: Diversify revenue and customer base

- Product: What product strategy or goals does this project support and how?

- Other: How does the project contribute to company OKRs and/or wider Prospection strategy

These proposals were reviewed on a weekly basis at a project review board and included product team participation. Gate 2, Strategic Alignment was key for the project to be approved to go ahead.

This approach allowed us to leverage existing customer relationships and collaborate with our analytics and consulting service team, harnessing their extensive knowledge and capabilities to explore and test potential product ideas. Our analytics consultants have the expertise and ability to understand complex problems, and their collaboration with the product team meant we could see whether we could solve the problem in a standardized way and also be able to offer it to more than just one customer. It basically allows us to try out innovative concepts in the real world without significant product investment and then refine them before productizing.

Anticipate “passive” resistance from across the organization

In theory, people initially liked the idea of becoming a product-led company, but the effort required to make that change could sometimes be overwhelming. Effecting this change required a comprehensive overhaul of how all departments operated within the company. In service-based companies, the sales force is often localized and specialized within specific regions. This specialization is necessary to ensure that the sales team has a thorough understanding of the client’s business so that they can provide tailored solutions and add value. Conversely, the sales force for product companies operates with a more standardized offering. In addition to in-depth knowledge of the product they are selling, they must also possess a deep understanding of its use cases and target markets.

In the services-led company, sales and customer success folks often dictate what the product team do. “A customer is wanting this now. We’re sure other customers will too. Regardless, we’ve already sold it to this customer. So please go and build it…now!”

A complete change in mindset is required when you’re having to position the value of a standard offering versus being able to do whatever a customer is asking for.

The challenge didn’t just stop with sales and customer success. Our analytics and delivery people were also sceptical as they were bringing their health and analytics expertise to each offering and felt like “productising” this meant we’d lose the creativity they bring to each customer engagement. We addressed this by standardizing the things that drained their time and didn’t require their expertise, allowing them to focus on high-value, complex analysis and consulting.

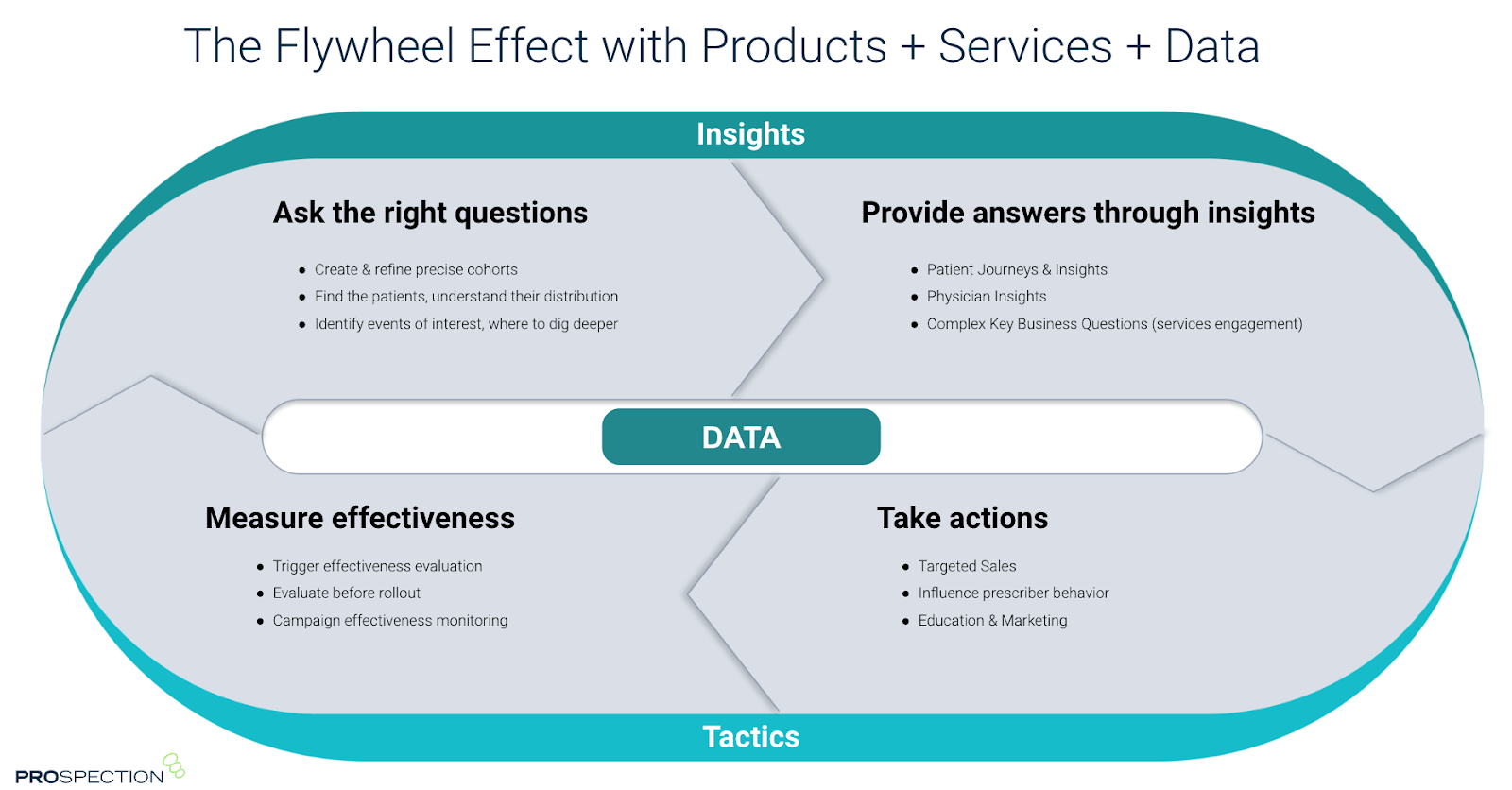

The product mindset can’t be set in stone either … a new flywheel is needed

Product people have their own journey to go on with this transformation. In this case, we arrived thinking we could capture this knowledge and make it generic yet valuable enough. But the reality was something else … we had to land in the middle.

Prospection has a role to play in solving very specific problems, ones that can’t always be productized. Recognising that and incorporating a degree of non-standard solutioning was important. Perhaps counter-intuitively, one way we did this was by creating a product service blueprint. It detailed a standardized way for our analytics and consulting team to think about subscription setups. But at the same time, it helped us understand the true costs and value of non-standard set-ups.

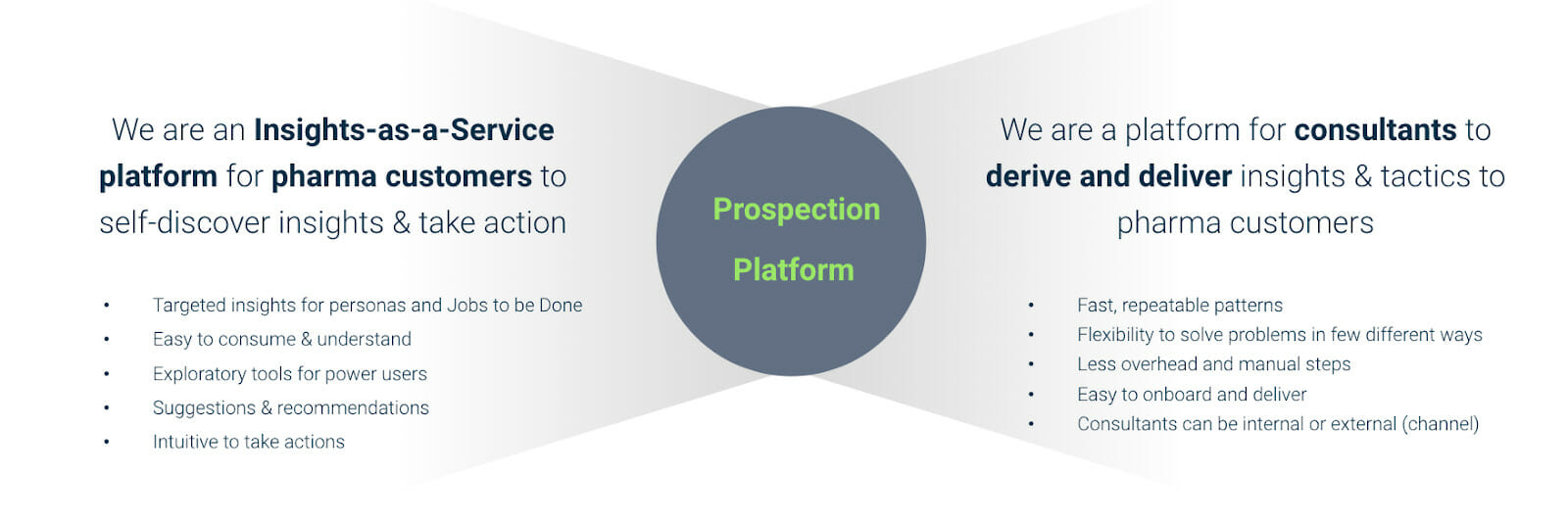

This journey saw me enter Prospection with a “pure SaaS” mindset – how do we remove high touch and standardise our offerings into products. I quickly realized there’s something integral to the services model that needs to be captured in the product-led vision for a business like Prospection’s. The Prospection platform had to serve pharma customers with insights but also enable our analytics/consulting teams to deliver services.

Why? The healthcare industry is incredibly complex. Each therapy area is nuanced, the drugs and treatments vary wildly, and clinical expertise is required in interpreting the customer strategy and the underlying market. A key part of enabling our flywheel is to use data and our product algorithms to provide answers through insights.

These answers preferably come via our product offering. However, the reality is complex questions that arise as a customer’s knowledge increases often requires a human. The key here is to power the link between insights and tactics – to keep the wheel spinning.

Pricing is always challenging

Another challenge we faced was that the pricing model that had evolved in Australia had not necessarily evolved to match the value we were actually delivering to customers or informed by the actual costs of delivering that value.

It’s difficult of course to make sudden changes to prices for existing customers. They’d been used to getting access to the platform, as well as a range of included services that were delivered at various times through the subscription period.

As we entered the Japanese market, we overcompensate and went in with a price that was too high – which made it harder to get sales traction from the outset. When entering the US, wanted to get the price just right. However, there were different challenges in the US that complicated things further.

Like in so many industries, the US is a mature market. There were a number of competitors already servicing customers, and promising much of what we can do. Their ability to actually match Prospection’s capabilities was often limited. But marketing is marketing …

This has meant that the US go-to-market strategy is considerably distinct from our other markets. We lead with a replacement, additive or substitute strategy, using a more customized product offering to get a foot in the door with a customer. Then once we get in, we can extend our elbows across the value chain, and show the end-to-end value we can provide with a platform subscription. Key to this has been to make the packaging and pricing of our product offerings simple and customer friendly (and, more importantly, a good fit to the US procurement process) so it’s understandable and can be sold in affordable chunks.

A journey is a journey …

Back in the 90s, there was a famous hair shampoo commercial where the big-haired model breathlessly claims “it won’t happen overnight but it will happen!”

If only it were this easy when it comes to transitioning from a service-led business to a product-led business. It will not be enough to do the bare minimum and then wait and see the results. Every step of the journey must be deliberate, must be planned. Complacency and organizational resistance makes for considerable inertia – keeping the business moving is challenging, and the tendency to revert to services as the focus will be great. But the rewards for making the transition are even greater.

It’s important to keep in mind that there’s no “one way” to rule them all – your approach will need to evolve and take into account your specific business context. It will be a unique journey, complete with its own pitfalls and opportunities. But there will be similarities too. I hope you’re able to use this story to help make your journey just that little bit smoother.

Just like that supermodel’s hair.

P.S. Want to learn more about “product versus service models and investor valuations”, check out Rich Mironov’s fantastic article.

Discover more case studies on Mind the Product

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK